Risk: Page 14

-

Harvard researchers flag BNPL risks

The working paper shines a spotlight on BNPL risks just as the payment method lures more consumers amid high inflation.

By Caitlin Mullen • Dec. 1, 2022 -

Banks discuss refund rule for customers defrauded on Zelle: report

Under measures being discussed, banks would share liability inside Zelle’s system and guarantee to reimburse one another, sources told The Wall Street Journal.

By Anna Hrushka • Nov. 28, 2022 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Demand for credit cards climbed this year

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

By Lynne Marek • Nov. 22, 2022 -

Card debt mounts for younger, less affluent borrowers

Debt burdens and delinquencies are rising more rapidly for younger and less wealthy borrowers, the New York Federal Reserve Bank researchers said.

By Caitlin Mullen • Nov. 18, 2022 -

Column

Can Congress come together on crypto?

Perhaps even a divided Congress can make bipartisan headway in crafting a regulatory framework for crypto following the FTX failure.

By Lynne Marek • Nov. 17, 2022 -

Q&A

CEOs Sound Off: Payments forecasts for 2023

The CEOs of Brex, Splitit and Paystand weigh in on what’s to come in the year ahead, commenting on the trends, challenges, regulation and M&A.

By Caitlin Mullen , Lynne Marek • Nov. 16, 2022 -

Discover concludes student loan probe

While the card company said it has finished its own investigation into its student loan servicing practices, it may still be subject to regulatory probes.

By Caitlin Mullen • Nov. 16, 2022 -

FTX files for bankruptcy, CEO steps down

FTX.com’s assets were frozen in the Bahamas, where the company is headquartered. Crypto lender BlockFi also paused withdrawals because of its exposure to FTX.

By Gabrielle Saulsbery • Nov. 11, 2022 -

FIS targets $500M in cost cuts

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

By Jonathan Berr • Nov. 9, 2022 -

Tracker

How active shooters pay for guns

Payment methods used by active shooters to acquire guns are becoming part of the U.S. dialogue about such incidents. A Payments Dive series tracking those details seeks to inform the discussion.

By Payments Dive staff • Updated Dec. 13, 2022 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments leans into fintechs

As it pursues more fintech clients, the payments processor sees B2B and commercial cards as areas ripe for expansion.

By Jonathan Berr • Nov. 3, 2022 -

6 payments takeaways from big consulting firms

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

By Caitlin Mullen , Lynne Marek , Jonathan Berr • Nov. 2, 2022 -

Sponsored by Banked

Mitigating fraud in the payments industry

Cybercrime countermeasures are essential to protecting private banking data. Here’s how fintech innovators can protect customer data.

Oct. 31, 2022 -

Visa eyes 2023 growth, sidesteps threats for now

“Should there be a recession, or a geopolitical shock that impacts our business...we will, of course, adjust our spending plans,” Visa’s CFO said.

By Lynne Marek • Oct. 27, 2022 -

Ukraine raises fraud concerns, Stripe exec says

The war in Ukraine raised the stakes for payment fraud detection, as bad actors devise more complex ways of evading oversight.

By Suman Bhattacharyya • Oct. 26, 2022 -

Synchrony delivers mixed results

While the financial services company’s third-quarter income rose over the year-earlier period, net earnings sagged. Synchrony also increased credit loss provisions.

By Jonathan Berr • Oct. 26, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover tightens underwriting

Count the card company among those that added to credit loss provisions in the third quarter as economic conditions soured.

By Caitlin Mullen • Oct. 26, 2022 -

Column

Fintechs party like it’s 2021 at Money 20/20

Thousands of payments and fintech professionals at the Money 20/20 conference in Las Vegas this week are racing ahead with high-growth businesses, even as a drop-off in capital threatens to ruin the celebration.

By Lynne Marek • Oct. 25, 2022 -

Fiserv divestiture hints at strategy shift

As payments companies face economic headwinds, Fiserv and its peers “may try to focus on their strongest market positions versus more ancillary opportunities,” said Oppenheimer & Co. analyst Dominick Gabriele.

