B2B: Page 11

-

Amex rolls out B2B digital payment tool

American Express cited data showing nearly two-thirds of small and mid-sized business owners expect increases in their cross-border spending.

By Caitlin Mullen • Aug. 2, 2022 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments buys Evo at a premium

Global Payments said it will pay $4 billion to buy Evo Payments as it sheds its Netspend consumer unit for $1 billion and takes a $1.5 billion investment from Silver Lake Partners.

By Lynne Marek • Aug. 1, 2022 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

Balance raises $56M for B2B payments

The B2B payments services provider has quickly attracted investors, including Forerunner and Salesforce Ventures, since its founding in 2020.

By Tatiana Walk-Morris • July 26, 2022 -

Amazon opens a new wallet for sellers

The e-commerce juggernaut said it’s offering a new digital wallet service to its sellers and planning to roll it out more broadly over the “next few months.”

By Lynne Marek • July 26, 2022 -

Q&A

Resolve CEO touts benefits of BNPL in B2B

As Resolve’s customers manage cash closely and navigate supply chain snags, CEO Chris Tsai expects the company’s BNPL model for B2B will stand out in a challenging economic environment.

By Caitlin Mullen • July 21, 2022 -

Payments funding, deal-making declines in Q2

Payments startups are getting caught in the venture funding downdraft. Investment dollars and deal-making dropped in the second quarter, according to a CB Insights report.

By Lynne Marek • July 21, 2022 -

Flywire expands presence in education payments

Following its second acquisition as a public company, Boston-based Flywire will continue to look for purchase opportunities that expand the payments company’s reach globally, said CEO Mike Massaro.

By Caitlin Mullen • July 19, 2022 -

Stake, Aliaswire target rental payment flows

The companies see millions of dollars of opportunity in offering new ways for management of rental payment flows.

By Lynne Marek • July 18, 2022 -

Modern Treasury expands on demand, readies for FedNow

The company has more than doubled its headcount over the past year to meet demand for its payments software from clients like Marqeta and Gusto. Now, it plans more expansion for real-time services.

By Jonathan Berr • July 18, 2022 -

Sponsored by Cybersource

5 essential features to look for in an omnichannel commerce partner

An experienced commerce partner can help provide the technology needed to help merchants keep up.

July 18, 2022 -

Relay Payments takes on incumbents in trucking

The fintech is taking on FleetCor and Wex as it seeks to take a bigger bite of a $500 billion U.S. trucking logistics market.

By Caitlin Mullen • July 13, 2022 -

Mesh Payments pursues $50M in debt financing to support growth

The corporate spend management startup, which has raised $63 million in capital, is trying to balance “growing too fast and making sure we are not under-servicing our clients,” said CEO Oded Zehavi.

By Caitlin Mullen • July 12, 2022 -

Prepaid Tech buys WorkStride to boost customer engagement

The Birmingham, Alabama-based fintech says there is room to grow in the $8 trillion market for business-to-business payment software services.

By Suman Bhattacharyya • July 12, 2022 -

Plastiq sees inflation boosting B2B card payment use

As companies grapple with inflation and supply chain snarls, the business payments firm says it’s targeting those that need credit cards for workflow capital.

By Caitlin Mullen • July 5, 2022 -

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022 Opinion

OpinionFrom a payments CEO: 5 discriminatory behaviors that need to go

“Until the industry addresses this blatant lack of advocacy for women in leadership, it will continue to foster a culture where women can’t thrive,” says Stax CEO Suneera Madhani.

By Suneera Madhani • June 30, 2022 -

PayPal launches small business credit card

The digital payments company is targeting small business owners as they seek credit financing and loans.

By Tatiana Walk-Morris • June 28, 2022 -

Brex's move has fellow fintechs ready to pounce

Brex cutting small business customers — the handling of which prompted a mea culpa from the co-founder — may provide opportunity for B2B fintechs like Ramp or Divvy. But big banks still dominate the space.

By Caitlin Mullen • June 27, 2022 -

Tipalti spearheads digitization in middle market

B2B fintech Tipalti aims to scoop up some additional businesses as startups struggle with a slowdown in equity funding.

