Banking: Page 45

-

Zelle counters scam talk with growth rates

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

By Lynne Marek • Sept. 12, 2022 -

Visa to adopt new coding for gun merchants

Card network juggernaut Visa said it will adhere to a new standard for identifying independent gun shops with a unique merchant code after an international body adopted the new approach last week.

By Caitlin Mullen and Lynne Marek • Sept. 12, 2022 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

JPMorgan buys payments firm Renovite

The biggest U.S. bank is buying the payments company as competition in the checkout and card processing ecosystem mounts.

By Lynne Marek • Sept. 12, 2022 -

Gun merchant code approved for card purchases

An international standards body approved a new merchant code that will apply to gun sellers for transactions using credit card networks like Visa and Mastercard.

By Caitlin Mullen • Updated Sept. 9, 2022 -

Google invests in new cohort of Black entrepreneurs

The tech behemoth invested another $5 million in Black entrepreneurs, including some that have founded firms in the payments arena.

By Tatiana Walk-Morris • Sept. 9, 2022 -

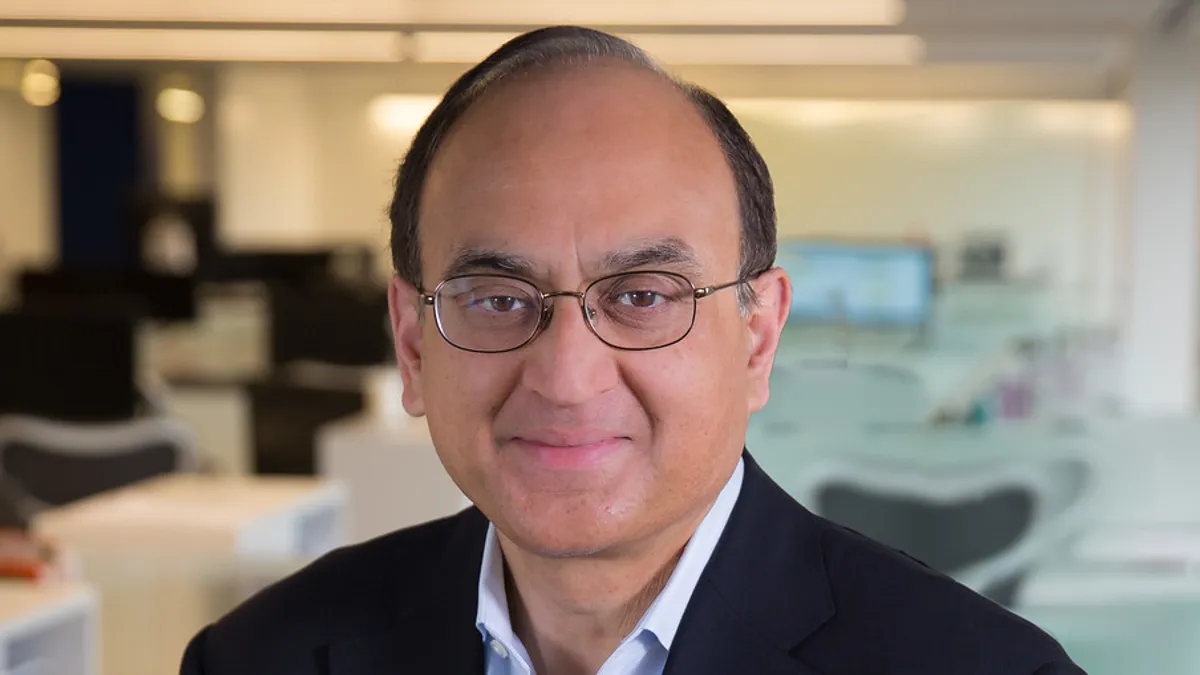

New Fed official speaks to payments, crypto and FedNow

Here are 10 takeaways from the Fed's new head of supervision, on everything from payments to crypto to FedNow.

By Dan Ennis • Sept. 8, 2022 -

Basic income pilots gain momentum across US cities

At least a dozen U.S. cities have implemented unconditional direct cash payment programs over the past year, as advocates seek to build evidence and experts debate the most effective structures.

