Regulations & Policy: Page 33

-

Biden to nominate Powell as Fed chair

Lael Brainard, Powell's chief rival for the role, will be nominated as vice chair. Biden intends to announce nominees for three open Fed slots in early December, the White House said Monday.

By Dan Ennis • Nov. 22, 2021 -

Will Amazon's war of words with Visa backfire?

Consumers may not tolerate fewer payment options from Amazon, an analyst says. Still, Amazon may be willing to risk angering customers as it pressures Visa and other payment providers to reduce their transaction costs.

By Jonathan Berr • Nov. 18, 2021 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Column

Ripple puts SEC on losing end in crypto regulation proposal

The company last week said the existing framework can be adapted to fit crypto and touted legislation that would de-emphasize the SEC's role in favor of the CFTC.

By Dan Ennis • Nov. 17, 2021 -

After much hyped IPO, Toast scales back financial disclosures

Wall Street analyst raises questions about the company's financial disclosures.

By Jonathan Berr • Nov. 12, 2021 -

Opinion

Payments trade group rebuts retailers

The Electronic Payments Coalition says it wants to set the record straight: "Expanding the Durbin Amendment would be a disaster for consumers and small businesses."

By Jeff Tassey • Nov. 11, 2021 -

Chopra screen grab/Payments Dive, data from Screen grab

Chopra screen grab/Payments Dive, data from Screen grab

CFPB's hard line with payments industry may be a hint of things to come

Six of the biggest tech companies in the US are stepping up to meet the demands of the CFPB's new head, Rohit Chopra, regarding their payments practices.

By Jonathan Berr • Nov. 8, 2021 -

Toomey cautions against proposal to regulate stablecoin issuers as banks

"I think we have to really think long and hard before we put some onerous regulatory regime on a new technology," the Republican senator from Pennsylvania said.

By Anna Hrushka • Nov. 8, 2021 -

Regulators eye bank-like oversight for stablecoin issuers

Stablecoins can support beneficial payments options, Treasury Secretary Janet Yellen said, "but the absence of appropriate oversight presents risks to users and the broader system."

By Anna Hrushka • Nov. 3, 2021 -

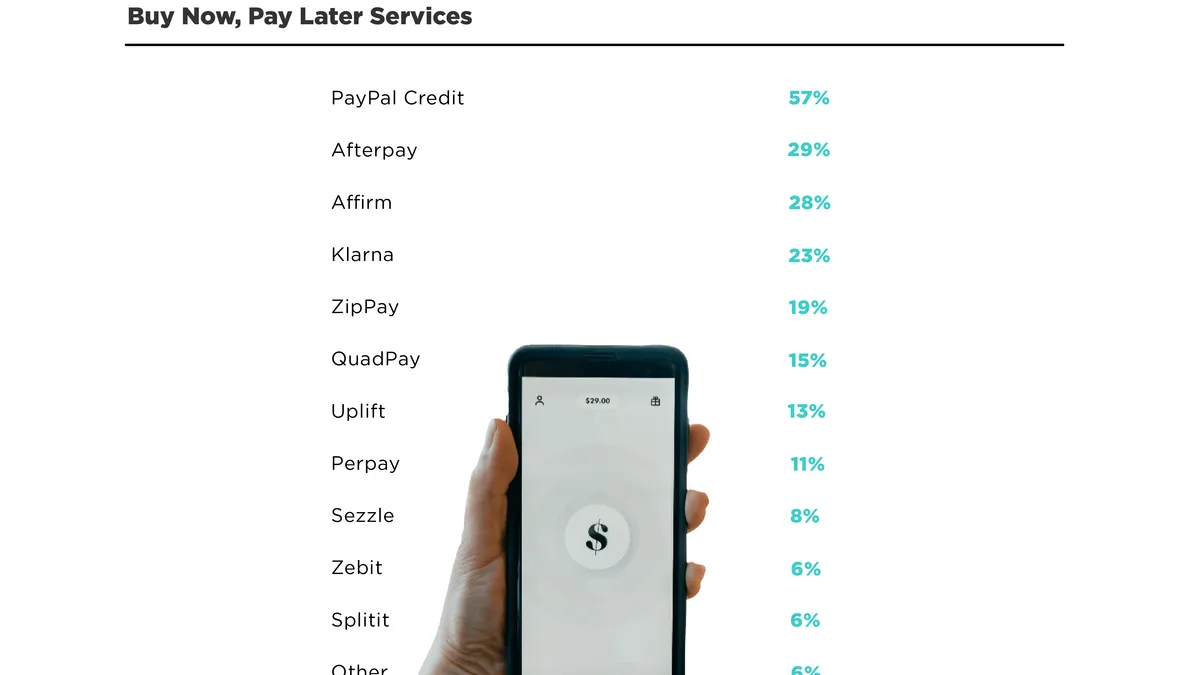

Congress debates pros and cons of BNPL

Buy now-pay later users love the convenience but also are falling behind in their payments.

