Technology: Page 41

-

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments leans into fintechs

As it pursues more fintech clients, the payments processor sees B2B and commercial cards as areas ripe for expansion.

By Jonathan Berr • Nov. 3, 2022 -

MoneyGram dives deeper into crypto

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

By Tatiana Walk-Morris • Nov. 2, 2022 -

Explore the Trendline➔

Explore the Trendline➔

kentoh via Getty Images

kentoh via Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

6 payments takeaways from big consulting firms

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

By Caitlin Mullen , Lynne Marek , Jonathan Berr • Nov. 2, 2022 -

Honeywell jumps into mobile payments battle

The tech conglomerate will couple new payments software with its mobile computers to process transactions anywhere, taking on a pack of rivals already in the market.

By Lynne Marek • Nov. 1, 2022 -

Warren urges CFPB crackdown on Zelle fraud

Sen. Elizabeth Warren told the Consumer Financial Protection Bureau that it should amend Regulation E of the Electronic Fund Transfer Act “to increase consumer protection.”

By Anna Hrushka • Oct. 31, 2022 -

Jack Henry debuts P2P payments tool

The company is bringing the peer-to-peer payments tool to community and regional bank clients, after big banks made P2P popular through Zelle.

By Tatiana Walk-Morris • Oct. 31, 2022 -

Deluxe aims to add crypto

The company better known for paper checks is preparing for increased consumer use of digital assets, with plans to add options for accepting crypto next year.

By Lynne Marek • Oct. 31, 2022 -

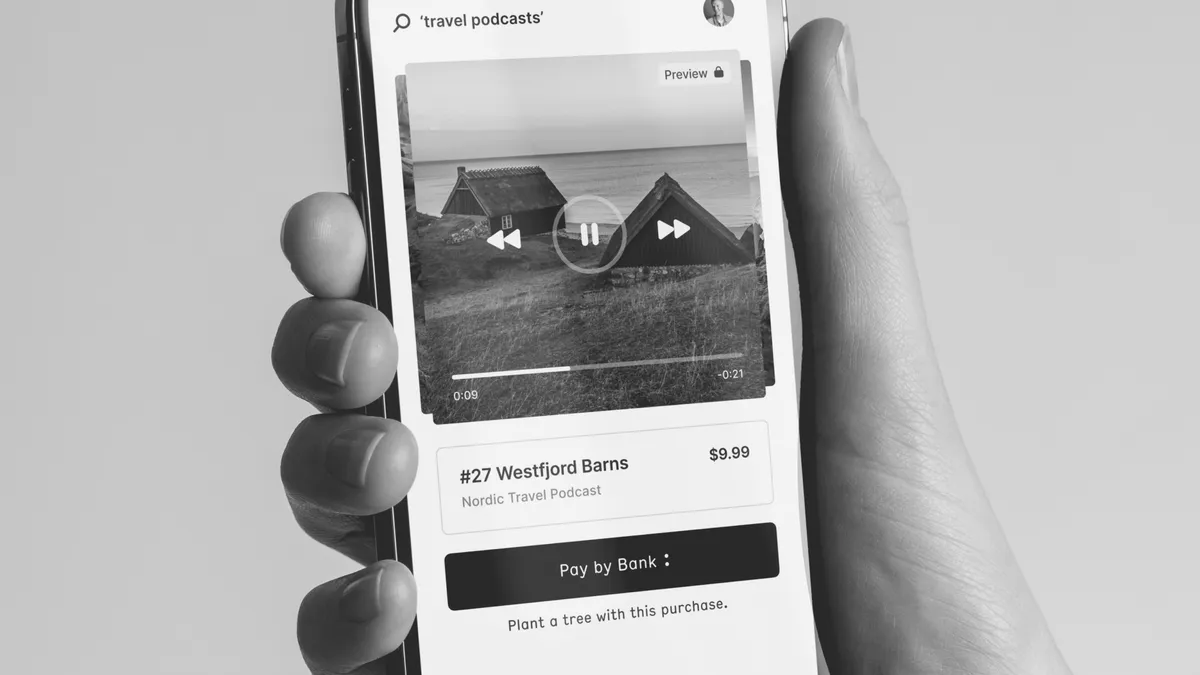

Sponsored by Banked

Mitigating fraud in the payments industry

Cybercrime countermeasures are essential to protecting private banking data. Here’s how fintech innovators can protect customer data.

Oct. 31, 2022 -

Papaya builds cross-border payroll services

The well-funded startup is taking on big clients and rivals in seeking to offer cross-border payroll payment services, with checks sent to workers in 72 hours.

By Lynne Marek • Oct. 28, 2022 -

Shoppers turn to installment payments for holidays: report

Shoppers aim to stretch their budgets by trying installment payment plans and seeking discounts from retailers, according to a new report.

By Tatiana Walk Morris • Oct. 27, 2022 -

Fiserv sheds Korea unit, plans move to Milwaukee

After selling off three business units and taking other actions to “tighten spending” in the third quarter, Fiserv CFO Bob Hau expects cost improvement for the fourth quarter.

By Caitlin Mullen • Updated Oct. 28, 2022 -

Ukraine raises fraud concerns, Stripe exec says

The war in Ukraine raised the stakes for payment fraud detection, as bad actors devise more complex ways of evading oversight.

By Suman Bhattacharyya • Oct. 26, 2022 -

CFPB aims to give ‘open banking’ rule teeth in 2024

The bureau's chief, Rohit Chopra, laid out the timeline this week for a rule change meant to make it easier for consumers to break up with their banks.

