B2B: Page 8

-

Paymentus bets on office return boost

New business bookings and onboarding of signed clients have both picked up steam as workers return to offices, said Paymentus CEO Dushyant Sharma.

By Caitlin Mullen • Feb. 27, 2023 -

Green Dot juggles customer changes

The banking-as-a-service company posted profits in the final quarter of last year even as it recovered from the loss of clients.

By Lynne Marek • Feb. 24, 2023 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

FedNow aims to avoid Zelle-type fraud

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

By Lynne Marek • Feb. 23, 2023 -

Same-day, B2B payments fuel ACH growth

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

By Tatiana Walk-Morris • Feb. 23, 2023 -

Euronet’s Dandelion takes on cross-border rivals

The international network that grew out of Ria parent Euronet is extending its cross-border money movement pitch to banks and businesses.

By Lynne Marek • Feb. 2, 2023 -

Marqeta to buy Power Finance

The virtual card company said it would pay $275 million to buy the New York fintech that allows companies to manage their credit card programs.

By Lynne Marek • Jan. 30, 2023 -

Paymentus to accept payments via Green Dot Network

Paymentus is tapping Green Dot’s network to extend the number of locations where it accepts cash bill payments from consumers.

By Tatiana Walk-Morris • Jan. 23, 2023 -

Billtrust plots growth in B2B

Although many companies are pulling back spending amid the darker economic climate, new CEO Sunil Rajasekar said the B2B payments firm is not.

By Caitlin Mullen • Jan. 19, 2023 -

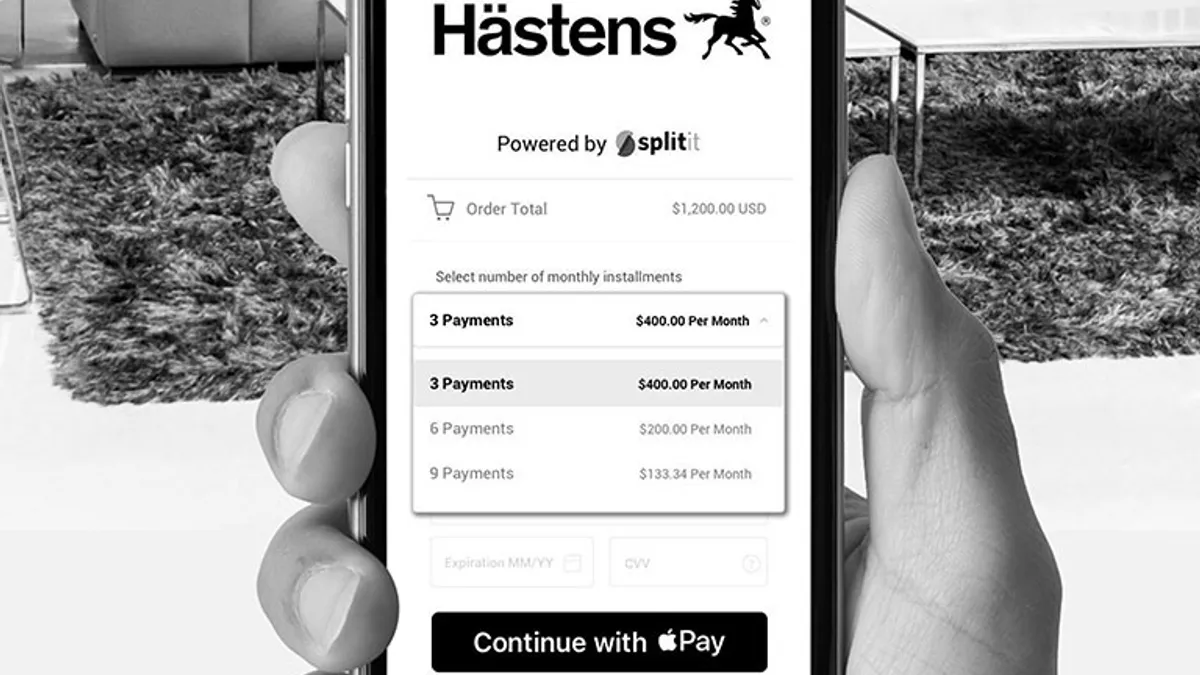

Splitit targets tech assets for acquisition

Splitit isn’t interested in being acquired, but the BNPL provider believes there may be assets ripe for the picking amid consolidation.

