Banking: Page 5

-

Discover Q4 payments volume drops

The card company still reported a rise in revenue and a surge in net income, driven partially by an increase in interchange and other fees paid by merchants.

By Patrick Cooley • Jan. 24, 2025 -

Visa supersizes Pismo expansion

The Brazilian core services provider acquired last year is rounding up new clients in Europe and elsewhere as it benefits from the card network's bigger marketing and sales team.

By Lynne Marek • Jan. 23, 2025 -

Explore the Trendline➔

Explore the Trendline➔

toeytoey2530 via Getty Images

toeytoey2530 via Getty Images Trendline

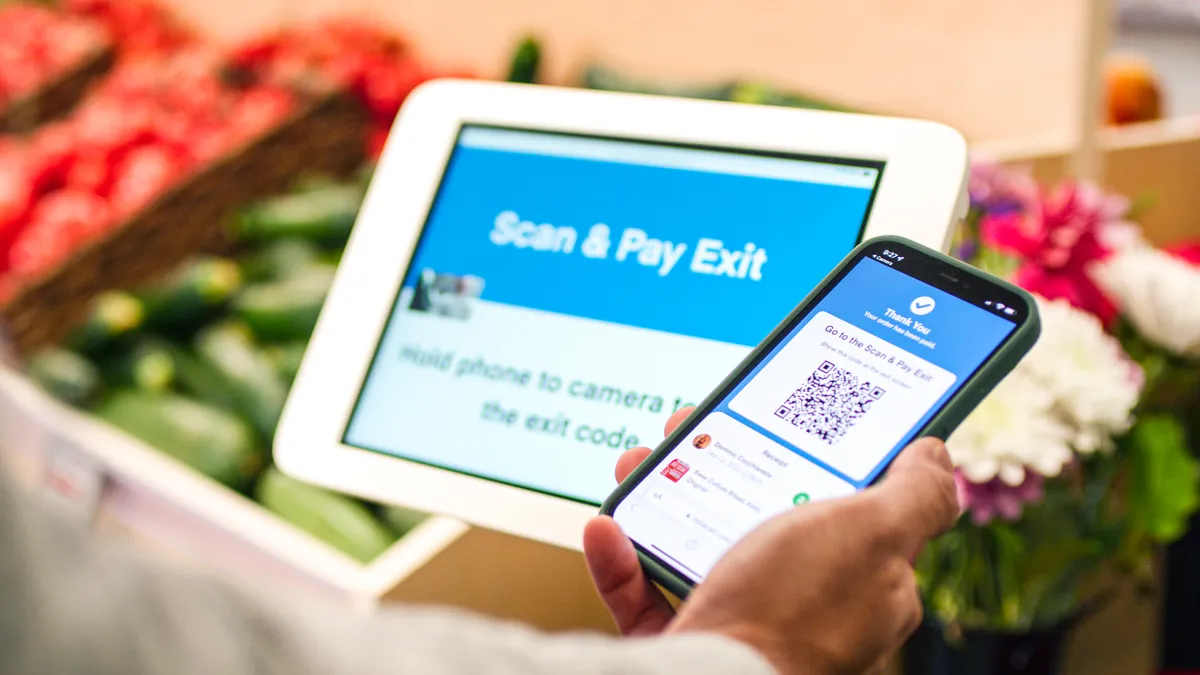

TrendlineE-commerce drives digital payment advances

As e-commerce activity continues to climb, providers of digital payment tools are likely to keep evolving their online offerings.

By Payments Dive staff -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv names Bisignano’s successor

The payments processor tapped Michael P. Lyons, currently president of PNC Financial Services Group, to succeed CEO Frank Bisignano.

By Patrick Cooley • Jan. 23, 2025 -

Ally to sell credit card business to CardWorks

The bank’s CEO said last month that the payments business wasn’t within Ally’s core focus, and pointed to a search for “strategic alternatives” earlier this month.

By Gabrielle Saulsbery • Jan. 22, 2025 -

Chopra delivers last-minute digital payment edicts

The Consumer Financial Protection Bureau made a bid in the last days of the Biden administration to better protect consumers using digital payments tools.

By Lynne Marek • Jan. 22, 2025 -

CFPB to consider broader ban on declined payment fees

The Consumer Financial Protection Bureau withdrew a rule proposal barring bank fees on certain declined transactions. Its plan for a “more comprehensive approach” faces an uncertain future in the Trump administration.

By Lynne Marek • Jan. 21, 2025 -

FIS entangled in Capital One outage over days

Fidelity National Information Services blamed a local power loss and hardware failure for the issue, which Bank of Oklahoma said affected more than two dozen financial institutions.

By Dan Ennis • Jan. 21, 2025 -

Judge partially halts Illinois law ending card fees for taxes, tips

Banks seeking to halt a new Illinois law that bars credit card interchange fees on taxes and tips succeeded on one front, but not another, at least for now.

By Lynne Marek • Jan. 17, 2025 -

Opinion

Why enabling FedNow ‘send’ matters

Financial institutions that “fail to adopt both send and receive functions may be exposing their organizations to competitive disadvantages as well as reputational risks,” writes one industry executive.

By Mihail Duta • Jan. 17, 2025 -

Amex pays $230M to resolve DOJ allegations

The credit card giant misrepresented features of some credit cards targeting small businesses and entered false information on card applications, the Justice Department alleged.

By Patrick Cooley • Jan. 16, 2025 -

Block agrees to pay $255M to regulators for Cash App deficiencies

The digital payments provider agreed to pay penalties to the Consumer Financial Protection Bureau and a group of states under settlements that alleged the company violated banking laws.