By Gaby Galvin • Sept. 8, 2022 -

Mesh Payments raises $60M

The payments company hopes to gain more business-to-business payments market share as the demand for expense management services rises.

By Tatiana Walk-Morris • Sept. 8, 2022 -

Visa, Mastercard face cross-border fee questions in U.K.

The U.S. card giants are taking a stand in defense of their services for cross-border transactions as U.K.’s parliament and regulators scrutinize higher fees.

By Lynne Marek • Sept. 7, 2022 -

Column

Strange bedfellows question CBDC

The Fed has an uphill effort ahead in pursuing a central bank digital currency, as evidenced by extensive skepticism from two disparate groups.

By Lynne Marek • Sept. 6, 2022 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon. Opinion

OpinionConsumers need credit card reform

“It's not just merchants at the mercy of the oligopoly,” writes Ed Mierzwinski, a senior director at the Public Interest Research Group. “Consumers all pay more at the store and more at the pump.”

By Ed Mierzwinski • Sept. 2, 2022 -

Go slow on a CBDC, Nacha says

The biggest payment system in the U.S. recommends limited implementation of a central bank digital currency if the Federal Reserve pursues that digital dollar.

By Lynne Marek • Sept. 2, 2022 -

Credit card interest rates reach record

With the Federal Reserve pushing up interest rates to calm inflation, the average credit card interest rate is climbing, too, reaching a two-decade-plus record in August.

By Lynne Marek • Sept. 2, 2022 -

Who’s afraid of FedNow? Not Visa

Visa's CFO on Wednesday brushed off any concerns about the threat of new competition from FedNow, or any other real-time payments system.

By Lynne Marek • Sept. 1, 2022 -

U.S. adults using mostly cash drops sharply

Affluence and age significantly affect whether people choose to use cash for purchases, according to the latest Gallup poll on cash use in the U.S.

By Debbie Carlson • Aug. 31, 2022 -

Digital wallets dig in

Continued adoption of digital wallets is likely to depend on the services that providers add, said Charlotte Principato, a financial services analyst for polling firm Morning Consult.

By Caitlin Mullen • Aug. 30, 2022 -

Retrieved from Federal Reserve Bank of Boston.

Retrieved from Federal Reserve Bank of Boston.

FedNow aims for September testing

FedNow, an effort by the Federal Reserve Banks to speed up and modernize the U.S. payments system, is expected to launch as early as next May.

By Lynne Marek • Aug. 30, 2022 -

Banks push back against CBDC

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

By Lynne Marek • Aug. 29, 2022 -

Affirm scans landscape for acquisitions

With plenty of cash on hand, Affirm CEO Max Levchin considers acquisitions as one of many routes for the buy now-pay later company to continue its growth.

By Lynne Marek • Aug. 26, 2022 -

Big payments companies poke at CBDC

Mastercard, PayPal, Fiserv and Stripe gave the Federal Reserve feedback on a central bank digital currency, pointing out key requirements and cautioning about the outcome.

