Opinion: Page 2

The latest opinion pieces by industry thought leaders

If you are interested in having your voice heard on Payments Dive's Opinion page, please read our editorial guidelines and fill out the submission form here.

-

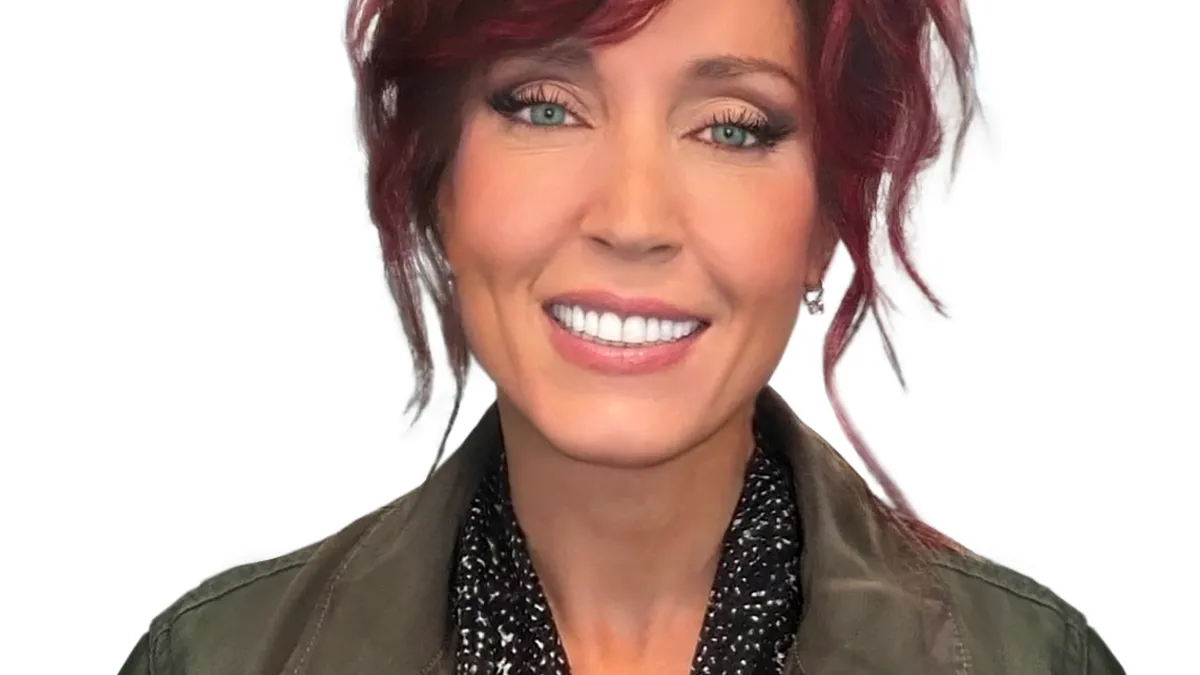

EWA shouldn’t be regulated like loans

“Attempts to regulate EWA as credit threaten worker access to this innovative and consumer-friendly financial tool,” writes one earned wage access industry CEO.

Darcy Tuer • April 5, 2024 -

Fintech founder backs Google, Apple

“It’s easy for giant app companies to pick fights with Apple and Google, but when billionaire companies fight about who gets richer, it’s usually the little guy that loses,” writes CashEx’s CEO.

Kingsley Ezeani • March 15, 2024 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Discover deal may trigger more competition

The merger at least raises the possibility that there won’t be two card networks that dominate the future of tokenized transactions, writes one fintech lawyer.

Ravieshwar Singh • Feb. 28, 2024 -

CFPB open banking proposal will be crucial

The agency’s open banking proposal is a step in the right direction, but details of the policy will shape how the market develops, a regulatory adviser writes in this op-ed.

Jonah Crane • Feb. 8, 2024 -

Where will embedded payments flourish in 2024?

There are three areas where embedded finance is a good fit, and they are characterized by high volume and frequent payments, writes one industry executive.

Julio Gomez • Feb. 5, 2024 -

Congressional card bill won’t yield benefit

If it were to pass, the Credit Card Competition Act proposal would result in additional costs without any gains, argues one payments industry consultant.

