Banking: Page 31

-

Global Payments tops Worldpay debt rating

Global Payments landed a better mark from debt rating agency Fitch than did Worldpay in recent reports. That may matter as they pursue acquisitions.

By Lynne Marek • Sept. 29, 2023 -

Chase to ban crypto payments for UK customers

“If we think you're making a payment related to crypto assets, we'll decline it,” Chase U.K. told customers in an email reported by CoinDesk.

By Gabrielle Saulsbery • Sept. 28, 2023 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Deluxe to offer direct-biller payment services

Though checks have been vital to its business, the company is venturing further into digital payments, with an assist from Aliaswire.

By Tatiana Walk-Morris • Sept. 28, 2023 -

Modern Treasury CEO targets bigger customers

The digital payment services company brought on a chief revenue officer last year to better serve larger companies, according to CEO Dimitri Dadiomov.

By James Pothen • Sept. 27, 2023 -

Column

Social apps face challenges in implementing shopping tools

Facilitating digital payments would be a big win for social apps, but regulators are less enthused.

By Andrew Hutchinson • Sept. 27, 2023 -

Retrieved from Wawa press release.

Retrieved from Wawa press release.

Wawa’s $10.7M data breach lawsuit against Mastercard thrown out

The convenience retailer accused the card network company of breach of contract and unfair practices stemming from its 2019 malware attack.

By Brett Dworski • Sept. 26, 2023 -

Andreessen Horowitz pushes cross-border payment improvements

While money is much older than software, it’s still more difficult to move payments around the world, the venture capital firm said in a recent report advocating cross-border improvements.

By James Pothen • Sept. 26, 2023 -

BNPL users ‘financially fragile,’ NY Fed says

Consumers using BNPL have lower credit scores, have been delinquent on a loan or have been rejected for a credit application over the past year, New York Fed researchers said.

By Caitlin Mullen • Sept. 26, 2023 -

Opinion

Is FedNow pivotal for payments or overhyped?

FedNow won’t fill the gap between the U.S. and other countries in payments innovation, writes one fintech CEO.

By Eric Shoykhet • Sept. 26, 2023 -

Congressional committee passes bill to thwart CBDC

The House Financial Services Committee advanced a bill last week that would block the creation of a central bank digital currency.

By Lynne Marek • Sept. 25, 2023 -

Payments processing can get complicated. Here’s a primer.

How many companies does it take to process a credit card payment?

By James Pothen • Sept. 22, 2023 -

Biden administration seeks to erase medical debt from credit reports

In kicking off a medical debt rulemaking process, the CFPB aims to address the "tremendous burden" of medical debt, Vice President Kamala Harris said Thursday.

By Caitlin Mullen • Sept. 22, 2023 -

Retrieved from Piqsels.

Retrieved from Piqsels.

Holiday spending to increase 3.7%: Mastercard

Consumer outlays for electronics and at restaurants are expected to boost expenditures this year, according to the card network.

