Banking: Page 69

-

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

Payments company CFO: We won't work with partners 'not aligned with our values'

Affirm went public on Wednesday, a week after the insurrection that has spurred many platforms to reassert their values.

By Jane Thier • Jan. 14, 2021 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Mastercard pilot turns smartphones into a point-of-sale device

Expansion into the contactless tech space has accelerated due to the pandemic and is expected to continue.

By Kaarin Moore • Jan. 14, 2021 -

Visa terminates $5.3B acquisition of Plaid after DOJ antitrust suit

The abandonment of the deal won't keep Visa from pursuing partnerships with Plaid or other fintechs, CEO Al Kelly said Tuesday during a call with analysts.

By Anna Hrushka • Jan. 13, 2021 -

Affirm IPO hits $1.2B

The buy now, pay later tech company announced an initial public offering stock price of $49, but opened at nearly $100 on its first day of trading.

By Daphne Howland , Kaarin Moore • Updated Jan. 19, 2021 -

Banks can use stablecoins, blockchains for payments, OCC says

The move follows a letter the agency issued in July clarifying national banks are allowed to provide cryptocurrency custody services, and hold unique cryptographic "keys" associated with cryptocurrency on behalf of customers.

By Anna Hrushka • Jan. 5, 2021 -

Crypto firms Paxos, BitPay apply for national bank charters

The OCC has taken a series of crypto-friendly actions under acting Comptroller Brian Brooks as lawmakers and trade groups continue to push back.

By Anna Hrushka • Dec. 14, 2020 -

Bank of America flags 640K accounts on suspected unemployment benefits fraud

The figure includes 76,000 cards — upon which the bank issues the benefits under contract with the state of California — that were sent to nonadjacent states or filed in the names of infants, children and centenarians.

