Retail: Page 14

-

Walmart removes self-checkout from select stores

The retailer joins Target, Dollar General and other chains in recalibrating a reliance on self-service, and rethinking the whole checkout experience.

By Kristen Doerer • April 25, 2024 -

Visa debit card volume growth keeps sliding

The card network behemoth’s latest earnings report showed a contraction in card volume growth during the first three months of the year, and into April.

By Lynne Marek • April 24, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Walmart offers a new BNPL option: report

The fintech One now offers buy now, pay later financing at the store chain, presenting competition for Affirm, which has partnered with the retail giant since 2019.

By Caitlin Mullen • April 24, 2024 -

Fiserv rises on international, government sales

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

By Lynne Marek • April 23, 2024 -

Klarna expands reach with Uber partnership

The Swedish BNPL pioneer said it has formed new partnerships with the ride-share company, as well as the travel firm Expedia Group.

By James Pothen • April 23, 2024 -

Amex endures slow return of SMB demand

Small and mid-sized businesses were fueling growth for American Express during the COVID-19 era, but not this year. That billed business grew 1% in the first quarter over last year.

By Lynne Marek • April 19, 2024 -

Amazon defends ‘Just Walk Out’ pullback

The retailer’s grab-and-go technology will be targeted to small stores, while its smart carts will be prevalent in grocery stores, the company said this week.

By James Pothen • April 19, 2024 -

Klarna overhauls credit card features

The Swedish buy now, pay later pioneer revised its approach to credit cards in the U.S. market, ditching a more expensive version it touted two years ago.

By Lynne Marek • April 18, 2024 -

CFPB $8 late fee cap edges toward reality

Despite an industry-backed lawsuit seeking to stop the Consumer Financial Protection Bureau’s new $8 late fee rule, bank card issuers are bracing for potential implementation.

By Lynne Marek • April 17, 2024 -

Opinion

CFPB’s new late fee cap charts ‘a better way,’ says Sunbit CEO

“The credit card industry should take a page from innovators, instead of relying on yesterday’s fee models,” argues the CEO of the payment tools provider.

By Arad Levertov • April 16, 2024 -

Q&A

Gen Z clings to new payment tools

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

By Lynne Marek • April 12, 2024 -

BNPL users grapple with financial stress: survey

BNPL users, who are having problems with overspending and missed payments, are tapping buy now, pay later services to spread out their cash flow.

By Tatiana Walk-Morris • April 12, 2024 -

Deep Dive

Why more tech in stores shouldn’t mean fewer workers

Stores can automate more tasks than ever, including pricing, inventory management and checkout. But for theft prevention, customer service and brand engagement, they need humans.

By Daphne Howland • April 11, 2024 -

Mastercard appoints three C-suite execs

As part of the leadership changes and a corporate realignment, a long-time executive is also leaving the card network company.

By Tatiana Walk-Morris • April 11, 2024 -

PayPal’s new CEO lands $42M pay package

The bulk of that compensation stems from a major stock grant handed to Alex Chriss when he took the digital payments company’s top post last year.

By Lynne Marek • April 10, 2024 -

Capital One’s Discover bid tops biggest Q1 tech-related deals

The proposed Capital One-Discover merger made the list because of fintech issues that are at stake in the $35.3 billion deal.