By Caitlin Mullen • June 16, 2022 -

Payrailz gains traction in battle with big rivals

The six-year-old company said it expanded its client base by a third in the first quarter and will double last year’s count to 150 by the end of this year.

By Lynne Marek • June 14, 2022 -

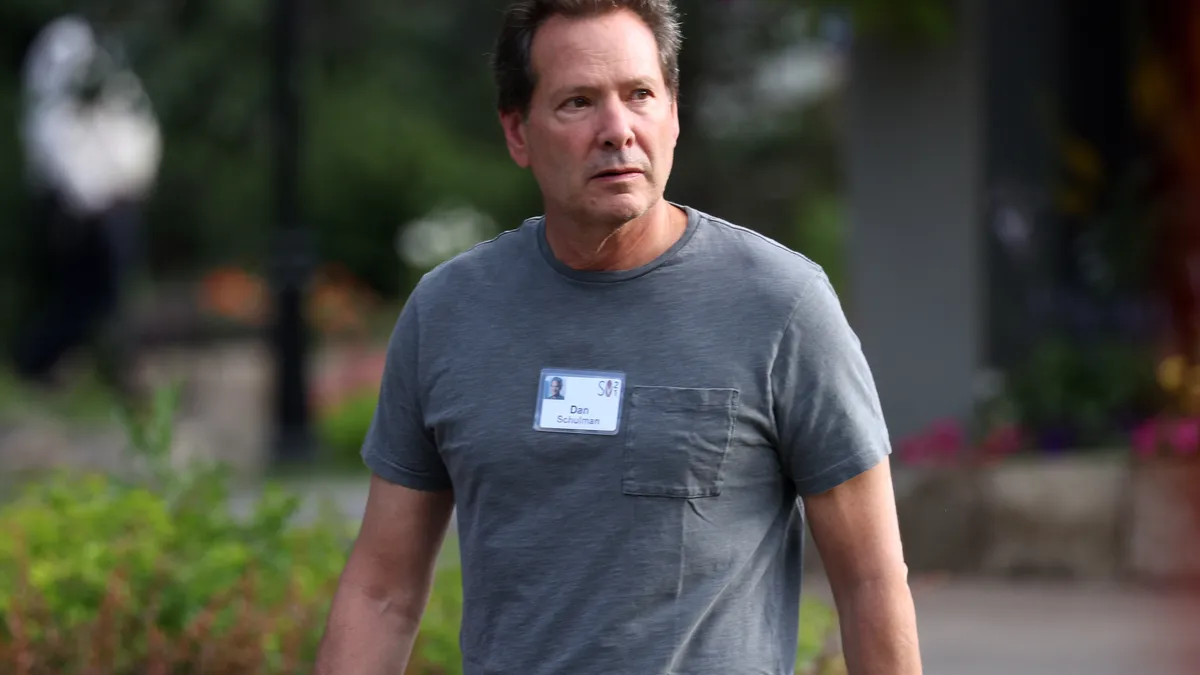

PayPal strives to improve checkout

The company aims to improve the checkout experience for both merchants and consumers, with new services being tested this year, CEO Dan Schulman said.

By Lynne Marek • June 13, 2022 -

AffiniPay buys legal software firm MyCase

AffiniPay will link the acquired firm with its LawPay business. The two companies combined are expected to generate about $200 million in annual revenue.

By Caitlin Mullen • June 13, 2022 -

JPMorgan hires exec from PayPal to head fintech partnerships

Peggy Mangot joined the bank this month to lead a team responsible for designing and developing fintech partnership strategy at JPMorgan Chase's commercial bank.

By Anna Hrushka • May 27, 2022 -

Chip shortage drives up card costs

Russia's invasion of Ukraine is affecting card chip prices because Ukraine is home to two companies that produce half of the world’s neon supply, a key ingredient in chips.

By Jonathan Berr • May 26, 2022 -

Column

CEOs Sound Off: BNPL takes aim at healthcare, legal costs

Companies offering installment payment options for healthcare, legal and auto repair say that buy now-pay later options will satisfy growing consumer demand.

By Caitlin Mullen • May 25, 2022 -

Billtrust to stay on acquisition streak

Billtrust, which focuses on the accounts receivable side of B2B payments, has acquired two European companies in recent months and plans to continue snapping up other firms.

By Caitlin Mullen • May 24, 2022