Regulations & Policy: Page 32

-

Opinion

Card reward programs are the rising tide to lift all boats

The chairman of the Electronic Payments Coalition argues "Americans— regardless of income—love their credit card rewards programs." And the programs benefit consumers and merchants alike, he contends.

By Jeff Tassey • Jan. 11, 2022 -

Crypto, privacy lead legislative priorities for payment trade group

The Electronic Transactions Association said legislative moves related to those issues will be among the most important it's tracking this year at the state and federal government levels.

By Jonathan Berr • Jan. 7, 2022 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

The potential payments peril of punishing Russia

The international community is weighing kicking Russia out of the Swift global payments network as a sanction for the country's aggression in Ukraine, but it could backfire.

By Jonathan Berr • Jan. 6, 2022 -

Amex plans March launch of return-to-office plan

After delaying its new work plan due to the omicron variant, the card company said Thursday it will move ahead with reopening its New York offices as COVID-19 cases have decreased.

By Caitlin Mullen • Updated Feb. 3, 2022 -

7 payments trends for 2022 as innovation climbs

From cross-border services to BNPL to cybersecurity tools, there will be no shortage of innovation and competition in the payments industry as businesses and their regulators shape new digital tools in the wake of the COVID-19 pandemic.

By Jonathan Berr , Caitlin Mullen , Lynne Marek • Jan. 4, 2022 -

Green Dot, PayPal helped recover $400M in stolen relief funds

Criminals have swindled nearly $100 billion through fraudulent applications since the start of the pandemic in the U.S., the agency said. Some payment companies aided in the effort to recover the money, CNBC reported.

By Robin Bradley • Dec. 30, 2021 -

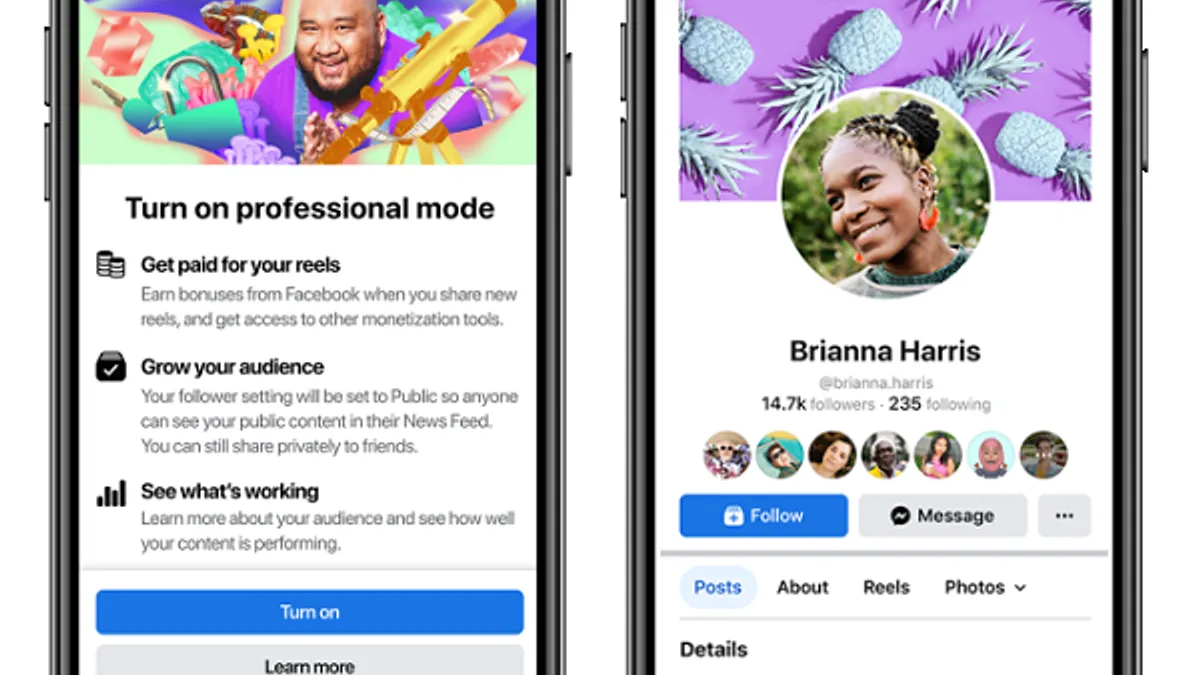

Retrieved from Facebook on December 09, 2021

Retrieved from Facebook on December 09, 2021

Tech trade group criticizes CFPB payments probe

The Electronic Transactions Association, a trade group representing tech companies, asked the Consumer Financial Protection Bureau to explain how the agency's inquiry fits within its authority.

