Technology: Page 5

-

Fintech Dave alters fee structure, blasts DOJ over amended lawsuit

The cash advance online platform called the lawsuit “a continued example of government overreach.”

By Rajashree Chakravarty • Jan. 9, 2025 -

FTV Capital raises $4B for more B2B investments

The venture capital firm with a fintech focus said the latest fundraising brings the total raised since its founding to $10.2 billion.

By Patrick Cooley • Jan. 9, 2025 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

Q&A

How ACI Worldwide is deploying AI

The payments software company has artificial intelligence delivering efficiencies in several areas of its business, CEO Tom Warsop said recently.

By Lynne Marek • Jan. 8, 2025 -

Sezzle challenges critical research from short-seller firm

The buy now, pay later firm argues that a recent Hindenburg Research report highlighting a decline in users and merchant partners overlooks important context and details.

By Patrick Cooley • Jan. 8, 2025 -

Payments player Tranch acquired by legal services firm

Both companies provide services to law firms worldwide, and the acquirer, Elite, says the merger will help expand its product offerings.

By Patrick Cooley • Jan. 7, 2025 -

How ‘frictionless’ payments may benefit, hurt consumers

Such digital payments can slash transaction times, improve data security and provide valuable insights into consumer purchasing behavior and preferences.

By Michael Brady • Jan. 6, 2025 -

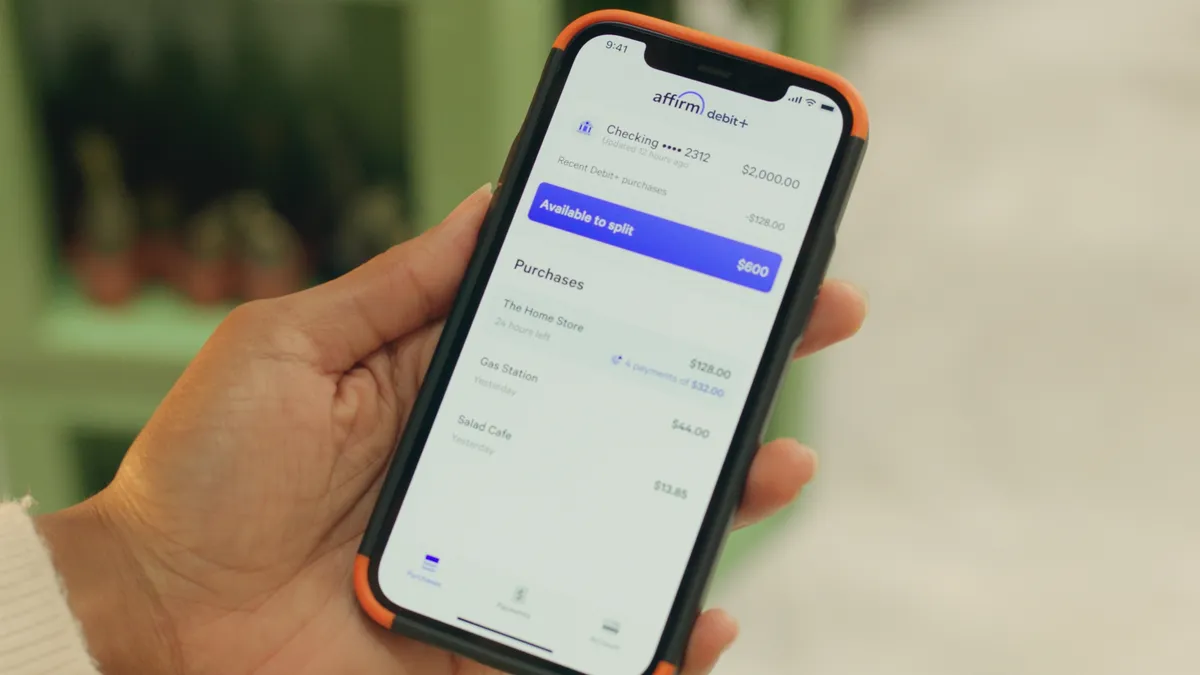

Debit card decline issue persists for Affirm

The buy now, pay later firm has a team working to correct a problem with some customers experiencing debit card declines, the company CFO said in December.

