Technology: Page 43

-

Fintechs gain ground in merchant acquiring

New businesses are far more likely to opt for integrated software vendors over legacy providers, McKinsey discovered.

By Caitlin Mullen • Oct. 3, 2022 -

Affirm targets offline growth

The buy now-pay later provider’s chief financial officer said this week its Debit+ card is a key part of Affirm’s strategy to push further into brick-and-mortar sales.

By Caitlin Mullen • Sept. 30, 2022 -

Explore the Trendline➔

Explore the Trendline➔

kentoh via Getty Images

kentoh via Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Retrieved from Star Concessions website.

Retrieved from Star Concessions website.

Convenience store turns to Just Walk Out tech

Grab & Fly is the latest airport convenience store to use Amazon’s Just Walk Out technology, following a Hudson Nonstop store at Chicago Midway International Airport that debuted last summer.

By Brett Dworski • Sept. 30, 2022 -

Q&A

CEOs Sound Off: Forecasting holiday payment trends

CEOs of payments-related companies shared their thoughts on what consumers and merchants want when it comes to checkout and payments this holiday season.

By Caitlin Mullen • Sept. 29, 2022 -

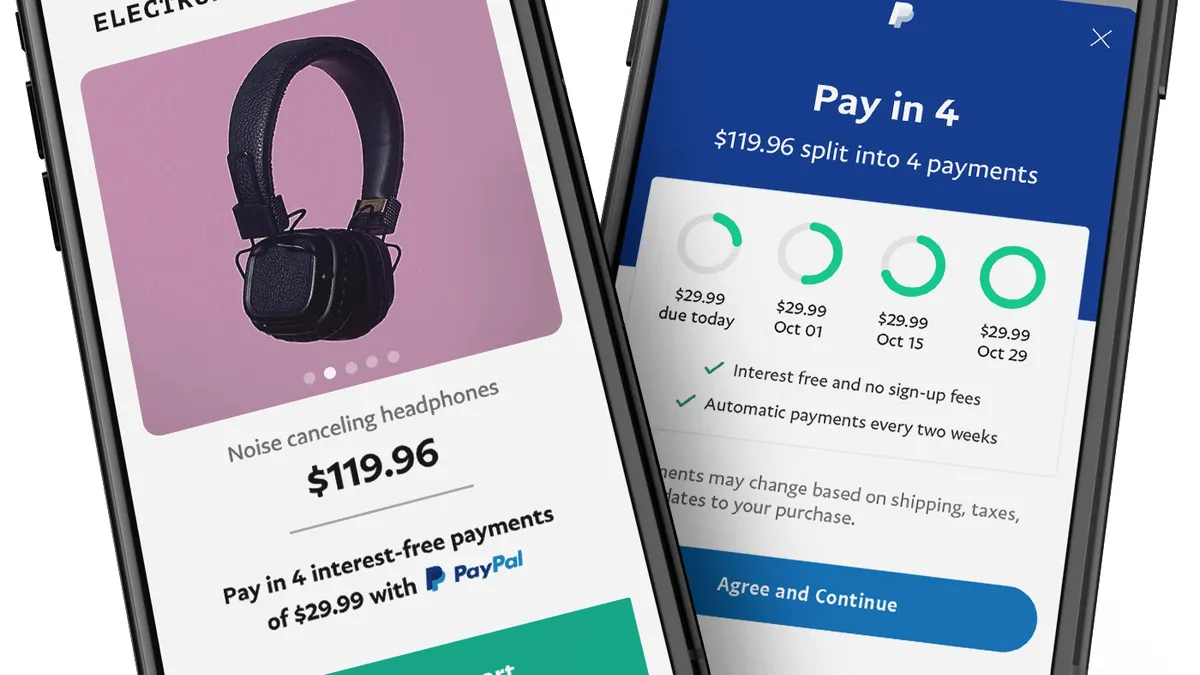

Consumers tap BNPL for larger purchases

Marqeta's report, which showed U.S. buy now-pay later use has climbed since last year, also points to consumers acquiring more credit cards.

By Tatiana Walk-Morris • Sept. 29, 2022 -

PayPal alum latest to take CFO seat for Zepz

PayPal alum Robert Mitchell will take the remittance platform’s financial helm as it looks to foster further growth after reaching profitability during the first half of 2022.

By Grace Noto • Sept. 29, 2022 -

BNPL firms encounter growing pains

As buy now-pay later providers face a shifting economic environment and regulatory scrutiny, they’re likely pursuing transformation, a Guidehouse consultant said.

By Caitlin Mullen • Sept. 28, 2022 -

Banks take stock of payment fraud threats

Credit card fraud tops the list of growing threats, but P2P and newer payment vehicles are quickly catching up, according to a recent poll of industry executives.

