Regulations & Policy: Page 18

-

Q&A

ACI eyes FedNow for cross-border uses

In the future, FedNow will be part of the race to develop cross-border instant payment systems and use cases, said ACI Worldwide CEO Tom Warsop.

By Lynne Marek • Aug. 1, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

RTP takes on FedNow

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

By Lynne Marek • July 31, 2023 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Opinion

It’s time for a new payday approach

“It's time to question whether this traditional approach to paying employees is still the most efficient and equitable,” writes one earned wage access CEO.

By Kevin Coop • July 28, 2023 -

Amex pays $15M OCC penalty

The card issuer paid the fine for failing to properly monitor a third-party affiliate and in connection with its courting of small business clients, the agency said.

By Lynne Marek • July 25, 2023 -

How FedNow may affect businesses

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

By Suman Bhattacharyya • July 25, 2023 -

Opinion

FedNow’s launch ‘is just the start’

Direct access to the Fed’s payments system for nonbanks — specifically payments companies — will push the U.S. more fully into payments modernization, writes an executive from cross-border payments company Wise.

By Brigit Carroll • July 21, 2023 -

Photo by Tima Miroshnichenko from Pexels

Q&A

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover facing FDIC probe

The company also disclosed during its 2Q earnings report that a pricing issue affected merchants and merchant acquirers, some of whom will get refunds.

By Caitlin Mullen • July 20, 2023 -

FedNow goes live for banks, credit unions

The Fed’s long-awaited instant payments system arrived right on time, giving consumers and businesses a new route for speedier transactions.

By Lynne Marek • July 20, 2023 -

CCCA opponents brace for defense bill move

Opponents of the Credit Card Competition Act proposal are gearing up to fight the bill as an attachment to the National Defense Authorization Act.

By Lynne Marek • July 19, 2023 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB, European regulator open a dialogue on digital rules

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

By Rajashree Chakravarty • July 18, 2023 -

Mastercard hires new chief legal officer

Rob Beard, who will also serve as head of global policy, brings M&A and capital markets experience to his new role at the card network company.

By Lyle Moran • July 18, 2023 -

Synchrony braces for late fee rule

The CEO of the private label card issuer expects a final rule on the CFPB’s proposed credit card late fee cap later this year, and litigation could follow, he said.

By Caitlin Mullen • July 18, 2023 -

Credit card bill opposition builds

Ten banking and payments trade associations sent a letter to Congress on Friday objecting to the Credit Card Competition Act.