By Patrick Cooley • Jan. 3, 2025 -

Walmart forced delivery workers to pay ‘junk fees,’ CFPB alleges

A Consumer Financial Protection Bureau lawsuit alleges the retailer and fintech Branch Messenger illegally opened accounts for drivers, and deposited their pay into accounts without their consent.

By Peyton Bigora • Jan. 3, 2025 -

Fiserv swallows gig rival Payfare

The mega payments processor bought a Canadian digital banking provider after the two jockeyed for business from the delivery company DoorDash.

By Patrick Cooley • Jan. 2, 2025 -

PAR Technology buys Delaget for $132M

The food service point-of-sale and payments software provider said it bought the data analytics company to better service restaurant operators.

By Lynne Marek • Jan. 2, 2025 -

BNPL payments rise with young, repeat users

Buy now, pay later users in the U.S. tended to be returning customers under 35 years-old, according to a new analysis from LexisNexis Risk Solutions.

By Patrick Cooley • Dec. 20, 2024 -

Stripe CFO joins board of AI start-up Vercel

The digital payments company’s CFO will become a director at the firm as it seeks to build out generative AI-enabled tools.

By Grace Noto • Dec. 19, 2024 -

BVNK raises $50M to fuel US expansion

The stablecoin startup’s plans, including a new office in San Francisco, coincide with the incoming crypto-friendly Trump administration.

By Tatiana Walk-Morris • Dec. 18, 2024 -

What role do stablecoins play in the payments industry?

With the discussion of stablecoins intensifying after the election of Donald Trump, here’s a primer explaining what this cryptocurrency is and what its practical uses may be.

By Patrick Cooley • Dec. 17, 2024 -

Q&A

Nacha CEO talks 2025 trends

Jane Larimer, who leads the association, predicts pay-by-bank and instant payments will remain hot topics next year, with artificial intelligence staying center stage as well.

By Lynne Marek • Dec. 16, 2024 -

PayPal to boost prices for merchants

The digital payments pioneer plans to increase fees U.S. merchants pay for some of its services, including buy now, pay later options, starting next month.

By Lynne Marek • Dec. 12, 2024 -

Opinion

Banks scramble to meet new ISO standard

“Companies that delay action risk losing out on both improved payment experiences and potential business with companies whose systems no longer sync up,” writes one industry senior vice president.

By Robert Turner • Dec. 12, 2024 -

Afterpay to drive Cash App growth, executive says

Once users have signed up for the Cash App card, Block can convince them to use other Block products, a company executive said.

By Patrick Cooley • Dec. 11, 2024 -

CFPB-Google battle likely to stretch into next administration

The Consumer Financial Protection Bureau says Google’s payment unit failed to explain why it was denying customer requests for refunds. Google told the agency to back off in a lawsuit.

By Patrick Cooley • Dec. 10, 2024 -

FIS nears capital markets acquisition

The financial tech provider is on the cusp of making a purchase, at the same time that it’s grappling with employee severance costs, its CFO said last week.

By Lynne Marek • Dec. 9, 2024 -

Q&A

Keeping cash may be critical for a resilient payment system

Climate change, wars and societal benefits should lead the U.S. to maintain greenbacks as an alternative to electronic money, one business professor argues, but he’s worried about preserving it.

By Lynne Marek • Dec. 9, 2024 -

Sponsored by Afterpay

Afterpay’s holiday shopping trends: Free shipping, BNPL for budgeting and more

The holidays are here, and while shoppers are filling their carts, check out what Afterpay is seeing as some of the trends.

Dec. 9, 2024 -

Crypto leaders have knives out for attorneys leaving the SEC

Coinbase and Ripple executives want law firms not to hire lawyers who worked on lawsuits against them.

By Robert Freedman • Dec. 6, 2024 -

RTP limit to rise to $10M for 2025

The Clearing House's move to increase to $10 million the amount that can be sent over its real-time network may attract more corporate use of the system.

By Tatiana Walk-Morris • Dec. 6, 2024 -

PayPal targets higher Braintree pricing

The digital payments pioneer is attempting to develop a more profitable unbranded business line, the company's CFO said at an investor conference this week.

By Suman Bhattacharyya • Dec. 5, 2024