Technology: Page 29

-

Metropolis snags parking company SP Plus for $1.5B

The purchase will expand Metropolis’ services, which facilitate parking payments without on-site cash or credit cards, to over 3,300 locations across North America.

By Joe Burns • Oct. 9, 2023 -

Payments conferences yet to come in 2024

Payments professionals still have plenty of choices when contemplating conferences to attend in the second half of the year. Here are our staff picks.

By Lynne Marek • Updated July 3, 2024 -

Explore the Trendline➔

Explore the Trendline➔

ArtemisDiana via Getty Images

ArtemisDiana via Getty Images Trendline

TrendlineCross-border payments targeted for upgrades

When it comes to cross-border payments, businesses, non-profits and governments alike are determined to increase the speed of transactions and cut the cost.

By Payments Dive staff -

CFPB’s Chopra warns of ‘financial censorship’ in payments

The federal agency is considering regulatory action to better protect U.S. consumers from “excessive surveillance,” Director Rohit Chopra said last week during a Brookings Institution event.

By James Pothen • Oct. 9, 2023 -

BNPL to drive $17B in online holiday spending: Adobe

Online mobile spending will surpass computers for the first time and shoppers will turn more to buy now, pay later services, according to the report.

By Tatiana Walk-Morris • Oct. 6, 2023 -

Block cuts employees

Jack Dorsey-led Block is the latest payments company to make staff cuts and pull back on hiring as it pursues profitable growth.

By Caitlin Mullen • Oct. 6, 2023 -

PayZen adds BNPL card for medical expenses

The debit card allows patients to swipe first, then pick a payment plan later, PayZen CEO Itzik Cohen said.

By James Pothen • Oct. 6, 2023 -

Amex pilots biometrics in online checkout

The card issuer is testing fingerprint and facial recognition with a fraction of its U.S. consumer cardholders before rolling out the capabilities more broadly early next year.

By Tatiana Walk-Morris • Oct. 5, 2023 -

PIRG calls out Mastercard’s data sales practices

The consumer advocacy group has taken aim at the card network for selling cardholder information. Mastercard has disputed the allegations.

By Caitlin Mullen • Oct. 5, 2023 -

Senate bill would let small businesses use SBA loans to cover fintech fees

The Financial Technology Association is backing a bill that would clarify that loans made through the Small Business Administration’s flagship lending program can be used to pay for fintech services.

By Anna Hrushka • Oct. 5, 2023 -

Q&A

Ceridian leans on payroll with EWA app

Offering payroll services through its human resources software gives Ceridian an advantage in the earned wage access market, executive Deepa Chatterjee said.

By James Pothen • Oct. 3, 2023 -

Opinion

What the CFPB’s open banking push means for financial institutions

“The narrative often centers around consumer empowerment, but let’s not overlook the advantages it holds” for financial institutions, writes an executive at financial connectivity company Atomic.

By Andrea Martone • Oct. 3, 2023 -

Shift4 acquires SpotOn unit for $100M

With the purchase of SpotOn’s sports and entertainment business unit, Shift4 scoops up its rival’s customers in that market.

By Caitlin Mullen • Oct. 3, 2023 -

Payment security at the pump tops consumer demands: survey

A fast payment process is another top feature customers value when buying items from convenience stores, Dover Fueling Solutions noted in its latest report.

By Jessica Loder • Oct. 3, 2023 -

Global Payments tops Worldpay debt rating

Global Payments landed a better mark from debt rating agency Fitch than did Worldpay in recent reports. That may matter as they pursue acquisitions.

