Technology: Page 21

-

Cash-strapped consumers turn to BNPL: Fed survey

Consumers facing financial hardships turned to buy now, pay later services more last year than stable consumers, according to survey results from the Philadelphia Federal Reserve Bank.

By Tatiana Walk-Morris • Feb. 23, 2024 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

OCC’s Hsu calls for federal payments licensing

The head of the OCC called on Congress to replace the current state-by-state money transmitter licensing system for payments companies with a federal regulatory framework.

By James Pothen • Feb. 22, 2024 -

Explore the Trendline➔

Explore the Trendline➔

ArtemisDiana via Getty Images

ArtemisDiana via Getty Images Trendline

TrendlineCross-border payments targeted for upgrades

When it comes to cross-border payments, businesses, non-profits and governments alike are determined to increase the speed of transactions and cut the cost.

By Payments Dive staff -

Affirm sheds workers

The buy now, pay later provider has cut about 6% of its employees, joining other payments companies that have trimmed workforces this year.

By Caitlin Mullen • Feb. 22, 2024 -

Warren probes Zelle scam policy

Three senators, including Elizabeth Warren, asked Zelle owner Early Warning Services to provide detailed information about its fraud reimbursement policy.

By James Pothen • Feb. 21, 2024 -

Cross-border payments remain focus for Fed

Tools that “automate processes, reduce costs and promote effective safeguards across jurisdictions” may help improve cross-border payments, a Federal Reserve official said last week.

By Lynne Marek • Feb. 20, 2024 -

PayPal invests in AI startup Rasa

The investment is the first that the digital payments pioneer is making from its new artificial intelligence venture fund.

By Tatiana Walk-Morris • Feb. 20, 2024 -

Meta forces Apple fees on advertisers

Meta said it will pass along Apple’s 30% service charge to advertisers who pay to boost the visibility of their posts on its social networks.

By James Pothen • Feb. 16, 2024 -

Toast to cut 550 employees

The company’s CEO acknowledged during an earnings call that “we grew our team too quickly in some areas,” while reporting a presence in 106,000 locations as of the end of 2023.

By Lynne Marek • Feb. 16, 2024 -

Same-day payments drive ACH increase: Nacha

Peer-to-peer transactions also contributed to a 4.8% increase in payments volume for the ACH Network last year over 2022.

By Tatiana Walk-Morris • Feb. 15, 2024 -

Global Payments may pare operations

While there has been industry speculation about the company making an acquisition, CEO Cameron Bready was more ready to talk “pruning” this week.

By Lynne Marek • Feb. 15, 2024 -

Apple extends prepaid debit card reach

Adding a virtual card number feature “is about giving options to consumers when retailers do not support Apple Pay,” Creative Strategies President Carolina Milanesi said.

By James Pothen • Feb. 15, 2024 -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

Bitcoin Depot expands footprint by 400 ATMs

The bitcoin ATM operator is adding to its fleet as it sees “a lot of demand,” according to COO Scott Buchanan.

By James Pothen • Feb. 14, 2024 -

Yellen asks Congress for stablecoin legislation

Treasury Secretary Janet Yellen renewed a call for Congress to act on digital assets, saying “there is no appropriate regulatory framework.”

By James Pothen • Feb. 13, 2024 -

Bill Holdings, Bank of America revamp contract

The provider of bill-pay software services was expecting to extend its services to more of the bank's clients, but now the bank is changing its plans.

By Lynne Marek • Feb. 12, 2024 -

Affirm takes cautious approach to six-month outlook

The buy now, pay later company’s forecast for the rest of the fiscal year was conservative, analysts said, even though revenue and merchandise volume jumped over the prior year during the holiday season.

