Regulations & Policy: Page 10

-

Mastercard, Fiserv execs take sides on debit regulation

A Mastercard executive painted Regulation II as potentially harmful to consumers, while Fiserv’s CEO said it was an appropriate update due to the rise of online transactions.

By Caitlin Mullen • March 4, 2024 -

Q&A

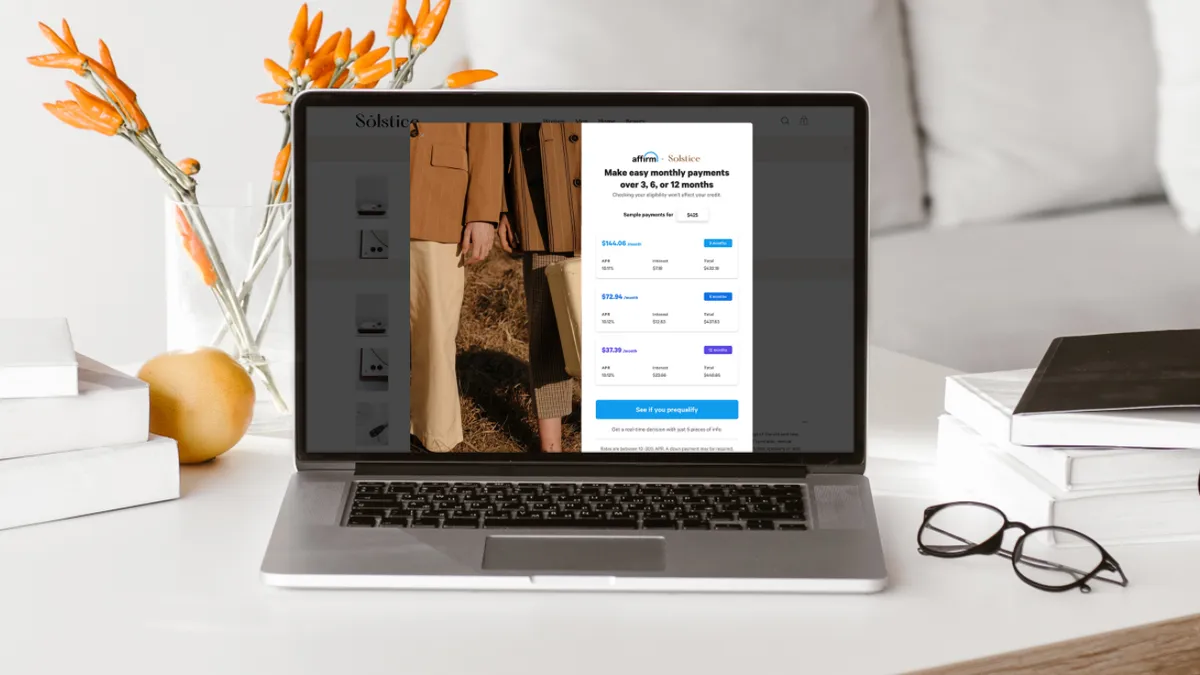

Affirm preps for UK launch

Beyond expansion to the U.K., the BNPL provider may seek to plant a flag where its large partners such as Amazon and Shopify have a presence, said Affirm’s Chief Revenue Officer Wayne Pommen.

By Caitlin Mullen • March 1, 2024 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

CFPB puts credit card comparison sites on notice

The bureau seeks “to ensure that digital advertisements for financial products are not disguised as unbiased and objective advice,” CFPB Director Rohit Chopra said.

By James Pothen • March 1, 2024 -

Green Dot faces Fed’s proposed consent order

The digital bank set aside $20 million to cover a potential penalty stemming from compliance risk management issues predating the company’s current management.

By Gabrielle Saulsbery • Feb. 29, 2024 -

Treasury Department to develop financial inclusion strategy

The department is considering how to measure and improve financial inclusion across payments and other financial services.

By Tatiana Walk-Morris • Feb. 29, 2024 -

Apple begins sharing BNPL data with Experian

The development may spur rival BNPL providers to follow suit, according to Ed deHaan, a professor at the Stanford Graduate School of Business.