By Tatiana Walk-Morris • Sept. 22, 2023 -

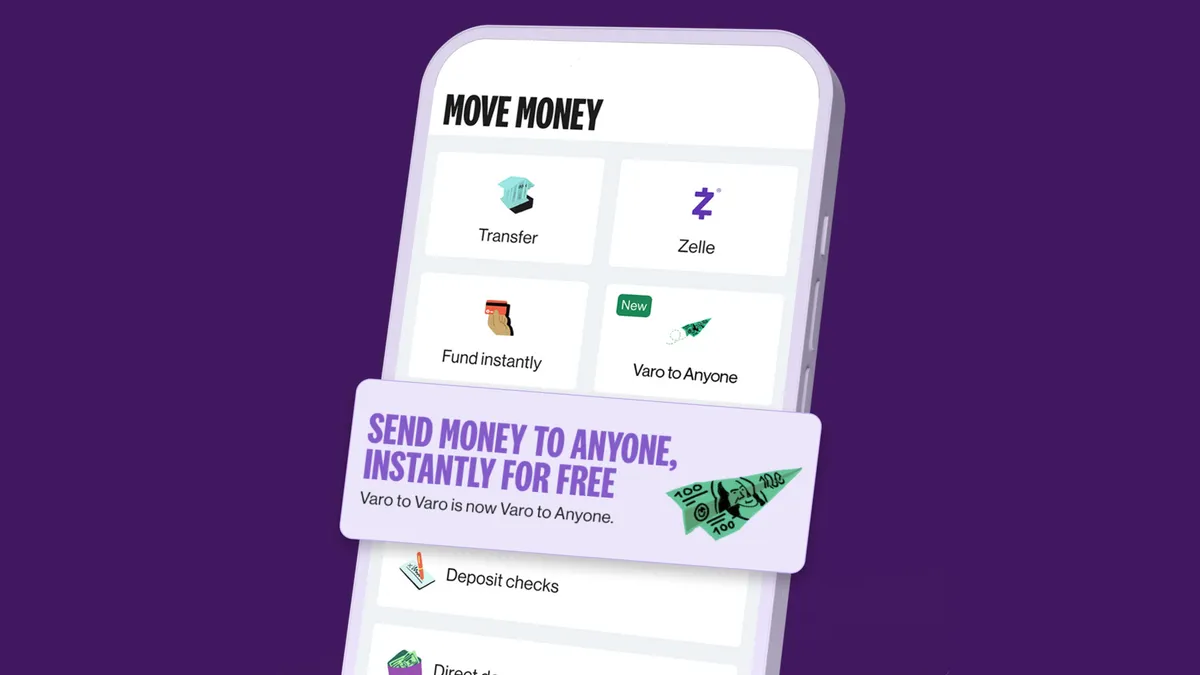

Varo aims to displace Venmo, Cash App volume with P2P feature

The bank has launched a feature enabling Varo account holders to instantly transfer funds at no cost to anyone with a U.S. debit card.

By Anna Hrushka • Sept. 21, 2023 -

JPMorgan taps Gusto to offer embedded payroll

Chase Payment Solutions’ small and medium-sized business customers can use Gusto to combine the payroll process with financial operations.

By Rajashree Chakravarty • Sept. 21, 2023 -

The image by 401(K) 2012 is licensed under CC BY-SA 2.0

The image by 401(K) 2012 is licensed under CC BY-SA 2.0

California legislature passes plastic gift card ban

The state’s lawmakers approved a bill that would ban the use of plastic for gift cards by 2027, but it’s still waiting on the governor’s signature.

By Lynne Marek • Sept. 21, 2023 -

Citi launches token service for institutional clients

The service uses blockchain technology to convert clients’ deposits into digital tokens that can be used for instant, cross-border payments 24/7, the bank said.

By Rajashree Chakravarty • Sept. 19, 2023 -

Connecticut moves to regulate EWA

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

By Lynne Marek • Sept. 19, 2023 -

Digital dollar bill resurfaces in Congress

The proposed digital dollar would create an electronic version of the U.S. currency, but it wouldn’t be the same as a central bank digital currency.

By Lynne Marek • Sept. 18, 2023 -

BNPL users seek and use more new credit, Fed study finds

Researchers with the Philadelphia Fed’s Consumer Finance Institute also discovered a typical BNPL user’s credit score was more than 50 points lower than a non-user's.

By Caitlin Mullen • Sept. 18, 2023 -

Battle over credit card bill escalates

The fight over the Credit Card Competition Act is intensifying on Capitol Hill, with Senate floor diatribes and doughnut truck freebies.

By Lynne Marek • Sept. 15, 2023 -

CEO out at embattled Binance.US

Brian Shroder joined the U.S. arm of the world's largest crypto exchange in 2021. Now, he's gone, as are one-third of the company's employees — who, unlike Shroder, were laid off this week.

By Gabrielle Saulsbery • Sept. 14, 2023 -

FIS battles higher labor costs

The run-up in labor costs at Fidelity National Information Services has eased, and the paytech services company is eyeing AI to keep them in check.

By Lynne Marek • Sept. 14, 2023 -

Fed officials tout FedNow, seek adoption

Fed officials are on a campaign to increase adoption of the new instant payments system, noting it may have implications for other Fed services.

By Lynne Marek • Sept. 13, 2023 -

Discover shares pricing error findings with regulators

Discover executives met with regulators on the issue Monday, and the company expects further discussion, CFO John Greene said.

By Caitlin Mullen • Sept. 13, 2023