Regulations & Policy: Page 31

-

Visa follows Mastercard in disclosing potential impact from Russia-Ukraine conflict

Visa disclosed Wednesday that Russia and Ukraine made up 5% of its 2021 revenue. Mastercard earlier in the week called Russia and Ukraine "important contributors" to its business and said sanctions triggered by Russia's invasion of Ukraine could impact 6% of its revenue.

By Lynne Marek • March 2, 2022 -

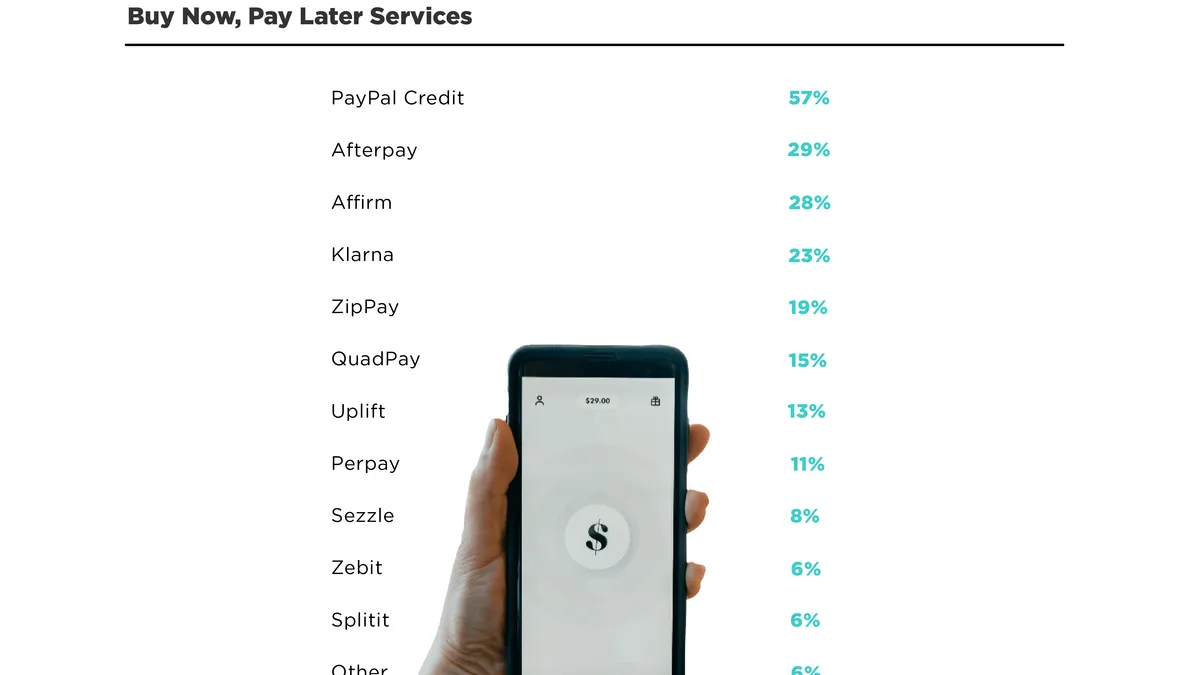

Affirm, Klarna meet CFPB deadline, others mum

There’s plenty at stake in the Consumer Financial Protection Bureau proceedings. The buy now-pay later companies were asked for voluminous amounts of data that could lead to additional scrutiny in the future.

By Jonathan Berr • March 1, 2022 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Visa, Mastercard block Russian banks from network

The card giants said they've disconnected Russian banks from their international payment networks to comply with the slew of sanctions being imposed on Russia after its invasion of Ukraine.

By Jonathan Berr • March 1, 2022 -

FTC report shows consumer fraud losses jumped last year

Consumers lost a whopping $5.9 billion to fraud in 2021, with bank payments and cryptocurrency transactions generating the highest losses, the government report said.

By Caitlin Mullen • March 1, 2022 -

G-7 nations impose limited Swift sanctions

Japan on Sunday joined a coalition of six nations and the European Union in imposing Swift money transfer system sanctions on a limited number of Russian banks.

By Jonathan Berr , Dan Ennis • Updated Feb. 27, 2022 -

Payment companies mainly skirt Russia-Ukraine impact

Payments industry executives likely aren't worrying too much about Russia's invasion of Ukraine, based on the amount of revenue coming from the region, at least not yet.

By Jonathan Berr • Feb. 25, 2022 -

FlexWage wins favorable California ruling

The on-demand pay company secured a statement from a California regulatory agency that said it doesn't need to hold two state licenses that are required for some companies providing financial services in the state.

By Lynne Marek • Feb. 24, 2022 -

Washington policymakers spout off on CBDC

With rising individual and institutional interest in digital assets, policymakers in Washington are cranking up their public discussion of the possibility of a digital dollar. Federal Reserve Gov. Lael Brainard weighed in last week and the Congressional Research Service did earlier this month.

