Banking: Page 14

-

Affirm says CFPB’s proposed BNPL rules will confuse customers

In commenting on the proposal, the BNPL provider said consumers would be better served by rules specific to BNPL transactions, as opposed to credit card regulations.

By Patrick Cooley • July 29, 2024 -

Capital One racks up Walmart, Discover costs

The card company set aside more than $800 million to brace for credit card losses tied to its break-up with retail behemoth Walmart.

By Caitlin Mullen • July 29, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

PayPal changes chairman, reduces board size

PayPal’s chairman of nine years left that post this week, and was replaced by one of the board’s newer members.

By Lynne Marek • July 26, 2024 -

Opinion

How to speed up FedNow adoption

“Interfaces need to be standardized to ensure a consistent and reliable payment experience for businesses and consumers,” writes one payments software executive.

By Ani Narayan • July 26, 2024 -

Revolut faces more fraud claims than other UK banks: report

The fintech investigates each fraud claim independently of other cases, and takes such claims “incredibly seriously,” a spokesperson for the company said.

By Gabrielle Saulsbery • July 25, 2024 -

Zelle, big banks challenge senators on scam reimbursements

Forcing banks to reimburse authorized payments could encourage bad behavior and would not deter scammers, bank executives said in a Senate hearing.

By Patrick Cooley • July 25, 2024 -

Q&A

Clair CEO backs CFPB rule proposal on EWA

Nico Simko supports the Consumer Financial Protection Bureau’s recent rule proposal, and it may be a competitive advantage for him.

By Lynne Marek • July 25, 2024 -

Visa CEO ‘strongly’ disagrees with class settlement ruling

The card network giant expects the parties to negotiate a new settlement following a judge’s rejection of an agreement reached earlier this year, but its CEO notes that could happen after a trial begins.

By Lynne Marek • July 24, 2024 -

Fiserv to leverage artificial intelligence to help merchants

The payments behemoth says its data team will use AI to mine transactions on its products to help merchants and financial institutions profit.

By Patrick Cooley • July 24, 2024 -

FTC demands pricing input from Mastercard, others

The Federal Trade Commission demanded information from eight companies, including the card network, to better understand how consumer data is being used in the pricing of products and services.

By Lynne Marek • July 23, 2024 -

Amex benefits from young cardholders’ spending

Gen Z and millennials are driving spending, sometimes as premium customers, to the benefit of the credit card company.

By Patrick Cooley • July 23, 2024 -

Visa, Mastercard say CrowdStrike didn’t impact networks

Still, cardholders may have been affected, particularly in Europe, as some bank card issuers were hit by the cybersecurity company’s update snafu.

By Lynne Marek • July 22, 2024 -

Capital One-Discover deal critics, supporters sound off

While some community groups spoke in favor of the $35.3 billion merger at the Friday virtual meeting, a raft of critics urged regulators to block the deal.

By Caitlin Mullen • July 21, 2024 -

JPMorgan Chase invests in B2B payments startup Slope

The big bank’s payments unit and Y Combinator were among investors providing $65 million in financing for the business-to-business upstart this month.

By Lynne Marek • July 19, 2024 -

6 viewpoints from the CFPB’s director that may affect payments

“We are looking a lot at the convergence of payments and commerce and the extent to which a very big player could use that to shatter that wall between banking and commerce,” the agency’s director, Rohit Chopra, said this month.

By Suman Bhattacharyya • July 19, 2024 -

Visa, OpenTable partner on dining perks program

The card giant expects to expand the network beyond its pilot markets, Los Angeles and Chicago.

By Tatiana Walk-Morris • July 19, 2024 -

CFPB to apply lending laws to EWA

The federal agency weighed in Thursday with a proposed rule to oversee the burgeoning earned wage access industry.

By Lynne Marek • July 18, 2024 -

Opponents of Capital One-Discover merger to air grievances

Consumer advocates say the merger will stifle competition and give the combined company an easy avenue to raise fees on card payments.