By James Pothen • Feb. 29, 2024 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon. Opinion

OpinionDiscover deal may trigger more competition

The merger at least raises the possibility that there won’t be two card networks that dominate the future of tokenized transactions, writes one fintech lawyer.

By Ravieshwar Singh • Feb. 28, 2024 -

Capital One tackles Discover compliance issues

Capital One is betting the resolution of Discover’s compliance issues will take longer and cost more than expected, Capital One CEO Richard Fairbank said.

By Caitlin Mullen • Feb. 28, 2024 -

Warren calls out OCC over merger policy ahead of Capital One-Discover

The senator urged regulators to block the deal and took the OCC to task for its approval record. Meanwhile, JPMorgan CEO Jamie Dimon advocated for Capital One to get a fair shake.

By Dan Ennis • Feb. 27, 2024 -

Column

Fed official makes a case for the dollar’s hegemony

Can the dollar’s reign as the world’s reserve currency persist? This Fed official makes a strong case, but digital doubts may remain.

By Lynne Marek • Feb. 27, 2024 -

Congress members lob dueling gun code bills

Democratic and Republican Congress members took opposing stances this month in introducing bills on the use of a new gun merchant category code.

By Caitlin Mullen • Feb. 26, 2024 -

Capital One-Discover deal carries $1.38B termination fee

The fee would apply if Discover chooses another buyer or if either board has a change of heart, but not if regulators block the deal.

By Dan Ennis • Feb. 23, 2024 -

Cash-strapped consumers turn to BNPL: Fed survey

Consumers facing financial hardships turned to buy now, pay later services more last year than stable consumers, according to survey results from the Philadelphia Federal Reserve Bank.

By Tatiana Walk-Morris • Feb. 23, 2024 -

CFPB may take legal action against Block

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

By Caitlin Mullen • Feb. 23, 2024 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

OCC’s Hsu calls for federal payments licensing

The head of the OCC called on Congress to replace the current state-by-state money transmitter licensing system for payments companies with a federal regulatory framework.

By James Pothen • Feb. 22, 2024 -

Capital One-Discover deal may spark antitrust concern

While the $35 billion acquisition is expected to prompt antitrust concerns related to consumer card lending, regulators may see competition benefits in the card network arena.

By Caitlin Mullen • Feb. 21, 2024 -

Warren probes Zelle scam policy

Three senators, including Elizabeth Warren, asked Zelle owner Early Warning Services to provide detailed information about its fraud reimbursement policy.

By James Pothen • Feb. 21, 2024 -

Capital One to acquire Discover in $35.3B deal

The transaction would give a big boost to a bank well-known for its credit card component, yet lend regulatory gravitas and investment dollars to a struggling card network.

By Dan Ennis • Feb. 20, 2024 -

Senator calls card CEOs on congressional carpet

Sen. Dick Durbin, sponsor of a card network competition bill, urged the CEOs of Visa and Mastercard to appear at an April congressional hearing and not send their underlings.

By Lynne Marek • Feb. 14, 2024 -

Yellen asks Congress for stablecoin legislation

Treasury Secretary Janet Yellen renewed a call for Congress to act on digital assets, saying “there is no appropriate regulatory framework.”

By James Pothen • Feb. 13, 2024 -

Amex gears up for bigger bank category

Given its asset growth, the card issuer anticipates facing more stringent regulatory requirements and more frequent stress tests.

By Caitlin Mullen • Feb. 13, 2024 -

More than half of P2P fraud victims lose money: AARP

“When it comes to addressing instances of financial exploitation, consumers are less likely to trust P2P platforms than banks and credit unions,” an AARP survey reported.

By Tatiana Walk-Morris • Feb. 12, 2024 -

Card networks to implement gun code in California: report

Visa, Mastercard and American Express are moving forward with use of a new gun merchant category code for credit card purchases in California, according to CBS News.

By Caitlin Mullen • Feb. 12, 2024 -

Q&A

Banks should step up scam response: fraud expert

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

By Caitlin Mullen • Feb. 9, 2024 -

Opinion

CFPB open banking proposal will be crucial

The agency’s open banking proposal is a step in the right direction, but details of the policy will shape how the market develops, a regulatory adviser writes in this op-ed.

By Jonah Crane • Feb. 8, 2024