By Gabrielle Saulsbery • Oct. 26, 2022 -

FedNow will be a ‘public utility model,’ Waller says

The central bank governor equated the nascent system with an interstate highway on which private companies will provide "on-ramps" and "off-ramps."

By Lynne Marek • Oct. 26, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover tightens underwriting

Count the card company among those that added to credit loss provisions in the third quarter as economic conditions soured.

By Caitlin Mullen • Oct. 26, 2022 -

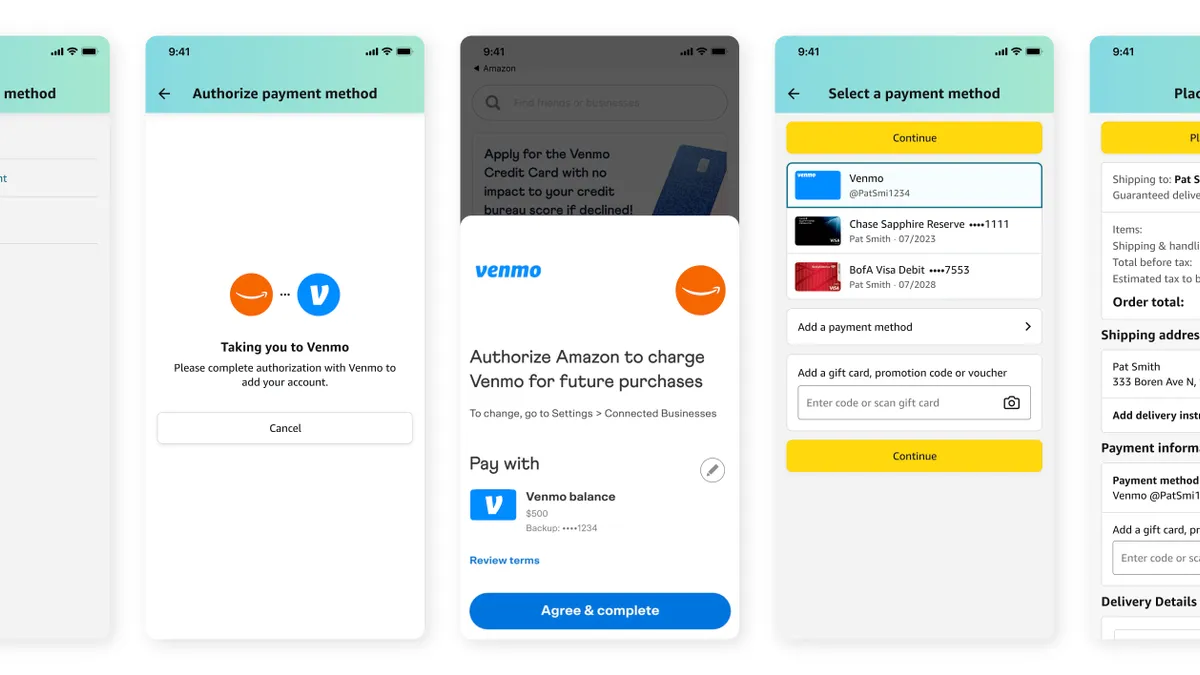

Amazon rolls out Venmo payment option

The e-commerce giant’s new payment method was first teased in an announcement from Venmo owner PayPal last year.

By Dani James • Oct. 25, 2022 -

Column

Fintechs party like it’s 2021 at Money 20/20

Thousands of payments and fintech professionals at the Money 20/20 conference in Las Vegas this week are racing ahead with high-growth businesses, even as a drop-off in capital threatens to ruin the celebration.

By Lynne Marek • Oct. 25, 2022 -

Fiserv divestiture hints at strategy shift

As payments companies face economic headwinds, Fiserv and its peers “may try to focus on their strongest market positions versus more ancillary opportunities,” said Oppenheimer & Co. analyst Dominick Gabriele.

By Caitlin Mullen • Oct. 24, 2022 -

Fiserv sells SIS unit, Costa Rica operations

The major payments processor agreed to sell an IT business unit and a Costa Rica division to Infinite Computer Solutions. They also entered a multiyear pact for the buyer to keep providing services.

By Caitlin Mullen • Oct. 21, 2022 -

Ammo to launch its own online payments processing

The Scottsdale, Arizona company said that bringing the payments aspect of transactions in-house, as opposed to using third parties, will allow it to reduce costs.

By Jonathan Berr • Oct. 21, 2022 -

JPMorgan doubles down on gaming firm tie

The bank said it invested in the regulated gaming company Sightline Payments this week, following an agreement earlier this year to be the firm’s primary merchant acquirer.

By Lynne Marek • Oct. 21, 2022 -

Earnings preview: Payments companies confront 3Q challenges

Macroeconomic headwinds, consumer health and cost management are set to be topics of conversation during payments companies' quarterly earnings calls.

By Caitlin Mullen • Oct. 20, 2022 -

PayPal user policy sparks Republican ire

Congressional Republicans this week demanded more details from PayPal over a proposed user policy that threatened to take users to task over “misinformation.”

By Lynne Marek • Oct. 20, 2022 -

Advanced checkout tech surges at c-stores

From self-checkout machines to checkout-free stores, the options for processing payments are expanding at retail venues. Here’s how retailers find the best fit.

By Jessica Loder • Oct. 19, 2022 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services. Opinion

OpinionFedNow may stumble without nonbanks, cross-border payments

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

By Rina Wulfing • Oct. 18, 2022