Banking: Page 35

-

Photo by Tima Miroshnichenko from Pexels

Q&A

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover facing FDIC probe

The company also disclosed during its 2Q earnings report that a pricing issue affected merchants and merchant acquirers, some of whom will get refunds.

By Caitlin Mullen • July 20, 2023 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

FedNow goes live for banks, credit unions

The Fed’s long-awaited instant payments system arrived right on time, giving consumers and businesses a new route for speedier transactions.

By Lynne Marek • July 20, 2023 -

CCCA opponents brace for defense bill move

Opponents of the Credit Card Competition Act proposal are gearing up to fight the bill as an attachment to the National Defense Authorization Act.

By Lynne Marek • July 19, 2023 -

Flywire, Tencent partner on cross-border education payments

The international payments software firm aims to give Chinese students abroad a tool for paying tuition using their home country’s most popular digital wallet.

By James Pothen • July 19, 2023 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB, European regulator open a dialogue on digital rules

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

By Rajashree Chakravarty • July 18, 2023 -

Synchrony braces for late fee rule

The CEO of the private label card issuer expects a final rule on the CFPB’s proposed credit card late fee cap later this year, and litigation could follow, he said.

By Caitlin Mullen • July 18, 2023 -

Credit card bill opposition builds

Ten banking and payments trade associations sent a letter to Congress on Friday objecting to the Credit Card Competition Act.

By James Pothen • July 18, 2023 -

Fintech funding drops in 2Q

While there was a drought of venture capital for payments startups and other fintechs in the first half of the year, industry reports spot potential for new flows in the second half.

By Lynne Marek • July 18, 2023 -

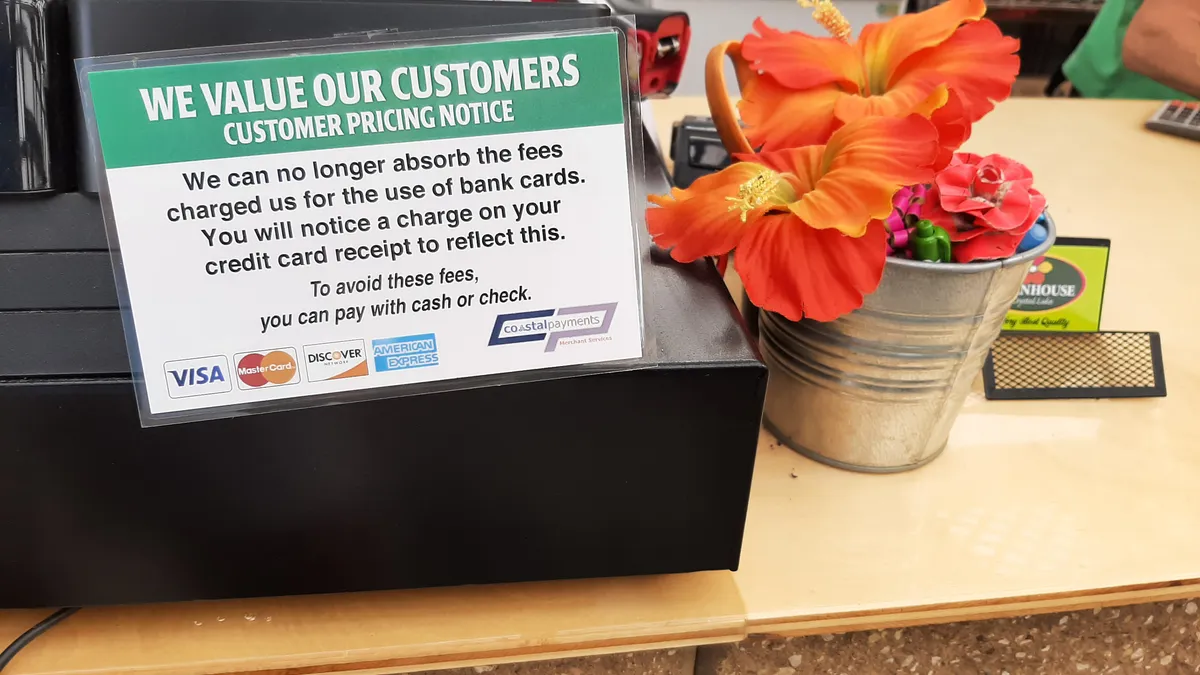

Will other states mimic New Jersey’s credit card surcharge?

The state’s legislature passed a bill recently to cap credit card surcharges. One experienced payments executive believes that’s the wave of the future.

By Lynne Marek • July 17, 2023 -

Dollar General rolls out new cash rewards program

The new program allows customers to earn cash back in their digital wallets from the chain store on eligible purchases.

By Catherine Douglas Moran • July 14, 2023 -

Apple debuts recurring payments

The tech giant, now valued at $3 trillion, is continuing to expand its financial offerings after debuting a buy now, pay later feature and a savings account earlier this year.

By James Pothen • July 14, 2023 -

Fed touts FedNow’s fraud tools

Cleveland Fed President Loretta Mester in a speech this week spelled out tools the new instant payments system will have for thwarting fraud.

By Lynne Marek • July 14, 2023 -

Consumers, SMBs prize security in cross-border payments: survey

Trust and transparency of fees were other key factors for consumers and businesses choosing a cross-border payment provider, a Swift survey revealed.

