Technology: Page 20

-

Black Friday winners and losers

Payments players charted an increase in spending over the Thanksgiving Day holiday weekend, with e-commerce sales growth outstripping the rise in stores.

By Daphne Howland • Dec. 2, 2024 -

Sponsored by PayNearMe

Lead or be left behind: Adapting to the payment needs of every generation

Meet the payment needs of every generation to boost loyalty, satisfaction and on-time payments.

Dec. 2, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

BNPL use may rise this year for holiday shopping

With credit card interest rates at a historic high, consumers are likely to gravitate to lower-cost alternatives, including potentially buy now, pay later options, industry consultants say.

By Patrick Cooley • Nov. 27, 2024 -

Q&A

Ex-PayPal CEO opines on everything from crypto to Cobol

Bill Harris, who briefly led the payments pioneer, talks about the U.S. lagging in payments innovation, and the potential of stablecoins.

By Lynne Marek • Nov. 26, 2024 -

Push payment scam losses to surpass $3B by 2028: report

U.S. fraud losses due to push payment scams are rising, partly because of more real-time payments, according to a report from the payments company ACI Worldwide.

By Tatiana Walk-Morris • Nov. 25, 2024 -

Real-time payments scams rise

More people are falling for real-time payment scams as the use of such speedy systems increases, a FICO survey showed.

By Patrick Cooley • Nov. 22, 2024 -

CFPB tweaks big tech payments rule

In finalizing the new rule to oversee digital wallet providers Thursday, the Consumer Financial Protection Bureau said it made important changes to its initial proposal.

By Lynne Marek • Nov. 21, 2024 -

Amazon now accepts EBT card payments

The e-commerce giant began letting needy families shop on its website with their federal benefits cards earlier this month.

By Patrick Cooley • Nov. 21, 2024 -

Deep Dive

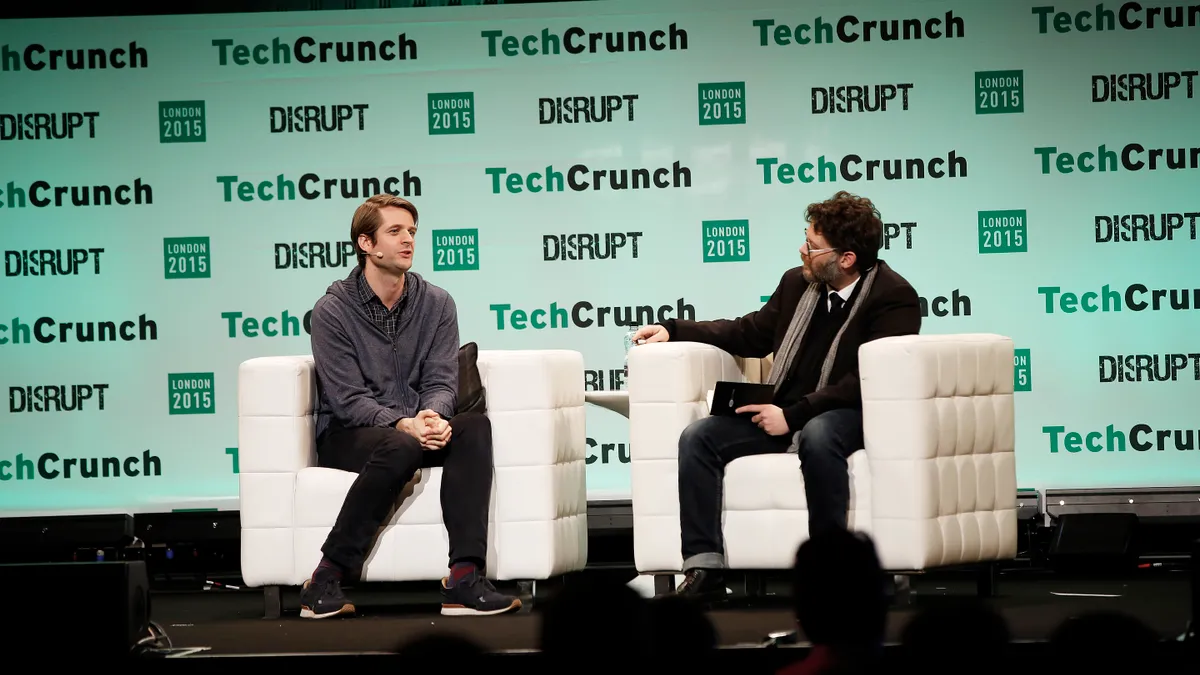

PayPal CEO pushes beyond payments

After a year as CEO of the digital payments pioneer, Alex Chriss is spearheading an expanded role in commerce for the company.

By Lynne Marek • Nov. 20, 2024 -

Google Pay adds Afterpay BNPL services

Users of the Google Pay digital wallet now have access to Afterpay’s BNPL services, and the tech titan is expected to add rival services from Klarna next year as well.

By Patrick Cooley • Nov. 19, 2024 -

Scams ensnare even sophisticated consumers, Fed says

Criminals leverage advanced technology to make so-called mule accounts that pass as humans and persuade consumers to send money to scammers, a Kansas City Fed paper says.

By Patrick Cooley • Nov. 18, 2024 -

Sponsored by Wind River Payments

The real question behind embedded vs. integrated payments: Creating seamless transactions

Interested in learning more about embedded payments and how you can leverage them for your business?

Nov. 18, 2024 -

Opinion

Payments players should embrace digital currencies

“Emerging currencies, digital assets, and even next-generation fiat options could be integrated thoughtfully, allowing companies to access new markets,” writes one industry chief revenue officer.