Ken Musante • Jan. 22, 2024 -

Retrieved from X on January 11, 2024

Retrieved from X on January 11, 2024

X gains money transmitter approval in Utah

X has been collecting money transmitter approvals in recent months to launch peer-to-peer payments in the app.

Andrew Hutchinson • Jan. 17, 2024 -

Why payments to government agencies should be easier

“Increasingly, government agencies — and the people they serve — need a payments system that is connected across departments and jurisdictions,” writes one payments executive.

Sloane Wright • Oct. 23, 2023 -

Now’s the time for national EWA legislation

“Instead of state-by-state regulation, federal government guidance must be updated and clarified,” authors of a recent working paper on earned wage access write.

Marshall Lux and Cherie Chung • Oct. 11, 2023 -

What the CFPB’s open banking push means for financial institutions

“The narrative often centers around consumer empowerment, but let’s not overlook the advantages it holds” for financial institutions, writes an executive at financial connectivity company Atomic.

Andrea Martone • Oct. 3, 2023 -

Is FedNow pivotal for payments or overhyped?

FedNow won’t fill the gap between the U.S. and other countries in payments innovation, writes one fintech CEO.

Eric Shoykhet • Sept. 26, 2023 -

Why on-demand pay lures employees

Employers can better compete for gig workers, and other employees, by offering instant payment of wages, one fintech president argues.

Charles Rosenblatt • Aug. 31, 2023 -

Why the CCCA is ‘ill-informed’

A payments processing consultant argues that the Credit Card Competition Act isn’t the way to spur more competition in the industry.

James Shepherd • Aug. 24, 2023 -

Why the ‘click-to-cancel’ amendment makes sense

“This proposal reflects the growing consumer demand for an easier subscription cancellation process,” writes a payments industry CEO. “However, this isn’t only in the interests of consumers.”

Monica Eaton • Aug. 11, 2023 -

It’s time for a new payday approach

“It's time to question whether this traditional approach to paying employees is still the most efficient and equitable,” writes one earned wage access CEO.

Kevin Coop • July 28, 2023 -

FedNow’s launch ‘is just the start’

Direct access to the Fed’s payments system for nonbanks — specifically payments companies — will push the U.S. more fully into payments modernization, writes an executive from cross-border payments company Wise.

Brigit Carroll • July 21, 2023 -

As biometrics use advances, so must hacker defenses

“Hackers are using all sorts of sophisticated methods to trick and bypass biometric technology – like capturing audio clips of individuals’ voices, making fake fingerprints using putty and gelatin, and downloading photos and videos,” an executive writes.

Alessandro Chiarini • July 7, 2023 -

B2B must embrace digital payments

“B2B organizations have been slow to adapt to the changing demands and expectations of Gen Z,” writes a payments company vice president. “This is a huge mistake, and it can cost them dearly in the long run.”

Justin Main • June 22, 2023 -

Get ready for FedNow

“In the U.S., we never kill payment systems,” writes Modern Treasury cofounder Sam Aarons. “People still write paper checks. But the future of money, especially inside larger enterprises, is instant payments.”

Sam Aarons • June 13, 2023 -

BNPL regulation requires balancing act

“As the CFPB prepares to release new regulatory guidance on BNPL providers, it is important that any new regulations do not stifle the industry's growth and limit its availability,” writes one checkout services CEO.

Jordan Gal • June 7, 2023 -

Give EWA a chance

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

Brian Tate • May 24, 2023 -

How to advance cross-border B2B payments

“Regional regulatory bodies must work together on common financial standards that support multilateral payment systems if we are to make progress,” writes one payments professional.

Scott Frisby • May 15, 2023 -

Swift executive calls for payments standardization

“As a standardized format, ISO 20022 creates a common language for international payments the world over,” writes an executive in support of industry collaboration.

Stephen Lindsay • April 26, 2023 -

FedNow won’t bring ‘tidal wave’ of change

“Payments solutions reach scale when they provide better usability, affordability, and security,” write partners at a San Francisco venture capital firm.

Kevin Jacques and Ben Malka • April 21, 2023 -

Why card networks should embrace gun codes

Using the new merchant category code for gun and ammunition sales “could help identify dangerous patterns,” one advocacy group lawyer argues.

Adam Skaggs • April 13, 2023