Retail: Page 13

-

Mastercard CEO outlines int’l ambitions

Mastercard has set its sights on expanding in China, Japan and elsewhere, Michael Miebach said in spelling out the company’s worldview. Last year, the company drew two-thirds of revenue from outside North America.

By Lynne Marek • May 21, 2024 -

Deep Dive

Real-time lessons for FedNow from Brazil, India

The fledgling U.S. instant payments system can learn from real-time systems that have flourished in Brazil and India using QR codes and broad missions, say industry professionals.

By Christiana Sciaudone • May 21, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Retrieved from Chestnut Market.

Retrieved from Chestnut Market.

How retailers are seeking to improve self-checkout

Executives from Mashgin, Invenco and other firms recently discussed issues they face in using kiosks for self-checkout, and how retailers can address them.

By Brett Dworski • May 20, 2024 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0 Opinion

OpinionCFPB should reconsider prepaid rule

The Consumer Financial Protection Bureau should revisit its rule affecting digital wallets, peer-to-peer payments and prepaid cards, writes one fintech group leader.

By Brian Tate • May 17, 2024 -

Supreme Court upholds CFPB’s funding structure

The 7-2 ruling puts an end to a case that threatened the bureau's existence and pushed at least two federal judges to pause CFPB rules, pending the high court's opinion.

By Dan Ennis • May 16, 2024 -

Payments firms seek candidates for product, partner roles

Industry players are increasingly eager to hire executives for product development and partnership-oriented jobs, according to a report from recruiting firm SpencerStuart.

By Tatiana Walk-Morris • May 16, 2024 -

Shift4 to buy rival POS firm Revel for $250M

The payments processing company plans to incorporate Revel’s point-of-sale capabilities into its SkyTab POS system, Shift4 CEO Jared Isaacson said.

By James Pothen , Lynne Marek • May 15, 2024 -

Fed bombarded by debit card fee commentary

The Federal Reserve Board said it has received some 2,500 comment letters regarding its Regulation II proposal to cut the fees that merchants are charged when they accept debit cards.

By Lynne Marek • May 14, 2024 -

7-Eleven testing financial services in stores

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

By Jessica Loder • May 14, 2024 -

Toast CFO weighs in on Visa-Mastercard settlement

The restaurant-focused payments company expects to see an impact from lowered interchange fees by the second half of 2025.

By James Pothen • May 13, 2024 -

CFPB, DOT take aim at airline rewards

The two agencies raised concerns that airlines and card companies could arbitrarily devalue points accrued in their joint rewards programs, amounting to a bait-and-switch for customers.

By James Pothen • May 10, 2024 -

Mastercard joint venture starts operations in China

The collaboration with a Chinese entity began Wednesday, with processing of cards issued by banks in the country following years of preparations.

By Lynne Marek • May 10, 2024 -

Jack Henry, Visa see escalating FedNow volume

While the Federal Reserve won’t specify payments volume on the new instant system, executives from certified service providers Visa and Jack Henry said they’re seeing an increase.

