Regulations & Policy: Page 21

-

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

FedNow spurs industry intrigue

Financial institutions, payments players and other businesses are being drawn in by FedNow, according to survey results presented at the Nacha Smarter Faster Payments conference.

By Lynne Marek • April 17, 2023 -

Visa remains cryptic about new surcharge cap

The card giant is set to impose a new surcharge cap of 3% tomorrow, but many payments processing professionals are still searching for details about it.

By Lynne Marek • April 14, 2023 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Opinion

Why card networks should embrace gun codes

Using the new merchant category code for gun and ammunition sales “could help identify dangerous patterns,” one advocacy group lawyer argues.

By Adam Skaggs • April 13, 2023 -

SBA to open flagship lending program to fintechs

A new rule, which takes effect May 11, ends a 40-year moratorium on admitting new nonbank lenders to the agency’s 7(a) loan program.

By Anna Hrushka • April 12, 2023 -

CFPB director wants some payments firms labeled systemically important

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

By Anna Hrushka • April 12, 2023 -

Visa rattles ISOs with surcharge plan

Payment processors and their merchant clients are bracing for Visa’s 3% surcharge cap. “Don’t fight Visa right now – you’re not going to win,” advises one consultant.

By Lynne Marek • April 12, 2023 -

Column

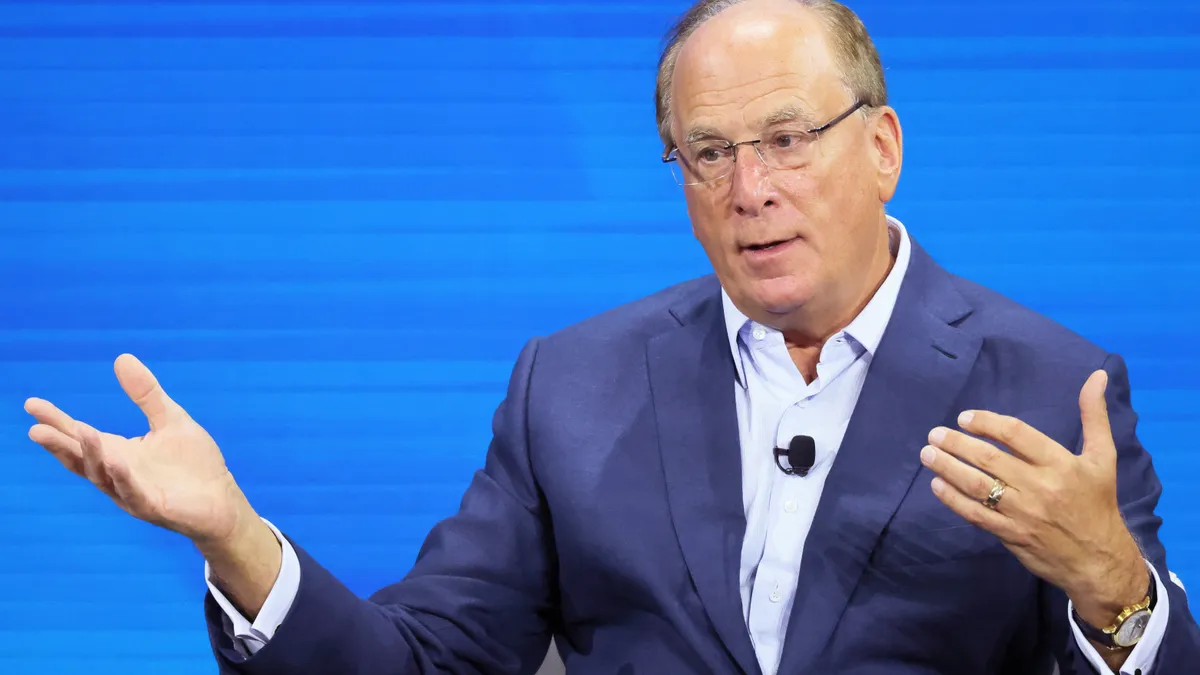

BlackRock CEO knocks US payments system

The leader of one of the biggest asset managers in the world doesn’t think the U.S. payments system is keeping pace.

