Retail: Page 6

-

Visa pinpoints rising fraud threats

In a new report, the card network detailed cyber schemes and scams that have led it to invest $11 billion over the past five years in improving its systems.

By Tatiana Walk-Morris • Nov. 10, 2024 -

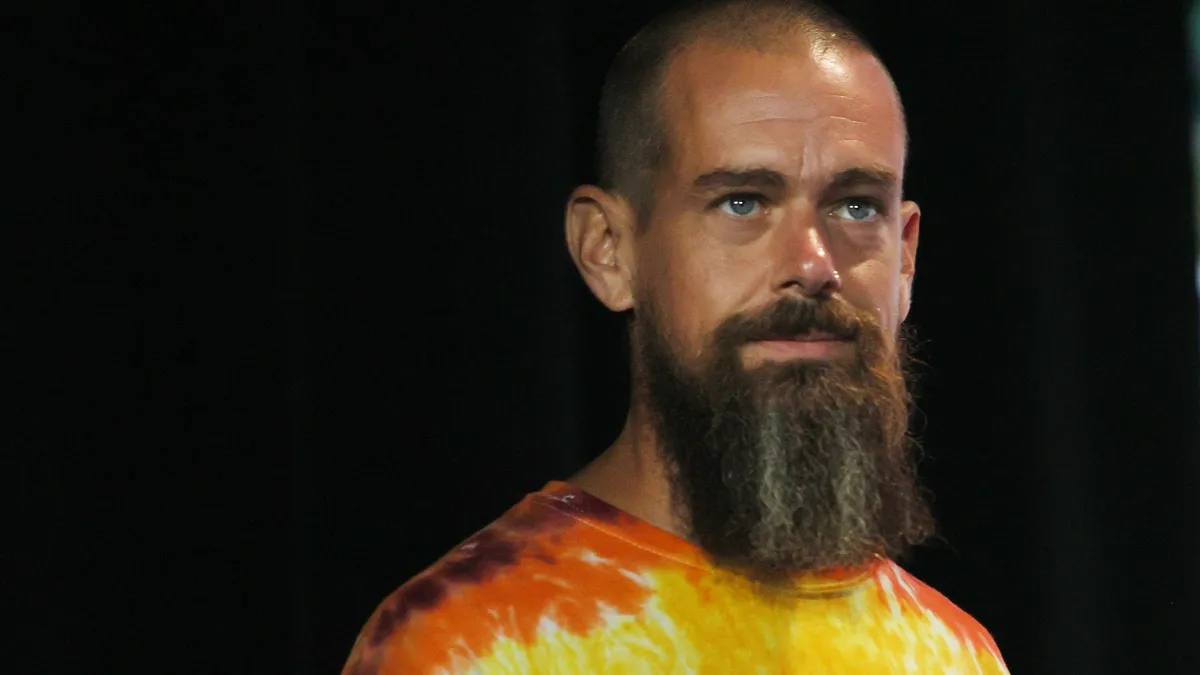

Afterpay to arrive on 24M Cash App cards

The digital payment company’s leader, Jack Dorsey, aims to create lending services that will appeal to millions of U.S. adults who haven’t had access to other forms of credit.

By Patrick Cooley • Nov. 8, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Remitly, Payoneer cross-border payments climb

Payments volume soared for the money transfer fintechs during the third quarter. Meanwhile, revenue at legacy rival Western Union slipped.

By Lynne Marek • Nov. 8, 2024 -

How Trump’s administration may rework payments policies

The president-elect and his new administration will have the opportunity to revamp federal government approaches for everything from earned wage access to digital currencies to open banking.

By Lynne Marek and Patrick Cooley • Nov. 7, 2024 -

Paze gets new leader amid slow start

Early Warning Services, the bank-owned company that operates Paze, tapped a new leader last month for the digital wallet operation after slow progress in launching the new service.

By Patrick Cooley • Nov. 7, 2024 -

Q&A

Fiserv exec opens up on Walmart, DoorDash partnerships

Sunil Sachdev, Fiserv’s head of embedded finance, shed light on his company’s latest high-profile collaborations.

By Patrick Cooley • Nov. 6, 2024 -

Sheetz accepting crypto at all locations

After a limited trial run, customers can now use several popular digital currencies to buy items at all of the East Coast retailer’s 750-plus locations.

By Jessica Loder • Nov. 5, 2024 -

Opinion

DOJ’s Visa suit is unfounded

The government acknowledges payment volumes are rising, in part because of fintech growth. This competition wouldn’t be happening if a single entity, like Visa, controlled the ecosystem.

