Banking: Page 11

-

Visa to buy cybersecurity firm Featurespace

The cybersecurity acquisition is the latest move in a race by card networks to meet their clients’ needs in keeping up with fraud threats.

By Lynne Marek • Sept. 26, 2024 -

FDX seeks to become open banking standard-setter

The Consumer Financial Protection Bureau will decide whether an organization’s practices are transparent and balanced enough to set standards for open banking.

By Patrick Cooley • Sept. 26, 2024 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

How Visa stymied big tech rivals

The U.S. lawsuit paints a picture of the dominant card network using lures and threats to stifle competition from competitors Apple, PayPal and others.

By Lynne Marek • Sept. 25, 2024 -

DOJ suit accuses Visa of illegal debit payment monopoly

The company threatens merchants with high fees, and "makes its potential rivals business partners to thwart competition in debit card processing," the DOJ says.

By Justin Bachman • Sept. 24, 2024 -

Visa faces possible DOJ lawsuit, news reports say

The card network may soon be sued by the Department of Justice over its debit card practices, according to multiple news reports citing anonymous sources.

By Lynne Marek • Sept. 24, 2024 -

Retrieved from DailyPay.

Retrieved from DailyPay.

DailyPay to offer service outside US

Earned wage access provider DailyPay plans to begin offering its services outside the U.S. for the first time later this year.

By Lynne Marek • Sept. 23, 2024 -

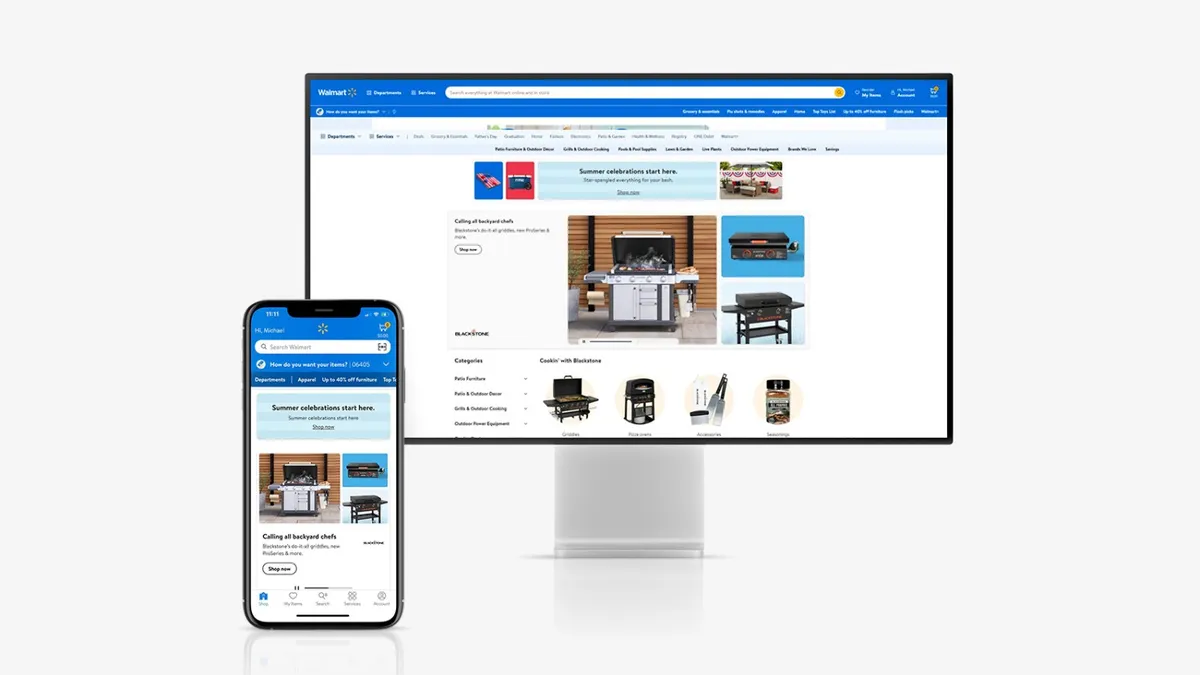

Walmart, Fiserv team to offer real-time payments

The retail giant and payments processor are targeting next year for offering consumers a real-time payment option online.