By Lynne Marek • April 5, 2023 -

Opinion

FedNow gives banks a leg up against fintechs

The instant payment floodgates are about to open when FedNow launches in July, giving banks a chance to win back customers lost to fintechs, says one GFT Group executive.

By Carlos Kazuo Missao • April 3, 2023 -

FedNow eyes cross-border enhancements

The new real-time payments system from the Federal Reserve will arrive in July, and officials are already considering a cross-border upgrade.

By Lynne Marek • March 31, 2023 -

Block defends against short seller allegations

The Jack Dorsey-led digital payments company pushed back by underscoring fraud mitigation tactics and account metrics for its Cash App business.

By Caitlin Mullen • March 30, 2023 -

US remains a laggard in real-time payments: report

Though the U.S. lags behind other countries, the Federal Reserve is preparing to launch its own real-time payments infrastructure.

By Tatiana Walk-Morris • March 30, 2023 -

Analysts call on Block to share anti-fraud details

Following a controversial short seller’s report, analysts advised digital payments company Block to share more information related to active user numbers and know-your-customer practices.

By Caitlin Mullen • March 29, 2023 -

Senators urge BNPL crackdown

Three Democratic U.S. senators pressed the Consumer Financial Protection Bureau to bring big buy now, pay later providers under federal oversight.

By Caitlin Mullen • March 28, 2023 -

BNPL remains mainly absent from consumer credit histories

The lack of BNPL data being furnished to credit bureaus more than a year after inclusion efforts were announced points to the complexity involved with fitting the burgeoning payment method into the traditional credit scoring framework.

By Caitlin Mullen • March 27, 2023 -

Sponsored by PayNearMe

3 ways to increase on-time payments during an economic downturn

Discover how to increase on-time payments and make flexibility and payment convenience a priority at your business.

March 27, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB funding is constitutional, 2nd Circuit court rules

The decision creates a clear conflict between the Second and Fifth Circuits, providing the Supreme Court with further incentive to directly resolve the issue, said an attorney at Dorsey & Whitney.

By Anna Hrushka • March 24, 2023 -

CFPB seeks to improve credit card transparency

The agency wants to give consumers more information from credit card issuers so that it’s easier to compare the cards’ offers, especially their interest rates.

By Tatiana Walk-Morris • March 24, 2023 -

FedNow attracts real-time payments early adopters

Companies partnering with the Federal Reserve to test the real-time payments system see it as a way to draw customers and get an edge on rivals.

By Lynne Marek • March 23, 2023 -

Q&A

Bank failures could cause SMB credit crunch

The future small business lending landscape and opportunities for fintechs are shifting in the wake of Silicon Valley Bank’s collapse, according to one fintech CEO.

By Anna Hrushka • March 22, 2023 -

Nacha CEO counts FedNow as competition

Although FedNow will be a competitor to the ACH network, it’s also poised to fill current gaps in the system, Nacha CEO Jane Larimer said Monday.

By Caitlin Mullen • March 21, 2023 -

Amex shareholders to vote on abortion-related proposal

The card company sought to block the proposal from facing a shareholder vote at Amex’s annual meeting in May, but the SEC said it must be voted on.

By Caitlin Mullen • March 21, 2023 -

Apto Payments, Sardine team on anti-fraud tools

Apto Payments and Sardine are joining forces to offer commercial customers issuing cards better anti-fraud tools.

By Tatiana Walk-Morris • March 20, 2023 -

Brex, other fintechs stand by troubled banks

After a week of several high-profile bank failures and near-failures, some fintechs don’t see jumping ship as an option.

By Gabrielle Saulsbery • March 17, 2023 -

Democrats slam card CEOs on gun code

A group of attorneys general took card company CEOs to task for pulling an about-face on implementing the gun merchant category code.

By Caitlin Mullen • March 16, 2023 -

Payments execs detail SVB impact

The Silicon Valley Bank downfall that sent shockwaves through the financial industry forced fintechs, such as Affirm and Marqeta, to react fast.

By Caitlin Mullen , Lynne Marek • March 16, 2023