By Lynne Marek • Aug. 25, 2022 -

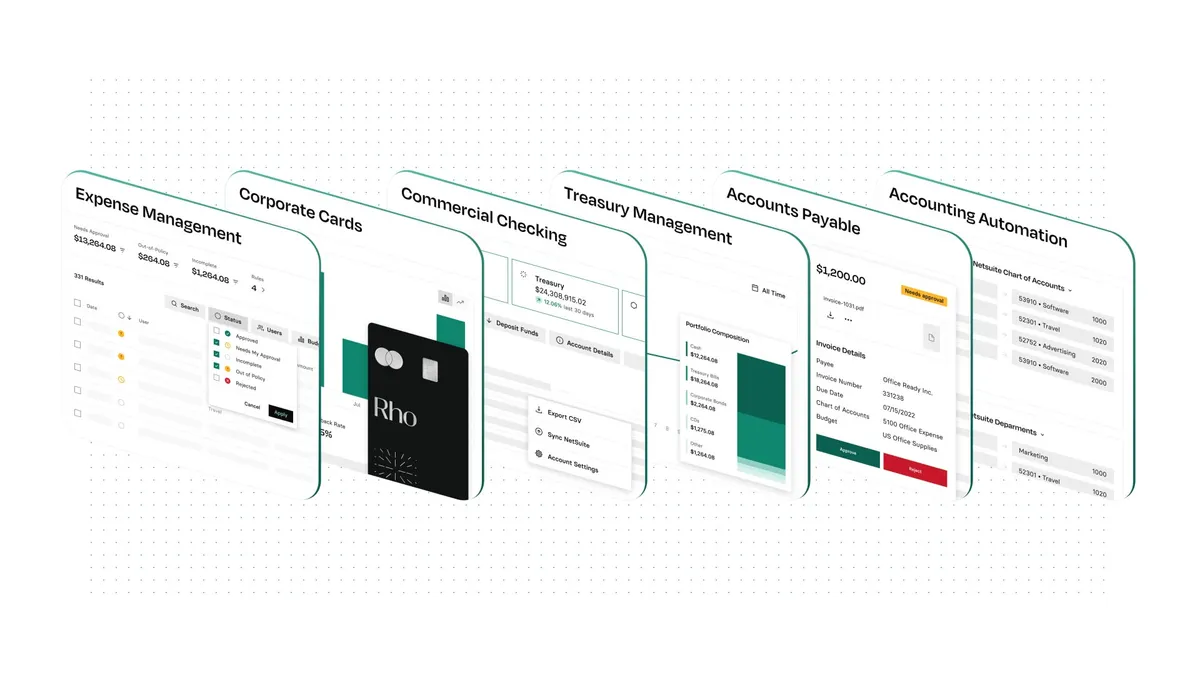

Rho woos clients in bid to fill Brex’s small-biz void

The business banking startup added an automated expense-management tool for its middle-market clients as the company angles to snatch its share of Brex's former clients.