By Jonathan Berr • Dec. 21, 2021 -

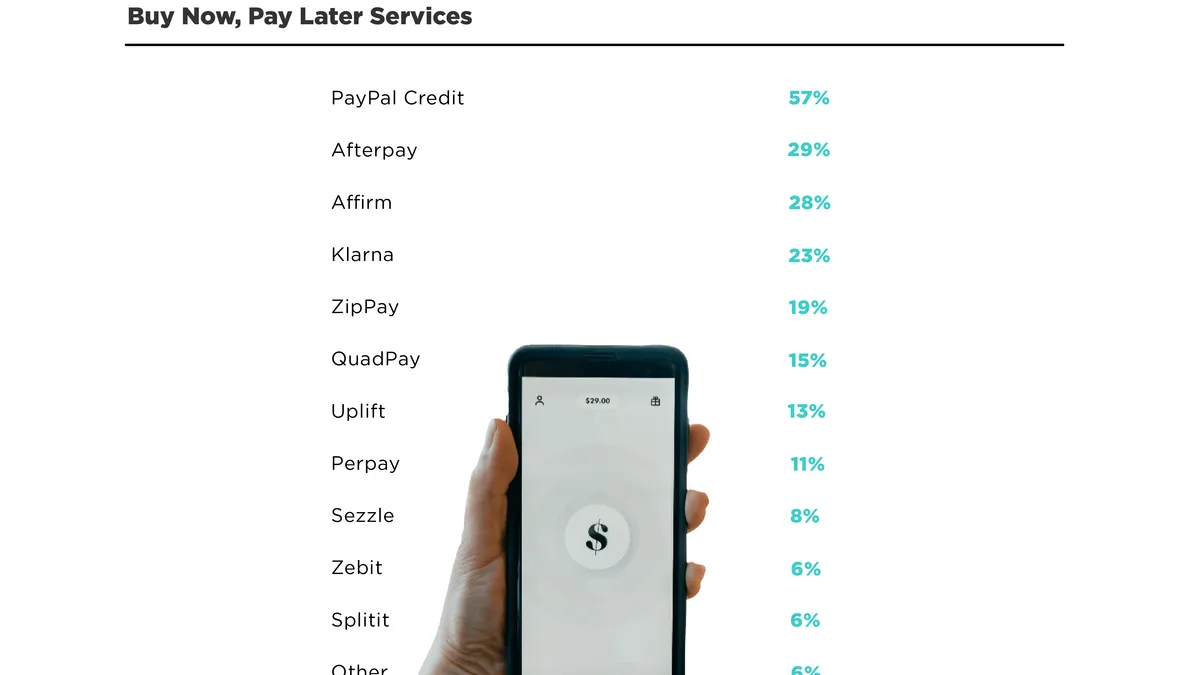

BNPL growth prompts change from credit bureaus

Paying in installments has become wildly popular, but many of these plans aren't reflected on consumers' credit reports. Credit agencies say adaptations are coming.

By Caitlin Mullen • Dec. 20, 2021 -

Bankers group presses CFPB to expand tech probe

Independent Community Bankers of America is urging the Consumer Financial Protection Bureau to sweep data aggregators into its inquiry into the practices of payment tech companies.

By Jonathan Berr • Dec. 20, 2021 -

Feds increase scrutiny of buy now-pay later

The Consumer Financial Protection Bureau is concerned about consumers taking on too much debt, and about BNPL providers evading laws. As a result, it's demanding information from five of the biggest players in the emerging industry.

By Lynne Marek , Jonathan Berr , Caitlin Mullen • Dec. 16, 2021 -

Gen Zers relied on buy now-pay later for holiday shopping. It's time to pay up.