By Caitlin Mullen • Oct. 24, 2022 -

Opinion

BNPL for business is a high stakes proposition

“As BNPL providers, especially in the business realm where more money is being spent, fintechs are going to need much more sophisticated, secure, reliable authentication methods,” writes Flexbase CEO Zaid Rahman.

By Zaid Rahman • Oct. 24, 2022 -

Amex adds to loss provisions

As consumers grapple with inflation, the card company reported this week that delinquencies have ticked up and that it’s boosting its loss provisions.

By Caitlin Mullen • Oct. 21, 2022 -

Earnings preview: Payments companies confront 3Q challenges

Macroeconomic headwinds, consumer health and cost management are set to be topics of conversation during payments companies' quarterly earnings calls.

By Caitlin Mullen • Oct. 20, 2022 -

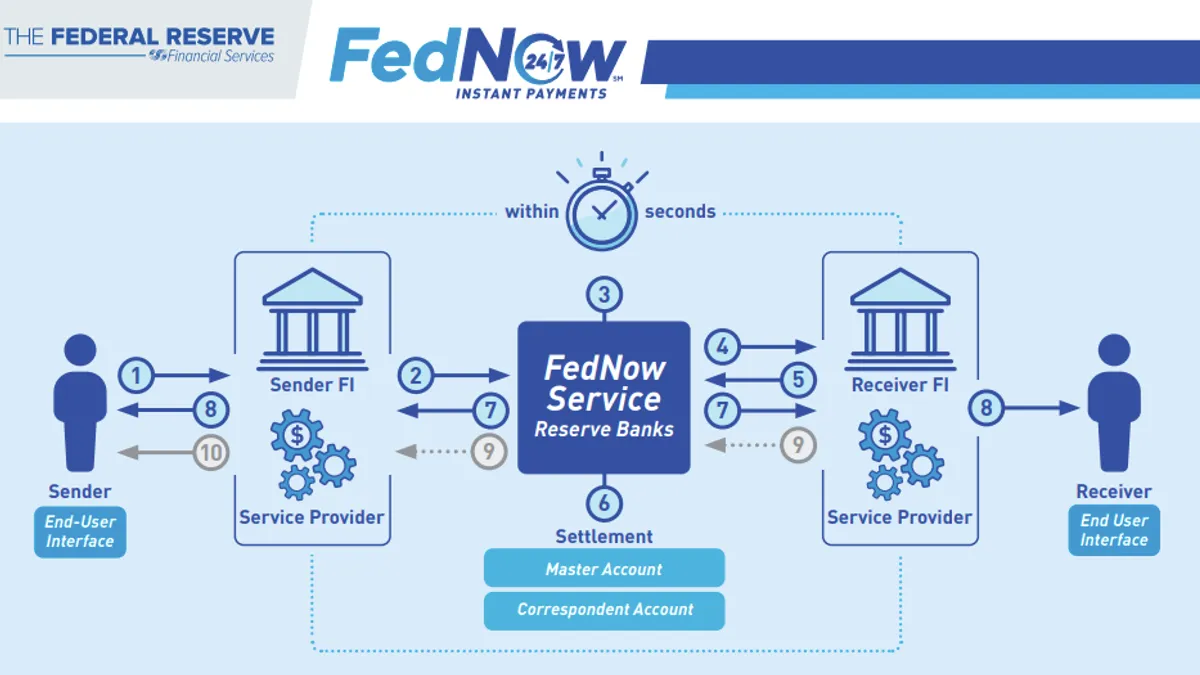

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services. Opinion

OpinionFedNow may stumble without nonbanks, cross-border payments

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

By Rina Wulfing • Oct. 18, 2022 -

Fintechs clamor for FedNow access

Nonbank fintechs are pushing for access to the new federal faster payments system as its launch date next year approaches.

By Lynne Marek • Oct. 17, 2022 -

Warren roasts Wells Fargo’s ‘severely bad performance’ on Zelle fraud

Four of the seven banks that own Zelle reported data to the senator, but she focused her attention on Wells CEO Charlie Scharf in a letter Thursday.

By Gabrielle Saulsbery • Oct. 14, 2022