Technology: Page 44

-

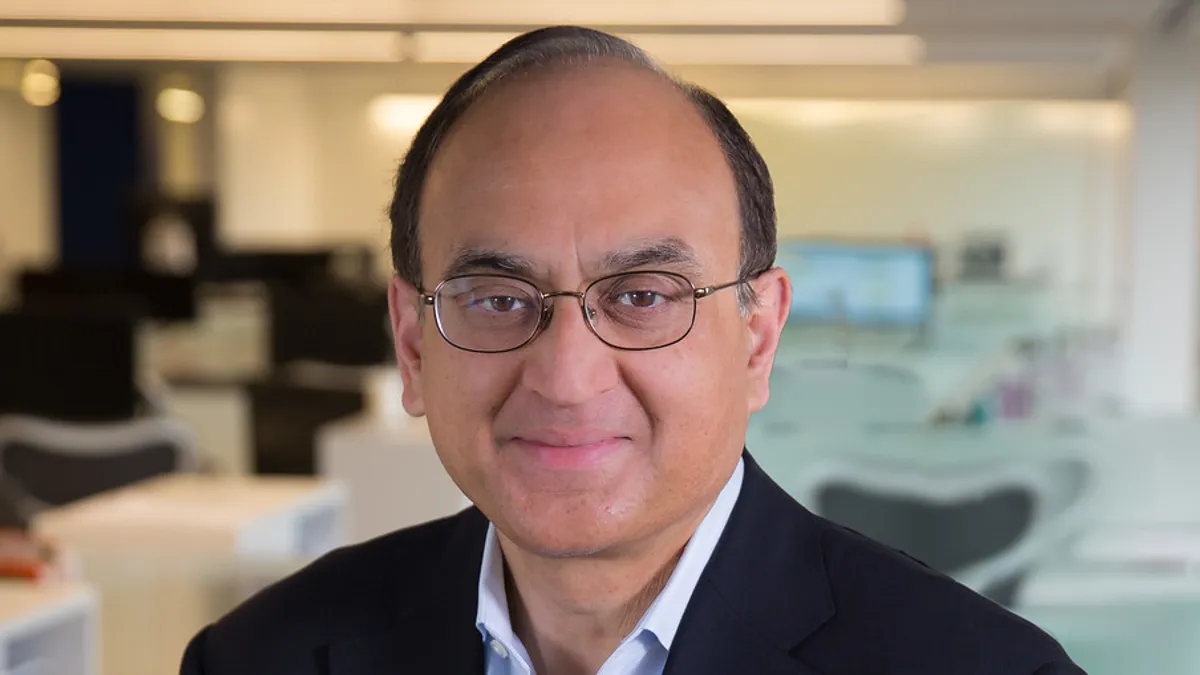

MoneyGram CEO bullish on stablecoins

The money transfer company’s brick-and-mortar business is being displaced by digital payments, mobile wallets and use of stablecoins as bridge assets.

By Suman Bhattacharyya • Sept. 19, 2022 -

Biden advances digital asset regulation

The Biden administration wants the Securities and Exchange Commission and the Commodity Futures Trading Commission to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.”

By Anna Hrushka • Sept. 16, 2022 -

Explore the Trendline➔

Explore the Trendline➔

kentoh via Getty Images

kentoh via Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

New PayPal CFO takes medical leave

PayPal SVP of Capital Markets Gabrielle Rabinovitch will step in for her second round as interim CFO as Blake Jorgensen departs for medical leave.

By Grace Noto • Sept. 16, 2022 -

BNPL players spar with CFPB

BNPL players under the microscope at the Consumer Financial Protection Bureau pushed back against the federal agency’s plan to increase regulation of the industry.

By Lynne Marek • Sept. 16, 2022 -

Freight fintech Denim lands $26M investment

The company, which aims to simplify freight shipment payments, plans to use $26 million in new capital and $100 million in debt financing to scale and give customers access to working capital.

By Caitlin Mullen • Sept. 16, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB mulls rules for BNPL

The Consumer Financial Protection Bureau is weighing new rules and guidance for the fast-growing buy now-pay later industry after wrapping up a comprehensive report on it.

