Technology: Page 10

-

Fed payments proposal pits big banks against small rivals

The Federal Reserve’s proposal to extend the operating hours of two interbank payments systems has been welcomed by large banks, but panned by many small financial institutions.

By Lynne Marek • Sept. 18, 2024 -

Rain to offer EWA services via Workday

The earned wage access provider will now be able to offer its services to more employers through the human resources software firm’s systems.

By Tatiana Walk-Morris • Sept. 18, 2024 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

Apple launches Affirm BNPL option

Apple Pay customers can now use their iOS 18 phone or iPadOS 18 to access Affirm buy now, pay later options, including some that don’t charge interest.

By Lynne Marek • Sept. 17, 2024 -

Block shuffles leadership, creates chief risk officer role

Block will move several longtime executives into different positions and create a new role to address customer safety, the company said Monday.

By Patrick Cooley • Sept. 17, 2024 -

Lawmakers push for crackdown on fintechs

Two U.S. senators demanded tighter regulations on BaaS and fintech partnerships, saying they pose “a broader threat to the stability of our banking system and the economy.”

By Rajashree Chakravarty • Sept. 17, 2024 -

Retrieved from Beijing Daily App on September 16, 2024

Retrieved from Beijing Daily App on September 16, 2024

Visa, Mastercard enable rail transit payment in Beijing

The major card networks enabled systems that allow international travelers in China to use their cards to pay for Beijing rail transit as of last week.

By Lynne Marek • Sept. 16, 2024 -

Sponsored by PayNearMe

Key trends shaping the future of payments

Explore trends reshaping the landscape of payments and how businesses can stay ahead with modern solutions.

Sept. 16, 2024 -

U.S. Bank rolls out access to Paze digital wallet

The bank began offering the payments option from Early Warning Services to its credit and debit cards customers this week.

