Banking: Page 29

-

Discover discloses SEC probe

A pricing error by the card company that affected merchants and merchant acquirers triggered the investigation.

By Caitlin Mullen • Oct. 27, 2023 -

Brex exec straddles CFO, COO roles

As C-suite responsibilities change, the gap between roles such as the CFO and chief operating officer is narrowing.

By Grace Noto • Oct. 27, 2023 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Ingenico, Jifiti partner to offer payment options

The payments acceptance company is racking up partnerships to expand services under Apollo Funds ownership.

By Tatiana Walk-Morris • Oct. 27, 2023 -

BNPL, EWA bills surface at House hearing

The legislative proposals emerged at a Wednesday hearing during which lawmakers queried witnesses on payments and fintech issues.

By Caitlin Mullen • Oct. 26, 2023 -

Payments M&A bounces back in October

A burst of industry acquisition activity this month, after a mid-year lull, is expected to continue for the rest of the year.

By James Pothen • Oct. 26, 2023 -

U.S. Bank jumps into BNPL

The launch of the point-of-sale option Avvance comes as nearly one in five consumers surveyed by the New York Fed say they've used buy now, pay later loans within the past year.

By Gabrielle Saulsbery • Oct. 26, 2023 -

Fed proposes reduction in debit fee cap

The Federal Reserve Board proposed a rule change that would slash the amount card issuers can charge merchants for processing a debit transaction. The proposal also calls for periodic updates to the fee cap in the future.

By Lynne Marek • Oct. 25, 2023 -

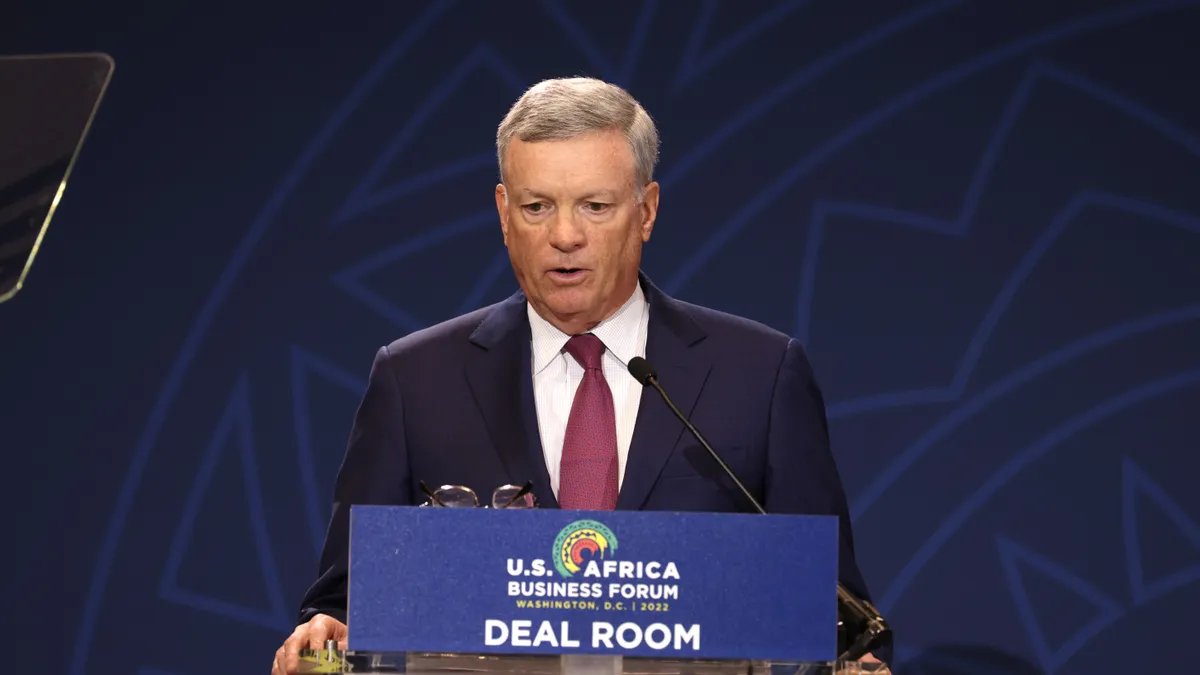

PayPal taps Fiserv as ‘core’ payments partner

Fiserv CEO Frank Bisignano said Tuesday that his company is now PayPal’s “core U.S. partner for payment services.”