By Lynne Marek • May 9, 2024 -

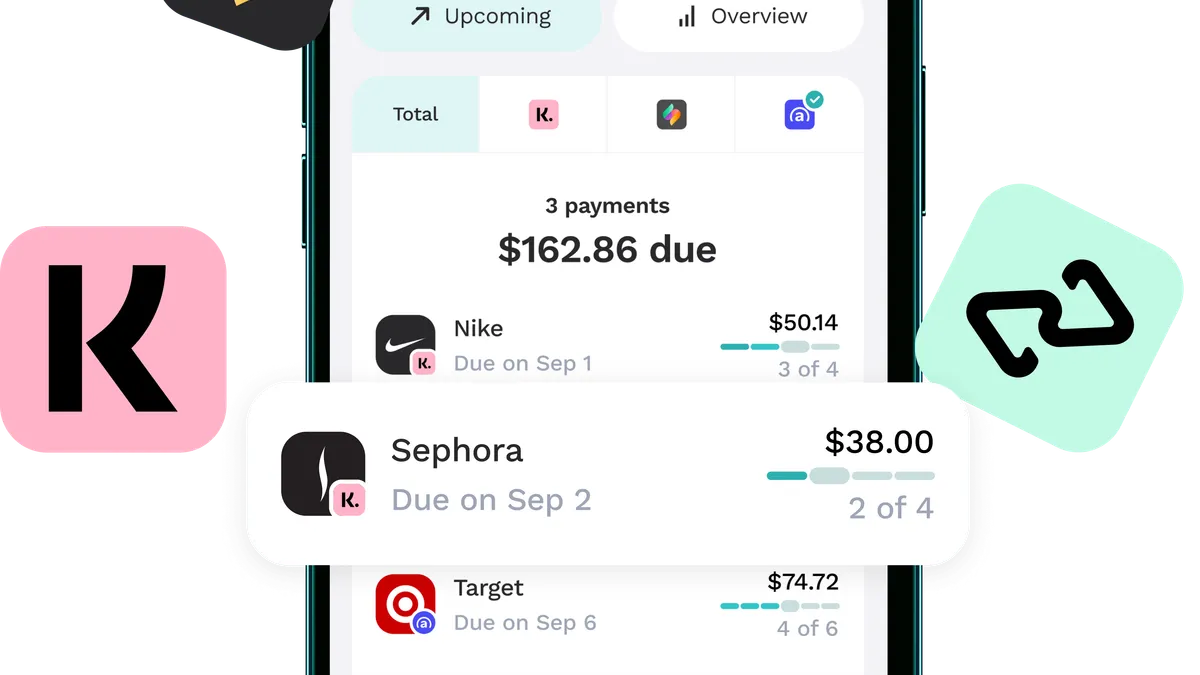

BNPL users tend to have lower incomes: Bank of America

The bank analyzed its BNPL user data and discovered low-income consumers are more likely to use installment payment services. It’s also popular among millennial and Gen X consumers.

By Lynne Marek • May 6, 2024 -

Merchants urged to file claims for $5.5B payment card settlement

Requests for a slice of the Visa-Mastercard settlement are due by a May 31 deadline. Lawyers are racing to alert eligible businesses.

By Lyle Moran • May 6, 2024 -

Opinion

Pay-by-bank holds promise

“The value proposition of pay-by-bank is clear: merchants win from drastically lower payment costs and consumers win from lower prices,” writes one fintech executive.

By Eric Shoykhet • May 3, 2024 -

Automatic age verification comes to self-checkout

Artificial intelligence is speeding up store checkout in a pilot by banking tech company Diebold Nixdorf using tech to verify a customer’s age.

By Jessica Loder • May 3, 2024 -

Global Payments to wrap review soon

The payments processor plans to finish an assessment of operations in the next few months, aiming to streamline its business and pare units it can’t scale.

By Lynne Marek • May 2, 2024 -

Amazon makes a subscription play

The giant digital retailer has created a new payment flow connected to groceries.

By Catherine Douglas Moran • May 1, 2024 -

PayPal, Bread brace for late fee cap

Payments and credit card companies are scrambling to soften the blow of an impending $8 cap on credit card late fees.

By Lynne Marek • May 1, 2024 -

Stripe unbundles services as industry shifts

The company’s move to decouple embedded financial services from payment processing means it’s ready to pursue larger customers, analysts said.

By James Pothen • May 1, 2024 -

Real-time consumer payments need standards to rise

To make instant payments a reality for consumers, the payments industry must work together to develop a common framework for the transactions, top industry executives say.

By Lynne Marek • April 30, 2024 -

NRF objects to Visa-Mastercard settlement

The National Retail Federation lashed out at a landmark Visa-Mastercard legal settlement Friday, calling the pact reached with some merchants last month “meager and temporary” relief.

By Lynne Marek • April 29, 2024 -

How Love’s is remaking stores and checkout

The convenience store chain has installed some self-checkout machines to replace employee checkout counters, C-Store Dive said in reporting on the company’s $1 billion renovation program.

By Jessica Loder • April 29, 2024 -

Opinion

Why financial institutions should embrace ISO 20022

Adopting ISO 20022 payment standards can help U.S. banks and credit unions unlock richer data and stay competitive in the global financial marketplace.

By Sylvie Boucheron-Saunier • April 26, 2024