Banking: Page 23

-

Global Payments may pare operations

While there has been industry speculation about the company making an acquisition, CEO Cameron Bready was more ready to talk “pruning” this week.

By Lynne Marek • Feb. 15, 2024 -

BNPL popularity rises among ‘financially fragile’ consumers

About 60% of that group has used BNPL five or more times in the past year, compared to just over 20% of financially stable consumers, the New York Fed said.

By Caitlin Mullen • Feb. 15, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Senator calls card CEOs on congressional carpet

Sen. Dick Durbin, sponsor of a card network competition bill, urged the CEOs of Visa and Mastercard to appear at an April congressional hearing and not send their underlings.

By Lynne Marek • Feb. 14, 2024 -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

Yellen asks Congress for stablecoin legislation

Treasury Secretary Janet Yellen renewed a call for Congress to act on digital assets, saying “there is no appropriate regulatory framework.”

By James Pothen • Feb. 13, 2024 -

Amex gears up for bigger bank category

Given its asset growth, the card issuer anticipates facing more stringent regulatory requirements and more frequent stress tests.

By Caitlin Mullen • Feb. 13, 2024 -

PayPal’s Rabinovitch takes Worldpay CFO seat

Worldpay will lean on PayPal alum Gabrielle Rabinovitch’s finance chops to help it navigate life as an independent company after a recent rocky history for the business.

By Grace Noto • Feb. 13, 2024 -

More than half of P2P fraud victims lose money: AARP

“When it comes to addressing instances of financial exploitation, consumers are less likely to trust P2P platforms than banks and credit unions,” an AARP survey reported.

By Tatiana Walk-Morris • Feb. 12, 2024 -

Bill Holdings, Bank of America revamp contract

The provider of bill-pay software services was expecting to extend its services to more of the bank's clients, but now the bank is changing its plans.

By Lynne Marek • Feb. 12, 2024 -

Western Union, Euronet lean into digital growth

The cross-border payments companies are increasingly turning to digital services to drive growth in a market that is “a bare-knuckle street fight every single day.”

By Lynne Marek • Feb. 9, 2024 -

Q&A

Banks should step up scam response: fraud expert

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

By Caitlin Mullen • Feb. 9, 2024 -

PayPal cost-cutting likely to persist

The digital payments pioneer’s expense reductions may take years to benefit the company’s bottom line as management resets the business strategy.