By Lynne Marek • Sept. 15, 2022 -

Zelle counters scam talk with growth rates

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

By Lynne Marek • Sept. 12, 2022 -

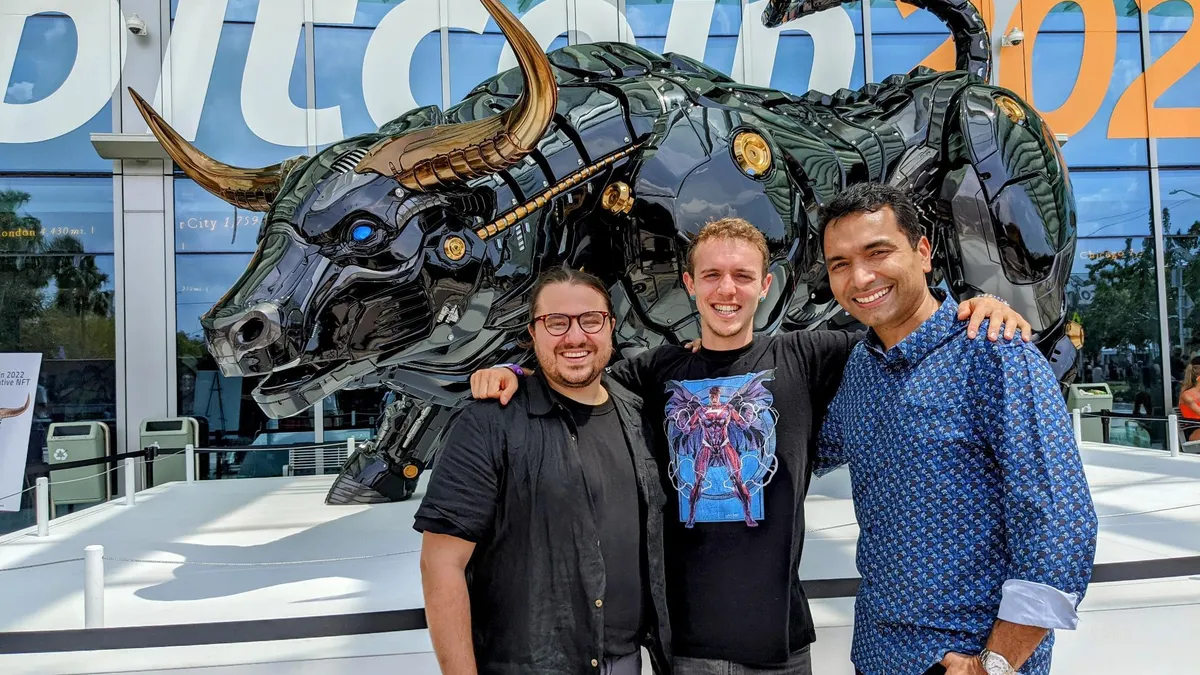

Permission granted by Bolt. From left to right: Wyre CEO Yanni Giannaros, Bolt founder and executive chairman Ryan Breslow, Bolt CEO Maju Kuruvilla at the Bitcoin 2022 conference in Miami.

Permission granted by Bolt. From left to right: Wyre CEO Yanni Giannaros, Bolt founder and executive chairman Ryan Breslow, Bolt CEO Maju Kuruvilla at the Bitcoin 2022 conference in Miami.

Bolt drops Wyre purchase

The checkout startup had planned to purchase the cryptocurrency payments firm for $1.5 billion. That was before the collapse of crypto values recently.

By Caitlin Mullen • Sept. 12, 2022 -

JPMorgan buys payments firm Renovite

The biggest U.S. bank is buying the payments company as competition in the checkout and card processing ecosystem mounts.

By Lynne Marek • Sept. 12, 2022 -

Google invests in new cohort of Black entrepreneurs

The tech behemoth invested another $5 million in Black entrepreneurs, including some that have founded firms in the payments arena.

By Tatiana Walk-Morris • Sept. 9, 2022 -

Ramp jumps into cross-border payments

The fintech startup is adding services as it targets a bigger bite of the $120 trillion business-to-business payments market.

