Banking: Page 41

-

Column

Can Congress come together on crypto?

Perhaps even a divided Congress can make bipartisan headway in crafting a regulatory framework for crypto following the FTX failure.

By Lynne Marek • Nov. 17, 2022 -

NY Fed launches CBDC project with Mastercard, big banks

Mastercard and big banks such as Citi, Wells Fargo, BNY Mellon and U.S. Bank are set to participate in the proof-of-concept trial.

By Rajashree Chakravarty • Nov. 16, 2022 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

Mastercard predicts Black Friday bonanza

The card network company said in a report this week that it expects a Black Friday “shopping blitz” will lead retail sales to jump 15% over last year.

By Jonathan Berr • Nov. 16, 2022 -

Q&A

CEOs Sound Off: Payments forecasts for 2023

The CEOs of Brex, Splitit and Paystand weigh in on what’s to come in the year ahead, commenting on the trends, challenges, regulation and M&A.

By Caitlin Mullen , Lynne Marek • Nov. 16, 2022 -

Discover concludes student loan probe

While the card company said it has finished its own investigation into its student loan servicing practices, it may still be subject to regulatory probes.

By Caitlin Mullen • Nov. 16, 2022 -

Nacha, Fed, Clearing House offer late night payments

The Federal Reserve and The Clearing House have launched late night ACH payments, speeding up the processing of some payments.

By Tatiana Walk-Morris • Nov. 16, 2022 -

Fiserv ‘maniacally focused’ on expense management

When asked Monday how Fiserv would adapt to an economic downturn, CEO Frank Bisignano said the company knows what levers to pull “to manage the expense line.”

By Caitlin Mullen • Nov. 15, 2022 -

Wex readies for acquisitions

Acquisitions are part of Wex CEO Melissa Smith’s annual growth goals, and the deteriorating economy could present attractive targets, she said.

By Lynne Marek • Nov. 11, 2022 -

FTX files for bankruptcy, CEO steps down

FTX.com’s assets were frozen in the Bahamas, where the company is headquartered. Crypto lender BlockFi also paused withdrawals because of its exposure to FTX.

By Gabrielle Saulsbery • Nov. 11, 2022 -

Musk pushes Twitter toward payments

“Give them some amount of money, like ten bucks or something, that they can send anywhere in the system,” said Twitter’s new owner, Elon Musk. “We need money transfer licenses for that, which we’ve applied for.”

By Anna Hrushka • Nov. 11, 2022 -

Green Dot CEO taps new team

The payment services company’s recently appointed CEO brought on his own team this week, naming a new CFO, COO and chief revenue officer.

By Lynne Marek • Nov. 11, 2022 -

CBDC could accelerate cross-border payments: NY Fed

Researchers designed a prototype digital currency that cleared cross-border transactions within 10 seconds, but they said the study doesn’t endorse a CBDC or assume the Fed will issue one.

By Rajashree Chakravarty • Nov. 10, 2022 -

Marqeta lands new client, faces questions on Block

While the company said this week that it won new business from a fintech backed by Walmart, it also faced questions over contract renewals for its biggest customer, Block.

By Lynne Marek • Nov. 10, 2022 -

Jack Henry & Associates bucks slowdown trend

Executives for the tech services provider asserted that their pipeline of new business remains healthy despite economic headwinds beating up the rest of the industry.

By Caitlin Mullen • Nov. 9, 2022 -

Opinion

Preparing for the CBDC era

Central bank digital currencies would allow for faster cross-border payments that would “help boost trade within the region and with the rest of the world,” an Equinix executive writes.

By Lance Homer • Nov. 9, 2022 -

Affirm curbs hiring amid economic uncertainty

The buy now-pay later company is pulling back on adding talent in some areas, but plunging ahead in others and seeking out talent in lower-cost regions.

By Jonathan Berr • Nov. 9, 2022 -

FIS targets $500M in cost cuts

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

By Jonathan Berr • Nov. 9, 2022 -

Tracker

How active shooters pay for guns

Payment methods used by active shooters to acquire guns are becoming part of the U.S. dialogue about such incidents. A Payments Dive series tracking those details seeks to inform the discussion.