By Alexei Alexis • April 10, 2024 -

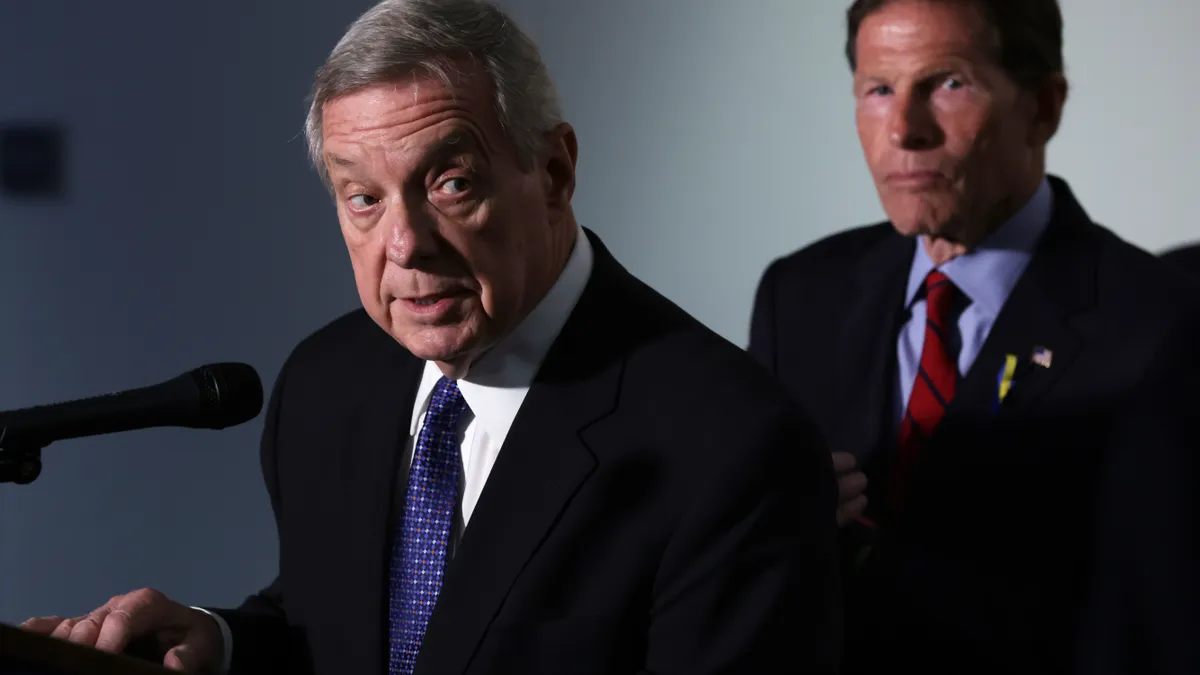

Visa, Mastercard CEOs throw hearing off track

Senate Judiciary Committee Chairman Dick Durbin postponed a plan to call credit card chieftains on the capitol carpet at a Tuesday hearing, but he’s still aiming to get them to Washington.

By Lynne Marek • April 9, 2024 -

Fiserv CEO compensation rose last year to $28M

Compensation for Fiserv CEO Frank Bisignano climbed 57% over 2022, as the value of stock awarded to him surged and he received a $3 million cash bonus.

By Lynne Marek • April 8, 2024 -

Amazon debuts app for palm payment

The Amazon One app can be used to enter various locations, identify individuals, pay for items and access loyalty rewards.

By Xanayra Marin-Lopez • April 7, 2024 -

Whole Foods to pull Amazon’s Just Walk Out technology from stores

The specialty grocer, which operates the checkout tech at just two stores, will follow the same path as Amazon Fresh stores in the U.S., a spokesperson confirmed Friday.

By Peyton Bigora • April 5, 2024 -

Photo by Bia Santana from Pexels.

Fiserv to let Brazilians use Pix in US

The payments processing giant is providing support to extend the Brazilian instant payments system to merchants and consumers around the world.

By Lynne Marek • April 4, 2024 -

PayPal pursues pricing power

The digital payments pioneer aims to increase pricing for its services to boost profitable growth under a new management team.

By Lynne Marek • April 3, 2024 -

Credit card complaints jumped 38% last year: CFPB

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

By James Pothen • April 3, 2024 -

Amazon to drop ‘just walk out’ at some grocery stores

The e-commerce giant will replace the grab-and-go tech with its smart shopping carts in its Amazon Fresh grocery stores, a tech media outlet reported.

By James Pothen • April 2, 2024 -

Nuvei goes private in stock sale to Advent

The sale of the Canadian payments processor’s stock to the private equity firm will hand some investors a $560 million windfall.

By Lynne Marek • April 2, 2024