By Caitlin Mullen • Sept. 8, 2022 -

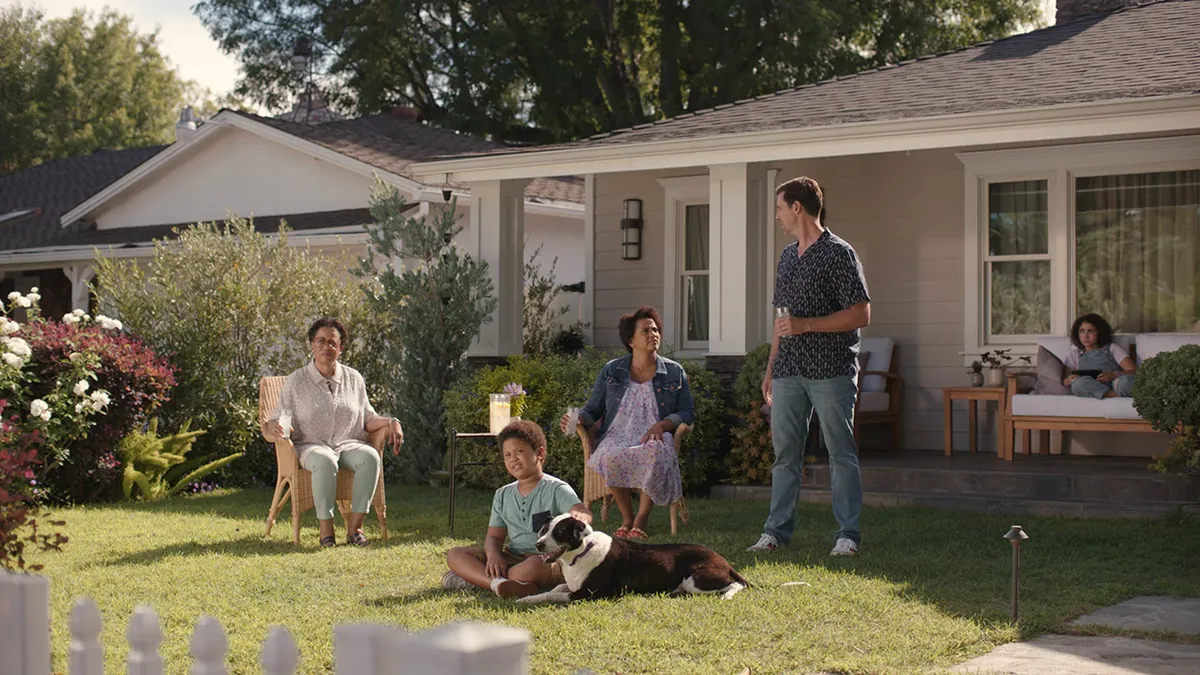

Basic income pilots gain momentum across US cities

At least a dozen U.S. cities have implemented unconditional direct cash payment programs over the past year, as advocates seek to build evidence and experts debate the most effective structures.

By Gaby Galvin • Sept. 8, 2022 -

Healthcare fintechs targeted by cyber criminals

Cybersecurity professionals say healthcare payments processing firms are particularly vulnerable to information technology breaches and ransom demands.

By Joe Burns • Sept. 8, 2022 -

Mesh Payments raises $60M

The payments company hopes to gain more business-to-business payments market share as the demand for expense management services rises.

By Tatiana Walk-Morris • Sept. 8, 2022 -

Column

Strange bedfellows question CBDC

The Fed has an uphill effort ahead in pursuing a central bank digital currency, as evidenced by extensive skepticism from two disparate groups.

By Lynne Marek • Sept. 6, 2022 -

Go slow on a CBDC, Nacha says

The biggest payment system in the U.S. recommends limited implementation of a central bank digital currency if the Federal Reserve pursues that digital dollar.

By Lynne Marek • Sept. 2, 2022 -

Credit card interest rates reach record

With the Federal Reserve pushing up interest rates to calm inflation, the average credit card interest rate is climbing, too, reaching a two-decade-plus record in August.

By Lynne Marek • Sept. 2, 2022 -

Fiserv buys LR2 Group

The global payments processor said it paid $26 million to acquire the independent sales organization, which had been a long-time partner.

By Caitlin Mullen • Sept. 1, 2022 -

Who’s afraid of FedNow? Not Visa

Visa's CFO on Wednesday brushed off any concerns about the threat of new competition from FedNow, or any other real-time payments system.

By Lynne Marek • Sept. 1, 2022 -

Digital wallets dig in

Continued adoption of digital wallets is likely to depend on the services that providers add, said Charlotte Principato, a financial services analyst for polling firm Morning Consult.

By Caitlin Mullen • Aug. 30, 2022 -

Retrieved from Federal Reserve Bank of Boston.

Retrieved from Federal Reserve Bank of Boston.

FedNow aims for September testing

FedNow, an effort by the Federal Reserve Banks to speed up and modernize the U.S. payments system, is expected to launch as early as next May.

By Lynne Marek • Aug. 30, 2022 -

FIS adds real-time payments, CBDC services

The payments processor is pitching real-time payments and central bank digital currency services to countries and central banks to aid them in advancing their financial systems.

By Caitlin Mullen • Aug. 29, 2022 -

Banks push back against CBDC

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

By Lynne Marek • Aug. 29, 2022 -

Affirm scans landscape for acquisitions

With plenty of cash on hand, Affirm CEO Max Levchin considers acquisitions as one of many routes for the buy now-pay later company to continue its growth.

By Lynne Marek • Aug. 26, 2022 -

Big payments companies poke at CBDC

Mastercard, PayPal, Fiserv and Stripe gave the Federal Reserve feedback on a central bank digital currency, pointing out key requirements and cautioning about the outcome.

By Lynne Marek • Aug. 25, 2022