By Lynne Marek • Feb. 8, 2024 -

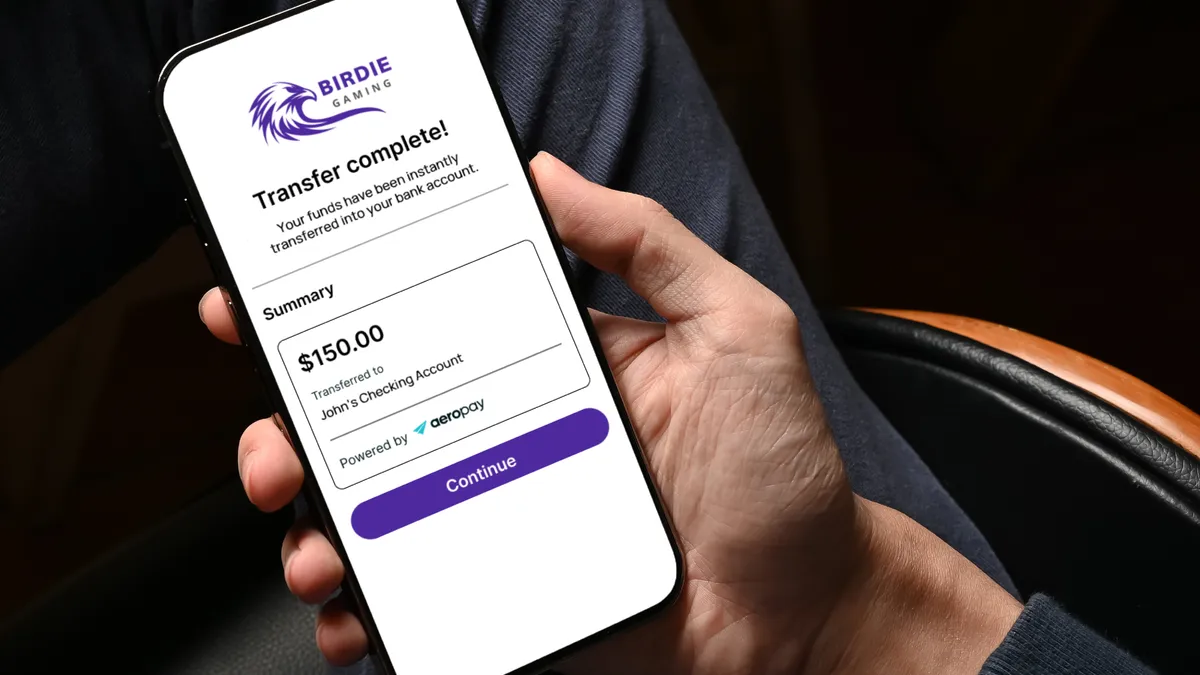

Aeropay partners with Cross River, UBank on sports gaming payouts

Digital payments provider Aeropay has lined up bank partners in an effort to facilitate faster access to winnings.

By Gabrielle Saulsbery • Feb. 8, 2024 -

Opinion

CFPB open banking proposal will be crucial

The agency’s open banking proposal is a step in the right direction, but details of the policy will shape how the market develops, a regulatory adviser writes in this op-ed.

By Jonah Crane • Feb. 8, 2024 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Card debt climbs to record $1.13 trillion

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

By Lynne Marek • Feb. 7, 2024 -

Fiserv CEO details special bank charter pursuit

The processing and acquiring company, which seeks a “very specific” special bank charter, doesn’t intend to compete with its financial institution partners, Fiserv CEO Frank Bisignano said Tuesday.

By Caitlin Mullen • Feb. 7, 2024 -

Fleet fintech ditches Visa for Mastercard

Fuel card startup AtoB, with $112 million in financial backing, plans to take on dominant fleet service rivals Wex and Fleetcor.

By Lynne Marek • Feb. 6, 2024 -

Fiserv lands Uber, eBay as debit network clients

The payment processing giant has signed more than a dozen large e-commerce clients following the Federal Reserve’s clarification of the debit routing rule.

By Caitlin Mullen • Feb. 6, 2024 -

Why ‘pay-by-bank’ faces adoption hurdles in US retail

Pay-by-bank has been catching on only slowly, and it’s a particularly long shot for showing up at the point-of-sale anytime soon.

By Suman Bhattacharyya • Feb. 5, 2024 -

Opinion

Where will embedded payments flourish in 2024?

There are three areas where embedded finance is a good fit, and they are characterized by high volume and frequent payments, writes one industry executive.

By Julio Gomez • Feb. 5, 2024 -

Why Discover went all-in on open source

The card network’s tech leadership eased the product development process, removing barriers to innovation and opening pathways for engineers to advance.

By Matt Ashare • Feb. 2, 2024 -

Payments companies’ job cuts may not be done

PayPal, Block and Brex all started cutting employees in January in pursuit of efficiency and profits.

By James Pothen • Feb. 2, 2024 -

Lawmakers clash on CFPB digital payment rule

Democratic senators said the proposed rule would curb “rampant” fraud, while Republican Congress members said it would introduce “regulatory uncertainty.”

By James Pothen • Feb. 1, 2024 -

Mastercard preps for China business

The card network is readying to offer Chinese consumers its card services domestically after winning approval last year for a joint venture in that country.

By Lynne Marek • Feb. 1, 2024 -

NY AG sues Citi over denied fraud claims

“If a bank cannot secure its customers’ accounts, they are failing in their most basic duty,” New York Attorney General Letitia James said in a statement Tuesday.

By Dan Ennis • Jan. 31, 2024