By Payments Dive staff • Updated Dec. 13, 2022 -

FedNow gives fee holiday in 2023

Federal Reserve banks introducing the new instant payments system next year will jettison customer transfer and participation fees for the launch.

By Lynne Marek • Nov. 7, 2022 -

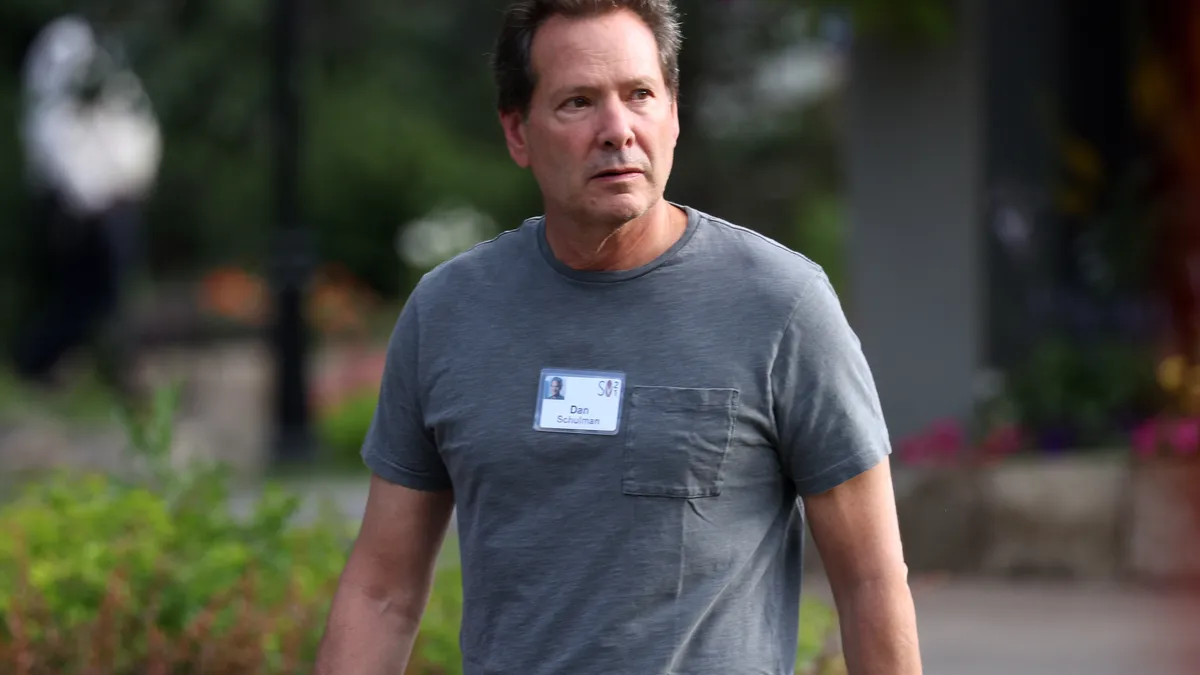

PayPal girds for slowdown, leans on Apple, Amazon

The digital payment pioneer is counting on its ties to Apple and Amazon as it prepares for an economic slowdown already showing up in e-commerce.

By Lynne Marek • Nov. 4, 2022 -

Amex’s Squeri gets $15M in stock options

The special grant to American Express CEO Steve Squeri reflects “his outstanding leadership” at the company, Amex said in a regulatory filing.

By Caitlin Mullen • Nov. 4, 2022 -

Musk aims Twitter at payments

Twitter’s new billionaire owner plans to make the company into a payments player, but industry pros say social media platforms aren’t cut out for that game.

By Lynne Marek • Nov. 3, 2022 -

Stripe chops workforce for ‘leaner times’

The payments company will cut about 1,140 jobs as it reins in expenses in the face of deteriorating economic conditions after growing too fast.

By Lynne Marek • Nov. 3, 2022 -

Amazon offers merchants cash advances

Sellers on the company’s online marketplace can access from $500 to $10 million in cash advances, with repayment based on a fixed percentage of their gross merchandise sales.

By Tatiana Walk-Morris • Nov. 2, 2022 -

6 payments takeaways from big consulting firms

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

By Caitlin Mullen , Lynne Marek , Jonathan Berr • Nov. 2, 2022