Regulations & Policy: Page 23

-

CFPB attacks credit card late fees

The Consumer Financial Protection Bureau proposed a new rule that would effectively cap credit card late fees and potentially save Americans $9 billion.

By Lynne Marek • Feb. 1, 2023 -

Deep Dive

Crypto may yet upend payments

Nearly 2,000 crypto workers have been laid off in 2023, but the value of Bitcoin climbed enough in January for Goldman Sachs to take note.

By Gabrielle Saulsbery • Jan. 30, 2023 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Warren calls for more regulation of crypto

The Democratic senator called SEC Chair Gary Gensler “the right leader to get the job done,” but said regulators need to do more to bolster their scrutiny of the industry.

By Anna Hrushka • Jan. 26, 2023 -

Visa stands by crypto

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

By Lynne Marek • Jan. 26, 2023 -

DailyPay lands $260M in debt financing

The early wage access provider has been raising capital to fund expansion in the U.S. and internationally.

By Lynne Marek • Jan. 26, 2023 -

Opinion

Why the Arizona AG opinion on EWA matters

“The Arizona decision is in line with decades of decisions across the country that have found that non-recourse products are not loans,” the Payactiv authors write in this opinion piece.

By Aaron Marienthal and Molly Jones • Jan. 24, 2023 -

Big banks to launch digital wallet operated by Zelle parent: report

The wallet, which is expected to launch in the second half of the year, aims to compete with PayPal and Apple, sources told The Wall Street Journal. But serious competition may take a while, an analyst said.

By Anna Hrushka • Jan. 24, 2023 -

International coalition pursues cross-border payments improvements

In a new report, a group of international organizations give a broad overview of routes for improving international payments systems.

By Lynne Marek • Jan. 23, 2023 -

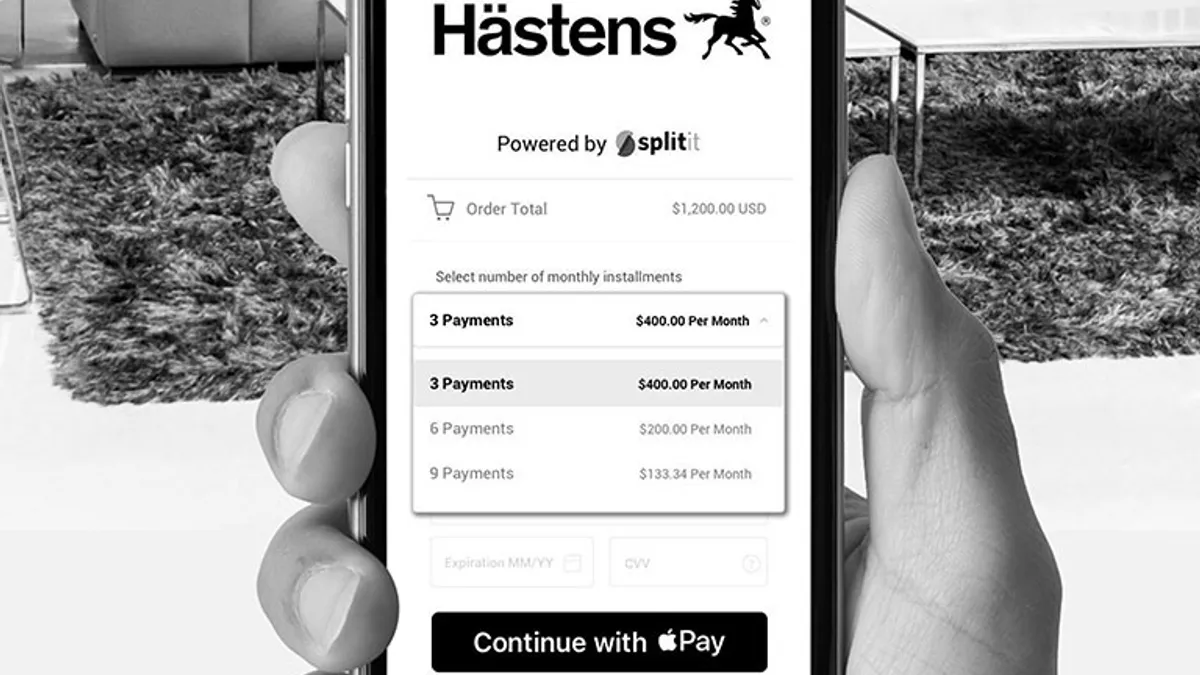

Splitit targets tech assets for acquisition

Splitit isn’t interested in being acquired, but the BNPL provider believes there may be assets ripe for the picking amid consolidation.