By Aurelien Portuese • Nov. 5, 2024 -

Mastercard gains edge in ancillary services

The card network is besting its larger rival Visa in the sale of cybersecurity and data services, at least according to one set of analysts who reviewed their recent results.

By Lynne Marek • Nov. 5, 2024 -

unsplashed.com/Simon Kadula

Fiserv, Capital One, others invest $150M in Melio

Some of the corporate investors are also partnering with the accounts payable and receivable company they’re backing.

By Tatiana Walk-Morris • Nov. 4, 2024 -

Opinion

Is the FTC targeting chargeback service providers?

“For better or for worse, applying pressure to payments organizations to ferret out bad-merchant actors seems to be an effective way for the FTC to make private industry police the merchant marketplace,” writes an industry lawyer.

By Edward A. Marshall • Nov. 1, 2024 -

5 payments predictions from research firm Forrester

Cash use worldwide will drop significantly next year, despite its U.S. persistence, the research firm Forrester predicts. Meanwhile, business-to-business acquisitions in the payments realm will pick up.

By Tatiana Walk-Morris and Lynne Marek • Nov. 1, 2024 -

Global Payments sells AdvancedMD for $1.1B

The payments processor divested the unit as part of a plan to streamline the company’s business, and it’s targeting more sales, CEO Cameron Bready said.

By Lynne Marek • Oct. 30, 2024 -

BofA discloses CFPB probe of Zelle payments

Bank of America is responding to a Consumer Financial Protection Bureau inquiry related to the bank’s processing of electronic payments through Zelle, the lender disclosed in a regulatory filing.

By Caitlin Mullen • Oct. 30, 2024 -

MoneyGram cites cash-to-digital conversion opportunity

A MoneyGram executive speaking at the Money 20/20 conference cooed about the trillion-dollar opportunity to lure cash users to digital options, but didn’t mention the company’s recent systemwide outage.

By Lynne Marek and Patrick Cooley • Oct. 30, 2024 -

Retrieved from Lynne Marek on March 04, 2022

Retrieved from Lynne Marek on March 04, 2022

MoneyGram replaces CEO, naming former Walmart executive to the role

The money transfer company named the new CEO just weeks after a cyberattack led to a systemwide shutdown of its services for several days.

By Lynne Marek • Oct. 29, 2024 -

Cable TV, advertisers ask appeals court to block FTC ‘click-to-cancel’ rule

The companies call the new regulation arbitrary and capricious, carrying a presumption that subscription services are deceptive.

By Justin Bachman • Oct. 28, 2024 -

Opinion

Illinois should abandon interchange law

“Illinois has made a hasty decision that, if implemented, would have government change our payments system that functions so well that we barely notice it,” writes a trade group CEO.

By Jodie Kelley • Oct. 25, 2024 -

Finix eyes competition with rivals like Stripe

The payment processor said Thursday that it raised $75 million and is seeking to grab a bigger slice of a payments market dominated by larger rivals.

By Patrick Cooley • Oct. 25, 2024 -

Goldman, Apple to pay CFPB $89.8M over Apple Card issues

The bank and tech firms failed to address disputed transactions in their joint Apple Card program, and misled cardholders about interest-bearing products, the bureau alleged.

By Gabrielle Saulsbery • Oct. 23, 2024 -

Apple, Klarna collaborate on BNPL

The tech giant has linked with the Swedish buy now, pay later provider to offer Apple Pay customers in the U.S. and U.K. another payment option.

By Patrick Cooley • Oct. 18, 2024 -

Discover discloses SEC accounting criticism

The federal agency disagrees with the way the card network is allocating card misclassification charges, Discover said in its third-quarter earnings report.

By Patrick Cooley • Oct. 17, 2024 -

Walmart pitches Fiserv’s Clover to business clients

The retailer is offering the mega-processor’s Clover equipment and account services to its business clients at a discount through next January.

By Lynne Marek • Oct. 17, 2024 -

FTC unveils final ‘click-to-cancel’ rule for consumers

The agency rule targeting recurring payments comes amid a broader effort by the Biden administration to reduce consumer “junk” fees.

By Justin Bachman • Oct. 16, 2024 -

Visa taps AI analytics partner to add merchant services

The card network giant has signed a new multi-year agreement with the marketing research firm Analytic Partners to deliver advertising insights to merchant clients.

By Lynne Marek • Oct. 16, 2024