Banking: Page 53

-

Retrieved from Federal Reserve Bank of Boston.

Retrieved from Federal Reserve Bank of Boston.

FedNow aims for September testing

FedNow, an effort by the Federal Reserve Banks to speed up and modernize the U.S. payments system, is expected to launch as early as next May.

By Lynne Marek • Aug. 30, 2022 -

Banks push back against CBDC

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

By Lynne Marek • Aug. 29, 2022 -

Explore the Trendline➔

Explore the Trendline➔

ArtemisDiana via Getty Images

ArtemisDiana via Getty Images Trendline

TrendlineCross-border payments targeted for upgrades

When it comes to cross-border payments, businesses, non-profits and governments alike are determined to increase the speed of transactions and cut the cost.

By Payments Dive staff -

Affirm scans landscape for acquisitions

With plenty of cash on hand, Affirm CEO Max Levchin considers acquisitions as one of many routes for the buy now-pay later company to continue its growth.

By Lynne Marek • Aug. 26, 2022 -

Big payments companies poke at CBDC

Mastercard, PayPal, Fiserv and Stripe gave the Federal Reserve feedback on a central bank digital currency, pointing out key requirements and cautioning about the outcome.

By Lynne Marek • Aug. 25, 2022 -

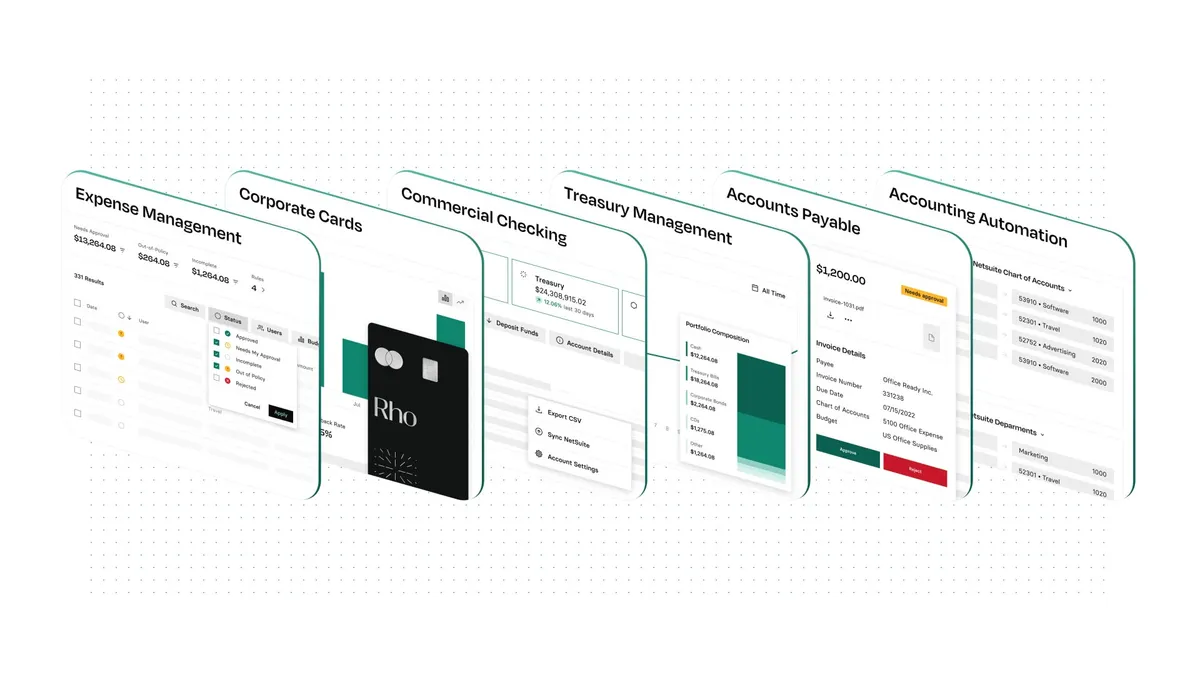

Rho woos clients in bid to fill Brex’s small-biz void

The business banking startup added an automated expense-management tool for its middle-market clients as the company angles to snatch its share of Brex's former clients.

