Regulations & Policy: Page 9

-

Capital One pledges to give Discover’s network a boost

Dominated by Visa and Mastercard, card network markets “sorely need an injection of competitive rivalry,” Capital One argued in its application to regulators to purchase Discover.

By Caitlin Mullen • March 26, 2024 -

DOJ calls Apple card fees ‘significant expense’ for banks

The tech giant’s fees for credit card transactions “cut into funding for features and benefits that banks might otherwise offer smartphone users,” the Department of Justice said in suing the company earlier this month.

By James Pothen • March 26, 2024 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Visa, Mastercard reach landmark credit card settlement

The two biggest U.S. card networks agreed to cap interchange fees for five years, among other terms, to settle merchant litigation that has lasted nearly two decades.

By Lynne Marek • March 26, 2024 -

Crypto fraud losses rose to $3.9B in 2023, a 53% yoy increase: FBI

SEC enforcement actions against cryptocurrency players were up last year, but the commission is under attack for not issuing new rules for the industry.

By Vincent Ryan • March 25, 2024 -

Advocates urge transparency in Capital One-Discover review

More than 30 organizations demanded the deal not be subject to expedited federal review and that public hearings be held in the largest lending markets for both Capital One and Discover.

By Caitlin Mullen • March 22, 2024 -

Wisconsin passes EWA law as states’ paths diverge

Wisconsin became the third state to pass a law requiring that earned wage access providers be licensed, and leaving the payments unregulated under lending laws.

By Lynne Marek • March 22, 2024 -

DOJ sues Apple over antitrust violations

The tech giant called the suit a threat to its identity and principles, vowing to "vigorously defend against it.”

By James Pothen • March 21, 2024 -

ABA, U.S. Postal Services jointly combat check fraud

American Bankers Association and the U.S. Postal Inspection Service are working together to educate postal and banking employees as well as consumers on the rising form of fraud.

By Tatiana Walk-Morris • March 21, 2024 -

Fed banks analyze consumer use of card promos

New research from the Philadelphia and Boston Feds finds that consumers are cycling through low APR credit card offers.

By Tatiana Walk-Morris • March 20, 2024 -

New Nacha rules strike at push-payment fraud

“With respect to transaction monitoring for fraud, it would no longer be acceptable to do nothing,” Nacha Executive Vice President Michael Herd said.

