Banking: Page 21

-

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 18, 2024 -

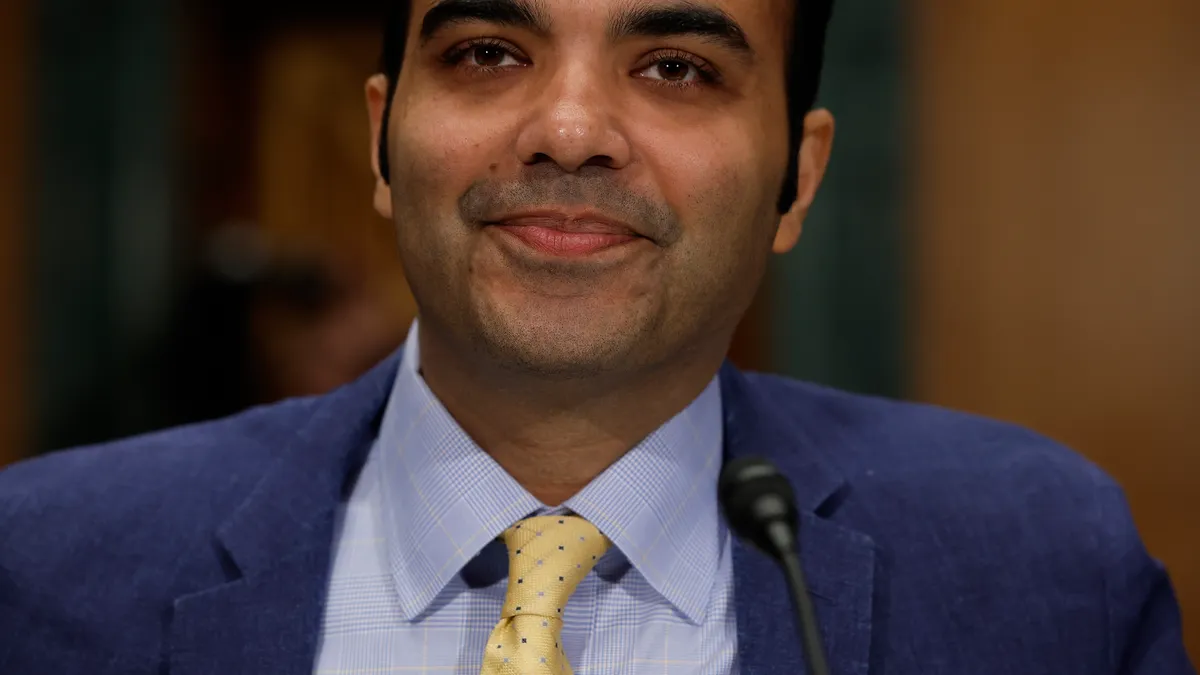

CFPB warns of ‘dangers’ on standards for open banking

“We know dangers exist when more powerful players weaponize industry standards,” Consumer Financial Protection Bureau Director Rohit Chopra said in advance of finalizing an open banking rule later this year.

By Lynne Marek • March 15, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Retrieved from Business Wire on March 14, 2024

Retrieved from Business Wire on March 14, 2024

Fiserv searches for ‘tuck-in type’ deals

Despite a focus on smaller acquisition options, the processor doesn’t feel confined to a particular price range, CFO Bob Hau suggested Thursday.

By Caitlin Mullen • March 15, 2024 -

Opinion

Fintech founder backs Google, Apple

“It’s easy for giant app companies to pick fights with Apple and Google, but when billionaire companies fight about who gets richer, it’s usually the little guy that loses,” writes CashEx’s CEO.

By Kingsley Ezeani • March 15, 2024 -

Q&A

ACI CEO weighs in on FedNow, cross-border payments

The federal real-time payments system may spool up slowly, but it could ultimately transform U.S. cross-border payments, ACI Worldwide's CEO predicted.