By Dan Ennis • Dec. 10, 2020 -

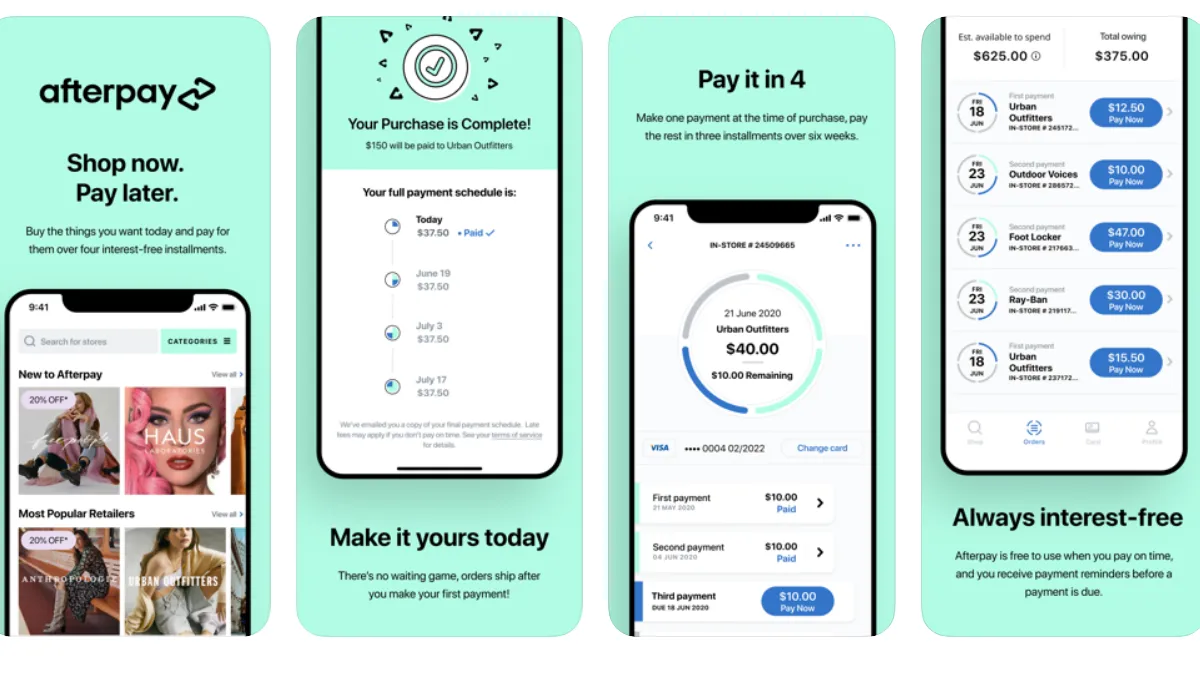

Capital One halts buy-now-pay-later credit card transactions

The move stands in contrast to fellow credit-card issuers Citi and JPMorgan Chase, which last year launched fixed-payoff options. PayPal and Ally Financial this year announced they were rolling out installment loans.

By Dan Ennis • Dec. 7, 2020 -

Teen-aimed banking app Step gets celebrity boost

The platform said it raised $50 million in a Series B funding round that included investment from singer Justin Timberlake, music group The Chainsmokers and retired athlete Eli Manning.

By Anna Hrushka • Dec. 3, 2020 -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Behind BNY Mellon's war against B2B checks

Peer-to-peer payments have made consumer transactions cheap and efficient. BNY Mellon wants to do that for business payments, with additional communication, reporting and security measures.

By Suman Bhattacharyya • Nov. 25, 2020 -

Google revamps Google Pay, adds 3 new partner banks

With a redesigned app and an expanded network of banks that have signed on to offer co-branded accounts, the tech giant continues its push into the consumer financial services space.

By Anna Hrushka • Nov. 19, 2020 -

Credit action helped payments company FLEETCOR withstand COVID-19

The company reined in the amount companies could float, limiting its exposure amid the uncertainty.

By Robert Freedman • Nov. 15, 2020 -

Fed, FinCEN want to make banks report international transfers of as little as $250

Friday's proposal to lower the threshold from $3,000 is meant to catch bad actors using low-dollar cross-border transactions to facilitate terrorist financing and other illicit activity.

By Anna Hrushka • Oct. 26, 2020 -

Afterpay partners with retailers for in-store payments

Shoppers nationwide can use a virtual, contactless card stored in their digital wallet to pay for in-store purchases in installments.

By Tatiana Walk-Morris • Oct. 19, 2020 -

Bank of America enters the small-dollar loan fray

Balance Assist, which will launch in January, will offer loans of up to $500 — to be repaid in three installments over 90 days — for a flat $5 fee to customers who have held Bank of America checking accounts for a year or more.

By Dan Ennis • Oct. 9, 2020 -

Venmo launches its first credit card

After teasing it last October, the payment platform this week unveiled the card, which is integrated with the existing Venmo app.

By Tatiana Walk-Morris • Oct. 6, 2020 -

Ally partners with Mastercard's Vyze to enter retail point-of-sale lending

The bank will offer installment loans on retail purchases between $500 and $40,000 with interest rates ranging from 9.99% to 26.99%. Monthly fixed-rate installment loans will range from six to 60 months, the company said.

By Dan Ennis • Aug. 26, 2020 -

Remote work exposes payment system inefficiencies

Although most organizations want to automate payments, only about 8% have fully done so.

By Robert Freedman • July 22, 2020 -

More than half of US consumers paying contactless, Mastercard finds

Banks such as HSBC, JPMorgan Chase and Bank of America have ramped up their efforts to push consumers toward tap-and-go technology. The coronavirus may prove the catalyst for behavioral shift.

By Dan Ennis • April 30, 2020 -

Banks mostly fear payments and money transfer fintechs, survey finds

Less of a concern among banks is competition from online investment and crowdfunding upstarts.

By Robert Freedman • March 3, 2020 -

Sephora launches store-branded credit card program

Cardholders will receive rewards in addition to those they already get from the retailer's popular Beauty Insider program.

By Cara Salpini • March 15, 2019

To find more content, use the "Topics" in the menu above.