Retail: Page 32

-

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry preps clients for FedNow

The financial technology provider is encouraging clients to be prepared to receive payments through FedNow.

By Caitlin Mullen • May 3, 2023 -

Andreessen Horowitz partners spy payments play

Gaming, cannabis and telehealth are some of the “high-risk” niches that would benefit from more vertical-specific payments software, two partners for the firm contend.

By Lynne Marek • May 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

ArtemisDiana via Getty Images

ArtemisDiana via Getty Images Trendline

TrendlineCross-border payments targeted for upgrades

When it comes to cross-border payments, businesses, non-profits and governments alike are determined to increase the speed of transactions and cut the cost.

By Payments Dive staff -

Finix takes aim at processor incumbents

Now certified as a processor, Finix seeks to take on legacy and fintech rivals.

By Caitlin Mullen • May 3, 2023 -

Fiserv arms vendors with text payment tool

Payment processor Fiserv this week began broadly offering a new tool that lets merchants text customers for payment.

By Caitlin Mullen • May 2, 2023 -

Walmart, Kroger eye instant payments

The giant retailers eagerly await instant payment system possibilities, especially as an alternative to card payments, according to industry professionals who heard their representatives speak recently.

By Lynne Marek • May 1, 2023 -

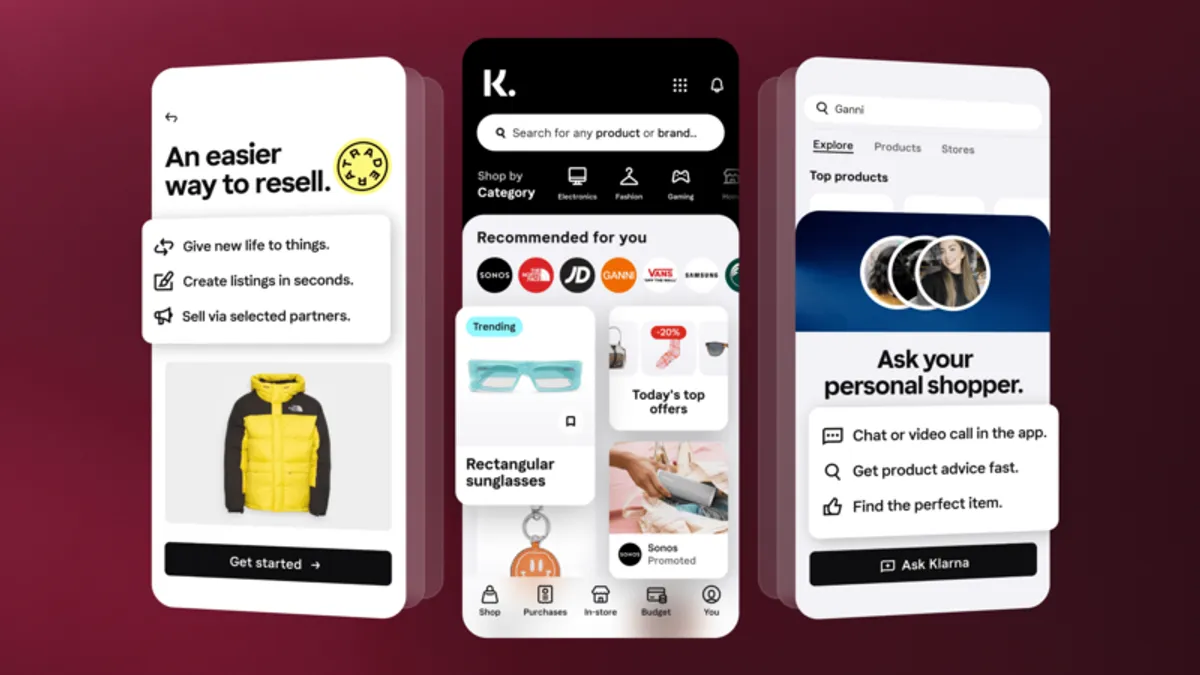

Klarna overhauls mobile app

The buy now, pay later company has rolled out an AI-powered shopping feed, along with tools for creators, a personal shopping assistant and new resell capabilities.

