Risk: Page 17

-

Deep Dive

Payments fraud climbs as banks reach for joint response

Financial institutions and payments players are seeking to coalesce around new efforts to battle skyrocketing payments fraud.

By Lynne Marek • May 25, 2023 -

Card debt weighs on consumers

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

By Caitlin Mullen • May 16, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Affirm, FICO to create BNPL credit-scoring model

The “first-of-its-kind” model will enable buy now, pay later loans to be factored into lending decisions, Affirm’s CEO said.

By Caitlin Mullen • May 10, 2023 -

Block boosts compliance spending to $160M

Square parent Block is increasing compliance spending on personnel and software this year.

By Caitlin Mullen • May 5, 2023 -

Finix takes aim at processor incumbents

Now certified as a processor, Finix seeks to take on legacy and fintech rivals.

By Caitlin Mullen • May 3, 2023 -

Mastercard ‘cannot afford to ignore’ AI, CEO says

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

By Caitlin Mullen • April 28, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Payments increasingly in regulatory crosshairs, industry lawyers say

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference in Atlanta.

By Caitlin Mullen • April 27, 2023 -

Profits slip for Amex, Discover

In light of rising charge-offs, the card companies on Thursday each reported adding to credit loss provisions. That put a dent in their first-quarter profits.

By Caitlin Mullen • April 21, 2023 -

Synchrony signals openness to Walmart

Despite Synchrony Financial’s history with Walmart, the card issuer may be willing to work with the retailer again.

By Caitlin Mullen • April 20, 2023 -

NCR in recovery as ransomware disrupts widely used point-of-sale system

In-restaurant purchases are still being processed on NCR Aloha, but other capabilities and business processes remain down, the company said.

By Matt Kapko • Updated April 24, 2023 -

CFPB focuses on BNPL consumer disputes

A Consumer Financial Protection Bureau official pointed to how buy now, pay later providers handle consumer disputes as a major area of concern for the agency.

By Lynne Marek • April 19, 2023 -

Visa remains cryptic about new surcharge cap

The card giant is set to impose a new surcharge cap of 3% tomorrow, but many payments processing professionals are still searching for details about it.

By Lynne Marek • April 14, 2023 -

CFPB director wants some payments firms labeled systemically important

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

By Anna Hrushka • April 12, 2023 -

North American Bancard taps Virtualitics’ AI tech

The artificial intelligence and data analytics company aims to help North American Bancard protect its merchants from payment processing fraud, Virtualitics CEO Michael Amori said.