By Lynne Marek • March 14, 2024 -

Banking apps fall short on fraud protections: report

Consumer Reports Senior Director Delicia Hand said preventing fraud and scams is "crucial" for traditional and digital banks alike, as more of their customers use their mobile apps.

By James Pothen • March 14, 2024 -

Klarna’s IPO prospects grab spotlight

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

By Caitlin Mullen • March 13, 2024 -

PayPal, Mastercard add C-suite hires

Payments firms are loading up on new C-suite hires this year as some in the industry build out new management teams.

By Lynne Marek • March 13, 2024 -

FDIC pushes regulators to address tokenization

Tokenization could be a "major leap" for the monetary system. FDIC Vice Chairman Travis Hill doesn't want the U.S. to be left out.

By Gabrielle Saulsbery • March 12, 2024 -

PayPal may axe straggler business units

On the fringes of the digital payment pioneer’s two main businesses are some in a third category that could be jettisoned this year, CEO Alex Chriss said last week.

By Lynne Marek • March 12, 2024 -

Visa spends ‘billions’ battling cybersecurity threats

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

By Lynne Marek • March 11, 2024 -

JPMorgan to launch biometric checkout next year

The bank’s payments unit plans to engage in more pilots this year before rolling out the checkout service broadly next year, said Prashant Sharma, JPMorgan’s executive director of biometrics and identity solutions.

By Caitlin Mullen • March 11, 2024 -

Fleetcor invests in Brazilian mobile app business Zapay

Fleetcor’s investment this week follows other payments companies, including Visa, in investing in Brazilian businesses.

By Lynne Marek • March 8, 2024 -

Biden, Republicans clash over card fees

President Biden and Republican lawmakers sparred Thursday over credit card late fees, as some House members also challenged the Federal Reserve’s proposed cap on debit card fees.

By Lynne Marek • March 8, 2024 -

Capital One angles to push Discover upmarket

With its acquisition of the card network, Capital One seeks to elevate Discover’s brand while also working to expand its acceptance abroad.

By Caitlin Mullen • March 7, 2024 -

PayPal CEO prioritizes bettering branded services

Alex Chriss aims to use the company’s faster-growing unbranded Braintree business to give a boost to the legacy PayPal brand.

By Lynne Marek • March 7, 2024 -

Visa, Western Union partner on cross-border payments

The card network and the cross-border payments company are developing an international payment system that could be used in disaster situations.

By Tatiana Walk-Morris • March 6, 2024 -

i2c pursues bank clients abroad

The issuing-processing fintech sees a bigger opportunity in regions outside the U.S. to sell its core banking services, founder and CEO Amir Wain said.

By Caitlin Mullen • March 6, 2024 -

Google allows alternatives in Europe, cracks down in India

The tech giant said it will expand in-app payments options in the EU, while cracking down on apps in India that it said refused to pay its fees.

By James Pothen • March 6, 2024 -

CFPB imposes $8 credit card late fee rate

The Consumer Financial Protection Bureau finalized a rule that sets a “threshold” of $8 for late fees that can be imposed by large credit card issuers, and eliminates automatic inflation increases.

By Lynne Marek • March 5, 2024 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv lines up FedNow clients

The mega processor has signed up 200 banks for FedNow, but now its clients are in search of use cases.

By Lynne Marek • March 5, 2024 -

Amex cardholder data exposed in merchant processor hack

The point-of-sale attack on a merchant processor may have compromised card numbers, expiration dates and cardholder names, Amex said in a state regulatory filing.

By Caitlin Mullen • March 5, 2024 -

Cash App enforcement action expected this year

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

By Lynne Marek • March 4, 2024 -

Zelle transactions jumped 28% last year to $806B

The peer-to-peer payment app provided a performance update, with transactions volume and value both up about 30% from the previous year.

By James Pothen • March 4, 2024 -

Mastercard, Fiserv execs take sides on debit regulation

A Mastercard executive painted Regulation II as potentially harmful to consumers, while Fiserv’s CEO said it was an appropriate update due to the rise of online transactions.

By Caitlin Mullen • March 4, 2024