Retail: Page 9

-

Ex-Discover exec alleges age, gender bias in lawsuit

Diane Offereins is suing the card network over roughly $7 million in clawed-back equity, claiming she was a “convenient scapegoat” for Discover’s card misclassification issue.

By Caitlin Mullen • Sept. 5, 2024 -

Grabango CEO pushes for more partnerships

The Berkleley, California-based company is looking to expand by building ties with established retailers, CEO Will Glaser said.

By Patrick Cooley • Sept. 5, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Academics question digital wallet security

Due to lax authentication practices, a thief or hacker can easily add a stolen credit card to their own digital wallet, the study concluded.

By Patrick Cooley • Sept. 4, 2024 -

Paysafe taps FIS alum for CFO amid growth pivot

The iGaming payments platform is looking to expand on its “robust” performance in the first half of the year with the appointment of new financial leadership.

By Grace Noto • Sept. 4, 2024 -

Maryland gets tough on BNPL

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

By Patrick Cooley • Sept. 3, 2024 -

PayPal offers guest checkout service to Fiserv clients

The two firms are working together again as other payment giants collaborate on checkout enhancements.

By Tatiana Walk-Morris • Sept. 3, 2024 -

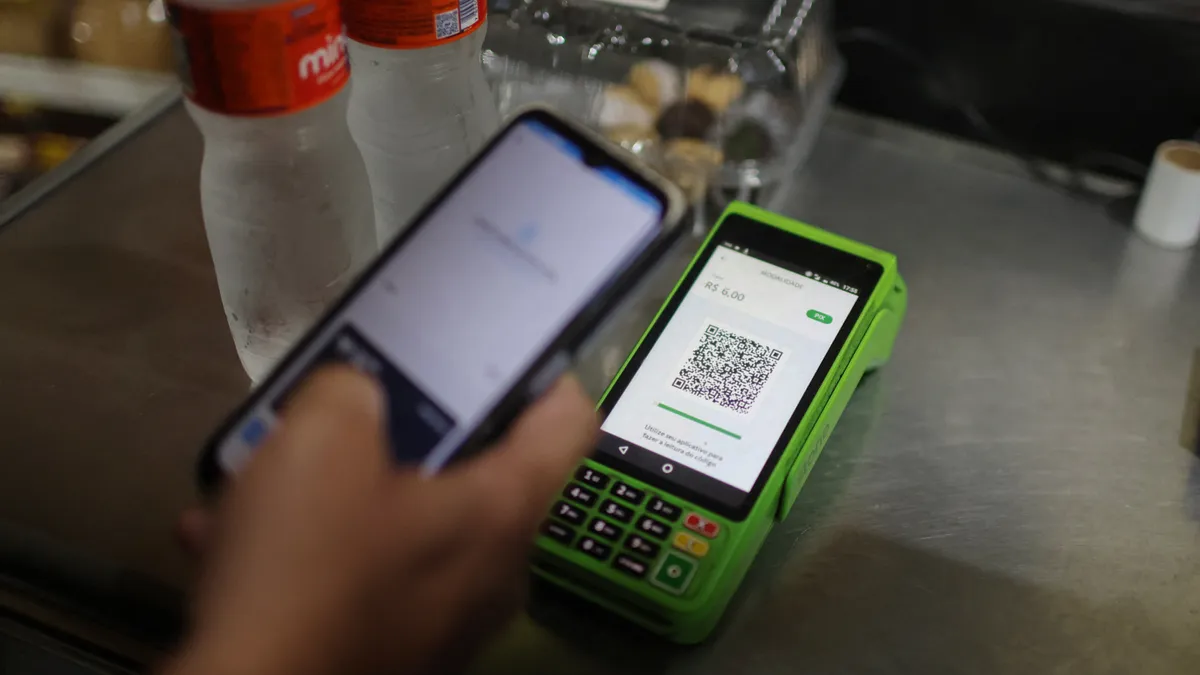

PayPal joins group investing $15M in Brazilian startup

The digital payments pioneer expects the fintech to capitalize on the rise of buy now, pay later services in Brazil.

By Tatiana Walk-Morris • Aug. 30, 2024 -

Affirm shuffles leadership, promoting CFO to COO

The BNPL provider plans to promote Michael Linford, the chief financial officer, to chief operating officer and tap a new CFO.

By Patrick Cooley • Aug. 29, 2024 -

Shoppers’ online fraud fears escalate

Four in five consumers are worried about identity theft or someone stealing their credit card numbers, according to a report this month from the credit monitoring agency Experian.

By Patrick Cooley • Aug. 28, 2024 -

CFPB chides retailers on fees for cash back

The federal agency surveyed major retailers and was concerned to find three retailers impose $90 million in fees annually when consumers ask for cash back with a debit or prepaid card purchase.

By Lynne Marek • Aug. 27, 2024 -

Shift4 acquires Canadian gift card company for $148M

Shift4 keeps buying up payments companies as it seeks to build out a global business servicing many sides of the industry.