By James Pothen • March 19, 2024 -

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 18, 2024 -

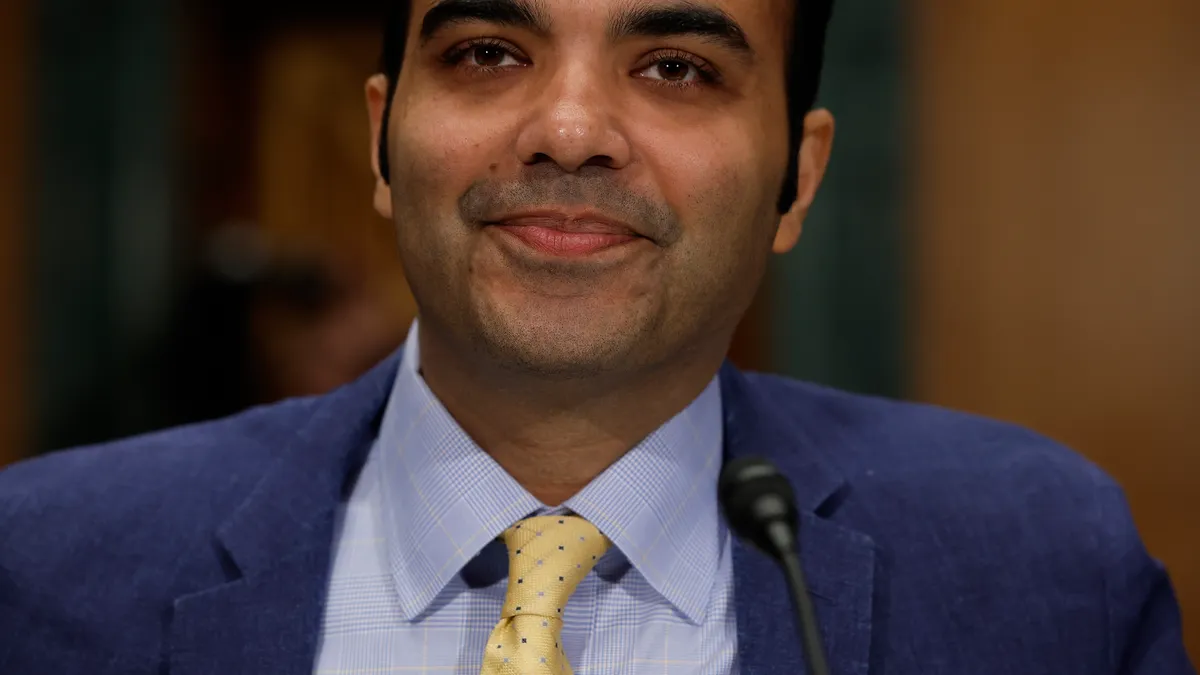

CFPB warns of ‘dangers’ on standards for open banking

“We know dangers exist when more powerful players weaponize industry standards,” Consumer Financial Protection Bureau Director Rohit Chopra said in advance of finalizing an open banking rule later this year.

By Lynne Marek • March 15, 2024 -

Q&A

ACI CEO weighs in on FedNow, cross-border payments

The federal real-time payments system may spool up slowly, but it could ultimately transform U.S. cross-border payments, ACI Worldwide's CEO predicted.

By Lynne Marek • March 14, 2024 -

FDIC pushes regulators to address tokenization

Tokenization could be a "major leap" for the monetary system. FDIC Vice Chairman Travis Hill doesn't want the U.S. to be left out.

By Gabrielle Saulsbery • March 12, 2024 -

Visa spends ‘billions’ battling cybersecurity threats

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

By Lynne Marek • March 11, 2024 -

Apple reverses decision on blocking Epic

“We are moving forward as planned to launch the Epic Games Store and bring Fortnite back to iOS in Europe,” Epic said following the change.

By James Pothen • March 8, 2024 -

Biden, Republicans clash over card fees

President Biden and Republican lawmakers sparred Thursday over credit card late fees, as some House members also challenged the Federal Reserve’s proposed cap on debit card fees.

By Lynne Marek • March 8, 2024 -

Apple blocks Epic’s rival app store

“Apple is trying to cynically kill off developers that stand up to them,” Epic Director of Public Policy Leo Rees said Wednesday.

By James Pothen • March 7, 2024 -

Capital One angles to push Discover upmarket

With its acquisition of the card network, Capital One seeks to elevate Discover’s brand while also working to expand its acceptance abroad.

By Caitlin Mullen • March 7, 2024 -

Google allows alternatives in Europe, cracks down in India

The tech giant said it will expand in-app payments options in the EU, while cracking down on apps in India that it said refused to pay its fees.

By James Pothen • March 6, 2024 -

CFPB imposes $8 credit card late fee rate

The Consumer Financial Protection Bureau finalized a rule that sets a “threshold” of $8 for late fees that can be imposed by large credit card issuers, and eliminates automatic inflation increases.

By Lynne Marek • March 5, 2024 -

$1.95B Apple fine is eye-catching, but EU faces tough road collecting

“While we respect the European Commission, the facts simply don’t support this decision. And as a result, Apple will appeal,” the tech giant said Monday.

By Robert Freedman • March 5, 2024 -

Q&A

EU fine challenges Apple’s payments business

The tech giant is fighting “tooth and nail” to protect its commission from in-app purchases, Consumer Reports Senior Researcher Sumit Sharma said.

By James Pothen • March 5, 2024 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv lines up FedNow clients

The mega processor has signed up 200 banks for FedNow, but now its clients are in search of use cases.

By Lynne Marek • March 5, 2024 -

Cash App enforcement action expected this year

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

By Lynne Marek • March 4, 2024