By Suman Bhattacharyya • Aug. 25, 2022 -

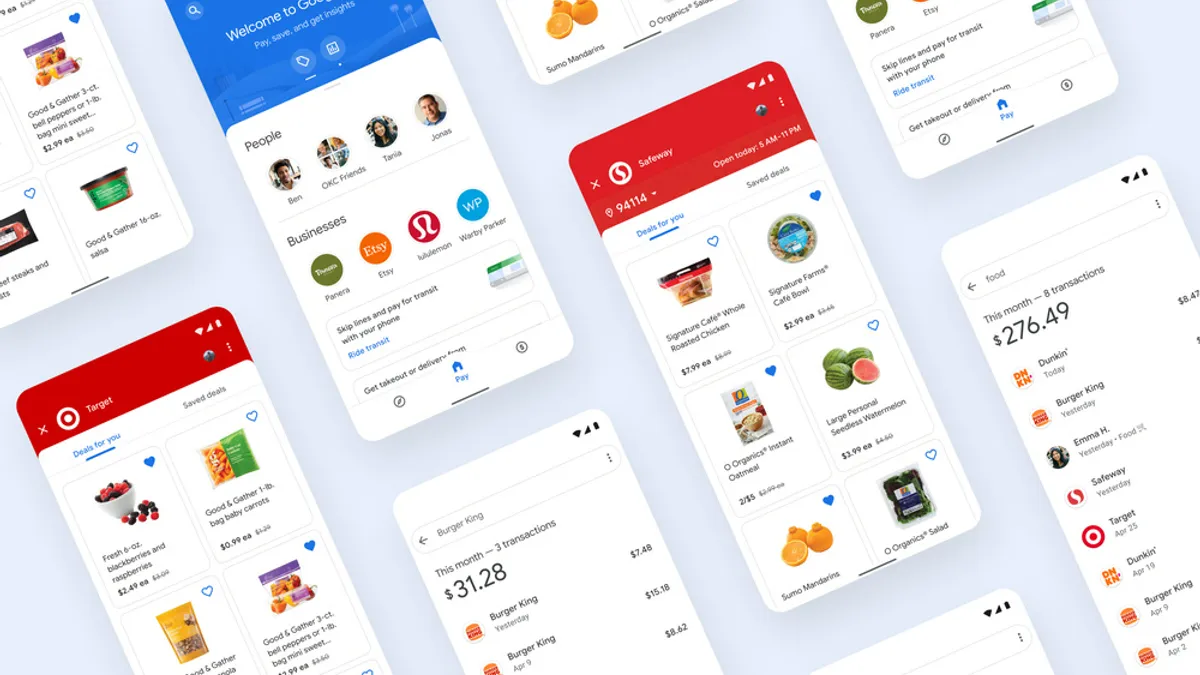

Retrieved from Google on April 30, 2021

Retrieved from Google on April 30, 2021

Google Wallet seeps into six more countries

The tech giant extended its payment services to more nations as competition with Samsung Pay and Apple Pay intensifies.

By Tatiana Walk-Morris • Aug. 25, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB seeks more credit card transparency

The Consumer Financial Protection Bureau is considering requiring top credit card issuers to share more information on their products to increase transparency for consumers.

By Caitlin Mullen • Aug. 24, 2022 -

Bill.com revenue leaps

Bill.com’s fiscal fourth-quarter and annual revenue more than doubled as the company scooped up more mid-size and small business customers.

By Lynne Marek • Aug. 24, 2022 -

DailyPay releases card with Visa

The earned wage access provider introduced the new debit card after major changes in leadership earlier this year.

By Tatiana Walk-Morris • Aug. 23, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB spotlights payments risks

The Consumer Financial Protection Bureau is “carefully monitoring” payments innovations and risks they pose to consumers, the agency said in a report.

By Caitlin Mullen • Aug. 22, 2022 -

Jack Henry expects lower margin expansion

Higher costs, and less revenue from merger and acquisition activity, are crimping the outlook for profit margin expansion at Jack Henry & Associates.

By Lynne Marek • Aug. 22, 2022 -

Grubhub offers BofA cardholders loyalty program perk

The delivery company is working with outside companies to expand its reach by offering limited free membership in its GrubHub+ loyalty program.

By Julie Littman • Aug. 19, 2022 -

Payments fundraising slows down in Q2: PitchBook

Point-of-sale, payroll, accounts payable and accounts receivable startups are leading the way in funding for payments startups, according to PitchBook.

By Tatiana Walk-Morris • Aug. 19, 2022 -

FedNow to launch by mid-2023, Fed official says

The federal government’s new real-time payments system should be ready for use by the middle of next year, Fed Governor Michelle Bowman said in a speech this week.

By Lynne Marek • Aug. 19, 2022 -

Credit card alternatives rise

Consumers are pulling back on use of their primary credit cards in favor of other payment methods, according to a survey from J.D. Power.

By Caitlin Mullen • Aug. 18, 2022 -

Western Union, Paymentus CFOs depart

The companies are the latest payments firms to announce a CFO change as the sector faces macroeconomic headwinds.

By Elizabeth Flood • Aug. 18, 2022 -

Walmart eyes payments opportunities

With PayPal’s former CFO on board, the retail behemoth is assessing its prospects in the payments arena near and far.

By Lynne Marek • Aug. 18, 2022 -

Remitly to buy Rewire for $80M

Cross-border payments company Remitly said it would buy the Israeli financial services company using a mix of cash and stock.

By Lynne Marek • Aug. 17, 2022 -

Marqeta executive exodus follows IPO

Of 10 top executives leading the company at its IPO last year, only three remain, including CEO Jason Gardner, who said he plans to exit that role and become executive chairman.

By Jonathan Berr , Lynne Marek • Aug. 17, 2022 -

Paysign aims to grow prepaid card services for drugs

Paysign aims to boost its prepaid card services for consumers shouldering the high cost of pharmaceuticals by offering drugmakers transparent pricing for such services.

By Joe Burns • Aug. 16, 2022 -

Circular Board, Mastercard unveil small business card

As a slew of fintechs try to capture small business customers, Circular Board’s Hello Alice brand is targeting entrepreneurs from marginalized backgrounds.

By Tatiana Walk-Morris • Aug. 16, 2022 -

Permission granted by Melissa Otten, Director of Marketing & Communications, Central Payments & Falls Fintech

Permission granted by Melissa Otten, Director of Marketing & Communications, Central Payments & Falls Fintech

Central Payments snags $30M

The banking-as-a-service company wants to expand its reach as it spins off from the Central Bank of Kansas City.

By Tatiana Walk-Morris • Aug. 15, 2022 -

Auto dealers tap U.S. Bank for real-time payments

U.S. Bank is using The Clearing House’s real-time payments system to offer auto dealers the option for speedier delivery of loan funding.

By Tatiana Walk-Morris • Aug. 12, 2022 -

Green Dot battles Uber, loses contracts

Green Dot disclosed in its recent quarterly report that it’s in a dispute with ride-share company Uber over their agreements. It also noted its failure to renew contracts with several other customers.

By Lynne Marek • Aug. 11, 2022 -

BNPL faces headwinds from rising rates, inflation: Fitch

Higher interest rates may make it more expensive for buy now-pay later providers to offer financing while inflation may put off lower-income consumers.

By Debbie Carlson • Aug. 10, 2022