Regulations & Policy: Page 14

-

5 takeaways from Michael Barr’s remarks at The Clearing House conference

The Fed's vice chair for supervision expressed optimism about FedNow’s benefits and said he expects it to co-exist with the privately owned RTP network.

By Suman Bhattacharyya • Nov. 20, 2023 -

EU digital identity wallet to stir paytech market

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

By James Pothen • Nov. 13, 2023 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

BNPL companies face grim outlook, Moody’s says

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

By Lynne Marek • Nov. 13, 2023 -

Bitcoin Depot CEO weighs in on new California law

Bitcoin Depot CEO Brandon Mintz contends a new California law will “create economic challenges” for his company and other crypto ATM operators.

By James Pothen • Nov. 10, 2023 -

FIS forms board committee to review litigant demands

Fidelity National Information Services disclosed that its board has formed a committee and hired an independent counsel to review demands tied to a stockholder lawsuit.

By Lynne Marek • Nov. 9, 2023 -

Affirm CEO welcomes CFPB oversight

Consumer Financial Protection Bureau supervision “levels the playing field” in buy now, pay later, Affirm’s CEO Max Levchin said Wednesday.

By Caitlin Mullen • Nov. 9, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

FTC, Florida reach $150,000 settlement with Chargebacks911

The Federal Trade Commision and Florida had sued the company for using deceptive tactics to prevent consumers from disputing credit card charges.

By James Pothen • Nov. 9, 2023 -

Citi fined $25.9M over alleged discrimination

The bank, between 2015 and 2021, denied certain credit card products to applicants with surnames ending in “ian” and “yan,” suffixes that Citi employees associated with Armenian national origin, the CFPB said.

By Anna Hrushka • Nov. 8, 2023 -

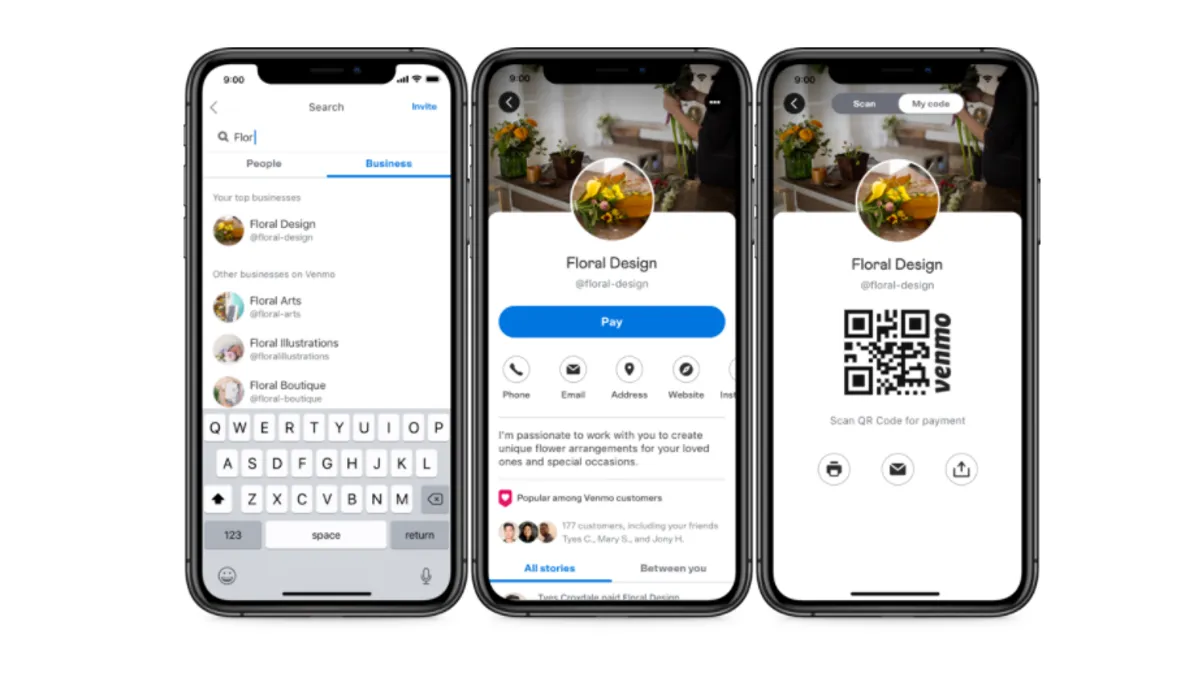

CFPB proposes new oversight for payment tech firms

Google, Apple and 15 other big non-bank technology companies that provide digital wallets or payments apps would be subject to increased regulation if a new Consumer Financial Protection Bureau rule is approved.

