Retail: Page 16

-

Q&A

Endava exec talks super apps, Paze and embedded payments

The consulting firm’s global marketing head explained in an interview why a bank-backed digital wallet won’t be “the PayPal killer” and why the U.S. hasn’t seen a super app for payments.

By James Pothen • Jan. 3, 2024 -

New York enacts surcharge law

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

By Lynne Marek • Jan. 3, 2024 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

Trade group girds for 2024 CCCA fight

The Electronic Payments Coalition is “fully funded” for the continuing fight over the proposed Credit Card Competition Act this year, said the organization’s executive chairman.

By Lynne Marek • Dec. 22, 2023 -

How Google’s settlement will change in-app payments

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

By Lynne Marek • Dec. 21, 2023 -

Walmart adds Affirm to self-checkout kiosks

In an expanded partnership between the two companies, Walmart is adding Affirm’s buy now, pay later option at its checkout kiosks at most stores.

By Tatiana Walk-Morris • Dec. 21, 2023 -

Q&A

Visa leans on fintech partners

Teaming with emerging fintechs is “a way of staying very, very relevant,” said Jim Schinella, Visa’s global head of digital partnerships.

By Caitlin Mullen • Dec. 20, 2023 -

Don’t know what a digital wallet is? We’ve got you covered.

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

By James Pothen • Dec. 20, 2023 -

Senators prod CFPB on BNPL oversight

Three Democratic lawmakers worried about financially vulnerable consumers during the holiday shopping season urged the Consumer Financial Protection Bureau to keep an eye on buy now, pay later offerings.

By Lynne Marek • Dec. 19, 2023 -

Visa seeks majority stake in Mexico payments processor

The card network giant said it plans to purchase a controlling interest in Prosa, with banks retaining a minority stake, subject to regulatory approvals.

By Lynne Marek • Dec. 15, 2023 -

Senators keep pressure on PayPal, Block

Senate Democrats urged top executives at PayPal and Block, in another round of letters, to improve reimbursement for victims of payment scams.

By Lynne Marek • Dec. 14, 2023 -

Synchrony, Bread plan offsets to late fee cap

“I want that shoe to drop so we can start mitigating that issue,” Bread CEO Ralph Andretta said last week, as the industry awaits the CFPB’s final rule.

By Caitlin Mullen • Dec. 14, 2023 -

Google-Epic trial outcome undercuts app payment model

The jury verdict in favor of Epic Games challenges the Google Play app store model that forces payments through its system, with fees up to 30% on sales.

