Regulations & Policy: Page 2

-

Banks say court’s ‘novel’ ruling upends wire transfer business

The banking industry wants a federal appeals court review in New York’s case against Citibank, arguing that a judge has injected uncertainty into the wire transfer market.

By Justin Bachman • March 5, 2025 -

CFPB drops fraud suit against Zelle’s operator, big banks

The 2024 lawsuit alleging rampant fraud on the peer-to-peer payments service is the latest action the CFPB has dismissed under the Trump administration.

By Justin Bachman • March 4, 2025 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

Trump names coins in strategic crypto reserve

Differing from prior calls for a national bitcoin stockpile, the strategic reserve will have bitcoin, ether, Ripple’s XRP, Solana’s SOL and Cardano’s ADA, according to the president’s Truth Social post.

By Gabrielle Saulsbery • March 4, 2025 -

Visa lays out blueprint for global growth

As if to push back against slowing card business growth in the U.S., the network’s top executives have staked out areas targeted for expansion.

By Lynne Marek • March 3, 2025 -

Q&A

Fiserv exec talks real-time payments and challenges

Matt Wilcox, president of digital payments solutions for Fiserv, discussed the company’s plans for making real-time payments ubiquitous, and the hurdles to reaching that goal.

By Patrick Cooley • March 3, 2025 -

NCR Voyix links with Worldpay, reports revenue drop

The e-commerce payments company narrowed its losses last year, even as revenue declined. Now, it’s wooing restaurants and retailers through the new tie.

By Tatiana Walk-Morris • Feb. 28, 2025 -

Democrats needle McKernan at nomination hearing

Given recent turmoil at the CFPB, Sen. Elizabeth Warren said Jonathan McKernan – nominated to lead the agency – seems “lined up to be the No. 1 horse at the glue factory.”

By Caitlin Mullen • Feb. 27, 2025 -

Stripe bids for worker shares in offer worth $91.5B

The payments processing company will join with some of its investors to buy stock from current and former employees, Stripe said Thursday.

By Patrick Cooley • Feb. 27, 2025 -

Gen Z uses BNPL more than credit cards, survey shows

A J.D. Power survey of about 4,300 U.S. consumers found that more of them used buy now, pay later products than credit cards during the holiday shopping season last year.

By Patrick Cooley • Feb. 27, 2025 -

FedNow boosts send option to $1M

Starting this summer, the Federal Reserve’s real-time payments system will let banks send payments up to $1 million, twice the amount of the existing limit.

By Lynne Marek • Feb. 27, 2025 -

Mastercard taps State Dept official for top role

Richard Verma will rejoin the company this spring as chief administrative officer, overseeing legal and government affairs, Mastercard said Wednesday.

By Justin Bachman • Feb. 27, 2025 -

Amex, Alipay target fast-growing China market

The card company has locked arms with the local digital payments player to accelerate its growth in China, the world’s second most populous nation.

By Patrick Cooley • Feb. 26, 2025 -

Durbin to reintroduce credit card competition bill

The senate minority whip from Illinois plans to reintroduce the Credit Card Competition Act proposal in a bid to increase competition for Visa and Mastercard.

By Lynne Marek • Feb. 25, 2025 -

Stripe employee share sale may mean delayed IPO

An internal sale of stock to workers may mean the company won’t pursue a public offering anytime soon, consultants and analysts said.

By Patrick Cooley • Feb. 25, 2025 -

CFPB drops case against SoLo Funds

The bureau’s lawsuit against the online lending platform – filed during Rohit Chopra’s tenure – “was wrong” and “the weaponization of ‘consumer protection’ must end,” the CFPB’s Acting Director Russ Vought said.

By Caitlin Mullen • Feb. 24, 2025 -

Block begins rollout of Afterpay on Cash App debit card

The buy now, pay later product Afterpay became available to eligible cardholders in 20 states Tuesday.

By Patrick Cooley • Feb. 21, 2025 -

Fed’s Barr warns of weaker regulation, supervision

The Fed board, he said, should resist initiatives that impede effective supervision by discouraging examiners to flag issues early, or ones that add to the process unnecessarily, he said.

By Rajashree Chakravarty • Feb. 21, 2025 -

23 AGs line up behind Baltimore in CFPB case

Efforts to shutter the agency are against public interest, the AGs said. The CFPB’s attorneys argue it’s in the public interest to act “consistent[ly] with the philosophy of a new administration brought about by a national election."