By Caitlin Mullen • July 14, 2023 -

Retrieved from Tim Gouw from Pexels.

Payoneer to cut nearly 10% of employees

The cross-border payments company plans to reinvest the savings in future growth, with hiring in research and development.

By James Pothen • July 13, 2023 -

CFPB urged to abolish deferred interest

Panelists who spoke during the agency’s Tuesday hearing on medical billing and collections identified deferred interest credit cards as a prime culprit saddling patients with medical debt.

By Caitlin Mullen • July 13, 2023 -

Discover pulls new CIO from Wells Fargo

Jason Strle, a 20-year tech vet, succeeds Amir Arooni, who spent nearly three years as the financial services company's CIO.

By Matt Ashare • July 13, 2023 -

Photo by Levi Meir Clancy on Unsplash

Twitter snags money transfer license in Arizona

That’s the fourth state in which the social media company has received a license, inching it closer to creating the payments tool and super-app envisioned by owner Elon Musk.

By James Pothen • July 12, 2023 -

Marqeta expands to Brazil

The corporate card issuer is entering South America by way of a new partnership with Fitbank, as part of broader international expansion ambitions.

By Lynne Marek • July 12, 2023 -

Bank of America fined $250M over fake accounts, junk fees

Regulators say Bank of America opened credit card accounts without customers’ consent and misled consumers about rewards for card applications.

By Anna Hrushka • July 11, 2023 -

New Jersey legislature passes credit card surcharge bill

Lawmakers passed a bill that limits the surcharge a merchant can impose on consumers to the cost of processing a credit card transaction.

By Lynne Marek • July 11, 2023 -

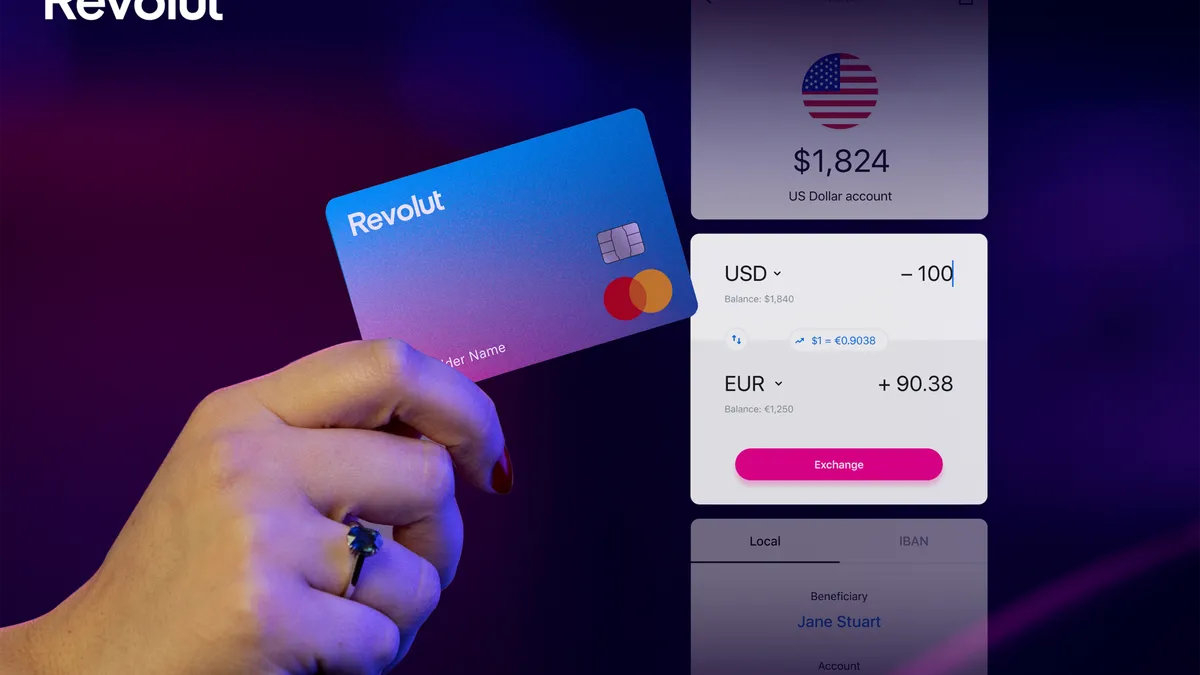

Criminals stole $20M from Revolut via payment loophole: report

Differences in the firm’s U.S. and European systems meant the neobank would use its own money to erroneously refund certain declined payments, the Financial Times reported.

By Anna Hrushka • July 11, 2023 -

Missouri follows Nevada in enacting EWA law

The new legislation creates a requirement that earned wage access providers operating in Missouri must register with the state.

By James Pothen • July 11, 2023 -

Feds drill down on medical cards

With consumers increasingly tapping medical credit cards to pay for healthcare costs, the Biden administration is zeroing in on regulations to police such financial services.

By Lynne Marek • July 10, 2023 -

Sponsored by Federal Reserve Financial Services

The FedNow® Service takes instant payments to a new level

The Federal Reserve in July is launching the FedNow Service, an instant-payment service that will help banks and other financial institutions better serve consumers and businesses.

July 10, 2023