By Robert Freedman • Dec. 13, 2023 -

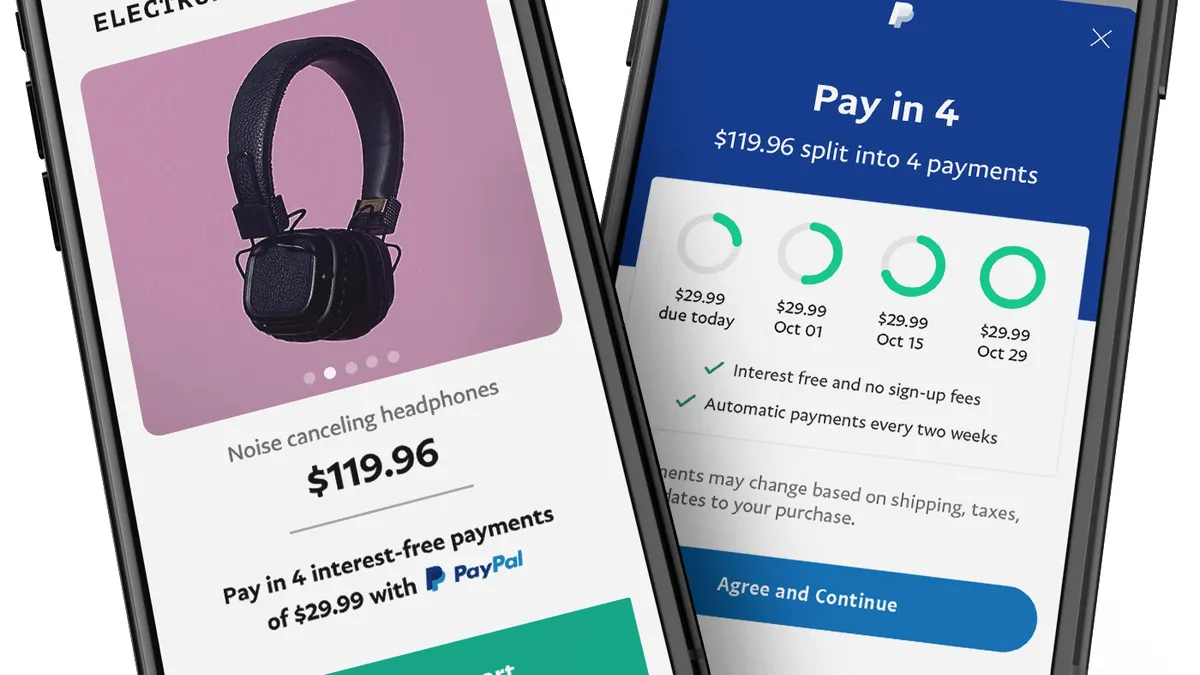

Google Pay taps Affirm, Zip for BNPL

The tech giant has linked with the buy now, pay later companies to develop installment payment options to be offered next year.

By Caitlin Mullen • Dec. 13, 2023 -

Q&A

ValueAct chops Fiserv stake: analyst

The activist investor has cut its ownership by about two-thirds, a sign that it might be satisfied with the payment company’s progress, Monness, Crespi, Hardt & Co. analyst Gus Galá says.

By Caitlin Mullen • Dec. 12, 2023 -

Mastercard ties growth to digital strategy

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

By Lynne Marek • Dec. 11, 2023 -

Durbin bashes United Airlines in CCCA fight

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

By Lynne Marek • Dec. 8, 2023 -

Lawmakers call for action on gun code

Sen. Elizabeth Warren and 48 other congressional Democrats called on the card networks to provide answers to a dozen questions related to the gun merchant category code.