By Patrick Cooley • Sept. 13, 2024 -

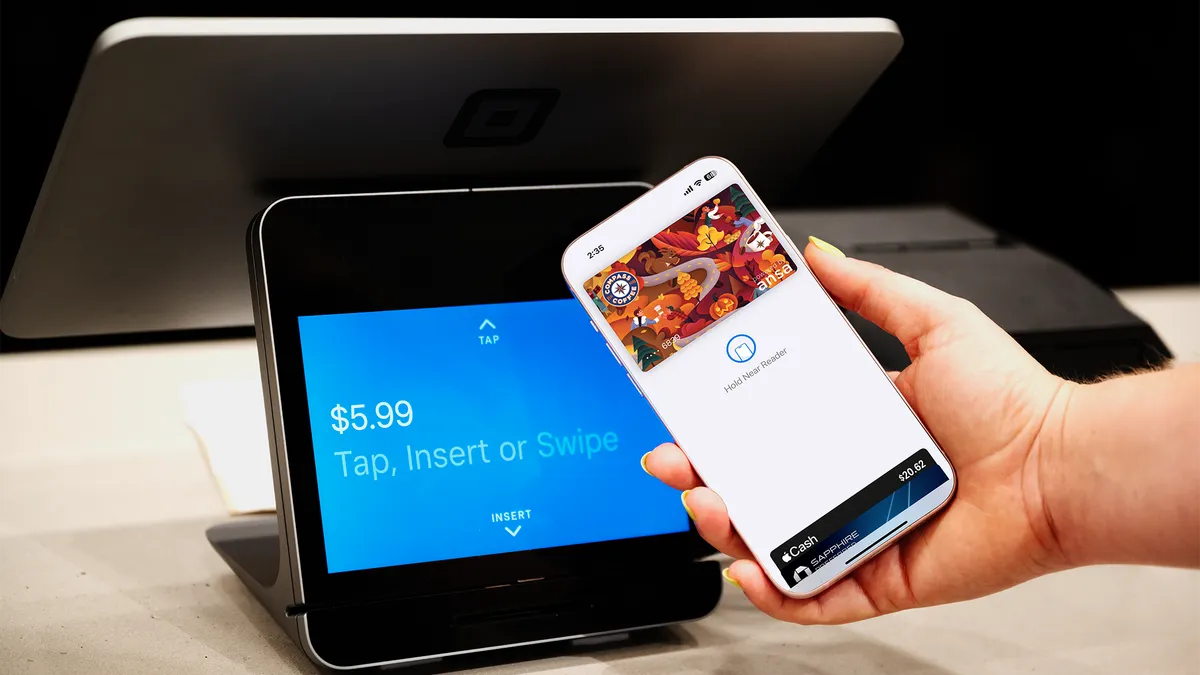

Ansa debuts in-store digital wallet capabilities

Ansa last week launched a software development kit, which can be patched onto the code of a brand’s mobile app. “The pain’s on our side to make sure all their systems talk,” co-founder Sophia Goldberg said.

By Gabrielle Saulsbery • Sept. 13, 2024 -

Mastercard acquires cybersecurity firm for $2.65B

The acquisition is the latest in a series of cybersecurity firm purchases by the card network over the years.

By Lynne Marek • Sept. 12, 2024 -

North American cashless payments to climb 7% by 2028: report

Real-time payments and open banking will drive the increase, forcing the shift even faster globally, a Capgemini report released this week said.

By Tatiana Walk-Morris • Sept. 12, 2024 -

Airwallex eyes embedded payments in global push

The payments software provider is making “immediate bets” on the Brazil and Mexico markets, a company executive said.

By Grace Noto • Sept. 12, 2024 -

Global Payments CEO reshapes the business

The payments technology company is getting a remake with job cuts, an acquisition and potential divestitures a year after Cameron Bready ascended to the CEO post.

By Lynne Marek • Sept. 11, 2024 -

FIS draws fintech startups into accelerator

Fidelity National Information Services this week continued an annual program backing young fintechs that are striving to disrupt the financial services landscape.

By Lynne Marek • Sept. 11, 2024 -

Amex taps troves of customer data

American Express eschews preset spending limits and instead relies on credit scores and spending history to manage risk, a company executive explained at a conference last week.

By Patrick Cooley • Sept. 10, 2024 -

Amazon provides checkout tech at universities, stadiums

The company said it expects to place its automated checkout technology at more venues in 2024 than in any year previously.

By Jessica Loder • Sept. 9, 2024 -

Sponsored by Adobe

5 ways Buy Now, Pay Later can boost your business

Buy Now, Pay Later (BNPL) has moved from a novel option to a must-have for retailers that aim to meet the demands of modern consumers.

Sept. 9, 2024 -

Visa to upgrade pay-by-bank service in UK next year

The card network plans to make the account-to-account service available to consumers for paying bills, like rent, but eventually for other uses too, such as digital streaming.

By Patrick Cooley , Lynne Marek • Sept. 6, 2024 -

Grabango CEO pushes for more partnerships

The Berkleley, California-based company is looking to expand by building ties with established retailers, CEO Will Glaser said.

By Patrick Cooley • Sept. 5, 2024 -

Opinion

CFPB’s EWA rule may undo progress

“The CFPB’s plan to reclassify EWA as a loan could accidentally backfire on the agency by driving people right back to the payday lending industry,” writes one tech trade group professional.

By Adam Kovacevich • Sept. 5, 2024 -

Academics question digital wallet security

Due to lax authentication practices, a thief or hacker can easily add a stolen credit card to their own digital wallet, the study concluded.

By Patrick Cooley • Sept. 4, 2024 -

CFPB slammed with EWA commentary

The Consumer Financial Protection Bureau asked for public feedback on its earned wage access rule proposal and it got an earful.

By Lynne Marek • Sept. 4, 2024 -

Viral JPMorgan Chase glitch is ‘fraud, plain and simple,’ bank says

Some customers deposited bad checks and immediately withdrew funds before the checks bounced in a glitch that went viral on TikTok. Now, some users have holds on their accounts.

By Gabrielle Saulsbery • Sept. 4, 2024 -

Paysafe taps FIS alum for CFO amid growth pivot

The iGaming payments platform is looking to expand on its “robust” performance in the first half of the year with the appointment of new financial leadership.

By Grace Noto • Sept. 4, 2024 -

Maryland gets tough on BNPL

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

By Patrick Cooley • Sept. 3, 2024