Retail: Page 15

-

DOJ suit accuses Visa of illegal debit payment monopoly

The company threatens merchants with high fees, and "makes its potential rivals business partners to thwart competition in debit card processing," the DOJ says.

By Justin Bachman • Sept. 24, 2024 -

Visa faces possible DOJ lawsuit, news reports say

The card network may soon be sued by the Department of Justice over its debit card practices, according to multiple news reports citing anonymous sources.

By Lynne Marek • Sept. 24, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Stripe shows signs of IPO, despite co-founder comments

The company, which offers payments processing software, has kept its plans close to the vest, but industry insiders say they’ve seen clues.

By Patrick Cooley • Updated Sept. 26, 2024 -

Love’s adds digital payment method

The convenience store operator turned to Relay Payments to allow truck drivers to pay securely at most of their fueling locations.

By Jessica Loder • Sept. 23, 2024 -

Amazon, Google stake out bigger foothold in payments

The tech giants are inserting themselves into more retail transactions to build loyalty and harvest customer data.

By Patrick Cooley • Sept. 23, 2024 -

Walmart, Fiserv team to offer real-time payments

The retail giant and payments processor are targeting next year for offering consumers a real-time payment option online.

By Lynne Marek • Sept. 20, 2024 -

Amazon adds PayPal option to Buy with Prime

The e-commerce platform will also let consumers connect their PayPal and Prime accounts next year, and access free shipping via Buy with Prime on some merchants’ sites.

By Tatiana Walk-Morris • Sept. 20, 2024 -

Affirm CEO stakes out differences with Klarna

Affirm makes money off transactions, whereas Klarna has revenue from marketing, Affirm CEO Max Levchin contended.

By Patrick Cooley • Sept. 19, 2024 -

Opinion

Who really pays for your credit card reward points?

"While rewards may feel like a bonus for those who use credit cards regularly, they ultimately come at a cost," writes one payments executive.

By Parth Vatsal • Sept. 19, 2024 -

Credit Card Competition bill backers keep pressure on

Republican Sen. Roger Marshall has a new ad pitching the Credit Card Competition Act proposal aimed at dislodging Visa and Mastercard’s dominance.

By Lynne Marek • Sept. 19, 2024 -

Mastercard CFO to continue working after cancer diagnosis

Decisions on medical disclosures can be challenging for companies. Mastercard’s approach drew high marks from some corporate governance experts.

By Maura Webber Sadovi • Sept. 18, 2024 -

Apple launches Affirm BNPL option

Apple Pay customers can now use their iOS 18 phone or iPadOS 18 to access Affirm buy now, pay later options, including some that don’t charge interest.

By Lynne Marek • Sept. 17, 2024 -

Block shuffles leadership, creates chief risk officer role

Block will move several longtime executives into different positions and create a new role to address customer safety, the company said Monday.

By Patrick Cooley • Sept. 17, 2024 -

Retrieved from Beijing Daily App on September 16, 2024

Retrieved from Beijing Daily App on September 16, 2024

Visa, Mastercard enable rail transit payment in Beijing

The major card networks enabled systems that allow international travelers in China to use their cards to pay for Beijing rail transit as of last week.

By Lynne Marek • Sept. 16, 2024 -

FTC cracks down on subscription traps

The Biden-Harris administration is taking to task companies that trap consumers in recurring subscriptions and make it nearly impossible to cancel.

By Kristen Doerer • Sept. 16, 2024 -

CFPB sues credit card company over excessive fees

The agency says Horizon Card Services violated the Truth in Lending Act by charging fees as high as 60% of a customer’s credit limit, and all but refusing to cancel their cards.

By Patrick Cooley • Sept. 16, 2024 -

U.S. Bank rolls out access to Paze digital wallet

The bank began offering the payments option from Early Warning Services to its credit and debit cards customers this week.

