Regulations & Policy: Page 15

-

Opinion

Why payments to government agencies should be easier

“Increasingly, government agencies — and the people they serve — need a payments system that is connected across departments and jurisdictions,” writes one payments executive.

By Sloane Wright • Oct. 23, 2023 -

Do low-income consumers need more digital payments protection?

“Big gaps in the law” are leaving the financially vulnerable open to harms from digital payments, one law professor argues in a recent Georgetown Journal on Poverty Law & Policy paper.

By James Pothen • Oct. 23, 2023 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Sponsored by Checkout.com

Modernizing momentum: How the right payment platform can create value in the C-Suite

When crafting strategies that can both create this future-forward perspective while capturing sales today, it’s important to consider modernizing the virtual payment structure.

Oct. 23, 2023 -

Same-day payments keep climbing: Nacha

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

By Tatiana Walk-Morris • Oct. 20, 2023 -

Fed to review debit card fee cap

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting this week.

By Lynne Marek • Oct. 20, 2023 -

CFPB unveils open banking proposal

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

By Anna Hrushka • Oct. 20, 2023 -

Fed’s Bowman urges ‘responsible innovation’

Federal Reserve Governor Michelle Bowman said the U.S. already has a “safe and efficient payment system” that could be disrupted by CBDCs or stablecoins.

By James Pothen • Oct. 19, 2023 -

ACI, states reach $20M in settlements over payments mishap

The company is being penalized for unauthorized withdrawals, and attempted withdrawals, from mortgage customer accounts in April 2021.

By Tatiana Walk-Morris • Oct. 18, 2023 -

Visa appoints advisory council for policy institute

The new council is tasked with providing “strategic guidance” to the San Francisco-based card giant’s Washington think tank, but none of the initial members are based in the U.S.

By Lynne Marek • Oct. 18, 2023 -

Consumer group pushes for stricter EWA protections

In a recent web post, the National Consumer Law Center issued a number of policy recommendations for states seeking to regulate earned wage access companies.

By James Pothen • Oct. 16, 2023 -

Immigrants denied credit cards, other loans: CFPB, DOJ

“The CFPB will not allow companies to use immigration status as an excuse for illegal discrimination,” the bureau’s Director Rohit Chopra said Thursday.

By James Pothen • Oct. 13, 2023 -

Fed’s Waller pushes back on criticism of FedNow’s adoption rate

“We have got more in the pipeline and there are various estimates that could range from 250 to 350 by the end of the year, and they just continue to grow as banks do it,” the central bank governor said at a recent payments event.

By Rajashree Chakravarty • Oct. 11, 2023 -

Opinion

Now’s the time for national EWA legislation

“Instead of state-by-state regulation, federal government guidance must be updated and clarified,” authors of a recent working paper on earned wage access write.