By Caitlin Mullen • Oct. 25, 2023 -

Visa leans into CFPB proposal

The card network’s CEO on Tuesday backed a recent Consumer Financial Protection Bureau proposal on open banking, but was more circumspect about Fed moves on debit rules.

By Lynne Marek • Oct. 25, 2023 -

Fiserv, Blackhawk Network push to expand bill-pay services

By increasing the number of retailers accepting walk-in bill payment, the two companies seek to better serve consumers who prefer to use cash.

By Caitlin Mullen • Oct. 24, 2023 -

Crypto legislation would put US ‘back in the game,’ stakeholders say

A pair of House bills would help the industry gain clarity, scale digital asset products and promote financial inclusion, cryptocurrency stakeholders said Sunday on a panel at Money20/20.

By Anna Hrushka • Oct. 24, 2023 -

BIS advances oversight structure for broader faster payments ecosystem

In the interest of faster, cheaper and more transparent cross-border payments, the Bank of International Settlements last week produced an interim report aimed at developing a governance structure for an interlinked faster payments system.

By Lynne Marek • Oct. 23, 2023 -

Visa faces remaining litigation settlements of up to $4B

That’s the maximum amount of money the card network estimates may yet result from settling claims brought against it years ago by merchants who argue they were overcharged for card transaction processing.

By Lynne Marek • Oct. 23, 2023 -

Amex adds cards at a slower rate

As the company’s marketing spending dipped in the third quarter, Amex acquired fewer new cards than it has in recent quarters.

By Caitlin Mullen • Oct. 20, 2023 -

Same-day payments keep climbing: Nacha

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

By Tatiana Walk-Morris • Oct. 20, 2023 -

Fed to review debit card fee cap

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting this week.

By Lynne Marek • Oct. 20, 2023 -

CFPB unveils open banking proposal

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

By Anna Hrushka • Oct. 20, 2023 -

Visa’s chairman heads for exit

When Al Kelly leaves the board in January, the company’s lead independent director, John Lundgren, is expected to become Visa’s new chairman.

By Lynne Marek • Oct. 19, 2023 -

Discover considers internal, external CEO candidates

The card issuer is searching for a replacement after former CEO Roger Hochschild resigned abruptly in August.

By Caitlin Mullen • Oct. 19, 2023 -

Fed’s Bowman urges ‘responsible innovation’

Federal Reserve Governor Michelle Bowman said the U.S. already has a “safe and efficient payment system” that could be disrupted by CBDCs or stablecoins.

By James Pothen • Oct. 19, 2023 -

Plaid names first CFO

The move comes as the 10-year-old fintech company is reportedly considering going public after its failed agreement to be acquired by Visa.

By Alexei Alexis • Oct. 19, 2023 -

ACI, states reach $20M in settlements over payments mishap

The company is being penalized for unauthorized withdrawals, and attempted withdrawals, from mortgage customer accounts in April 2021.

By Tatiana Walk-Morris • Oct. 18, 2023 -

Payments funding slips further

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

By Caitlin Mullen • Oct. 18, 2023 -

Q&A

Fiserv exec talks Carat competition, growth

Carat’s recent expansion of its relationship with customer Inspire Brands “is what ‘good’ looks like in many ways for us,” said Casey Klyszeiko, the head of Fiserv’s global commerce platform for large clients.

By Caitlin Mullen • Oct. 16, 2023 -

Immigrants denied credit cards, other loans: CFPB, DOJ

“The CFPB will not allow companies to use immigration status as an excuse for illegal discrimination,” the bureau’s Director Rohit Chopra said Thursday.

By James Pothen • Oct. 13, 2023