Regulations & Policy: Page 4

-

Chopra delivers last-minute digital payment edicts

The Consumer Financial Protection Bureau made a bid in the last days of the Biden administration to better protect consumers using digital payments tools.

By Lynne Marek • Jan. 22, 2025 -

Stripe pushes out 300 employees

Despite the 3.5% cut to the payments services company’s headcount, it still plans to increase its total employee headcount to 10,000 by the end of the year, up from 8,200 now.

By Patrick Cooley • Jan. 22, 2025 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

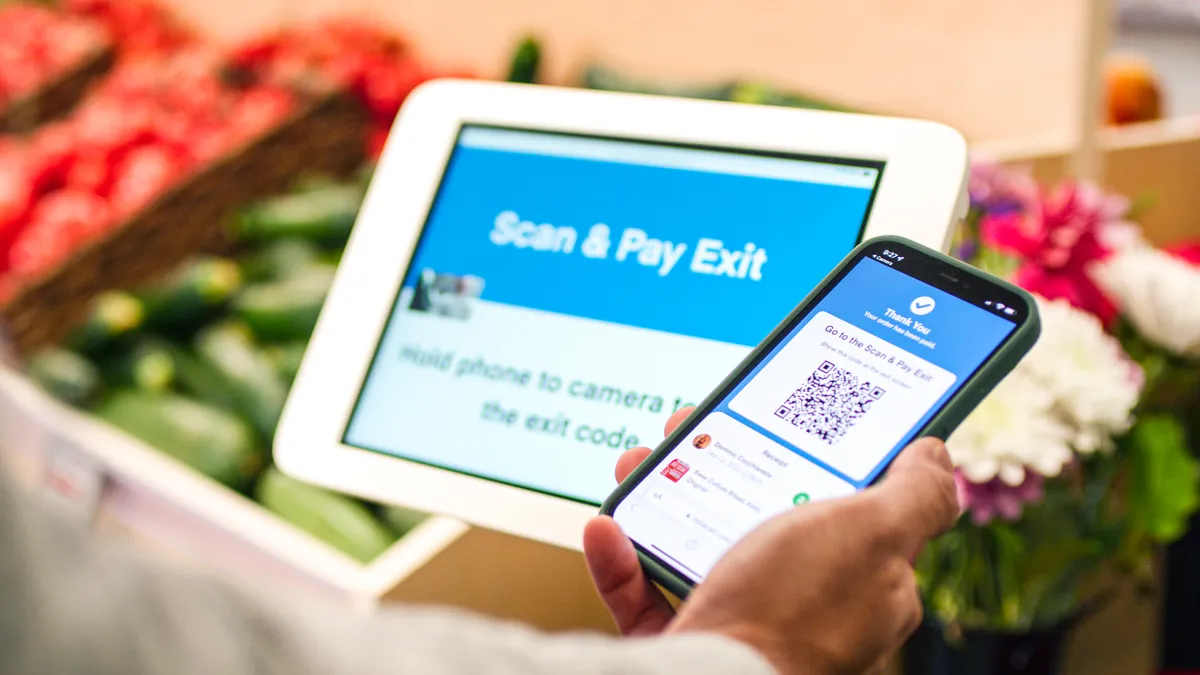

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

CFPB to consider broader ban on declined payment fees

The Consumer Financial Protection Bureau withdrew a rule proposal barring bank fees on certain declined transactions. Its plan for a “more comprehensive approach” faces an uncertain future in the Trump administration.

By Lynne Marek • Jan. 21, 2025 -

Judge partially halts Illinois law ending card fees for taxes, tips

Banks seeking to halt a new Illinois law that bars credit card interchange fees on taxes and tips succeeded on one front, but not another, at least for now.

By Lynne Marek • Jan. 17, 2025 -

Opinion

Why enabling FedNow ‘send’ matters

Financial institutions that “fail to adopt both send and receive functions may be exposing their organizations to competitive disadvantages as well as reputational risks,” writes one industry executive.

By Mihail Duta • Jan. 17, 2025 -

Amex pays $230M to resolve DOJ allegations

The credit card giant misrepresented features of some credit cards targeting small businesses and entered false information on card applications, the Justice Department alleged.

By Patrick Cooley • Jan. 16, 2025 -

Shift4 makes $4.7M in undisclosed payments to executives’ relatives

The payments were made over a three-year period beginning in 2020, and were not listed in some filings with the Securities and Exchange Commission. As a result, the company agreed to pay a fine under a settlement last week.