By Suman Bhattacharyya • Jan. 19, 2023 -

Payoneer tees up Webster Bank exec for CFO

Webster Bank alum Bea Ordonez will take the payments company’s finance reins in March after current CFO Michael Levine steps away from the role.

By Grace Noto • Jan. 19, 2023 -

Amex acquires B2B automation company Nipendo

The acquisition is the latest B2B move for the card company, which expects Nipendo’s capabilities to strengthen its position in that market.

By Caitlin Mullen • Jan. 12, 2023 -

2023 Payments Outlook

These payments companies could be acquisition targets

With industry acquisitions ramping up this year, payments analysts have pinpointed a pack of potential payments company targets.

By Caitlin Mullen • Jan. 12, 2023 -

Paya purchase bolsters Nuvei for economic downturn

With its expansion in the U.S. and markets less susceptible to a decline in consumer demand, Nuvei is adding protection against a downturn.

By Lynne Marek • Jan. 11, 2023 -

Fintech funding tumbled in 2022

U.S. fintech funding for the fourth quarter of 2022 was down nearly 80% compared to the same quarter in 2021, CB Insights said Wednesday.

By Caitlin Mullen • Jan. 11, 2023 -

Amazon expands ‘Buy with Prime’ to all US merchants

With help from Saas platform BigCommerce, the e-commerce giant is even looping sellers outside its own marketplace into its ecosystem.

By Daphne Howland • Jan. 11, 2023 -

Nuvei to acquire Paya for $1.3B

Nuvei’s acquisition of the Atlanta company will strengthen its position in global e-commerce, integrated payments and B2B, CEO Philip Fayer said.

By Caitlin Mullen • Jan. 9, 2023 -

Cargo payment firms duel in court

CargoSprint and PayCargo have battled for years over antitrust violations, intellectual property and trademark infringement, among other nettlesome issues.

By Robert Freedman • Jan. 9, 2023 -

Clearing House, Swift appoint top executives

The companies tapped new leaders as they seek to build international cross-border payment systems amid rising global competition.

By Tatiana Walk-Morris • Jan. 5, 2023 -

2023 Payments Outlook

Payments deals may climb in 2023

While the number of deals in the payments industry declined 14% last year, and even more by value, there are reasons to believe 2023 will be more active.

By Lynne Marek • Jan. 4, 2023 -

Billtrust appoints new CEO

The payments processing software company tapped Sunil Rajasekar for the top post as it moves forward under new ownership.

By Tatiana Walk-Morris • Dec. 20, 2022 -

Q&A

Brex maintains hiring for key roles, some replacements

The fintech doesn't anticipate workforce reductions in 2023, but the broader industry isn’t done with job cuts, predicts Chief People Officer Angela Crossman.

By Caitlin Mullen • Dec. 13, 2022 -

Shift4 buys European payments provider for $126M

The purchase of Online Payments Group will bolster Shift4’s international expansion plans, the company's CEO said last week.

By Caitlin Mullen • Dec. 5, 2022 -

Amex debuts B2B payments system

The card company is adding to its product line-up in an attempt to cater to small businesses as they try to recover from COVID-19 pandemic lows and face inflationary pressures.

By Tatiana Walk-Morris • Dec. 1, 2022 -

Visa’s next CEO sees a world of growth

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

By Lynne Marek • Nov. 21, 2022 -

Visa names new CEO for next year

Visa President Ryan McInerney will become the card network company’s next CEO next February as Al Kelly exits that role to become executive chairman.

By Lynne Marek • Nov. 18, 2022