By Patrick Cooley • July 18, 2024 -

Discover to sell student loan portfolio to Carlyle, KKR in $10.8B deal

The student loan sale is the latest loose end Discover seeks to tie up since Capital One announced its intent to purchase the card company.

By Caitlin Mullen • July 17, 2024 -

Stripe leads the way to Q2 fundraising recovery

Payment startups, particularly Stripe, benefitted from a revival of venture capital flows during the second quarter.

By Lynne Marek • July 17, 2024 -

FedNow zooms past RTP participation in inaugural year

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

By Lynne Marek • July 16, 2024 -

Prepaid card spending accelerates

The rise of digital wallets hasn't dampened prepaid card use, including the payroll cards some employers use to pay their workers.

By Patrick Cooley • July 16, 2024 -

Mastercard updates travelers on latest card precautions

With summer vacation season in full swing, the card network suggested ways that its card clients can better protect themselves against the latest fraud threats.

By Tatiana Walk-Morris • July 15, 2024 -

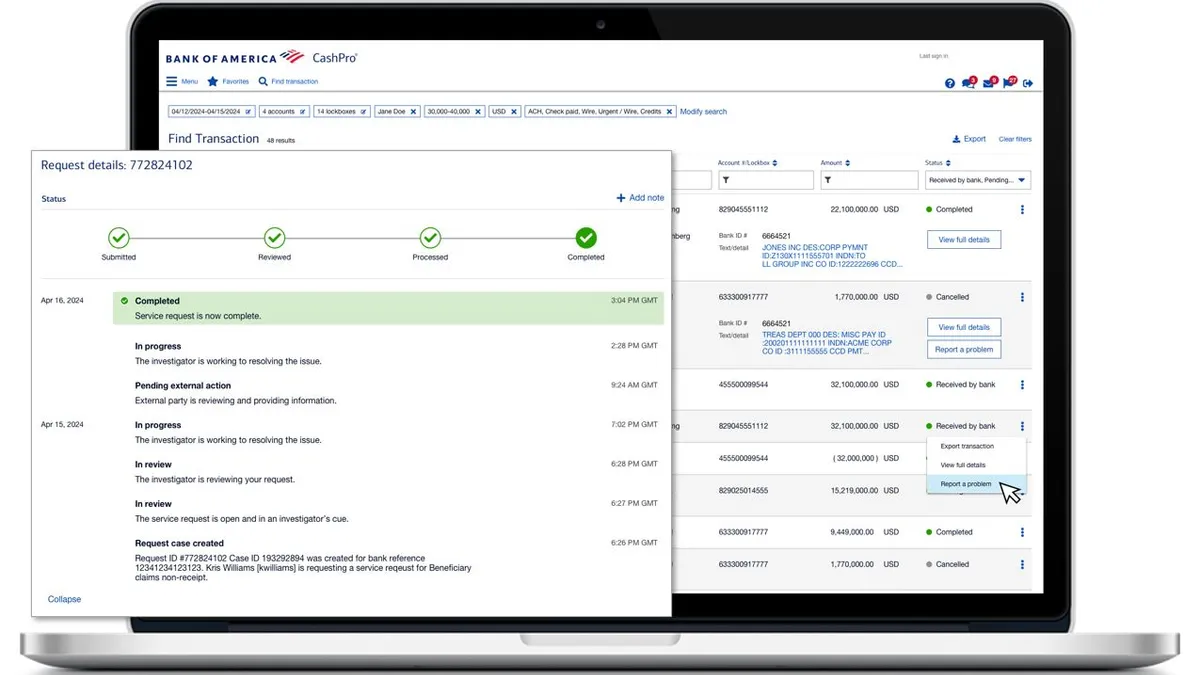

BofA tackles digital payments pain points

The bank’s latest platform update is designed to better address transaction-related inquiries — one of the top reasons business customers call and email for help.

By Maura Webber Sadovi • July 15, 2024 -

Banks should proactively tackle instant payments fraud: BNY

Use of data-sharing protocols among banks could warn customers before they send money, said Carl Slabicki, a BNY executive.

By Suman Bhattcharyya • July 12, 2024