By Suman Bhattacharyya • Sept. 28, 2022 -

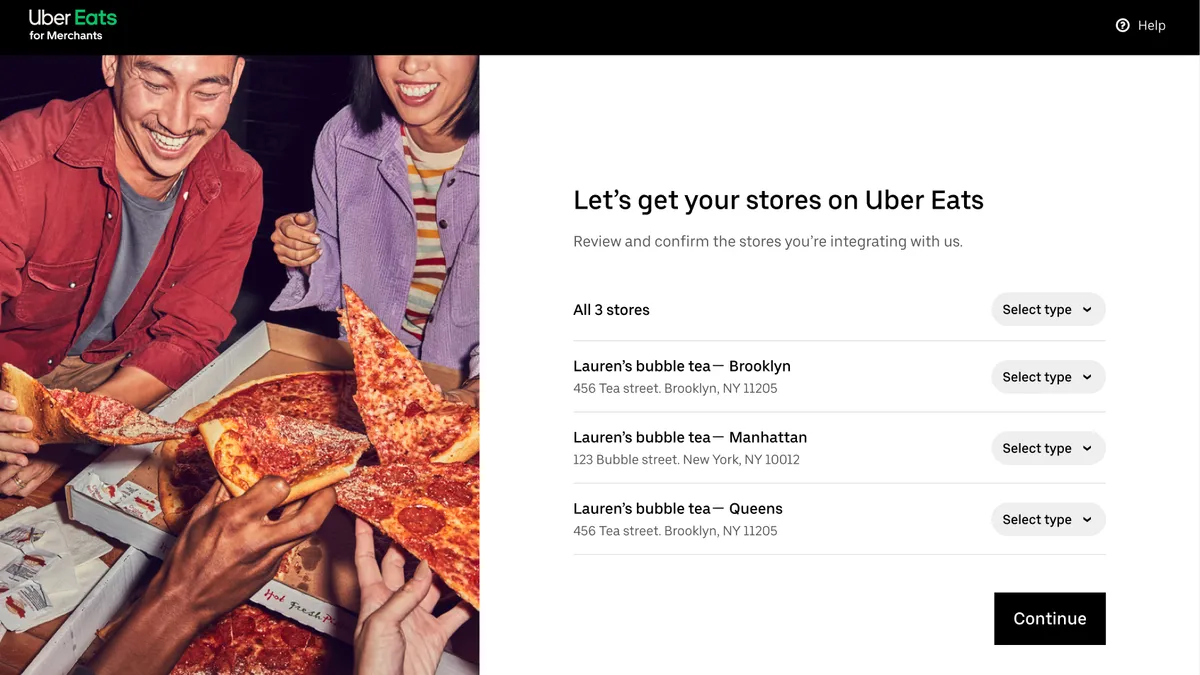

Uber Eats integrates with Toast, Clover

The integrations will allow Uber Eats’ restaurant partners to onboard with both their POS provider and the delivery company much faster.

By Julie Littman • Sept. 27, 2022 -

Opinion

Busting the myths on FedNow

Jessica Cheney, a vice president at Bottomline Technologies, aims to dispel myths about the meaning and impact of the coming Federal Reserve instant payment system.

By Jessica Cheney • Sept. 27, 2022 -

PNC buys restaurant point-of-sale firm Linga

The Pittsburgh-based bank is boosting its payments footprint as banks from Banc of California to JPMorgan Chase are making similar large investments.

By Anna Hrushka • Sept. 27, 2022 -

Shopify adds mobile POS hardware

Pushing further into brick-and-mortar shopping, the commerce company faces competition from other point-of-sale providers as the volume of POS transactions is expected to rise.

By Tatiana Walk-Morris • Sept. 27, 2022 -

Deep Dive

Will biometrics be the future of payments?

The use of biometrics to authenticate payments is poised to bring more security and speed to transactions, but some say broad adoption on the part of consumers and merchants is still far from reach.

By Caitlin Mullen • Sept. 26, 2022 -

Banc of California acquires Deepstack in payment processing play

The acquisition will give Banc of California access to clients’ payment insight, which the bank hopes to use for credit purposes, said Jared Wolff, the bank’s president and CEO.

By Anna Hrushka • Sept. 26, 2022 -

Bank CEOs defend Zelle in Senate hearing

Sen. Elizabeth Warren called the peer-to-peer payments network “unsafe,” claiming Zelle users were defrauded out of $500 million last year.

By Anna Hrushka • Sept. 23, 2022 -

Buyers, vendors blame each other for slow digital payment adoption

A majority of vendors said their customers aren’t ready to stop using checks, although check use among accounts payable teams fell 10% compared to last year, MineralTree’s report revealed.

By Caitlin Mullen • Sept. 23, 2022 -

Klarna seeks to shed more workers

In acknowledging the pursuit of further downsizing, a Klarna spokesperson cited changes being made by company executive Camilla Giesecke assuming COO duties.

By Caitlin Mullen • Sept. 22, 2022 -

PayPal defends BNPL position

The payments firm is just as popular with younger shoppers as its buy now-pay later rivals, a PayPal executive said last week.

By Caitlin Mullen • Sept. 22, 2022 -

Opinion

QR code resurges for payments

“Businesses that have consigned QR technology to the tech graveyard would be wise to give it another look,” writes Mike Storiale, Synchrony’s VP of innovation development.

By Mike Storiale • Sept. 22, 2022 -

Extra costs biggest reason shoppers ditch online carts

With cart abandonment costing online retailers up to $136 billion annually, Coresight Research’s findings suggest they might want to focus on total purchase price more closely matching shopper expectations.

By Caitlin Mullen • Sept. 21, 2022 -

Visa eyes B2B, remittances for growth

Visa is eyeing certain portions of the B2B market for near-term growth, the company’s chief financial officer said during a conference last week. It’s also building out its network for remittances.

By Lynne Marek • Sept. 21, 2022 -

Tipalti introduces new card

After entering the U.K. last year, the company this year is targeting more growth with a new card, a newly promoted president and 100 more employees.

By Tatiana Walk-Morris • Sept. 20, 2022 -

Instacart rolls out in-store tech enhancements

Frictionless checkout and a more efficient shopping journey are core focuses under the new services, which include a scan-and-pay mobile checkout program.

By Jeff Wells • Sept. 19, 2022 -

Square adds services in Spanish

The Block-owned merchant platform debuted its Spanish-language tools in an effort to serve a bigger share of Hispanic-owned businesses in the U.S.

By Tatiana Walk-Morris • Sept. 19, 2022 -

Modern Treasury, Goldman Sachs team up

The two companies want to target mid-size firms that find it too complex to build their own embedded payments service.

By Tatiana Walk-Morris • Sept. 19, 2022