By Patrick Cooley • Jan. 16, 2025 -

Block agrees to pay $255M to regulators for Cash App deficiencies

The digital payments provider agreed to pay penalties to the Consumer Financial Protection Bureau and a group of states under settlements that alleged the company violated banking laws.

By Lynne Marek • Jan. 16, 2025 -

Mastercard agrees to pay $26M to settle discrimination lawsuit

The card network entered the agreement to settle a proposed class action that alleged it discriminated against Black, Hispanic and female employees by underpaying them.

By Lynne Marek • Jan. 14, 2025 -

Buy now, pay later users pile on debt, CFPB finds

Consumers who use BNPL take out multiple loans and have more personal debt than consumers who don’t use the payment method, according to a new report from the Consumer Financial Protection Bureau.

By Patrick Cooley • Jan. 14, 2025 -

Payments laws apply to online games, CFPB says

Video game companies that operate online gaming platforms must comply with the Electronic Fund Transfer Act, the agency said.

By Patrick Cooley • Jan. 13, 2025 -

RTP payments surged 38% last year

The high-speed payments system operated by The Clearing House also saw the value of transactions nearly double last year over 2023.

By Lynne Marek • Jan. 10, 2025 -

Deep Dive

Payments plays gather momentum in 2025: 6 industry trends to watch

Deregulation, artificial intelligence and stablecoin use are among the industry forces that will drive more digital payments use and innovation this year.

By Lynne Marek and Patrick Cooley • Jan. 9, 2025 -

Fintech Dave alters fee structure, blasts DOJ over amended lawsuit

The cash advance online platform called the lawsuit “a continued example of government overreach.”

By Rajashree Chakravarty • Jan. 9, 2025 -

Column

Will Trump and Sanders lock arms to cap credit card interest rates?

The senator and incoming president partnering on a cap proposal may not be as far-fetched as the payments and banking industries would hope.

By Lynne Marek • Jan. 7, 2025 -

CFPB details BNPL, EWA supervision for first time

In its latest supervisory overview, the Consumer Financial Protection Bureau included a review of buy now, pay later and earned wage access examinations.

By Lynne Marek • Jan. 6, 2025 -

Merchants, banks spar over Fed’s debit card fee proposal

Major trade groups for merchants and banks engaged in another round of fighting last week over whether the Federal Reserve should finalize a lower debit card interchange fee rate.

By Lynne Marek • Jan. 3, 2025 -

Walmart forced delivery workers to pay ‘junk fees,’ CFPB alleges

A Consumer Financial Protection Bureau lawsuit alleges the retailer and fintech Branch Messenger illegally opened accounts for drivers, and deposited their pay into accounts without their consent.

By Peyton Bigora • Jan. 3, 2025 -

CFPB takes aim at gambling card fees

The federal agency says credit card issuers are charging cash advances fees of at least $10 on gambling transactions, even if those transactions are small.

By Patrick Cooley • Dec. 19, 2024 -

BVNK raises $50M to fuel US expansion

The stablecoin startup’s plans, including a new office in San Francisco, coincide with the incoming crypto-friendly Trump administration.

By Tatiana Walk-Morris • Dec. 18, 2024 -

CFPB swats at retail credit cards

The federal agency warned companies issuing credit cards about illegal tactics, specifically calling out promotions that turn into “bait-and-switch” offers.

By Lynne Marek • Dec. 18, 2024 -

What role do stablecoins play in the payments industry?

With the discussion of stablecoins intensifying after the election of Donald Trump, here’s a primer explaining what this cryptocurrency is and what its practical uses may be.

By Patrick Cooley • Dec. 17, 2024 -

U.S. Bank CEO talks payments split

Dividing its payments unit into two segments under different leaders points to the significance of the business at the bank, said Andy Cecere, the lender’s chief executive.

By Caitlin Mullen • Dec. 16, 2024 -

Amex keeps focus on younger customers

The credit card company is sticking with a strategy to concentrate marketing on the millennial and Gen Z generations shaping shopping trends.

By Patrick Cooley • Dec. 16, 2024 -

Ex-TD employee charged in debit card case

The former worker issued dozens of cards linked to accounts opened by another TD employee in the names of shell companies, and received bribes for that work, the Justice Department alleged.

By Dan Ennis • Dec. 13, 2024