Risk: Page 11

-

Q&A

BNPL risks raise questions for Consumer Reports

BNPL’s ubiquity and growing use for everyday purchases should grab regulators’ attention, said Consumer Reports’s senior policy counsel.

By Caitlin Mullen • Aug. 21, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover ‘acting with urgency’ on Hochschild replacement

Interim CEO John Owen also said the company has hired about 200 compliance officers in recent months as Discover bolsters regulatory and risk management efforts.

By Caitlin Mullen • Aug. 17, 2023 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Splitit targets areas BNPL rivals have ‘underserved’: CEO

The installment payments company aims to more than double its B2B merchant sales volume by mid-next year, CEO Nandan Sheth said.

By Caitlin Mullen • Aug. 14, 2023 -

New Fed unit to supervise crypto, nonbank partnerships

The central bank clarified that any state bank it supervises must get the regulator’s green light before issuing, holding or transacting in dollar tokens, such as stablecoins, to facilitate payments.

By Anna Hrushka • Aug. 9, 2023 -

Credit card debt tops $1 trillion

Second-quarter credit card balances saw “the most pronounced worsening in performance” compared to other categories such as housing and student loan debt, the New York Fed said.

By Tatiana Walk-Morris • Aug. 9, 2023 -

Column

What a shooter’s payment choice reveals — or doesn’t

Whether or not the payment type behind an active shooter’s purchase of a gun means anything may be revealed in patterns.

By Lynne Marek • Aug. 8, 2023 -

Senate ‘making good progress’ on pot banking bill, Schumer says

There may be bipartisan agreement on SAFE Banking’s goal to help the cannabis industry enter the banking fold, but lawmakers are reportedly haggling over some of the bill’s details.

By Anna Hrushka • Aug. 2, 2023 -

Will payments M&A pick up after slow start?

Despite a flurry of payments acquisitions recently, deal activity was slow in the first half of the year and some factors are still suppressing M&A.

By Caitlin Mullen • July 24, 2023 -

Photo by Tima Miroshnichenko from Pexels

Q&A

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover facing FDIC probe

The company also disclosed during its 2Q earnings report that a pricing issue affected merchants and merchant acquirers, some of whom will get refunds.

By Caitlin Mullen • July 20, 2023 -

Synchrony braces for late fee rule

The CEO of the private label card issuer expects a final rule on the CFPB’s proposed credit card late fee cap later this year, and litigation could follow, he said.

By Caitlin Mullen • July 18, 2023 -

FIS, GTCR craft Worldpay escape hatch

In its recent sale of an ownership stake in Worldpay, FIS agreed that the new joint venture with GTCR could be put up for sale a handful of years after they close the deal.

By Lynne Marek • July 13, 2023 -

Bank of America fined $250M over fake accounts, junk fees

Regulators say Bank of America opened credit card accounts without customers’ consent and misled consumers about rewards for card applications.