By Lynne Marek • Jan. 16, 2025 -

Card fraud losses will increase over next decade

Fraud losses in card payments will continue to rise worldwide, the research firm Nilson Report said this month, predicting $404 billion in global losses over the next ten years.

By Lynne Marek • Jan. 15, 2025 -

Q&A

How AI makes payments faster, cheaper

Artificial intelligence can simplify payment transactions for merchants, Davi Strazza, president of North America for Adyen, said in an interview.

By Patrick Cooley • Jan. 15, 2025 -

Mastercard agrees to pay $26M to settle discrimination lawsuit

The card network entered the agreement to settle a proposed class action that alleged it discriminated against Black, Hispanic and female employees by underpaying them.

By Lynne Marek • Jan. 14, 2025 -

Payments laws apply to online games, CFPB says

Video game companies that operate online gaming platforms must comply with the Electronic Fund Transfer Act, the agency said.

By Patrick Cooley • Jan. 13, 2025 -

CFPB picks FDX to set open banking standards

The nonprofit will craft standards for consumer data sharing between financial institutions for the next five years.

By Patrick Cooley • Jan. 10, 2025 -

Ally lays off hundreds of employees

The digital bank also said this month that it’s exploring strategic alternatives for its credit card business.

By Gabrielle Saulsbery • Jan. 10, 2025 -

RTP payments surged 38% last year

The high-speed payments system operated by The Clearing House also saw the value of transactions nearly double last year over 2023.

By Lynne Marek • Jan. 10, 2025 -

Deep Dive

Payments plays gather momentum in 2025: 6 industry trends to watch

Deregulation, artificial intelligence and stablecoin use are among the industry forces that will drive more digital payments use and innovation this year.

By Lynne Marek and Patrick Cooley • Jan. 9, 2025 -

Fintech Dave alters fee structure, blasts DOJ over amended lawsuit

The cash advance online platform called the lawsuit “a continued example of government overreach.”

By Rajashree Chakravarty • Jan. 9, 2025 -

FTV Capital raises $4B for more B2B investments

The venture capital firm with a fintech focus said the latest fundraising brings the total raised since its founding to $10.2 billion.

By Patrick Cooley • Jan. 9, 2025 -

Column

Will Trump and Sanders lock arms to cap credit card interest rates?

The senator and incoming president partnering on a cap proposal may not be as far-fetched as the payments and banking industries would hope.

By Lynne Marek • Jan. 7, 2025 -

CFPB details BNPL, EWA supervision for first time

In its latest supervisory overview, the Consumer Financial Protection Bureau included a review of buy now, pay later and earned wage access examinations.

By Lynne Marek • Jan. 6, 2025 -

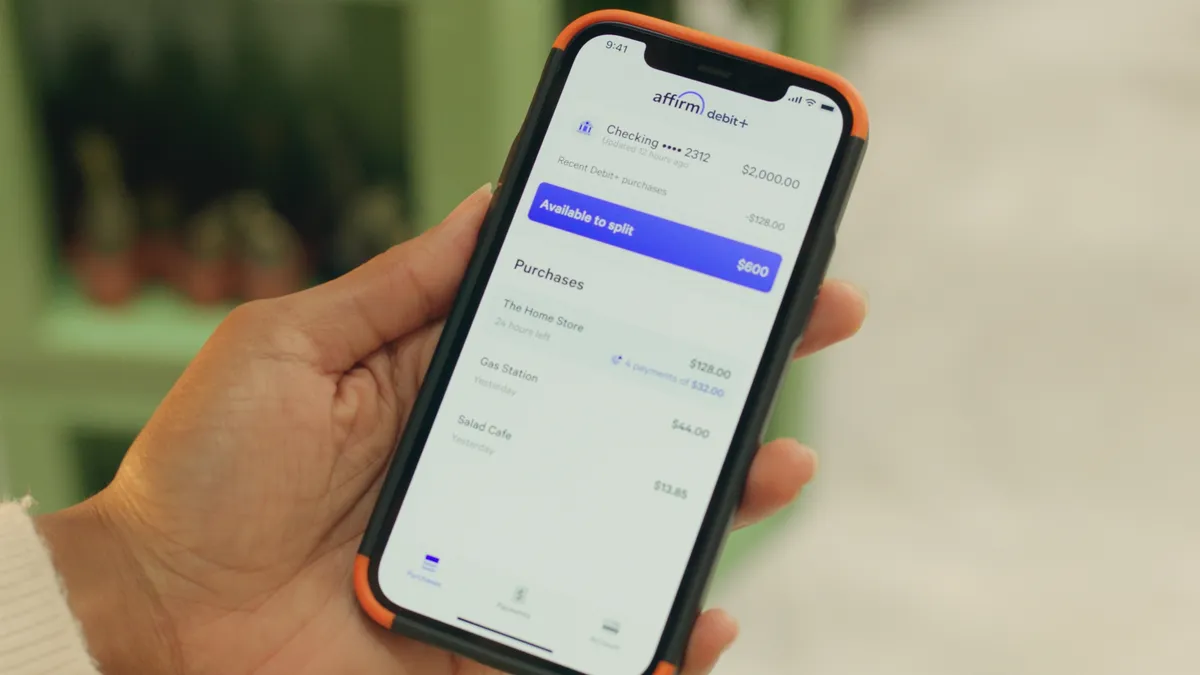

Debit card decline issue persists for Affirm

The buy now, pay later firm has a team working to correct a problem with some customers experiencing debit card declines, the company CFO said in December.

By Patrick Cooley • Jan. 3, 2025 -

Merchants, banks spar over Fed’s debit card fee proposal

Major trade groups for merchants and banks engaged in another round of fighting last week over whether the Federal Reserve should finalize a lower debit card interchange fee rate.

By Lynne Marek • Jan. 3, 2025