Opinion: Page 3

The latest opinion pieces by industry thought leaders

If you are interested in having your voice heard on Payments Dive's Opinion page, please read our editorial guidelines and fill out the submission form here.

-

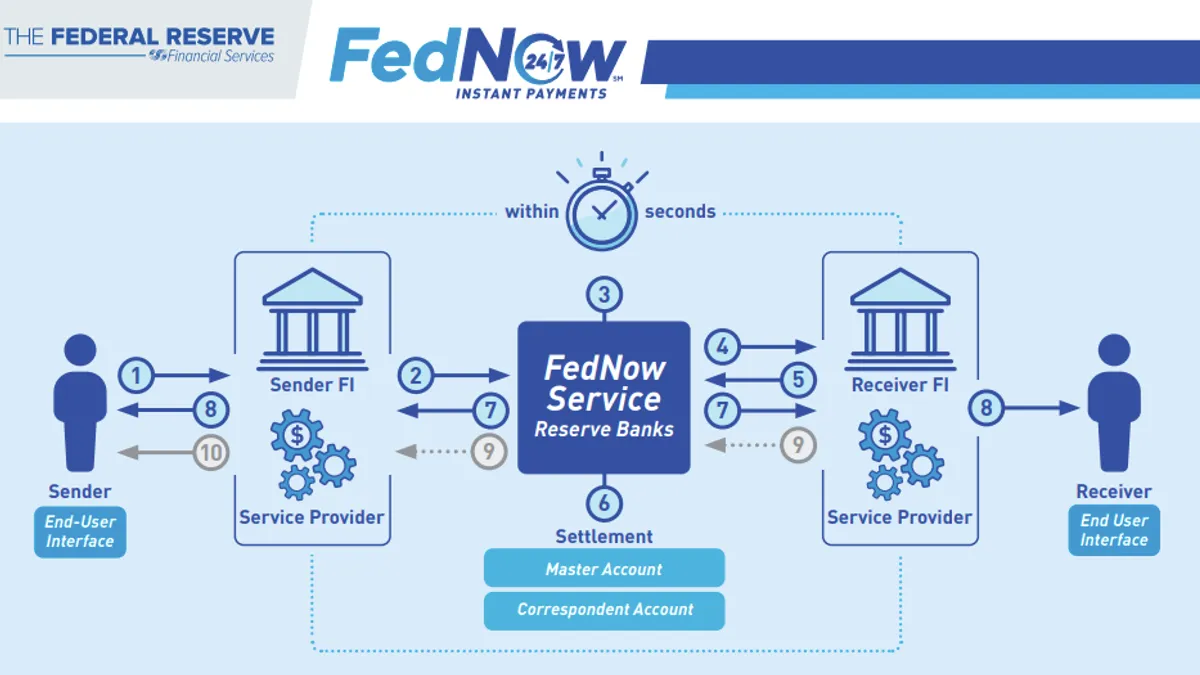

FedNow gives banks a leg up against fintechs

The instant payment floodgates are about to open when FedNow launches in July, giving banks a chance to win back customers lost to fintechs, says one GFT Group executive.

Carlos Kazuo Missao • April 3, 2023 -

Eliminating costly false declines online

“False declines are especially problematic in an environment where demanding customers with high expectations are not afraid to take their business elsewhere,” writes an Experian executive.

Chris Ryan • Feb. 6, 2023 -

Why the Arizona AG opinion on EWA matters

“The Arizona decision is in line with decades of decisions across the country that have found that non-recourse products are not loans,” the Payactiv authors write in this opinion piece.

Aaron Marienthal and Molly Jones • Jan. 24, 2023 -

Can anything challenge ACH?

The ACH system has proven to be scalable, secure, ubiquitous and reliable, but complaints about processing times persist, writes Sila CEO Shamir Karkal.

Shamir Karkal • Jan. 6, 2023 -

Why real-time payments make sense today

The impact real-time payments could have on customers and providers alike should not be ignored — especially in the face of an impending recession, writes a fintech co-founder.

