Risk: Page 15

-

Opinion

Reduce cyber risk as digital bill payment options expand

“Not all payment platform companies are managing operational and security as judiciously as they could, and that will eventually result in costly payment failures, customer friction, or potentially a breach,” writes PayNearMe Vice President Tim Murphy.

By Tim Murphy • Oct. 13, 2022 -

Card delinquency rates, balances rise: TransUnion

As card issuers report an uptick in delinquencies and balances, the credit reporting bureau offers new research to help lenders spot trouble.

By Tatiana Walk-Morris • Oct. 10, 2022 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Warren report slams Zelle reimbursements

The senator pushed to bolster a key CFPB rule after releasing a report tallying claims of fraud and scams on the P2P platform submitted by Truist, PNC, U.S. Bank and Bank of America.

By Dan Ennis • Oct. 4, 2022 -

Affirm targets offline growth

The buy now-pay later provider’s chief financial officer said this week its Debit+ card is a key part of Affirm’s strategy to push further into brick-and-mortar sales.

By Caitlin Mullen • Sept. 30, 2022 -

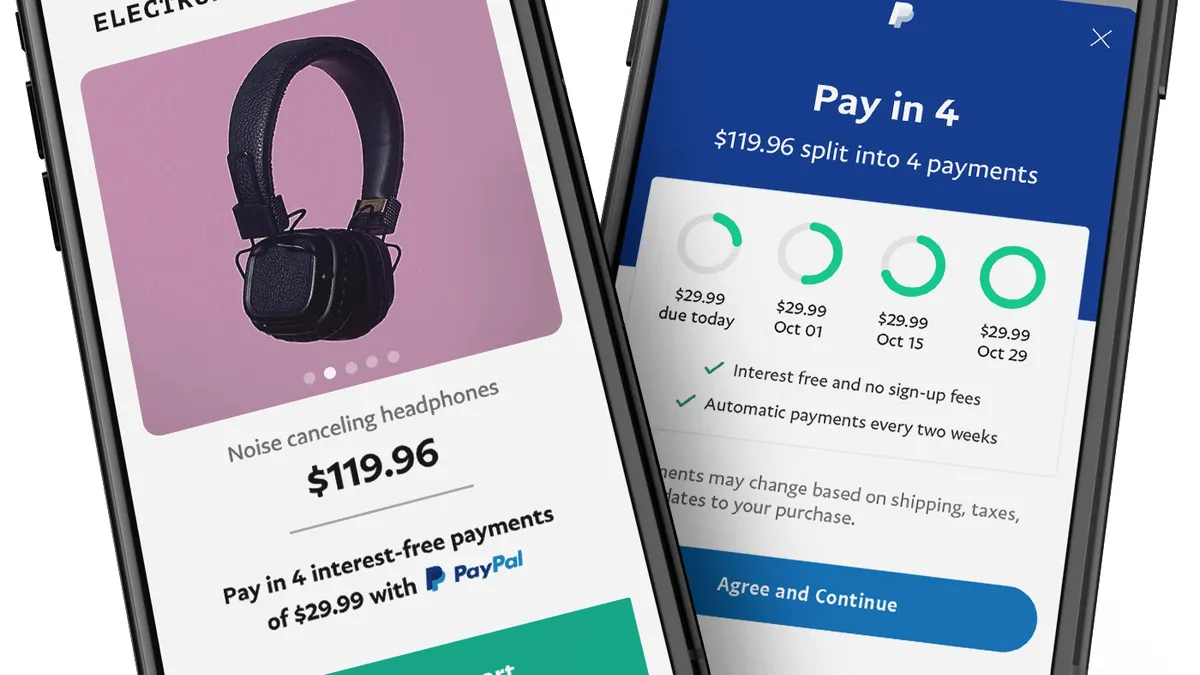

BNPL firms encounter growing pains

As buy now-pay later providers face a shifting economic environment and regulatory scrutiny, they’re likely pursuing transformation, a Guidehouse consultant said.

By Caitlin Mullen • Sept. 28, 2022 -

Banks take stock of payment fraud threats

Credit card fraud tops the list of growing threats, but P2P and newer payment vehicles are quickly catching up, according to a recent poll of industry executives.

By Suman Bhattacharyya • Sept. 28, 2022 -

Bank CEOs defend Zelle in Senate hearing

Sen. Elizabeth Warren called the peer-to-peer payments network “unsafe,” claiming Zelle users were defrauded out of $500 million last year.

