Regulations & Policy

-

Amex opposes shareholder proposals

A conservative legal group wants American Express to end financial incentives for executives who source diverse suppliers, although the card issuer says it doesn’t offer those anymore.

By Patrick Cooley • April 2, 2025 -

House plans vote to kill CFPB payments rule

The chamber’s measure revoking bureau oversight of large tech payments players has passed the Senate and would next head to an approving Trump.

By Justin Bachman • Updated 6 hours ago -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

EWS drops Zelle standalone app

Zelle users will need to turn to their online banking portals starting today in light of Early Warning Services proceeding as planned with the shutdown of its Zelle app this month.

By Patrick Cooley • April 1, 2025 -

Affirm COO: Walmart deal was “uneconomic”

Walmart makes up a relatively small portion of Affirm’s business that the buy now, pay later company can make up elsewhere, Chief Operating Officer Michael Linford said.

By Patrick Cooley • March 31, 2025 -

CFPB plans to spike BNPL rule

The buy now, pay later industry sued to block the consumer-friendly rule, arguing that the services are not the same as those offered via credit cards.

By Justin Bachman • March 31, 2025 -

Mercury raises $300M

The payments startup, which has backing from Marathon Management Partners and Andreessen Horowitz, aims to use the funds to expand its clientele and increase its profitability.

By Tatiana Walk-Morris • March 28, 2025 -

Swipe fee foes find legislative support in almost a dozen states

The battle to curb interchange fees has migrated from Illinois across the nation, with bills in 11 states seeing robust lobbying.

By Justin Bachman • March 28, 2025 -

CFPB nixes filing in case tied to Electronic Funds Transfer Act

The bureau’s brief was withdrawn because it “advances an interpretation of the law that has never been embraced by any federal court prior.”

By Gabrielle Saulsbery • March 27, 2025 -

Utah governor signs EWA law

The state joins a pack of others that have passed industry-friendly laws seeking to oversee earned wage access providers and their services.

By Lynne Marek • March 27, 2025 -

Republicans air CFPB grievances, jockey for agency change

Kentucky Republican Rep. Andy Barr called the bureau an “Orwellian predator” at a House subcommittee hearing where several lawmakers proposed reforms.

By Caitlin Mullen • March 26, 2025 -

CFPB predicts late fee lawsuit settlement

The agency’s new leadership believes it can settle a 2024 lawsuit banks and business groups filed over an $8 cap on credit card late fees.