Look up #Klarna, #Afterpay or #Affirm on the social media site TikTok. Beneath some of those BNPL provider hashtags are videos of teens dancing and lip syncing to viral sounds, with the balances they owe in the background.

By Maria Monteros • Dec. 15, 2021 -

How Elon Musk's mood drives crypto

The world's richest man can send cryptocurrency prices soaring or plummeting depending on his mood. This year, Dogecoin has been the object of his affection, and derision.

By Jonathan Berr • Dec. 14, 2021 -

Crypto execs urge regulation tailored to risks

They told lawmakers at a Wednesday hearing on Capitol Hill that nothing short of U.S. leadership in the field of digital assets is at stake.

By Dan Ennis • Dec. 10, 2021 -

Fintech firms lock arms for new standard

Digital finance company Plaid is leading a group of fintechs, data security companies and compliance firms in developing a new standard to protect confidential consumer data from hackers.

By Jonathan Berr • Dec. 9, 2021 -

Opinion

For hourly workers, the paycheck is the enemy

The magnitude of financial precarity in America is staggering. This is why employers have a responsibility for the financial health of their workers.

By David Baga • Dec. 8, 2021 -

Coinbase president seeks "rules of the road"

At a Tuesday conference, Emilie Choi reiterated the company's call for a single regulator to oversee the emerging digital asset industry. She also said the company remains on the hunt for acquisitions.

By Caitlin Mullen • Dec. 8, 2021 -

Bank groups spell out payments industry concerns

"Consumers can make better-informed choices if they more fully understand a big tech’s ability to collect and use a consumer’s financial transaction data, or directly and regularly access their bank account using their sign in and password," the trade groups say.

By Jonathan Berr • Dec. 8, 2021 -

New York Fed, BIS partner on fintech research center

The innovation hub is meant to support the U.S. central bank's analysis of digital currencies, including CBDCs, and to help make cross-border payments faster and less expensive, Fed Chair Jerome Powell said.

By Robin Bradley • Dec. 7, 2021 -

CardX CEO Jonathan Razi testifies before the Colorado House Business Affairs & Labor Committee earlier this year. Retrieved from CardX on July 8.

Will Stax acquisition of CardX mean more surcharging?

With the Stax acquisition of CardX last week, the combined company plans to scale its mission of bringing surcharging tools to more merchants.

By Lynne Marek • Dec. 6, 2021 -

SEC Chair Gensler to crypto platforms: Come to us before we come for you

The SEC head called on digital asset exchanges to register with the agency, citing concerns for "vulnerable" investors. "If we don’t address these issues, I worry a lot of people will be hurt," he said.

By Caitlin Mullen • Dec. 3, 2021 -

Crypto execs to face House panel next week

Executives from crypto firms Coinbase and Circle are among those in the line-up for a Dec. 8 discussion of "the challenges and benefits of financial innovation" as House lawmakers seek answers.

By Robin Bradley • Dec. 3, 2021 -

Will the Amazon-Visa dispute spill over to other credit card companies?

While Visa's rivals are dependent on interchange fees like those at the center of the Amazon-Visa fight, they also might benefit if Amazon tosses some business in new directions.

By Jonathan Berr • Nov. 30, 2021 -

Senate banking chair queries crypto CEOs

The complexity of stablecoins makes it difficult for investors and consumers to fully understand their potential risks, Sen. Sherrod Brown, D-OH, said in letters to eight issuers and exchanges, including Coinbase and Tether.

By Anna Hrushka • Nov. 29, 2021 -

Bank regulators to roll out crypto guidance in 2022

Tuesday's two-page report didn’t provide many details on how banks should navigate digital assets, but regulators said the industry should expect to see the agencies roll out guidance throughout next year.

By Anna Hrushka • Nov. 24, 2021 -

Deep Dive

Payment Choice Act wins bipartisan backing

New Jersey Democrat Rep. Payne is trying to preserve cash as a form of payment and collecting support across the aisle, even as the possibility of a U.S. digital dollar gains traction.

By Lynne Marek • Nov. 23, 2021