By Tatiana Walk-Morris • April 7, 2023 -

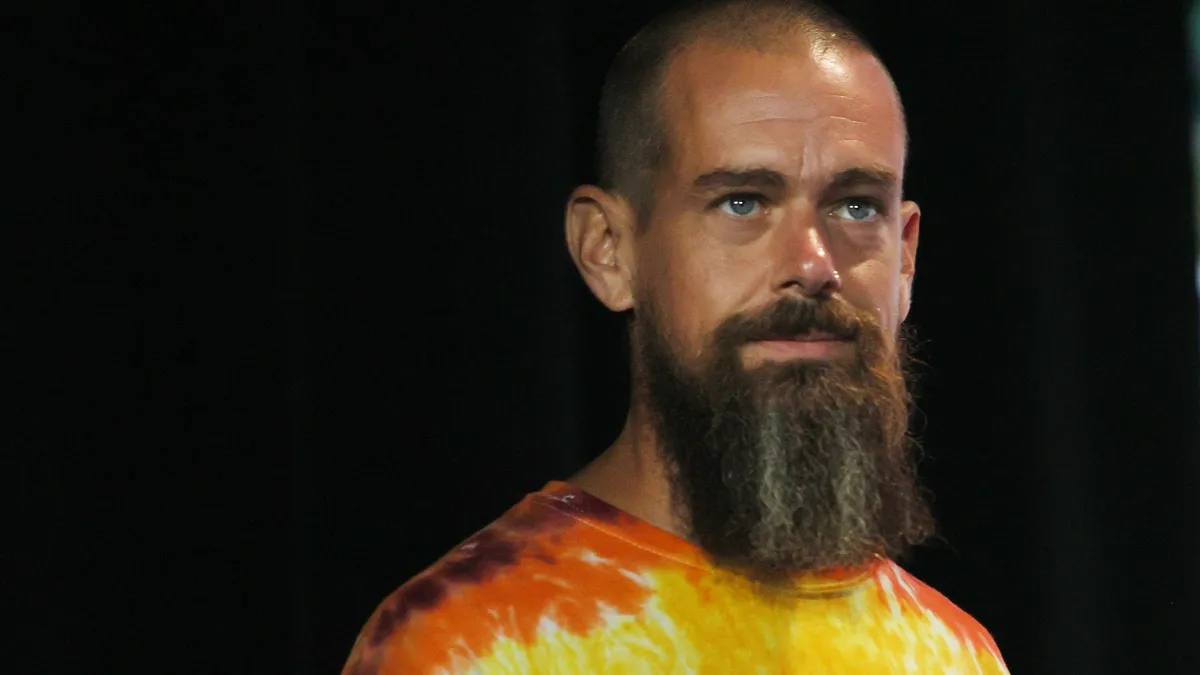

Block defends against short seller allegations

The Jack Dorsey-led digital payments company pushed back by underscoring fraud mitigation tactics and account metrics for its Cash App business.

By Caitlin Mullen • March 30, 2023 -

Analysts call on Block to share anti-fraud details

Following a controversial short seller’s report, analysts advised digital payments company Block to share more information related to active user numbers and know-your-customer practices.

By Caitlin Mullen • March 29, 2023 -

BNPL remains mainly absent from consumer credit histories

The lack of BNPL data being furnished to credit bureaus more than a year after inclusion efforts were announced points to the complexity involved with fitting the burgeoning payment method into the traditional credit scoring framework.

By Caitlin Mullen • March 27, 2023 -

Sponsored by PayNearMe

3 ways to increase on-time payments during an economic downturn

Discover how to increase on-time payments and make flexibility and payment convenience a priority at your business.

March 27, 2023 -

Sponsored by Justt

Visa says the recession is irrelevant at Merchant Risk Council 2023

Visa says a U.S. recession is nothing to worry about, but heightened fraud paints a different story.

By Ronen Shnidman • March 27, 2023 -

Mastercard buys Baffin Bay Networks

The card network company said it bought the cybersecurity business to better combat cyber-attacks in an increasingly threatening environment.

By Lynne Marek • March 20, 2023 -

Payments execs detail SVB impact

The Silicon Valley Bank downfall that sent shockwaves through the financial industry forced fintechs, such as Affirm and Marqeta, to react fast.

By Caitlin Mullen , Lynne Marek • March 16, 2023 -

Fiserv, Jack Henry CEOs react to bank crisis

Payments processors’ CEOs this week described how their companies were affected by the recent bank industry turmoil, downplaying the impact.

By Caitlin Mullen , Lynne Marek • March 15, 2023 -

Payments players caught in SVB fallout

As the banking crisis spread, payments players, such as FIS, and venture-backed firms, including Payoneer, were caught in the contagion.

By Lynne Marek , Caitlin Mullen • March 13, 2023 -

Brex offers ChatGPT-style tools

The announcement comes as interest in ChatGPT is rapidly gaining momentum, even as some worry about potential privacy and security risks.

By Alexei Alexis • March 8, 2023 -

Walmart shooter likely used card to buy gun

The gunman in a 2019 attack at an El Paso Walmart store likely used a credit card to buy his gun online. This story is one in a series of pieces tracking payment methods for guns used in mass shootings.

By Debbie Carlson • March 7, 2023