By Lynne Marek • Feb. 22, 2022 -

CFPB's deadline looms for BNPL players

Allen Denson, a partner with Washington, D.C. law firm Stroock & Stroock & Lavan, thinks "we will see investigations opened up as a result of the information collection, and possibly enforcement actions."

By Jonathan Berr • Feb. 17, 2022 -

Rep. Gottheimer unveils stablecoin legislation

As the debate over stablecoins heats up, the New Jersey Democrat Tuesday released a "discussion draft" of his stablecoin bill, along with statements of support from crypto-related trade groups.

By Jonathan Berr • Updated Feb. 16, 2022 -

SIM swap schemes threaten mobile payments

The FBI says SIM card swap fraud, where cybercrooks snatch sensitive data from mobile phones, is on the rise. The Federal Communications Commission is trying to do something about it, but it's not an easy crime to stop.

By Mercedes Cardona • Feb. 15, 2022 -

Crypto lender BlockFi to pay $100M to settle with SEC, states

The company agreed to stop making unregistered offers and sales of its interest-bearing accounts. Half of the settlement money will go to the SEC. The other $50 million will be split among 32 states.

By Dan Ennis • Feb. 14, 2022 -

CFTC chief eyes greater authority in crypto oversight

CFTC Chair Rostin Behnam asked a Senate panel for an extra $100 million and the authority to police the cash market for digital assets, in addition to its traditional role overseeing derivatives.

By Robin Bradley • Feb. 10, 2022 -

U.S. House members spar over crypto regulation

Add cryptocurrency regulation to the list of issues dividing Congress. The debate over regulating digital assets is heating up, and battle lines are being drawn.

By Jonathan Berr • Feb. 9, 2022 -

Electronic Transactions Association calls for regulatory collaboration

The Electronic Transactions Association worries that too much regulation will stifle innovation and hurt underserved consumers, the industry group said in a document outlining its policy perspectives.

By Jonathan Berr • Feb. 7, 2022 -

Apple eyes more payments services

Will Apple angling for a bigger push into the payments sector roil the competitive landscape? Rival Block, and its point-of-sale service, may be squarely in the tech giant's sights.

By Jonathan Berr • Feb. 4, 2022 -

Blockchain startups landed record $25B in 2021

Investors showered blockchain companies with almost twice as much money last year as the prior six years combined, according to a report from research firm CB Insights. Meanwhile, regulations may be on the horizon for the blockchain-based technology cryptocurrency and payments businesses.

By Tatiana Walk-Morris • Feb. 3, 2022 -

CFPB Director Chopra takes on tough payments issues

CFPB head Rohit Chopra is a visionary regulator to some, a breaker of norms to others. Now, as director of the Consumer Financial Protection Bureau, those monikers are coming into play as he takes a magnifying glass to key payments issues, including big tech interests in the industry, rising buy now-pay later companies and on-demand pay concerns.

By Jonathan Berr • Jan. 27, 2022 -

Crypto questions one of 2022 regulatory agenda's unknowns

The people doing the regulating will be as important as rulemaking substance — including which agency will assume the role of cryptocurrency regulator.

By Dan Ennis • Jan. 24, 2022 -

Column

CEOs Sound Off: Fintechs press for open banking mandates

In 2022, CEOs whose companies touch payments are eager for regulators to move toward increased open banking in the U.S., to allow a framework for more sharing of consumer data. They believe it will drive innovation and enhanced financial services.

By Lynne Marek • Jan. 24, 2022 -

Fed's long-awaited CBDC report arrives

"While the existing U.S. payment system is generally effective and efficient, certain challenges remain," the Fed paper says. "A significant number of Americans currently lack access to digital banking and payment services."

By Jonathan Berr • Jan. 20, 2022 -

CFPB weighs in on earned wage access

The federal agency hinted this week that it will scrutinize earned wage access services and their fees to determine whether they're subject to lending laws. It also suggested it may revisit Trump-era policies regarding such businesses.

By Lynne Marek • Jan. 20, 2022 -

Settlement in Amazon-Visa dispute may be near

Amazon backed off a threat to stop taking Visa credit cards in the U.K. this week, as the two companies issued statements suggesting they'll avoid a pitched battle over "swipe" fees.

By Jonathan Berr • Jan. 18, 2022 -

Powell says Fed paper on CBDC is weeks away

The oft-delayed digital currency white paper is coming "within weeks," Powell said Tuesday, but is "an exercise in asking questions and seeking input ... rather than taking a lot of positions."

By Dan Ennis • Jan. 13, 2022 -

Merchant group prods Fed on debit routing proposal

The Merchants Payments Coalition took Fed Chairman Jerome Powell's appearance before Congress this week as an opportunity to call out the central bank's slow-moving review of a debit routing proposal.

By Lynne Marek • Jan. 12, 2022