By Jonathan Berr • Nov. 3, 2021 -

Payments tech to draw $40B next year: Forrester

The research firm's 2022 outlook also anticipates IPOs for major payments players as well as increased use of digital wallets and QR codes.

By Tatiana Walk-Morris • Nov. 3, 2021 -

Deep Dive

Early wage payments draw scrutiny

Companies that offer earned wage access, aka on-demand pay, have proliferated in the U.S. Now, legislators and regulators are targeting the industry for more oversight.

By Lynne Marek • Updated Nov. 4, 2021 -

Regulator previews coming crypto, stablecoin policy

Jelena McWilliams shared details about the interagency "crypto sprint" involving the FDIC, the OCC and the Fed, and said the agencies plan to issue a series of policy statements in the coming months.

By Anna Hrushka • Oct. 28, 2021 -

Valley Bank unveils payments app for cannabis businesses

Valley Bank is partnering with a large processor to offer the service, which is similar to using a reloadable Starbucks wallet gift card, Chief Digital Product Officer Stuart Cook said. A "large processor" that's involved wants to remain anonymous.

By Anna Hrushka • Oct. 27, 2021 -

Discover CEO plans payments push

Discover's Payments business could have a much bigger impact on the company's bottom line, according to analysts at William Blair.

By Jonathan Berr • Oct. 26, 2021 -

Retrieved from ATPC on July 07, 2021

Retrieved from ATPC on July 07, 2021

Elavon eyes BNPL arena

Payments processor Elavon will do what it takes to get into the buy now-pay later market--whether that means buying, building or partnering, said CEO Jamie Walker.

By Lynne Marek • Oct. 26, 2021 -

Ransomware activity soars, Treasury finds

The number of "suspicious activity reports" filed this year has already jumped 30% over the 2020 total, and the agency has tracked billions of dollars in bitcoin payments potentially linked to ransomware.

By Samantha Schwartz • Oct. 19, 2021 -

Opinion

Retail groups urge credit swipe routing changes

Retail and merchant trade groups have long pressed policymakers for regulatory changes to reduce card interchange fees. Now, they're urging that routing of credit card transactions be regulated just as debit transactions already are.

By Doug Kantor • Oct. 19, 2021 -

Column

Celsius, Tether and the 'known known'

Lender Celsius' admission that Tether accepts crypto tokens in exchange for stablecoins should be a bombshell. Rather, it confirms a suspicion regulators held so strongly that they've already penalized Tether for it. Twice.

By Dan Ennis • Oct. 19, 2021 -

Coinbase sees single regulator, new framework for crypto supervision

The approach would keep companies from having to comply with several agencies, which are adapting old laws to new tech, and help maintain the U.S.'s status as a "shaper" of oversight, Coinbase said.

By Dan Ennis • Oct. 18, 2021 -

Andreessen Horowitz poaches Facebook digital wallet execs

Two executives who had been working on the Novi wallet project backed by Facebook will pivot to crypto investing for Andreessen Horowitz.

By Dan Ennis • Oct. 13, 2021 -

Half of CFOs plan to assess digital currencies for business: Gartner

“Sentiment towards digital currencies appears to be improving among finance leaders,” a Gartner researcher said.

By Jim Tyson • Oct. 13, 2021 -

Spat erupts over postal banking pilot

Bank and trade groups derided the US Postal Service's new limited pilot program for financial services, but advocates say it could provide needed services for unbanked consumers and buttress USPS's operations.

By Anna Hrushka , Robin Bradley • Oct. 6, 2021 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Card critics call for credit routing scrutiny

One merchant group has opened up a new front in the battle against Visa and Mastercard, calling for more federal antitrust scrutiny of credit card routing.

By Lynne Marek • Oct. 1, 2021 -

Column

Don't hold your breath for a US CBDC

Given the vast spectrum of American payment choices and slower U.S. digital advances, any central bank digital currency may be a long time coming.

By Lynne Marek • Sept. 27, 2021 -

Fed won't go it alone on CBDC

At a press conference Wednesday, Federal Reserve Chairman Jerome Powell emphasized the need for the Fed to work with Congress and the Biden Administration in moving ahead on any cental bank digital currency.

By Lynne Marek • Sept. 23, 2021