By Anna Hrushka • Sept. 23, 2022 -

PayPal defends BNPL position

The payments firm is just as popular with younger shoppers as its buy now-pay later rivals, a PayPal executive said last week.

By Caitlin Mullen • Sept. 22, 2022 -

Biden advances digital asset regulation

The Biden administration wants the Securities and Exchange Commission and the Commodity Futures Trading Commission to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.”

By Anna Hrushka • Sept. 16, 2022 -

Healthcare fintechs targeted by cyber criminals

Cybersecurity professionals say healthcare payments processing firms are particularly vulnerable to information technology breaches and ransom demands.

By Joe Burns • Sept. 8, 2022 -

Visa, Mastercard face cross-border fee questions in U.K.

The U.S. card giants are taking a stand in defense of their services for cross-border transactions as U.K.’s parliament and regulators scrutinize higher fees.

By Lynne Marek • Sept. 7, 2022 -

Lawmakers push card companies to back gun-merchant code

Democratic Congress members, in letters to the CEOs of Visa, Mastercard and American Express, pressed the companies to support creating a merchant code for gun sellers.

By Caitlin Mullen • Sept. 7, 2022 -

Column

Strange bedfellows question CBDC

The Fed has an uphill effort ahead in pursuing a central bank digital currency, as evidenced by extensive skepticism from two disparate groups.

By Lynne Marek • Sept. 6, 2022 -

Lawsuit filed against Block

A class action lawsuit has been filed against Cash App Investing and parent company Block over a December 2021 data breach.

By Caitlin Mullen • Aug. 25, 2022 -

Q&A

Convera CEO revamps former Western Union biz

Patrick Gauthier, the former head of Amazon Pay, aims to remake Western Union’s B2B unit and aid corporate clients in navigating currency volatility.

By Caitlin Mullen • Aug. 23, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB spotlights payments risks

The Consumer Financial Protection Bureau is “carefully monitoring” payments innovations and risks they pose to consumers, the agency said in a report.

By Caitlin Mullen • Aug. 22, 2022 -

Consumer spending rises despite inflation: Mastercard

While card issuers are bracing for economic headwinds, consumer spending has continued to rise recently, including for apparel, jewelry and travel.

By Tatiana Walk-Morris • Aug. 8, 2022 -

Block pulls back on expenses

The parent of Square is cutting $250 million in planned expenses for the year, after reporting another quarterly net loss on Thursday.

By Caitlin Mullen • Aug. 5, 2022 -

The image by Achim Hepp is licensed under CC BY-SA 2.0

The image by Achim Hepp is licensed under CC BY-SA 2.0

Gucci expands crypto payment options to ApeCoin, Euro Coin

More brands have entered the cryptocurrency and NFT markets despite signs of declining consumer interest.

By Tatiana Walk-Morris • Aug. 4, 2022 -

Fiserv whittles workforce

The payments processor cut employees in the first half of the year and shouldered higher severance expenses, following a string of acquisitions in recent years.

By Caitlin Mullen • Aug. 4, 2022 -

Will a swoon in valuations affect Block’s Afterpay?

Block acquired Afterpay for what was ultimately $13.9 billion in stock, but a string of fintechs writing down valuations in the face of economic pressures raises the possibility Block will be forced to do the same.

By Caitlin Mullen • Aug. 2, 2022 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments buys Evo at a premium

Global Payments said it will pay $4 billion to buy Evo Payments as it sheds its Netspend consumer unit for $1 billion and takes a $1.5 billion investment from Silver Lake Partners.

By Lynne Marek • Aug. 1, 2022 -

Card CEOs react to macroeconomic threats

Amid talk of a recession, executives with Visa, Mastercard, American Express and Discover are keeping a close eye on inflation, consumer demand and unemployment levels.

By Caitlin Mullen , Lynne Marek • July 29, 2022 -

Retrieved from Loves Furniture & Mattresses on January 11, 2021

Retrieved from Loves Furniture & Mattresses on January 11, 2021 Column

ColumnCEOs Sound Off: Payments execs navigate economic turmoil

CEOs of three payments companies share how macroeconomic headwinds are affecting their businesses and how they’re seeing their firms through the uncertainty.

By Jonathan Berr • July 29, 2022 -

Attorneys weigh case against Discover

After Discover disclosed an internal investigation into its student loan practices, the company’s stock price dropped more than 8% on July 21, attorneys noted.

By Caitlin Mullen • July 26, 2022