By Lynne Marek • Aug. 27, 2024 -

Opinion

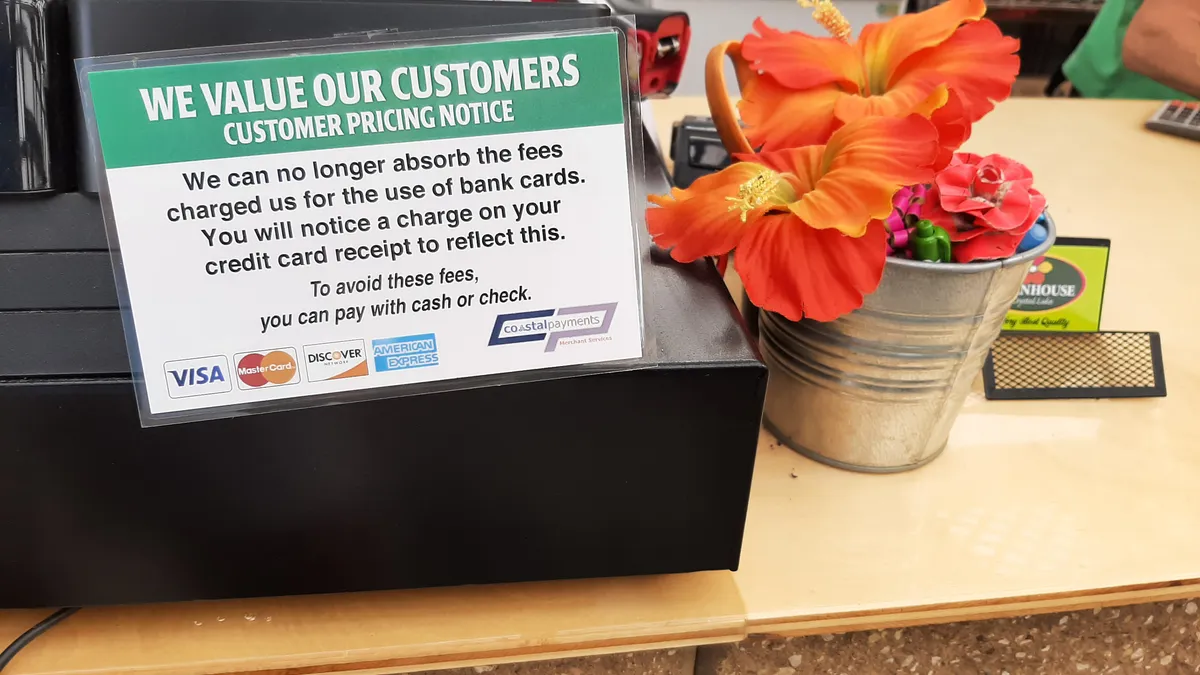

Surcharging doesn’t have to be a bad word

“The time has come to rethink surcharging not as a necessary evil but as a strategic advantage that can benefit both businesses and customers,” writes a Billtrust executive.

By Nick Izquierdo • Aug. 23, 2024 -

Amex, Flutterwave partner in Nigeria

The collaboration marks the latest move by American Express to expand its footprint in Africa, which is the world's second-largest continent by population.

By Patrick Cooley • Aug. 22, 2024 -

EWA providers crusade against CFPB rule proposal

Earned wage access providers that backed state laws friendly to the industry are preparing for a fight over the Consumer Financial Protection Bureau’s plan to treat such payments like loans.

By Lynne Marek • Aug. 21, 2024 -

Stripe, Zip partner on BNPL processing

The buy now, pay later firm will partner with Stripe, adding another major payments player tie to a set of recent high-profile collaborations.

By Patrick Cooley • Aug. 21, 2024 -

BNPL providers won’t face penalties during transition to new CFPB rule

CFPB Director Rohit Chopra said in a blog post that the agency will not fine companies making a good faith effort to follow regulations treating buy now, pay later loans like credit card transactions. His remarks follow significant industry pushback.

By Patrick Cooley • Aug. 20, 2024 -

Adyen collects more US customers

The Dutch payments service provider is gaining traction in the U.S. market as it adds to its client roster, including big U.S. retail names such as Crate & Barrel.

By Patrick Cooley • Aug. 19, 2024 -

Visa-Mastercard settlement claims deadline postponed

Merchants seeking a piece of the $5.5 billion settlement now have until February 2025 to file claims, a federal judge overseeing the class action said.

By Lyle Moran • Aug. 19, 2024 -

Mastercard to cut 1,000 employees in restructuring

The card network is shrinking its workforce as it restructures the company to focus more resources on some international markets.

By Lynne Marek • Aug. 19, 2024 -

Q&A

Credit card users struggle with inflation

JD Power’s annual credit card survey found that more than half of U.S. credit card users don’t pay their balances in full every month, and less than half are considered financially healthy.

By Patrick Cooley • Aug. 16, 2024 -

Klarna jumps into banking business

The Swedish buy now, pay later company will let consumers use savings accounts to make payments, receive refunds and earn cash rewards from some retailers.

By Lynne Marek • Aug. 15, 2024 -

North American Bancard rebrands in bid to improve

The card payments service provider for merchants said it will now be known as North as part of an effort to evolve and appeal to businesses of all sizes.

By Lynne Marek • Aug. 12, 2024 -

Shift4 strives to become ‘SpaceX of payments’

Recent acquisitions and an expanded roster of clients that includes several sports teams are intended to help Shift4 dominate the payments space, the CEO said.

By Patrick Cooley • Aug. 9, 2024 -

US credit card balances climb to $1.14 trillion

Consumer credit card debt delinquencies are also on the rise, particularly among younger consumers, according to a New York Federal Reserve report.

By Tatiana Walk-Morris • Aug. 8, 2024 -

JPMorgan fires up biometric payments processing

The biggest U.S. bank is piloting payments processing for biometric transactions, with plans to use it at the hamburger chain Whataburger, which lets customers pay with a face scan.

By Lynne Marek • Aug. 7, 2024