By Patrick Cooley • Sept. 13, 2024 -

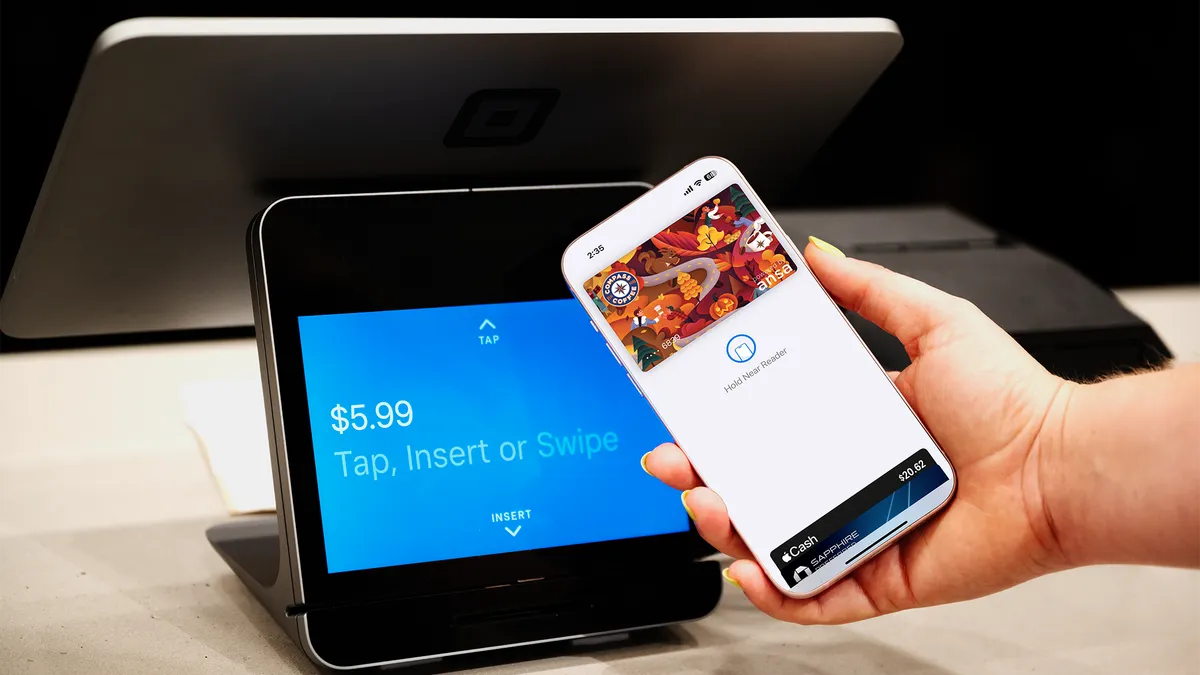

Ansa debuts in-store digital wallet capabilities

Ansa last week launched a software development kit, which can be patched onto the code of a brand’s mobile app. “The pain’s on our side to make sure all their systems talk,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • Sept. 13, 2024 -

Global Payments CEO reshapes the business

The payments technology company is getting a remake with job cuts, an acquisition and potential divestitures a year after Cameron Bready ascended to the CEO post.

By Lynne Marek • Sept. 11, 2024 -

FIS draws fintech startups into accelerator

Fidelity National Information Services this week continued an annual program backing young fintechs that are striving to disrupt the financial services landscape.

By Lynne Marek • Sept. 11, 2024 -

PayPal seeks to attract users offline

The digital payments pioneer is leaning on cashback rewards to attract more consumer use in stores, and will also tap near-field technology to expand.

By Lynne Marek • Sept. 10, 2024 -

Amex taps troves of customer data

American Express eschews preset spending limits and instead relies on credit scores and spending history to manage risk, a company executive explained at a conference last week.

By Patrick Cooley • Sept. 10, 2024 -

Amazon provides checkout tech at universities, stadiums

The company said it expects to place its automated checkout technology at more venues in 2024 than in any year previously.

By Jessica Loder • Sept. 9, 2024 -

Visa to upgrade pay-by-bank service in UK next year

The card network plans to make the account-to-account service available to consumers for paying bills, like rent, but eventually for other uses too, such as digital streaming.

By Patrick Cooley , Lynne Marek • Sept. 6, 2024 -

Ex-Discover exec alleges age, gender bias in lawsuit

Diane Offereins is suing the card network over roughly $7 million in clawed-back equity, claiming she was a “convenient scapegoat” for Discover’s card misclassification issue.

By Caitlin Mullen • Sept. 5, 2024