By Suman Bhattacharyya • Aug. 25, 2022 -

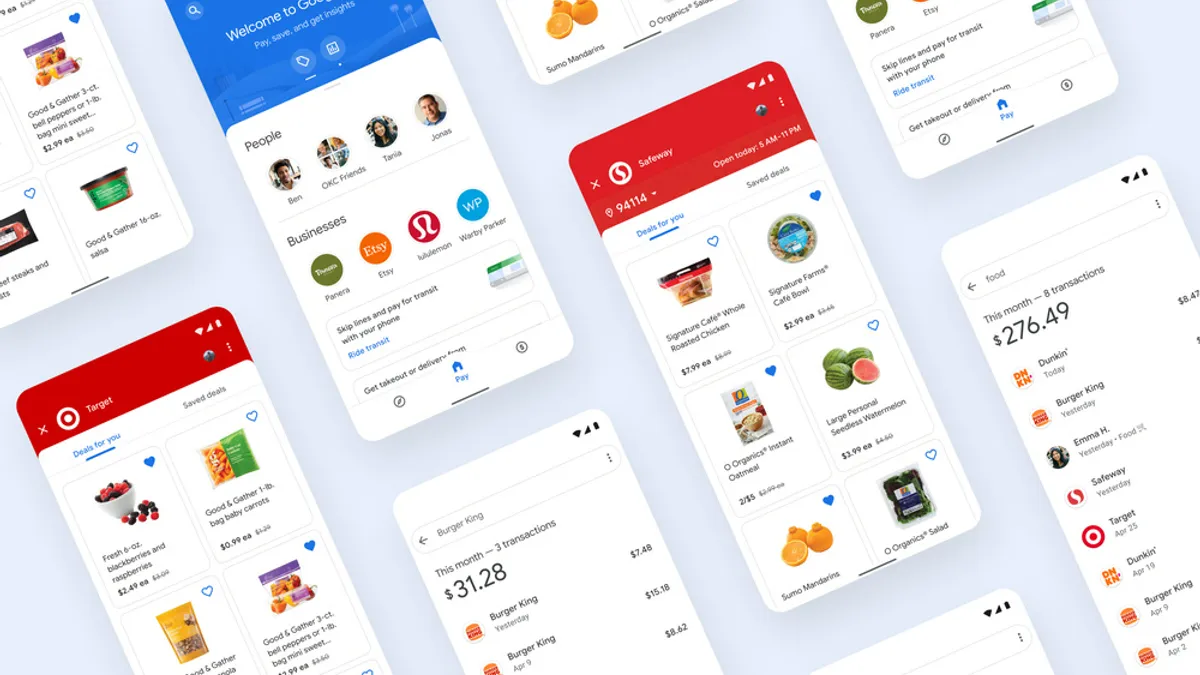

Retrieved from Google on April 30, 2021

Retrieved from Google on April 30, 2021

Google Wallet seeps into six more countries

The tech giant extended its payment services to more nations as competition with Samsung Pay and Apple Pay intensifies.

By Tatiana Walk-Morris • Aug. 25, 2022 -

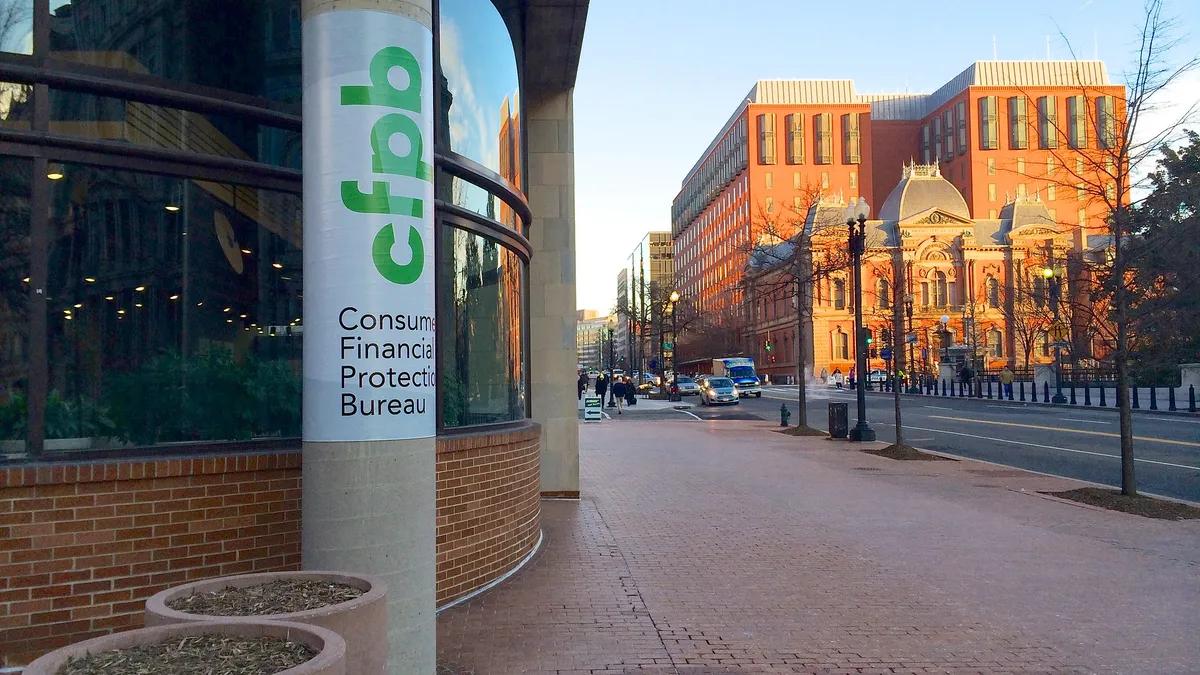

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB seeks more credit card transparency

The Consumer Financial Protection Bureau is considering requiring top credit card issuers to share more information on their products to increase transparency for consumers.

By Caitlin Mullen • Aug. 24, 2022 -

Bill.com revenue leaps

Bill.com’s fiscal fourth-quarter and annual revenue more than doubled as the company scooped up more mid-size and small business customers.

By Lynne Marek • Aug. 24, 2022 -

DailyPay releases card with Visa

The earned wage access provider introduced the new debit card after major changes in leadership earlier this year.

By Tatiana Walk-Morris • Aug. 23, 2022