By Caitlin Mullen • Dec. 7, 2023 -

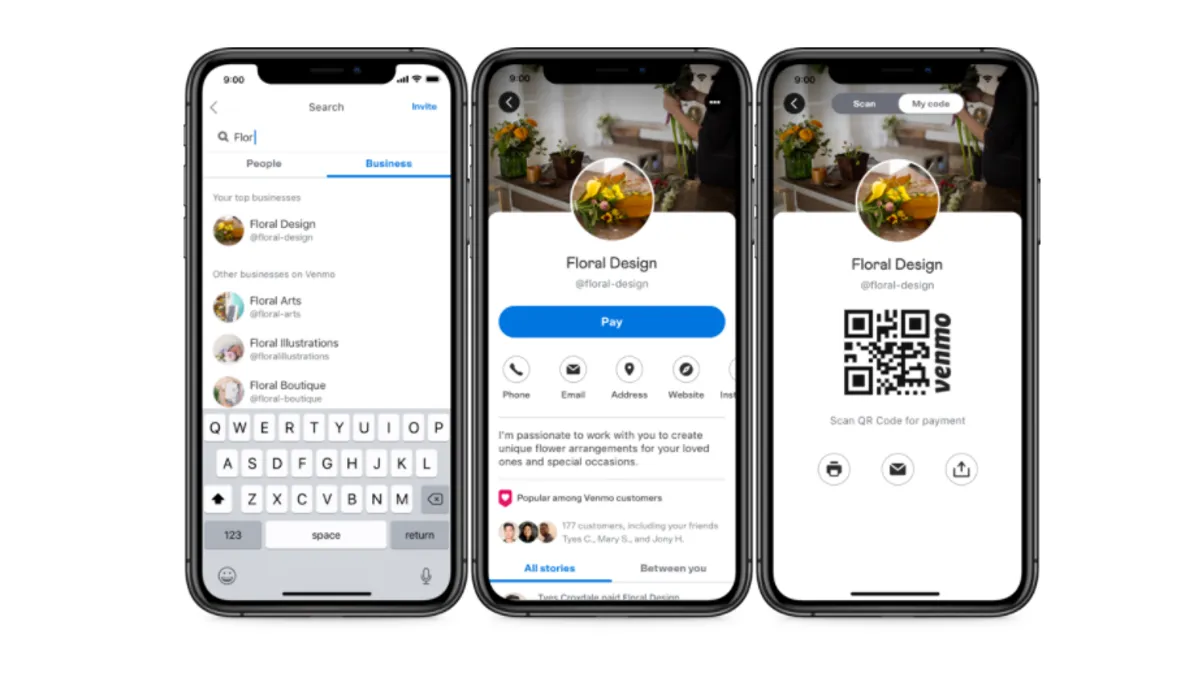

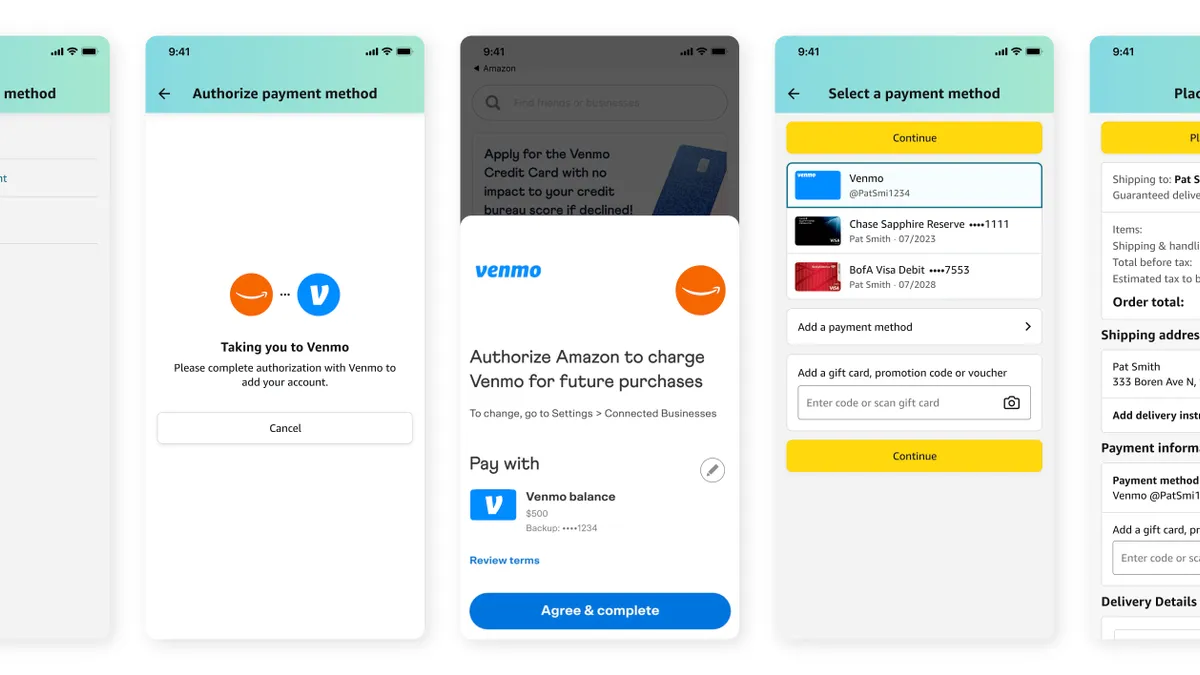

Amazon drops Venmo users

Jettisoning Venmo from the retail juggernaut’s marketplace is another strike against PayPal’s recent growth efforts.

By Lynne Marek • Dec. 7, 2023 -

Fiserv resurrects growth officer role for M&A focus

The payments processor has hired an enterprise growth officer who will zero in on M&A, strategy and ventures for the company.

By Caitlin Mullen • Dec. 7, 2023 -

PayPal taps Fiserv exec for top post

PayPal’s new CEO is making executive suite changes, creating a president of global markets post and tapping a payments industry veteran for the role.

By Lynne Marek • Dec. 6, 2023 -

Amex CEO talks co-brand partnerships after Apple reports

The card issuer’s premium designation isn’t compatible with all potential card issuing partners, Amex CEO Steve Squeri said Tuesday.

By Caitlin Mullen • Dec. 6, 2023 -

PayPal venture arm backs Israeli data privacy startup

The funding boost comes as data privacy management startup Mine seeks to increase its hiring in the U.S.

By Alexei Alexis • Dec. 5, 2023 -

BNPL growth decelerates: Bank of America

The growth rate in the number of shoppers downloading buy now, pay later apps shrunk for this year's Thanksgiving shopping weekend compared to 2022.

By Tatiana Walk-Morris • Dec. 5, 2023 -

Banked builds a US presence

The fintech, founded in the U.K. and now building up operations in the U.S., expects its pay-by-bank services for bank clients will eventually lure retailers.

By Lynne Marek • Dec. 4, 2023 -

Sponsored by Adobe

Reduce fraud risk during the holidays: 4 strategies for retailers

Boosting revenue while minimizing fraud risk is a common goal for e-commerce merchants, particularly during the holiday season when sales surge and fraud incidents tend to rise.

Dec. 4, 2023