By Anna Hrushka • July 11, 2023 -

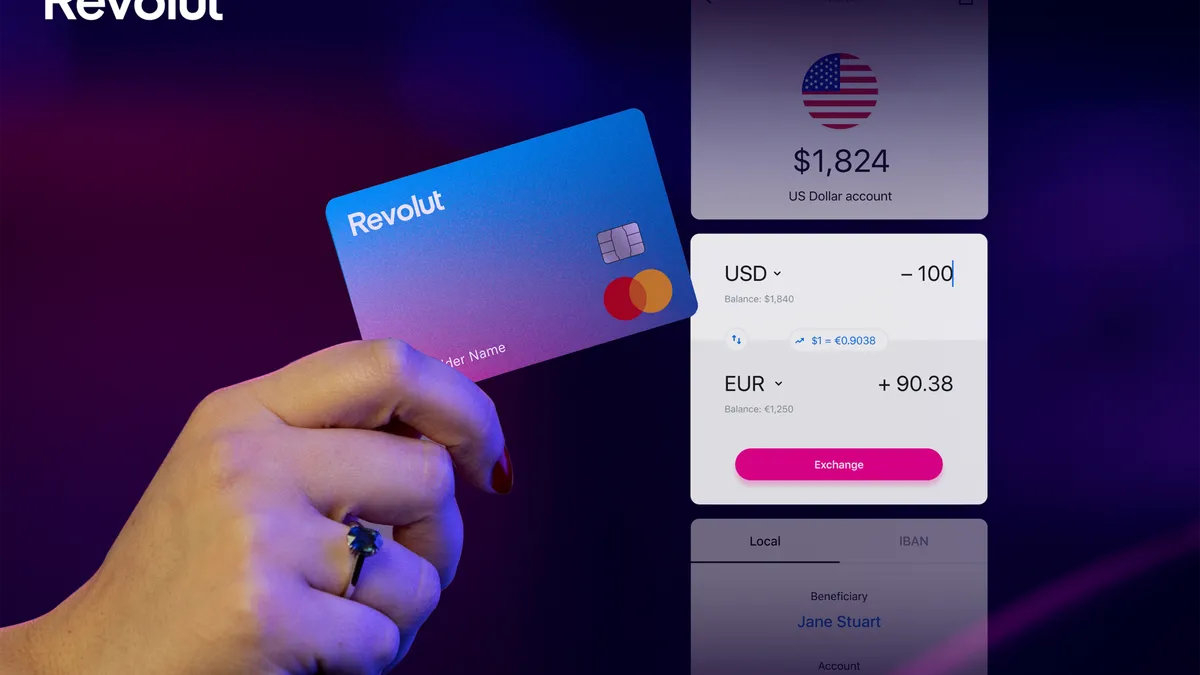

Criminals stole $20M from Revolut via payment loophole: report

Differences in the firm’s U.S. and European systems meant the neobank would use its own money to erroneously refund certain declined payments, the Financial Times reported.

By Anna Hrushka • July 11, 2023 -

Debit plagued by security concerns: survey

Just 40% of consumers feel confident in the security and safety of their debit cards, J.D. Power said.

By Caitlin Mullen • July 5, 2023 -

Deep Dive

Will BNPL pass the test?

The buy now, pay later trend faces a starkly different environment than the one in which it gained traction. Regulation looms, the economy has worsened and investors are demanding profits. It’s all a test of BNPL’s long-term footing.

By Caitlin Mullen • June 27, 2023 -

Credit card used to buy AR-15 rifle in New Mexico shooting

Police confirm the gunman’s father used a credit card to pay for part of a transaction that included the weapon purchase.

By Debbie Carlson • June 26, 2023 -

Fees, interest charges rise to $347B: report

Fees and interest incurred on financial services, including credit cards, rose 14% last year, the Financial Health Network reported.

By Tatiana Walk-Morris • June 23, 2023 -

Fraud losses to surpass $40B by 2027: report

One in five consumers worldwide have been victims of payment fraud in the past four years, according to an ACI report.

By Tatiana Walk-Morris • June 16, 2023 -

Michigan State shooter tapped cash, debit card

A gunman who killed three Michigan State University students in February used more than one payment method to buy guns. This coverage is part of a Payments Dive series.

By Debbie Carlson • June 15, 2023 -

Banks too slow to address P2P payment scams, CFPB’s Chopra says

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

By Anna Hrushka • June 14, 2023 -

Affirm CFO acknowledges ‘difficult environment’

Bank failures and macroeconomic challenges have made capital markets challenging to navigate, Affirm CFO Michael Linford said.

By Caitlin Mullen • June 9, 2023 -

Fed, FDIC, OCC update guidance on third-party risk management

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

By Anna Hrushka • June 8, 2023 -

Republicans draft crypto legislation

The discussion draft, which addresses how digital assets can be defined, represents the most comprehensive federal legislative development in the crypto sphere this year.

By Gabrielle Saulsbery • June 5, 2023 -

CBDCs offer benefits, risks

Central bank digital currencies, which are being tested around the world, could increase the efficiency of cross-border payments, but there are associated risks, according to a trade group report.

By Lynne Marek • June 5, 2023