Justin Adler • Dec. 14, 2022 -

Payments will evolve with digital banking

“Rather than basic capabilities, consumers want a complete digital banking experience,” a payments firm professional writes. “They want access to all of the buzzworthy features.”

John Mitchell • Dec. 9, 2022 -

Credit swipe-fee relief needed

“Congress has a responsibility to bring much-needed transparency and competition” to credit card swipe fees, writes the chairman of the trade association for 7-Eleven franchisees.

Sukhi Sandhu • Nov. 18, 2022 -

Preparing for the CBDC era

Central bank digital currencies would allow for faster cross-border payments that would “help boost trade within the region and with the rest of the world,” an Equinix executive writes.

Lance Homer • Nov. 9, 2022 -

BNPL for business is a high stakes proposition

“As BNPL providers, especially in the business realm where more money is being spent, fintechs are going to need much more sophisticated, secure, reliable authentication methods,” writes Flexbase CEO Zaid Rahman.

Zaid Rahman • Oct. 24, 2022 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

FedNow may stumble without nonbanks, cross-border payments

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

Rina Wulfing • Oct. 18, 2022 -

Reduce cyber risk as digital bill payment options expand

“Not all payment platform companies are managing operational and security as judiciously as they could, and that will eventually result in costly payment failures, customer friction, or potentially a breach,” writes PayNearMe Vice President Tim Murphy.

Tim Murphy • Oct. 13, 2022 -

Future of B2B payments lies in embedded finance

“Unfortunately, the business-to-business market lags behind its B2C counterpart and is only just beginning to embrace embedded finance,” writes Melio COO Tomer Barel.

Tomer Barel • Oct. 7, 2022 -

Busting the myths on FedNow

Jessica Cheney, a vice president at Bottomline Technologies, aims to dispel myths about the meaning and impact of the coming Federal Reserve instant payment system.

Jessica Cheney • Sept. 27, 2022 -

QR code resurges for payments

“Businesses that have consigned QR technology to the tech graveyard would be wise to give it another look,” writes Mike Storiale, Synchrony’s VP of innovation development.