By Caitlin Mullen • Feb. 12, 2024 -

Q&A

Banks should step up scam response: fraud expert

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

By Caitlin Mullen • Feb. 9, 2024 -

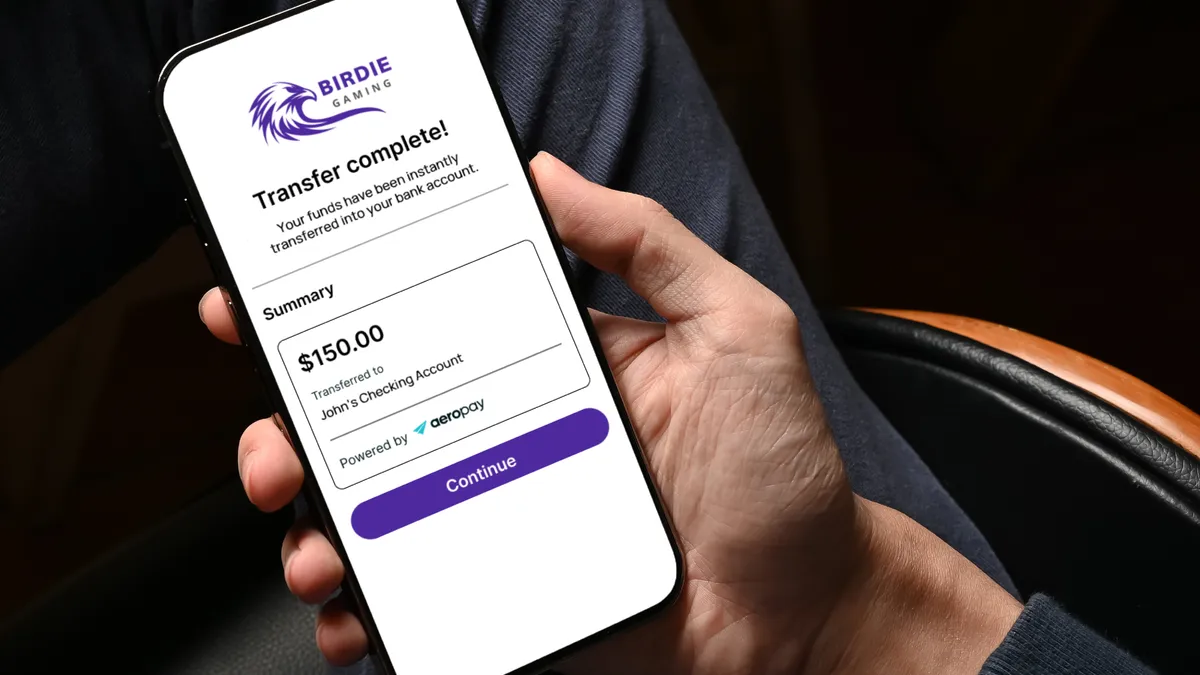

Aeropay partners with Cross River, UBank on sports gaming payouts

Digital payments provider Aeropay has lined up bank partners in an effort to facilitate faster access to winnings.

By Gabrielle Saulsbery • Feb. 8, 2024 -

Opinion

CFPB open banking proposal will be crucial

The agency’s open banking proposal is a step in the right direction, but details of the policy will shape how the market develops, a regulatory adviser writes in this op-ed.

By Jonah Crane • Feb. 8, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

USDA offers online payment tool for farm loan borrowers

The new online option will give farmers and ranchers an alternative to making payments by phone, mail or visits to a USDA office.

By James Pothen • Feb. 6, 2024 -

Fiserv lands Uber, eBay as debit network clients

The payment processing giant has signed more than a dozen large e-commerce clients following the Federal Reserve’s clarification of the debit routing rule.

By Caitlin Mullen • Feb. 6, 2024 -

Apple CEO pushes back on European regulation

The company’s customers may experience a drop in quality thanks to EU regulation slated to take effect next month, said Tim Cook, chief executive of the tech giant.

By James Pothen • Feb. 5, 2024 -

Why ‘pay-by-bank’ faces adoption hurdles in US retail

Pay-by-bank has been catching on only slowly, and it’s a particularly long shot for showing up at the point-of-sale anytime soon.

By Suman Bhattacharyya • Feb. 5, 2024 -

Opinion

Where will embedded payments flourish in 2024?

There are three areas where embedded finance is a good fit, and they are characterized by high volume and frequent payments, writes one industry executive.

By Julio Gomez • Feb. 5, 2024