By Lynne Marek • Sept. 29, 2023 -

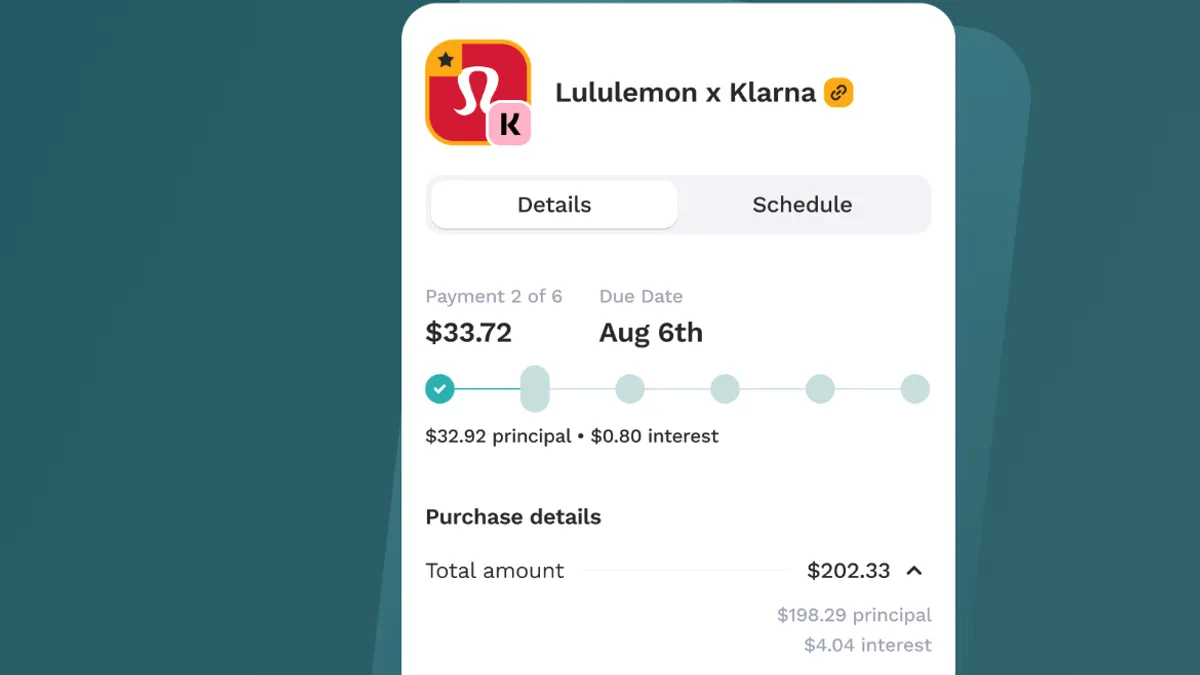

Keeping track of multiple BNPL loans? There’s an app for that.

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to keep track of several BNPL loans at once, so he shifted his fintech’s focus to help others in the same boat.

By Gabrielle Saulsbery • Sept. 28, 2023 -

Chase to ban crypto payments for UK customers

“If we think you're making a payment related to crypto assets, we'll decline it,” Chase U.K. told customers in an email reported by CoinDesk.

By Gabrielle Saulsbery • Sept. 28, 2023 -

Deluxe to offer direct-biller payment services

Though checks have been vital to its business, the company is venturing further into digital payments, with an assist from Aliaswire.

By Tatiana Walk-Morris • Sept. 28, 2023 -

Jack Dorsey faces full Square agenda

The billionaire co-founder is likely to focus on large clients, sales strategy and IT issues after he takes over the Block merchant unit next week, analysts predicted.

By Caitlin Mullen • Sept. 28, 2023 -

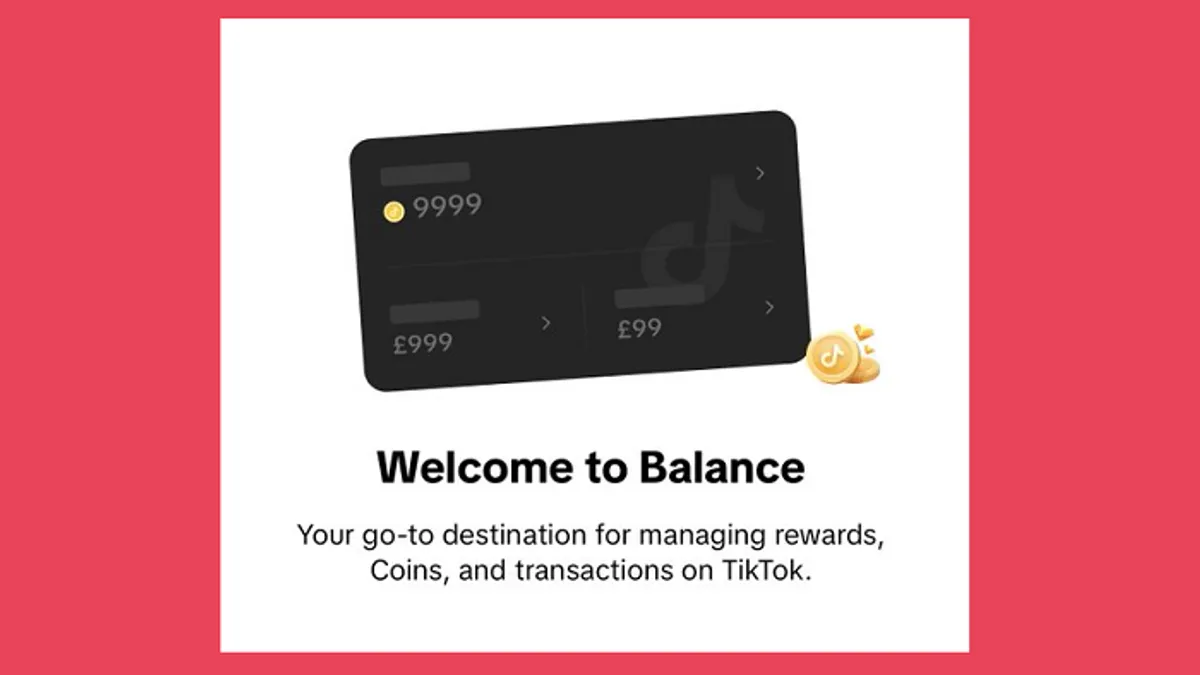

Retrieved from Matt Navarra/Twitter on September 28, 2023

Retrieved from Matt Navarra/Twitter on September 28, 2023 Column

ColumnTikTok moves to add ‘in-app’ wallet

The social media app has taken another step toward providing in-app commerce and payments, but may face regulatory resistance.