By James Pothen • July 18, 2023 -

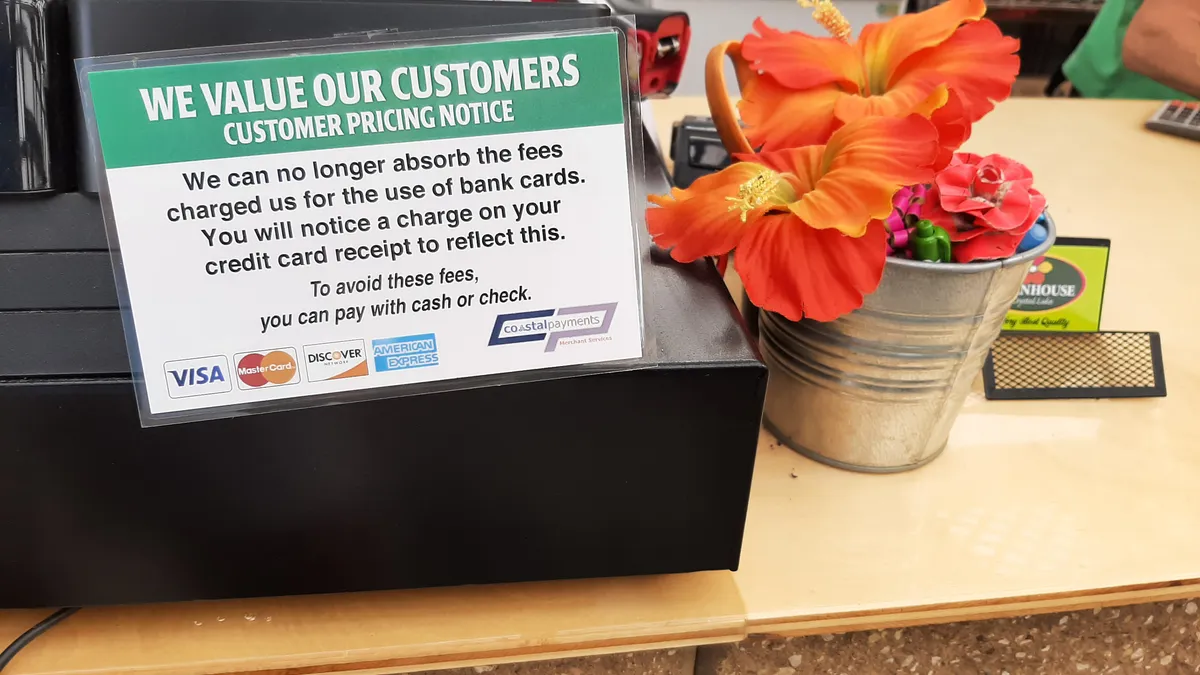

Will other states mimic New Jersey’s credit card surcharge?

The state’s legislature passed a bill recently to cap credit card surcharges. One experienced payments executive believes that’s the wave of the future.

By Lynne Marek • July 17, 2023 -

CFPB urged to abolish deferred interest

Panelists who spoke during the agency’s Tuesday hearing on medical billing and collections identified deferred interest credit cards as a prime culprit saddling patients with medical debt.

By Caitlin Mullen • July 13, 2023 -

Photo by Levi Meir Clancy on Unsplash

Twitter snags money transfer license in Arizona

That’s the fourth state in which the social media company has received a license, inching it closer to creating the payments tool and super-app envisioned by owner Elon Musk.

By James Pothen • July 12, 2023 -

Bank of America fined $250M over fake accounts, junk fees

Regulators say Bank of America opened credit card accounts without customers’ consent and misled consumers about rewards for card applications.

By Anna Hrushka • July 11, 2023 -

New Jersey legislature passes credit card surcharge bill

Lawmakers passed a bill that limits the surcharge a merchant can impose on consumers to the cost of processing a credit card transaction.

By Lynne Marek • July 11, 2023 -

Missouri follows Nevada in enacting EWA law

The new legislation creates a requirement that earned wage access providers operating in Missouri must register with the state.

By James Pothen • July 11, 2023 -

Feds drill down on medical cards

With consumers increasingly tapping medical credit cards to pay for healthcare costs, the Biden administration is zeroing in on regulations to police such financial services.

By Lynne Marek • July 10, 2023 -

Opinion

As biometrics use advances, so must hacker defenses

“Hackers are using all sorts of sophisticated methods to trick and bypass biometric technology – like capturing audio clips of individuals’ voices, making fake fingerprints using putty and gelatin, and downloading photos and videos,” an executive writes.

By Alessandro Chiarini • July 7, 2023 -

FTC revs up money transfer case against Walmart

The Federal Trade Commission revved up its case against Walmart last week, alleging the retailer facilitated fraudulent transactions, despite a court ruling setback in March.

By Lynne Marek • July 6, 2023 -

Card issuers defend late fees

In responses to a group of U.S. senators, the top 10 credit card issuers outlined their late fee practices and warned of potential consequences if fees are capped as the CFPB has proposed.

By Caitlin Mullen • July 6, 2023 -

Moody’s report spotlights FedNow downside

The soon-to-launch real-time payments system from the Federal Reserve may reduce interchange fee revenue for some payments players and increase IT costs for others.

By Lynne Marek • June 30, 2023