Technology: Page 17

-

EWA providers hail new Kansas law

Kansas has joined a pack of states in passing a law backed by earned wage access providers, as regulations for the industry remain a contentious issue.

By Lynne Marek • April 25, 2024 -

Fed seeks 8,000 financial institutions for FedNow

About 700 financial institutions have connected to the Fed’s instant payment network since last July, with at least 1,000 more in the pipeline, a FedNow official said this week.

By Lynne Marek , James Pothen • April 25, 2024 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

Walmart offers a new BNPL option: report

The fintech One now offers buy now, pay later financing at the store chain, presenting competition for Affirm, which has partnered with the retail giant since 2019.

By Caitlin Mullen • April 24, 2024 -

Ramp may target US startups this year: report

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

By James Pothen • April 23, 2024 -

Klarna expands reach with Uber partnership

The Swedish BNPL pioneer said it has formed new partnerships with the ride-share company, as well as the travel firm Expedia Group.

By James Pothen • April 23, 2024 -

Video game industry preps for oversight

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

By James Pothen • April 22, 2024 -

Fed courts nonbanks for FedNow growth

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

By Lynne Marek • April 22, 2024 -

Codat seeks to topple check fraud with virtual card adoption

JPMorgan Chase is an early user of Codat’s Supplier Enablement product, which launched last week.

By Gabrielle Saulsbery • April 22, 2024 -

Amazon defends ‘Just Walk Out’ pullback

The retailer’s grab-and-go technology will be targeted to small stores, while its smart carts will be prevalent in grocery stores, the company said this week.

By James Pothen • April 19, 2024 -

Accounts receivable automator Versapay taps new CFO

Ed Neumann is joining the AR platform provider as it looks to grow by targeting companies seeking to digitize their older manual systems.

By Maura Webber Sadovi • April 19, 2024 -

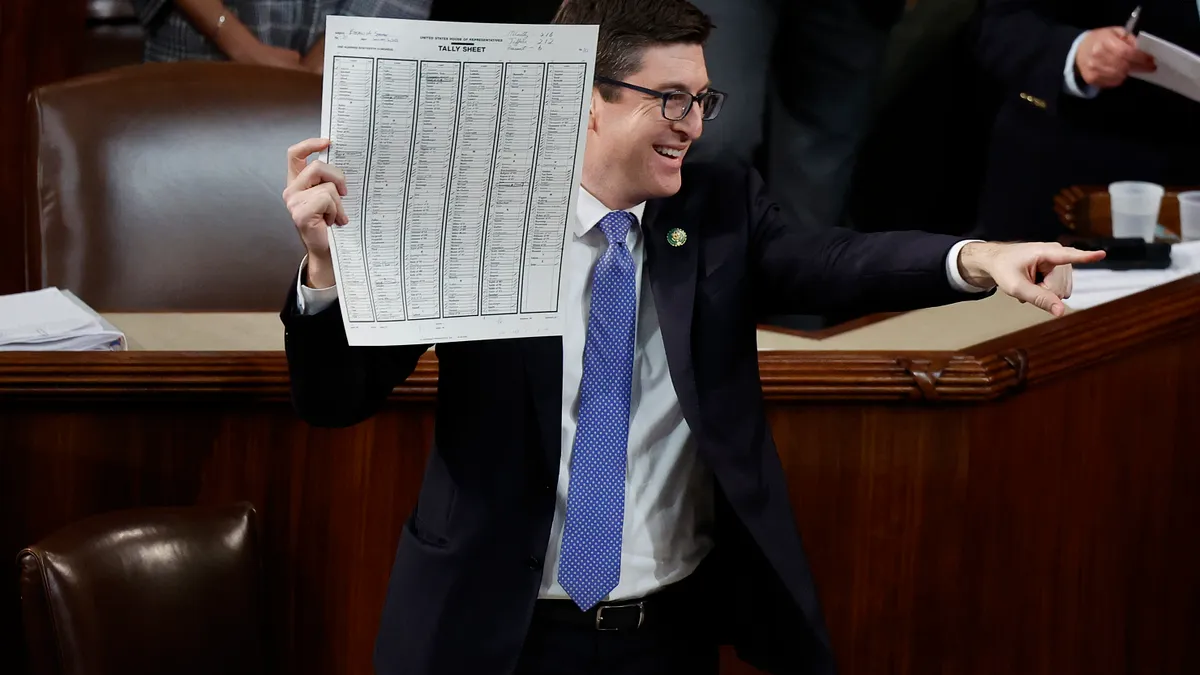

House committee advances EWA bill

The Republican-backed and industry-friendly bill was passed by the House Financial Services Committee despite pushback from Democratic lawmakers.

By James Pothen • April 18, 2024 -

Fed keeps up CBDC research

Despite political opposition to a potential U.S. central bank digital currency, research staff at the central bank continue to study the possibility.

By Lynne Marek • April 17, 2024 -

Steak ‘n Shake installs facial recognition at self-ordering kiosks

The chain first tested the technology that lets customers pay using their face in October, and began deploying it in January.

By Julie Littman • April 16, 2024 -

CFPB notes ‘growing financialization’ of medical, rental payments

The bureau has received about 15,000 complaints in the last two years concerning medical debt collectors, according to General Counsel Seth Frotman.

By James Pothen • April 16, 2024 -

Sponsored by Pipe

Can embedded finance solve one of payments’ biggest problems?

As crucial as it is to focus on your core business, today’s merchants demand a broader range of services from their providers. Can embedded finance help solve this core competency problem?

By CEO Luke Voiles • April 16, 2024 -

FlexWage wins Vermont EWA carve-out

Earned wage access provider FlexWage has received leeway from the Vermont Department of Financial Regulation to operate in the state without a lender or money transmitter license.

By Lynne Marek • April 15, 2024 -

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

Sponsored by Lithic

What card issuers need to know about 3DS

Card programs can increase purchase authorization rates without taking on undue fraud-liability risk with 3-D Secure (3DS). Here’s what it is and how card issuers can leverage it.

April 15, 2024 -

Q&A

Gen Z clings to new payment tools

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

By Lynne Marek • April 12, 2024 -

Deep Dive

Why more tech in stores shouldn’t mean fewer workers

Stores can automate more tasks than ever, including pricing, inventory management and checkout. But for theft prevention, customer service and brand engagement, they need humans.

By Daphne Howland • April 11, 2024 -

EWA providers seek to steer state legislation

Payactiv, DailyPay and other earned wage access providers teamed up in calling on the governor of Kansas to pass legislation similar to laws recently enacted in three other states.

By Lynne Marek • April 11, 2024 -

Capital One’s Discover bid tops biggest Q1 tech-related deals

The proposed Capital One-Discover merger made the list because of fintech issues that are at stake in the $35.3 billion deal.

By Alexei Alexis • April 10, 2024 -

CFPB, DOJ boost teamwork on cases

The bureau will refer “potentially criminal conduct,” including “anti-competitive mischief,” to the DOJ for action, CFPB Director Rohit Chopra said Monday.

By James Pothen • April 9, 2024 -

Amazon debuts app for palm payment

The Amazon One app can be used to enter various locations, identify individuals, pay for items and access loyalty rewards.

By Xanayra Marin-Lopez • April 7, 2024 -

Whole Foods to pull Amazon’s Just Walk Out technology from stores

The specialty grocer, which operates the checkout tech at just two stores, will follow the same path as Amazon Fresh stores in the U.S., a spokesperson confirmed Friday.

By Peyton Bigora • April 5, 2024