Banking: Page 18

-

CFPB will keep defending late fee cap

The 5th Circuit Court of Appeals blocked the Consumer Financial Protection Bureau’s $8 late fee cap, but the federal agency said it will continue to “defend” the rule.

By Lynne Marek • May 13, 2024 -

Sponsored by U.S. Bank

How U.S. Bank Card as a Service (CaaS) can solve B2B payment bottlenecks

With CaaS, you can reimagine the payment process, offer new payment services and improve the customer or employee experience.

May 13, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

CFPB, DOT take aim at airline rewards

The two agencies raised concerns that airlines and card companies could arbitrarily devalue points accrued in their joint rewards programs, amounting to a bait-and-switch for customers.

By James Pothen • May 10, 2024 -

Mastercard joint venture starts operations in China

The collaboration with a Chinese entity began Wednesday, with processing of cards issued by banks in the country following years of preparations.

By Lynne Marek • May 10, 2024 -

Jack Henry, Visa see escalating FedNow volume

While the Federal Reserve won’t specify payments volume on the new instant system, executives from certified service providers Visa and Jack Henry said they’re seeing an increase.

By Lynne Marek • May 9, 2024 -

Will EWA payments expand with real-time?

While some earned wage access providers use real-time payments to make distributions to employees, the big payroll services provider ADP doesn’t see employers gravitating to that option.

By Lynne Marek • May 7, 2024 -

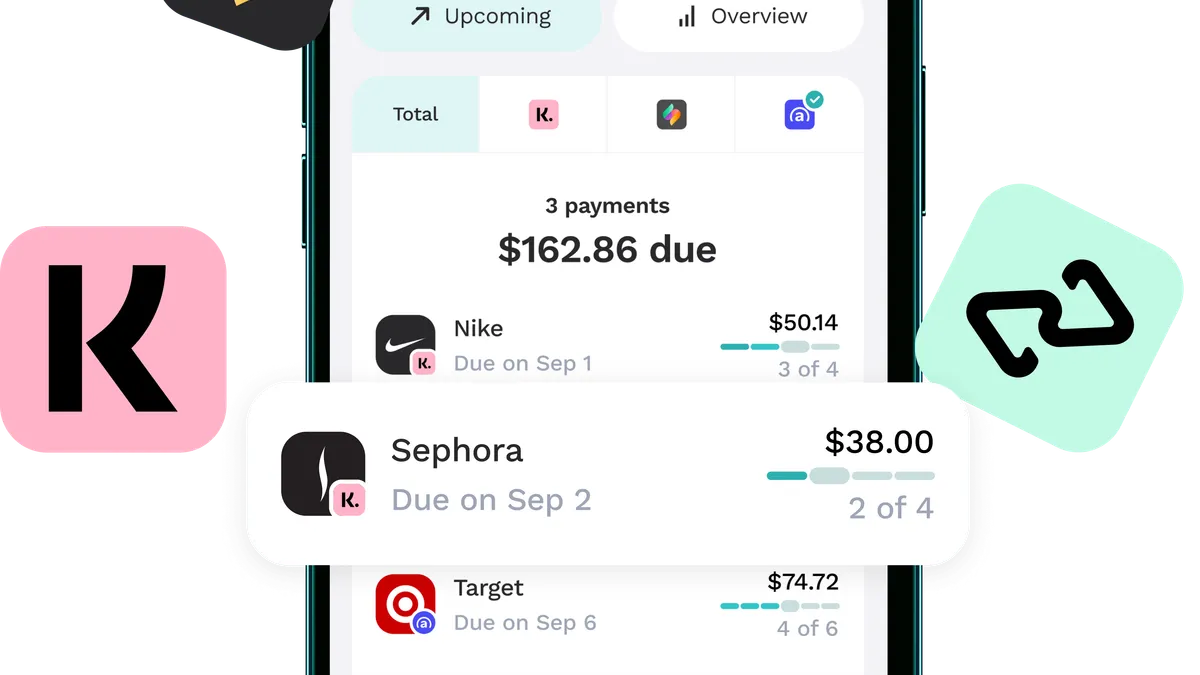

Block integrates Afterpay with Cash App card

The test offering provides buy now, pay later financing to a limited number of users of Block’s Cash App debit card for “a small fee.”