By Suman Bhattacharyya • Jan. 19, 2023 -

2023 Payments Outlook

What payments can expect from Washington this year

From buy now, pay later to peer-to-peer payment fraud, there’s no shortage of payments targets for lawmakers and regulators.

By Caitlin Mullen • Jan. 18, 2023 -

Banks, fintechs battle over SBA’s proposal

Vice President Kamala Harris has said opening the SBA’s flagship lending program to fintechs would increase loans in underserved markets.

By Anna Hrushka • Jan. 11, 2023 -

Deep Dive // 2023 Payments Outlook

6 payments trends to watch in 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

By Lynne Marek , Caitlin Mullen • Jan. 10, 2023 -

Cargo payment firms duel in court

CargoSprint and PayCargo have battled for years over antitrust violations, intellectual property and trademark infringement, among other nettlesome issues.

By Robert Freedman • Jan. 9, 2023 -

Adobe Stock/artinspiring/bbk22

Sponsored by Paymerang

Sponsored by PaymerangRecession-proofing a business starts in the accounts payable department

How AP Automation can help you survive and thrive during times of economic uncertainty.

Jan. 9, 2023 -

Durbin to reintroduce credit card competition bill

The Democrat’s bill takes aim at the Visa-Mastercard duopoly, but faces an uphill battle for passage in a House controlled by Republicans.

By Lynne Marek • Jan. 6, 2023 -

Opinion

Can anything challenge ACH?

The ACH system has proven to be scalable, secure, ubiquitous and reliable, but complaints about processing times persist, writes Sila CEO Shamir Karkal.

By Shamir Karkal • Jan. 6, 2023 -

Coinbase to pay $100M in settlement

The system that flags suspicious activity saw a backlog of more than 100,000 alerts in late 2021, New York's Department of Financial Services found.

By Gabrielle Saulsbery • Jan. 5, 2023 -

Fed, OCC, FDIC issue joint warning on crypto risks

The regulators didn't go so far as to create new rules around bank-crypto partnerships, but said they're "continuing to assess" if — and how — such tie-ups can proceed safely.

By Gabrielle Saulsbery • Jan. 4, 2023 -

Toomey bill would put stablecoin oversight in OCC’s hands

The outgoing senator said he wanted to shield stablecoin activity from the Fed, which is still debating whether to issue a central bank digital currency. Toomey noted the Fed’s “significant skepticism” of stablecoins.

By Gabrielle Saulsbery • Dec. 22, 2022 -

Deep Dive

Investors press FIS, Fiserv for divestitures

The big processors mushroomed in 2019 acquisitions, with promises that scale would pay off, but shareholders now urge them to consider divestitures.

By Lynne Marek , Caitlin Mullen • Dec. 22, 2022 -

Card Competition Act skids toward 2023

With the bill unlikely to be passed by Congress this week, supporters of the Credit Card Competition Act are turning their attention to next year.

By Lynne Marek • Dec. 21, 2022 -

CFPB faces Republican reckoning in next Congress

“Next month there will be a new majority in the House of Representatives — I think you'll wish you tried harder to play by the rules,” Rep. Patrick McHenry, R-NC, told CFPB Director Rohit Chopra.

By Anna Hrushka • Dec. 15, 2022 -

SEC calls for disclosure on crypto risks

The collapse of FTX has slammed scores of creditors, prompting SEC concerns that companies may suffer losses from direct or indirect links to crypto markets.

By Jim Tyson • Dec. 12, 2022 -

Circle’s $9B SPAC deal falls apart

The stablecoin issuer and the blank-check company that had hoped to take it public terminated their agreement over the wait for SEC approval.

By Dan Ennis • Dec. 6, 2022 -

FTX fallout spurs regulatory fears

Payments industry professionals, including at the software security firm Fireblocks, worry that the crypto exchange’s downfall could trigger a regulatory backlash against digital assets.

By Caitlin Mullen • Dec. 6, 2022