By Dan Ennis • Feb. 21, 2025 -

Opinion

How stablecoins may extend US dollar supremacy

“Dollar-based stablecoins such as USDT and USDC are traded all over the world at any time of the day, regardless of holidays, time zones, and whether markets are open or closed,” writes the CEO of an embedded finance company.

By Bam Azizi • Feb. 20, 2025 -

Waller sees stablecoins advancing in retail

Stablecoins are seeping into payments at stores, but there are plenty of hurdles before they become widely used, according to Federal Reserve Governor Christopher Waller.

By Lynne Marek • Feb. 20, 2025 -

Cap One, Discover shareholders approve merger

Stockholders of the two companies approved the big bank's $35.3 billion acquisition in separate meetings Tuesday.

By Patrick Cooley • Feb. 19, 2025 -

Fed delays start of new Fedwire standard

The central bank postponed a deadline for banks and credit unions to move Fedwire payments to the ISO 20022 format. That may also hold up a broader industry modernization effort.

By Lynne Marek • Feb. 19, 2025 -

Payments players mull new approaches to fraud

Google, Nacha, Early Warning Services and Truist are among the companies seeking to better protect the e-commerce ecosystem from push-payment scams.

By Lynne Marek • Feb. 18, 2025 -

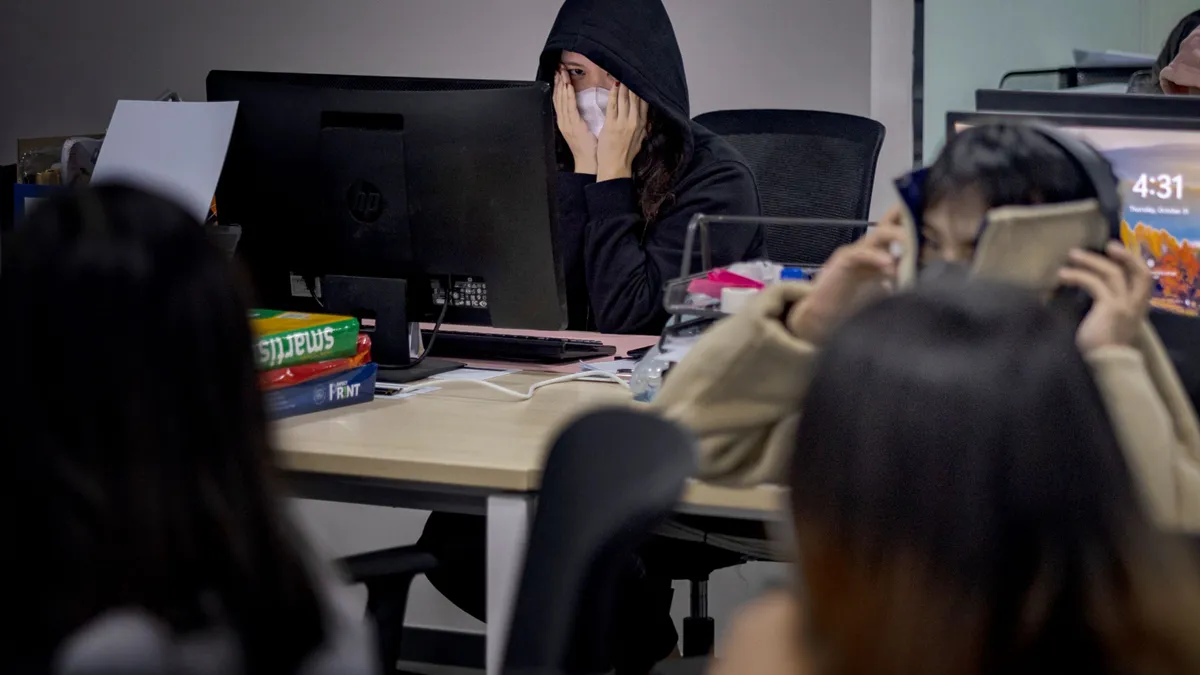

How payment scams start on social media

Bad actors contact consumers through social media and then persuade them to send money over payment platforms, a JPMorgan Chase payments executive said during a Payments Dive virtual event.

By Patrick Cooley • Feb. 18, 2025 -

Georgia special charter attracts another applicant

The move follows the approval of payment processing company Fiserv’s application, which was approved in October, but payments industry consultants say the path to using such a charter is a rocky one.

By Patrick Cooley • Feb. 13, 2025