By Justin Bachman • March 26, 2025 -

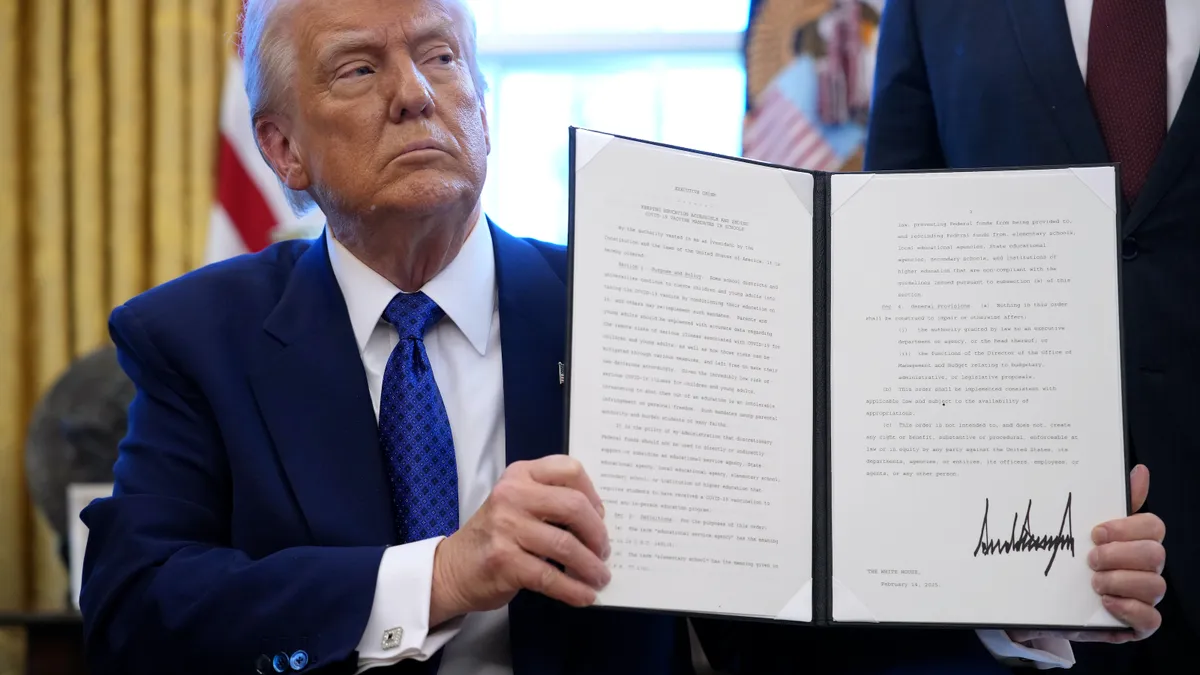

Trump calls on federal gov’t to banish paper checks

The White House issued an executive order Tuesday calling on the federal government to cease using paper checks by September, except in certain circumstances.

By Lynne Marek • March 26, 2025 -

Revolut US CFO aims for growth, maturity ahead of U.S. entry

Balancing agility and compliance is crucial for the digital banking platform as it seeks to expand into markets like the U.S., Revolut Chief Financial Officer Max Lapin said.

By Grace Noto • March 26, 2025 -

Fiserv CEO vows to keep Social Security Administration intact

Senate Democrats questioned Frank Bisignano on privatization of the federal agency’s function during a confirmation hearing Tuesday.

By Patrick Cooley • March 26, 2025 -

Banks bash Illinois trend-setting law on card swipe fees

Banks and credit unions are trying to kill a new Illinois law banning interchange fees, with a court filing, as multiple states seek to emulate the legislation.

By Justin Bachman • March 25, 2025 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv CEO faces fire for Social Security cuts

Two Senate Democrats are calling on Frank Bisignano to oppose any cuts to Social Security ahead of hearings on his nomination to lead the agency.

By Patrick Cooley • March 25, 2025 -

Arkansas, Utah move ahead with EWA laws

The two states are the latest to pass legislation addressing workers’ growing practice of using earned wage access to tap their income before a regularly scheduled payday.

By Lynne Marek • March 24, 2025 -

CFPB seeks extension to respond to nonbank oversight lawsuit

The Consumer Financial Protection Bureau asked a federal court for more time to respond to a lawsuit over its authority to oversee big tech payments players.

By Justin Bachman , Lynne Marek • March 24, 2025 -

Column

States may be called on to pick up payments regulatory slack

As the Trump administration dismantles the Consumer Financial Protection Bureau, state lawmakers and regulators have more opportunity to shape payments tool oversight, or risk repercussions.

By Lynne Marek • March 18, 2025 -

Trump Organization lawsuit raises questions about Capital One-Discover deal

Capital One needs three U.S. approvals to proceed with its $35 billion purchase of Discover. Could a Trump Organization lawsuit against the bank spell trouble?

By Justin Bachman • March 18, 2025 -

Retail, crypto groups converge to back stablecoin legislation

The Merchants Payments Coalition and the Payment Choice Coalition locked arms to advance stablecoins as the Senate Banking Committee passed a stablecoin bill.

By Lynne Marek • March 14, 2025 -

Discover Financial alum takes Wells Fargo IT role

A former executive for the card company, Heather Blair, joined the bank’s IT team Monday. She’ll take the CIO post for its branch and ATM division.

By Matt Ashare • March 14, 2025 -

Q&A

Pathward CEO: Regulatory scrutiny of BaaS ‘just getting started’

Regulators will keep BaaS under the microscope, continuing to put pressure on the fintech play, said Brett Pharr, the bank’s CEO.

By Caitlin Mullen • March 13, 2025 -

Green Dot considers sale as CEO exits

The embedded finance company, which posted a loss last year, hired Citigroup to explore its strategic options and named an interim CEO.

By Lynne Marek • March 11, 2025 -

Q&A

Killing the CFPB would create a vacuum, former insider says

Payment players and large banks might enjoy lighter regulation if the agency disappears, but should be careful what they wish for, a former CFPB executive says.

By Justin Bachman • March 7, 2025