By Ryan Miller • Nov. 15, 2024 -

Mastercard aims to cancel manual card entry by 2030

The card network has documented a spike in online fraud, and contends that numberless cards will reduce such wrongdoing.

By Tatiana Walk-Morris • Nov. 15, 2024 -

Shift4 CEO bets on crypto and Trump

The payment processor’s CEO, Jared Isaacman, plans to plunge ahead with a recent crypto initiative, wagering that President-elect Trump will give a boost to the effort.

By Patrick Cooley • Nov. 14, 2024 -

Private sector merits ‘significant’ payments footprint, Waller says

The Federal Reserve must consider when to make up for private sector shortcomings in payments, while keeping its role limited, board member Christopher Waller said Tuesday.

By Tatiana Walk-Morris • Nov. 13, 2024 -

Klarna files for IPO

The buy now, pay later company announced Tuesday it had filed confidentially with the Securities and Exchange Commission for an initial public offering.

By Patrick Cooley • Nov. 13, 2024 -

Young people fall prey to payments fraudsters

Debit and credit card users under 40 years old are more likely than older peers to experience fraud in making payments, a recent J.D. Power survey found.

By Patrick Cooley • Nov. 12, 2024 -

Will Shift4 scoop up Lightspeed?

The acquisitive payments company could be a good fit with the Canadian point-of-sale technology provider, analysts said Monday.

By Lynne Marek • Nov. 11, 2024 -

Q&A

Open banking to move toward FDX standard

Industry collaboration on open banking is likely to move forward, with or without the CFPB’s recent final 1033 rule, one Jack Henry executive said.

By Lynne Marek • Nov. 11, 2024 -

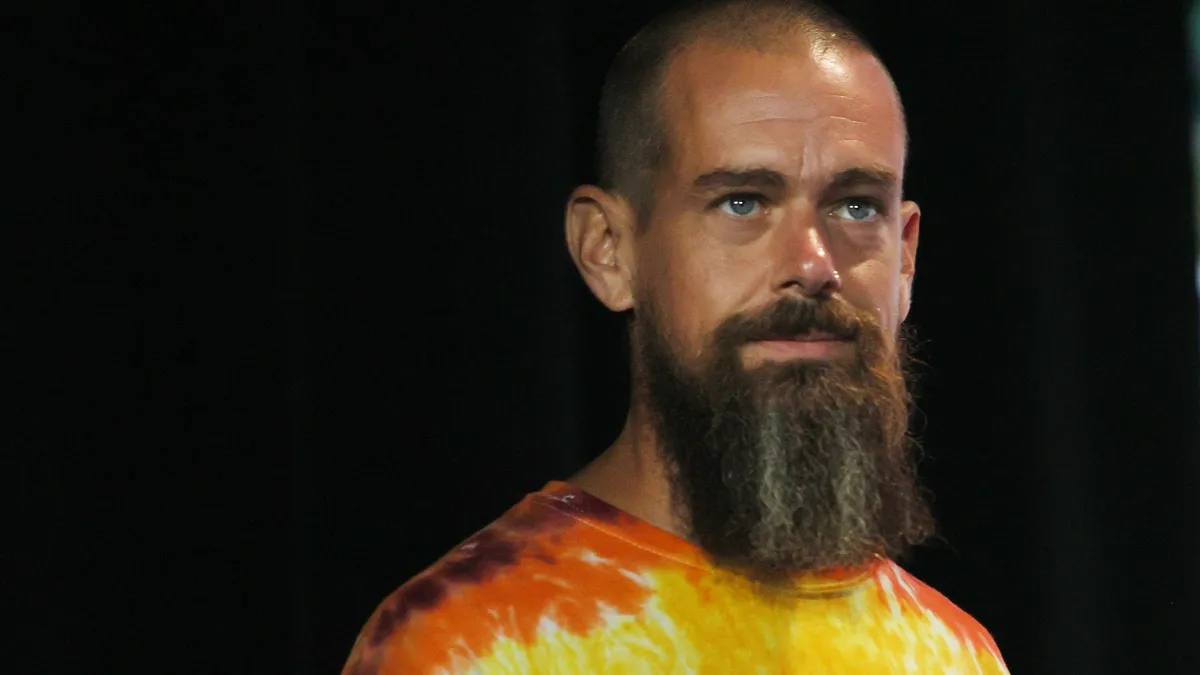

Afterpay to arrive on 24M Cash App cards

The digital payment company’s leader, Jack Dorsey, aims to create lending services that will appeal to millions of U.S. adults who haven’t had access to other forms of credit.

By Patrick Cooley • Nov. 8, 2024 -

How Trump’s administration may rework payments policies

The president-elect and his new administration will have the opportunity to revamp federal government approaches for everything from earned wage access to digital currencies to open banking.

By Lynne Marek and Patrick Cooley • Nov. 7, 2024 -

Paze gets new leader amid slow start

Early Warning Services, the bank-owned company that operates Paze, tapped a new leader last month for the digital wallet operation after slow progress in launching the new service.

By Patrick Cooley • Nov. 7, 2024 -

Q&A

Fiserv exec opens up on Walmart, DoorDash partnerships

Sunil Sachdev, Fiserv’s head of embedded finance, shed light on his company’s latest high-profile collaborations.

By Patrick Cooley • Nov. 6, 2024 -

Sheetz accepting crypto at all locations

After a limited trial run, customers can now use several popular digital currencies to buy items at all of the East Coast retailer’s 750-plus locations.

By Jessica Loder • Nov. 5, 2024