Mike Storiale • Sept. 22, 2022 -

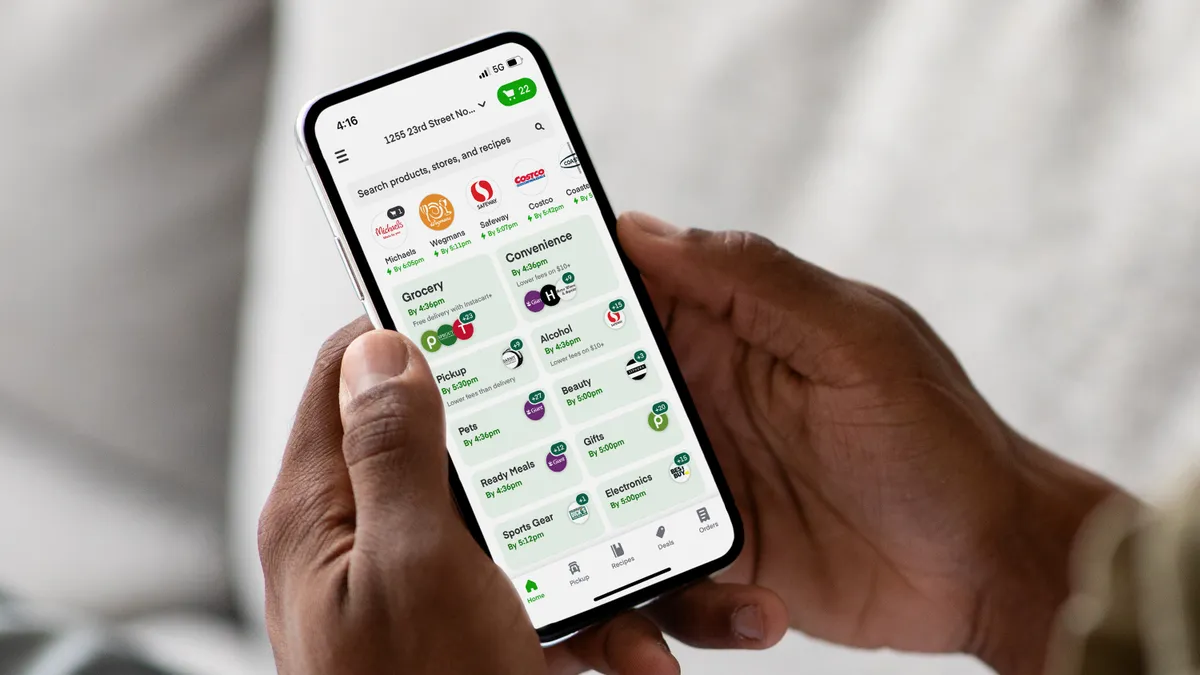

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Consumers need credit card reform

“It's not just merchants at the mercy of the oligopoly,” writes Ed Mierzwinski, a senior director at the Public Interest Research Group. “Consumers all pay more at the store and more at the pump.”

Ed Mierzwinski • Sept. 2, 2022 -

Blaming cards for high gas prices doesn't make sense, trade group argues

The leader of the Electronic Payments Coalition tells people looking to blame credit and debit card companies for higher gas prices to find a different scapegoat.

Jeff Tassey • July 25, 2022 -

BNPL will evolve as providers tweak the model

“Challengers frequently believe BNPL 1.0 is what it is, and will not evolve,” writes Brian Shniderman, CEO of Opy, a U.S. subsidiary of Australian payments fintech Openpay. “But it can, and very recently, it has proven that it will.”

Brian Shniderman • July 20, 2022 -

Banks and fintechs don't need to fight

“Rather than competing with one another, banks and fintechs are increasingly partnering,” writes Modern Treasury CEO Dimitri Dadiomov.

Dimitri Dadiomov • July 12, 2022 -

Don't abandon stablecoins over Terra, CFO says

Fintechs and financial services players will "be the driver of innovations and regulations that enable stablecoins, crypto and other digital assets to scale," argues Metallicus Chief Financial Officer Irina Berkon.

Irina Berkon • July 6, 2022 -

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022

From a payments CEO: 5 discriminatory behaviors that need to go

“Until the industry addresses this blatant lack of advocacy for women in leadership, it will continue to foster a culture where women can’t thrive,” says Stax CEO Suneera Madhani.

Suneera Madhani • June 30, 2022 -

Friendly fraud: How should fintechs view the risks?

With friendly fraud, fintechs don’t always consider the whole picture when it comes to fraudulent disputes.

Sarah Mirsky-Terranova • June 21, 2022 -

Card fees: the price hike nobody is talking about

"The Visa-Mastercard duopoly controls about 80% of the market share, allowing them to raise fees indiscriminately and with no formidable opposition," contends Doug Kantor, general counsel for the National Association of Convenience Stores.

Doug Kantor • June 17, 2022 -

Visa's CEO braces for legislation

Visa CEO Al Kelly said Sen. Dick Durbin is contemplating new legislation that would impose more pricing restrictions on the card industry. Kelly didn't elaborate and Durbin has been mum.

Lynne Marek • May 31, 2022 -

Are restaurant operators eating too many fees?

"I’ve been disappointed to see how the payments industry is constantly looking for ways to profit off of small businesses in sneaky ways," says Copper CEO Dickson Chu.

Dickson Chu • May 16, 2022 -

FTA pushes for remittance fee reform

"We urge Director Rohit Chopra to update the CFPB’s outdated remittance rule and take on the high cost of international payments," the Financial Technology Association says in this op-ed piece.

Penny Lee • May 2, 2022