By Aaron Baar • May 1, 2023 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments to replace CEO

CEO Jeff Sloan will step down June 1 and be replaced by the payment processor’s president and chief operating officer, Cameron Bready.

By Caitlin Mullen • May 1, 2023 -

Q&A

Will frictionless checkout ever take off in retail?

Standard AI CEO Jordan Fisher acknowledged that the technology has “been a really hard market to start growing,” but believes it will expand alongside other AI-driven innovations.

By Sam Silverstein • April 28, 2023 -

Mastercard ‘cannot afford to ignore’ AI, CEO says

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

By Caitlin Mullen • April 28, 2023 -

Justice debit probe draws in Mastercard

The Justice Department’s antitrust division issued a civil investigative demand to the card company as part of a debit card probe that has also entangled its larger rival Visa.

By Lynne Marek • April 28, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Payments increasingly in regulatory crosshairs, industry lawyers say

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference in Atlanta.

By Caitlin Mullen • April 27, 2023 -

Self-checkout now dominant grocery checkout format, report says

Self-checkout, which grocers have turned to as a way of lowering costs, accounted for 55% of transactions in 2022, according to shopper insights firm VideoMining.

By Peyton Bigora • April 27, 2023 -

Visa’s CEO dismisses competition

Ryan McInerney isn’t worried about FedNow, debit rivals or AI challenging the giant card network company.

By Lynne Marek • April 26, 2023 -

Fiserv lines up bank clients for FedNow

The mega processor has a handful of bank customers in the Federal Reserve’s real-time payments pilot, and a pack signed up for services after the system’s July launch. It’s part of the company’s growth strategy.

By Lynne Marek • April 26, 2023 -

CFOs hunt for revenue-generating tech tools: Stripe

The financial service provider’s updated tools come as CFOs seek emerging technologies that can aid in key areas like revenue generation.

By Grace Noto • April 25, 2023 -

Enerbase pilots Amazon One at first convenience stores

The technology that allows a contactless payment using a customer’s palm is being tested at the first stand-alone convenience stores.

By Jessica Loder • April 25, 2023 -

Fiserv takes lead back from FIS

Fiserv bested FIS in the competitive payments processing market last year, handling more transactions with a larger value, said an industry consultant.

By Lynne Marek • April 25, 2023 -

Fed study highlights growth in card, ACH payments

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

By Caitlin Mullen • April 24, 2023 -

Sponsored by Justt

3 reasons why declined transactions explain the rise in BNPL adoption

Explaining three reasons why declined transactions are turning customers on to Buy Now Pay Later services for a friendlier purchasing process.

By Ronen Shnidman in partnership with Kipp • April 24, 2023 -

Profits slip for Amex, Discover

In light of rising charge-offs, the card companies on Thursday each reported adding to credit loss provisions. That put a dent in their first-quarter profits.

By Caitlin Mullen • April 21, 2023 -

Synchrony signals openness to Walmart

Despite Synchrony Financial’s history with Walmart, the card issuer may be willing to work with the retailer again.

By Caitlin Mullen • April 20, 2023 -

Grocery chain H-E-B unveils cashback cards

The two Visa credit cards offer 5% cash back for the grocer’s private brand items and 1.5% back for all other eligible purchases.

By Catherine Douglas Moran • April 20, 2023 -

Credit card processor Nexway to pay $650K fine for fraud

A court initially imposed a $49.5 million judgment against a group of Nexway companies over processing payments tied to tech support scams, but they’ll ultimately pay the smaller fine for defrauding consumers.

By Caitlin Mullen • April 19, 2023 -

FIS executive compensation jumps

Compensation for FIS CEO Stephanie Ferris and former CEO Gary Norcross jumped significantly last year despite the company’s underperformance.

By Lynne Marek • April 18, 2023 -

US payments funding rebounds

U.S. payments venture funding surged in the first quarter of the year, largely thanks to Stripe’s March funding round, CB Insights said.

By Caitlin Mullen • April 18, 2023