By Andrew Hutchinson • Sept. 27, 2023 -

Modern Treasury CEO targets bigger customers

The digital payment services company brought on a chief revenue officer last year to better serve larger companies, according to CEO Dimitri Dadiomov.

By James Pothen • Sept. 27, 2023 -

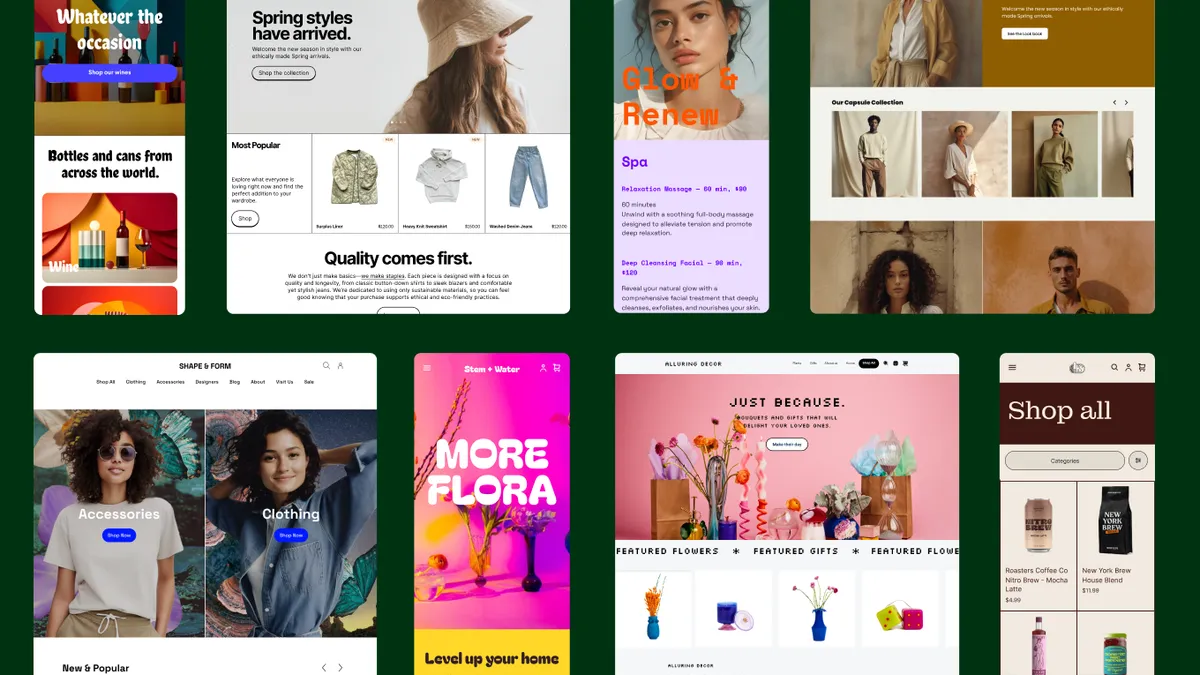

Column

Social apps face challenges in implementing shopping tools

Facilitating digital payments would be a big win for social apps, but regulators are less enthused.

By Andrew Hutchinson • Sept. 27, 2023 -

FTC lawsuit knocks Amazon on payments play

The FTC alleged in a lawsuit filed Tuesday against the online retail juggernaut that it maintained a monopoly partly through its checkout process.

By Lynne Marek • Sept. 27, 2023 -

Retrieved from Business Wire on September 27, 2023

Retrieved from Business Wire on September 27, 2023

Square adds merchant tools

Block’s merchant business, facing stiffer competition in the point-of-sale space, has added about a dozen new features for its sellers.

By Caitlin Mullen • Sept. 27, 2023 -

Andreessen Horowitz pushes cross-border payment improvements

While money is much older than software, it’s still more difficult to move payments around the world, the venture capital firm said in a recent report advocating cross-border improvements.

By James Pothen • Sept. 26, 2023 -

BNPL users ‘financially fragile,’ NY Fed says

Consumers using BNPL have lower credit scores, have been delinquent on a loan or have been rejected for a credit application over the past year, New York Fed researchers said.

By Caitlin Mullen • Sept. 26, 2023