By Lynne Marek , James Pothen • Nov. 7, 2023 -

PayPal discloses SEC, CFPB probes

The digital payments company said it’s cooperating with a Securities and Exchange Commission probe of its stablecoin, and a Consumer Financial Protection Bureau inquiry related to bank transfers.

By Lynne Marek • Nov. 3, 2023 -

Breaking down buy now, pay later

After its pandemic-era growth spurt, buy now, pay later has gone mainstream in consumer payments. But changing economic conditions are forcing the installment trend to evolve.

By Caitlin Mullen • Nov. 3, 2023 -

Apple’s payments regulation woes mount

Regulators in the Netherlands, South Korea and Australia have targeted the tech giant’s payments business, and antitrust litigation is brewing in the U.S.

By James Pothen • Nov. 2, 2023 -

Klarna transfers 500 jobs in cost-cutting move

The buy now, pay later provider is outsourcing about 500 positions in 10 markets to two partners, a company spokesperson said.

By Caitlin Mullen • Nov. 2, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Non-bank financial institutions must report data security breaches: FTC

The amendment to the FTC’s Safeguards Rule would require non-banking financial institutions to report when they discover information impacting at least 500 people has been accessed without authorization.

By Rajashree Chakravarty • Nov. 1, 2023 -

Payments players react to debit cap cut

The CEOs of Mastercard and Global Payments chimed in with opposing views of the Federal Reserve Board’s proposal to lower the cap on debit interchange.

By Caitlin Mullen • Oct. 31, 2023 -

Frequent flyer programs drawn into credit card bill fray

Sens. Dick Durbin and Roger Marshall, who have introduced legislation to spur credit card competition, called on federal regulators to investigate card frequent flyer program abuses.

By Lynne Marek • Oct. 31, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

Affirm sees CFPB supervision on the horizon

The buy now, pay later company expects to begin being supervised by the federal watchdog in the “immediate future.”

By Caitlin Mullen • Oct. 30, 2023 -

Discover discloses SEC probe

A pricing error by the card company that affected merchants and merchant acquirers triggered the investigation.

By Caitlin Mullen • Oct. 27, 2023 -

CFPB: Consumers paid record credit card fees in 2022

"With credit card debt crossing the trillion dollar mark, we will be working to prevent bait-and-switch tactics when it comes to rewards,” CFPB Director Rohit Chopra said in a Wednesday press release.

By James Pothen • Oct. 26, 2023 -

BNPL, EWA bills surface at House hearing

The legislative proposals emerged at a Wednesday hearing during which lawmakers queried witnesses on payments and fintech issues.

By Caitlin Mullen • Oct. 26, 2023 -

Fed proposes reduction in debit fee cap

The Federal Reserve Board proposed a rule change that would slash the amount card issuers can charge merchants for processing a debit transaction. The proposal also calls for periodic updates to the fee cap in the future.

By Lynne Marek • Oct. 25, 2023 -

Visa leans into CFPB proposal

The card network’s CEO on Tuesday backed a recent Consumer Financial Protection Bureau proposal on open banking, but was more circumspect about Fed moves on debit rules.

By Lynne Marek • Oct. 25, 2023 -

Three lessons in ACI’s $2.4B payments test disaster

Pay attention to how legacy vendors are integrated after an acquisition, treat internal data sharing requests as cyber risks and don’t let staff test systems using real data.

By Robert Freedman • Oct. 25, 2023 -

Crypto legislation would put US ‘back in the game,’ stakeholders say

A pair of House bills would help the industry gain clarity, scale digital asset products and promote financial inclusion, cryptocurrency stakeholders said Sunday on a panel at Money20/20.

By Anna Hrushka • Oct. 24, 2023 -

BIS advances oversight structure for broader faster payments ecosystem

In the interest of faster, cheaper and more transparent cross-border payments, the Bank of International Settlements last week produced an interim report aimed at developing a governance structure for an interlinked faster payments system.

By Lynne Marek • Oct. 23, 2023