By Marshall Lux and Cherie Chung • Oct. 11, 2023 -

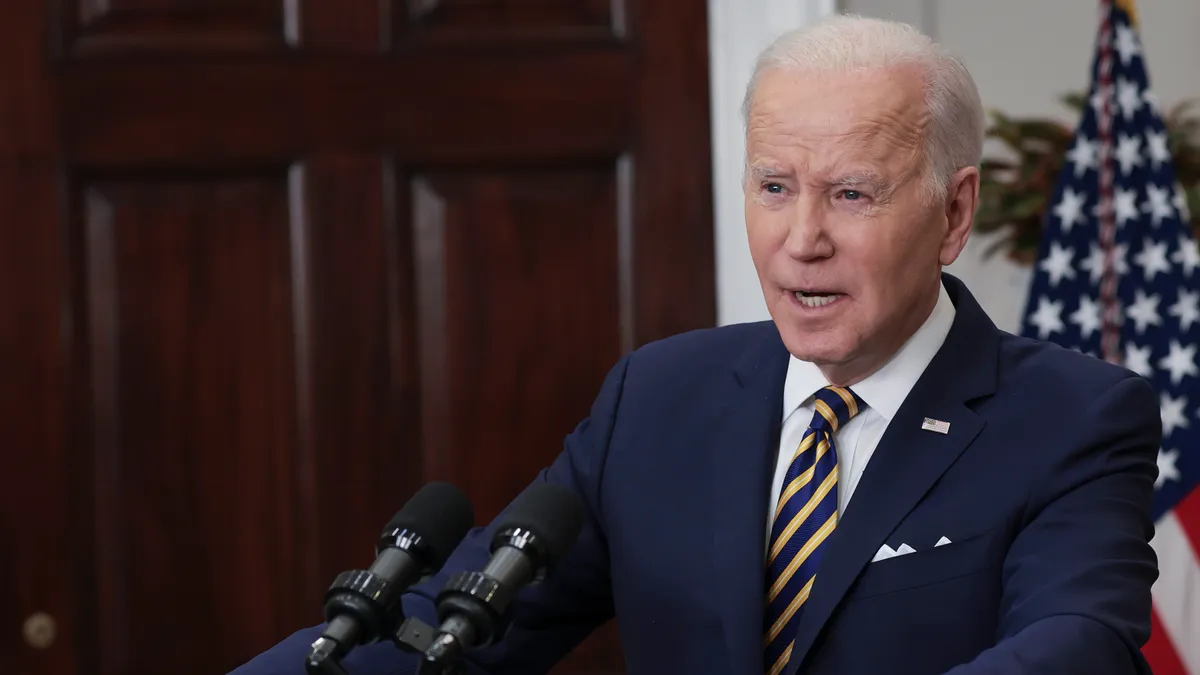

White House, CFPB are coming for ‘junk fees’

The Biden administration and the CFPB want banks and other institutions to stop hitting consumers with extra fees. Come February, offenders face monetary penalties.

By Gabrielle Saulsbery • Oct. 11, 2023 -

Fiserv among MOVEit cyberattack victims

The payment processor recently notified one of its customers, Flagstar Bank, that it was entangled in a May cyberattack that’s affected more than 2,000 organizations.

By Caitlin Mullen • Oct. 10, 2023 -

Orum uses FedNow to launch account verification tool

The service, built on top of the Fed’s instant payments network, allows customers to verify a bank account within 15 seconds before sending a payment, Orum said.

By James Pothen • Oct. 10, 2023 -

Payments conferences yet to come in 2024

Payments professionals still have plenty of choices when contemplating conferences to attend in the second half of the year. Here are our staff picks.

By Lynne Marek • Updated July 3, 2024 -

CFPB’s Chopra warns of ‘financial censorship’ in payments

The federal agency is considering regulatory action to better protect U.S. consumers from “excessive surveillance,” Director Rohit Chopra said last week during a Brookings Institution event.

By James Pothen • Oct. 9, 2023 -

PayZen adds BNPL card for medical expenses

The debit card allows patients to swipe first, then pick a payment plan later, PayZen CEO Itzik Cohen said.

By James Pothen • Oct. 6, 2023 -

PIRG calls out Mastercard’s data sales practices

The consumer advocacy group has taken aim at the card network for selling cardholder information. Mastercard has disputed the allegations.

By Caitlin Mullen • Oct. 5, 2023 -

Senate bill would let small businesses use SBA loans to cover fintech fees

The Financial Technology Association is backing a bill that would clarify that loans made through the Small Business Administration’s flagship lending program can be used to pay for fintech services.

By Anna Hrushka • Oct. 5, 2023 -

Q&A

Ceridian leans on payroll with EWA app

Offering payroll services through its human resources software gives Ceridian an advantage in the earned wage access market, executive Deepa Chatterjee said.

By James Pothen • Oct. 3, 2023 -

Opinion

What the CFPB’s open banking push means for financial institutions

“The narrative often centers around consumer empowerment, but let’s not overlook the advantages it holds” for financial institutions, writes an executive at financial connectivity company Atomic.

By Andrea Martone • Oct. 3, 2023 -

Credit card debt tops $1 trillion, before the holidays even arrive

Retailers may feel the pinch, especially those whose own store cards are facing rising delinquencies and a potential cap on late fees.

By Daphne Howland • Oct. 3, 2023 -

Column

Payments bill defies congressional rancor

A bill important to the payments industry has attracted bipartisan support despite the political divide on Capitol Hill.

By Lynne Marek • Oct. 3, 2023