By James Pothen • May 7, 2024 -

Fed, TCH joust over interoperability

When it comes to bridging the FedNow and RTP networks, officials at the Federal Reserve and The Clearing House have slightly different priorities.

By Lynne Marek • May 7, 2024 -

BNPL users tend to have lower incomes: Bank of America

The bank analyzed its BNPL user data and discovered low-income consumers are more likely to use installment payment services. It’s also popular among millennial and Gen X consumers.

By Lynne Marek • May 6, 2024 -

Merchants urged to file claims for $5.5B payment card settlement

Requests for a slice of the Visa-Mastercard settlement are due by a May 31 deadline. Lawyers are racing to alert eligible businesses.

By Lyle Moran • May 6, 2024 -

Opinion

Pay-by-bank holds promise

“The value proposition of pay-by-bank is clear: merchants win from drastically lower payment costs and consumers win from lower prices,” writes one fintech executive.

By Eric Shoykhet • May 3, 2024 -

Global Payments to wrap review soon

The payments processor plans to finish an assessment of operations in the next few months, aiming to streamline its business and pare units it can’t scale.

By Lynne Marek • May 2, 2024 -

Stripe unbundles services as industry shifts

The company’s move to decouple embedded financial services from payment processing means it’s ready to pursue larger customers, analysts said.

By James Pothen • May 1, 2024 -

Real-time consumer payments need standards to rise

To make instant payments a reality for consumers, the payments industry must work together to develop a common framework for the transactions, top industry executives say.

By Lynne Marek • April 30, 2024 -

FTC sues Doxo over deceptive ads, junk fees

After the federal agency’s lawsuit landed Thursday, the Seattle bill-pay provider countered the allegations on Friday.

By Tatiana Walk-Morris • April 30, 2024 -

NRF objects to Visa-Mastercard settlement

The National Retail Federation lashed out at a landmark Visa-Mastercard legal settlement Friday, calling the pact reached with some merchants last month “meager and temporary” relief.

By Lynne Marek • April 29, 2024 -

Opinion

Why financial institutions should embrace ISO 20022

Adopting ISO 20022 payment standards can help U.S. banks and credit unions unlock richer data and stay competitive in the global financial marketplace.

By Sylvie Boucheron-Saunier • April 26, 2024 -

FedNow pricing aimed at avoiding market disruption

The Federal Reserve aimed to “not upset the marketplace as a second mover” when it set fees for the new instant payments system last year, a Fed official said Wednesday.

By James Pothen , Lynne Marek • April 25, 2024 -

EWA providers hail new Kansas law

Kansas has joined a pack of states in passing a law backed by earned wage access providers, as regulations for the industry remain a contentious issue.

By Lynne Marek • April 25, 2024 -

Fed seeks 8,000 financial institutions for FedNow

About 700 financial institutions have connected to the Fed’s instant payment network since last July, with at least 1,000 more in the pipeline, a FedNow official said this week.

By Lynne Marek , James Pothen • April 25, 2024 -

Synapse signs deal with TabaPay, files for bankruptcy

TabaPay set a purchase price of $9.7 million to acquire Synapse's assets — a deal that is pending bankruptcy court approval.

By Rajashree Chakravarty • April 24, 2024 -

Visa debit card volume growth keeps sliding

The card network behemoth’s latest earnings report showed a contraction in card volume growth during the first three months of the year, and into April.

By Lynne Marek • April 24, 2024 -

Walmart offers a new BNPL option: report

The fintech One now offers buy now, pay later financing at the store chain, presenting competition for Affirm, which has partnered with the retail giant since 2019.

By Caitlin Mullen • April 24, 2024 -

Ramp may target US startups this year: report

After successfully raising $150 million in funding, the finance automation platform will have its choice of acquisition targets, according to research firm CB Insights.

By James Pothen • April 23, 2024 -

Video game industry preps for oversight

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

By James Pothen • April 22, 2024