By Lynne Marek • Sept. 20, 2024 -

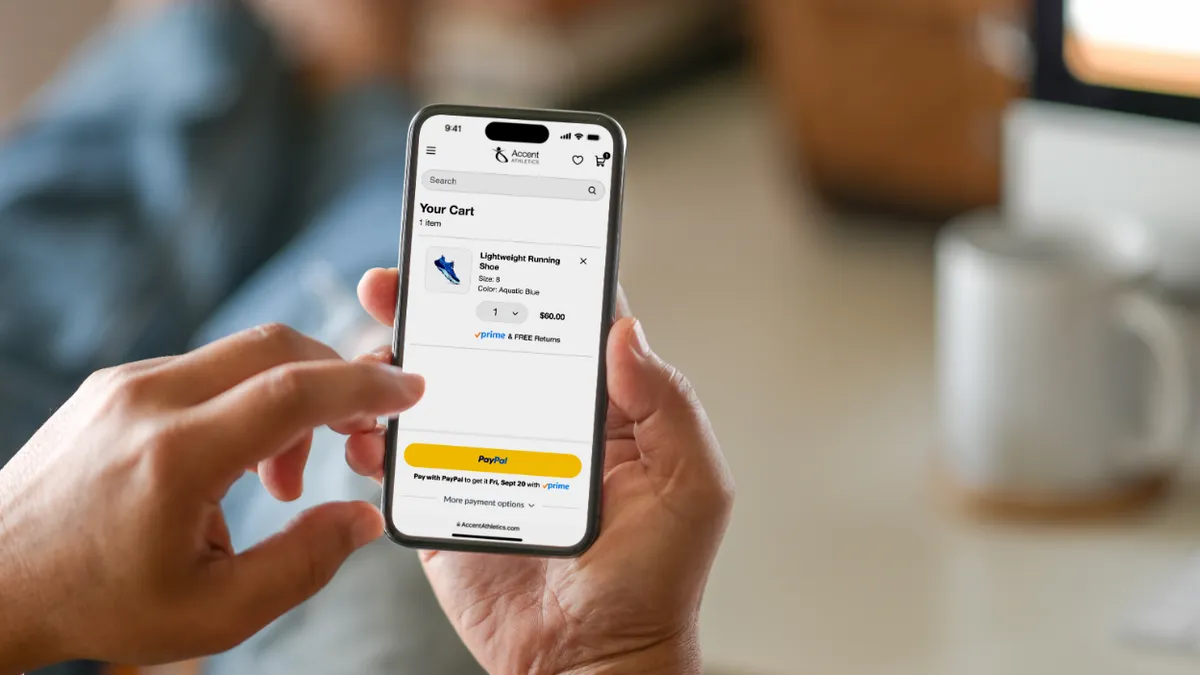

Amazon adds PayPal option to Buy with Prime

The e-commerce platform will also let consumers connect their PayPal and Prime accounts next year, and access free shipping via Buy with Prime on some merchants’ sites.

By Tatiana Walk-Morris • Sept. 20, 2024 -

Reliant pushes back against CFPB lawsuit

The card services company argued Wednesday that it has always been upfront with customers about fees, and was blindsided by the CFPB's legal action.

By Patrick Cooley • Sept. 19, 2024 -

Opinion

Who really pays for your credit card reward points?

"While rewards may feel like a bonus for those who use credit cards regularly, they ultimately come at a cost," writes one payments executive.

By Parth Vatsal • Sept. 19, 2024 -

Brex rolls out embedded payments tool

The fintech aims to capture a larger share of the B2B payments market, working with partners in addition to selling directly, Brex's president said.

By Rajashree Chakravarty • Sept. 19, 2024 -

Credit Card Competition bill backers keep pressure on

Republican Sen. Roger Marshall has a new ad pitching the Credit Card Competition Act proposal aimed at dislodging Visa and Mastercard’s dominance.

By Lynne Marek • Sept. 19, 2024 -

Fed payments proposal pits big banks against small rivals

The Federal Reserve’s proposal to extend the operating hours of two interbank payments systems has been welcomed by large banks, but panned by many small financial institutions.

By Lynne Marek • Sept. 18, 2024 -

Rain to offer EWA services via Workday

The earned wage access provider will now be able to offer its services to more employers through the human resources software firm’s systems.

By Tatiana Walk-Morris • Sept. 18, 2024 -

CFPB takes aim at ATM, debit card fees

Regulators should assume, as a default, that customers have not agreed to coverage and fees unless banks can provide signed agreements or recorded conversations, the agency said in a policy reminder.

By Dan Ennis • Sept. 18, 2024 -

Mastercard CFO to continue working after cancer diagnosis

Decisions on medical disclosures can be challenging for companies. Mastercard’s approach drew high marks from some corporate governance experts.

By Maura Webber Sadovi • Sept. 18, 2024 -

Apple launches Affirm BNPL option

Apple Pay customers can now use their iOS 18 phone or iPadOS 18 to access Affirm buy now, pay later options, including some that don’t charge interest.

By Lynne Marek • Sept. 17, 2024 -

Lawmakers push for crackdown on fintechs

Two U.S. senators demanded tighter regulations on BaaS and fintech partnerships, saying they pose “a broader threat to the stability of our banking system and the economy.”

By Rajashree Chakravarty • Sept. 17, 2024 -

Retrieved from Beijing Daily App on September 16, 2024

Retrieved from Beijing Daily App on September 16, 2024

Visa, Mastercard enable rail transit payment in Beijing

The major card networks enabled systems that allow international travelers in China to use their cards to pay for Beijing rail transit as of last week.

By Lynne Marek • Sept. 16, 2024 -

U.S. Bank rolls out access to Paze digital wallet

The bank began offering the payments option from Early Warning Services to its credit and debit cards customers this week.

By Patrick Cooley • Sept. 13, 2024 -

Mastercard acquires cybersecurity firm for $2.65B

The acquisition is the latest in a series of cybersecurity firm purchases by the card network over the years.

By Lynne Marek • Sept. 12, 2024 -

North American cashless payments to climb 7% by 2028: report

Real-time payments and open banking will drive the increase, forcing the shift even faster globally, a Capgemini report released this week said.

By Tatiana Walk-Morris • Sept. 12, 2024 -

Airwallex eyes embedded payments in global push

The payments software provider is making “immediate bets” on the Brazil and Mexico markets, a company executive said.

By Grace Noto • Sept. 12, 2024 -

Global Payments CEO reshapes the business

The payments technology company is getting a remake with job cuts, an acquisition and potential divestitures a year after Cameron Bready ascended to the CEO post.

By Lynne Marek • Sept. 11, 2024 -

PayPal seeks to attract users offline

The digital payments pioneer is leaning on cashback rewards to attract more consumer use in stores, and will also tap near-field technology to expand.

By Lynne Marek • Sept. 10, 2024